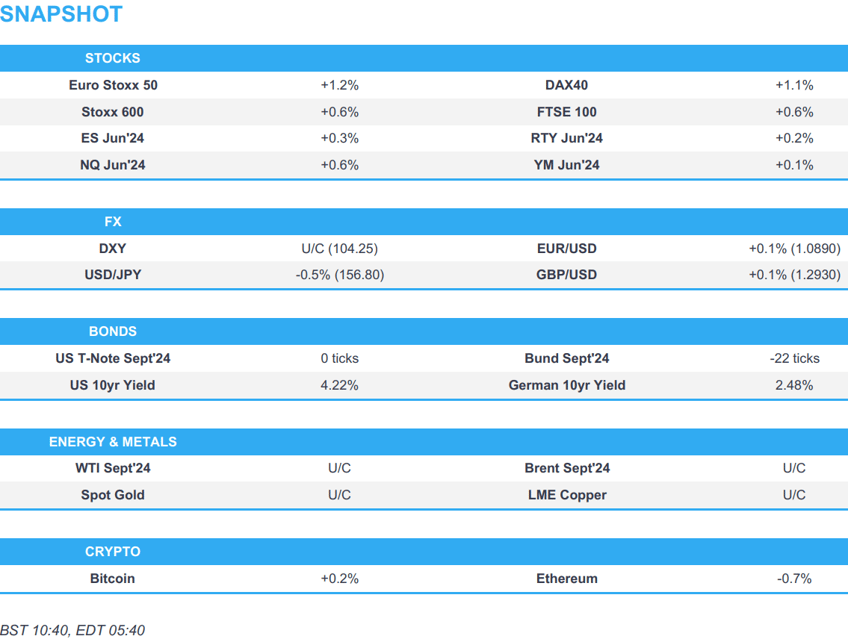

- European equities are entirely in the green and reside near session highs; US futures are modestly firmer with slight outperformance in the NQ.

- US President Biden has dropped out of the Presidential race and endorsed VP Harris.

- Dollar is flat, JPY outperforms after catching a bid in early European trade, whilst the Antipodeans lag after disappointing stimulus efforts by the PBoC.

- USTs are flat and unreactive to Biden dropping out of the election, Bunds slip below 132.00.

- Crude holds around the unchanged mark, XAU is flat and trades on either side of USD 2400/oz & base metals are mixed.

- Looking ahead, highlights include a light calendar and a lack of pertinent releases.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European equities, Stoxx 600 (+0.4%) are entirely in the green, shrugging off a mostly weaker APAC session overnight.

- European sectors hold a strong positive bias; Tech takes the top spot, whilst Travel & Leisure lags, following poor Ryanair (-12%) earnings.

- US equity futures (ES +0.3%, NQ +0.5%, RTY +0.2) are modestly firmer to various degrees, with slight outperformance in the NQ, as traders digest news that US President Biden is dropping out of the election race.

- Citi (C) has added NVIDIA (NVDA) to Upside Catalyst Watch on the pullback. Direction: Upside, Duration: Within 30 Days, expected event date 29 Jul, Catalyst: Corporate event. Click for more details.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD is steady vs. peers with DXY tucked within Friday's 104.13-42 range. Little follow-through in FX markets from US President Biden's decision to drop out of the election race as it remains unclear if Harris (yet to be officially nominated) would be able to change the electoral calculus.

- EUR is a touch firmer vs. the USD but EUR/USD is unable to gain a footing above 1.09. EZ newsflow remains light with ECB officials continuing to echo caution on the rate-cutting cycle.

- GBP is flat vs. peers as speculation over potential tax hikes/additional borrowing has little follow-through. For now, Cable remains tucked within Friday's 1.2901-1.2951 range.

- JPY strengthened in early European trade after the pair tripped through 157.00 and Friday's low @ 156.96 in quiet newsflow before basing out at 156.29.

- Yuan is a touch softer vs. the USD following stimulus efforts by Chinese officials. Desks remain of the view that measures are too piecemeal to have a materially stimulative impact. USD/CNH now eyeing 7.30; last breached 4th July.

- PBoC set USD/CNY mid-point at 7.1335 vs exp. 7.2624 (prev. 7.1315)

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are flat and saw a muted reaction seen in fixed income markets to Biden dropping out of the Presidential race. It is unclear if Harris is any more likely to beat Trump than Biden was. Plus, desks still fancy Republicans to control both houses. Sep'24 UST contract sits within Friday's 110.25-111.07 range.

- Contained price action within European fixed income markets as the ECB heads for its summer break. Sep'24 Bund has breached 132.00 and Friday's low (131.93) to the downside.

- Gilts are lower by only a handful of ticks ahead of this week's PMI before the BoE next week. UK 10yr is now below Friday's trough after slipping below the 98.00 level. Next target is the 12th July low at 97.81.

- Click for a detailed summary

COMMODITIES

- Modestly firmer intraday but more-so a consolidation following the slump on Friday. Overnight, China conducted surprise rate cuts overnight to the RRR, LPR, and SLF in a bid to inject stimulus, although markets are seemingly overlooking these efforts. Brent Sept sits in the middle of a USD 82.75-83.22/bbl parameter.

- Mixed trade arcross precious metals with the complex awaiting the next catalyst. Spot gold resides in a narrow range on either side of USD 2,400/oz.

- Mixed trade across base metals with little follow-through seen on the surprise Chinese rate cuts, with some participants suggesting the announcements were ultimately underwhelming.

- Dubai set official crude differential to DME Oman for October at USD 0.10/bbl premium.

- Click for a detailed summary

NOTABLE EUROPEAN HEADLINES

- UK Chancellor Reeves said she will consider inflation-busting pay rises for almost 2mln public sector workers this month to avert crippling strikes, according to Reuters.

- UK Treasury ministers are reportedly softening up public opinion for a tough autumn Budget and potential tax increases, while Chancellor Reeves said she wanted to “level” with the public about the fiscal “mess”, according to FT.

- ECB’s Makhlouf said there is no need to rush to make decisions and that rapid interest-rate action from the central bank is not required, according to an interview with the Irish Examiner.

- ECB's Kazimir said doors remain open to additional easing should the environment warrant it; market bet on two more cuts by year-end is not entirely misplaced but a given; no need to rush decisions, data will set stage for Sept decision.

NOTABLE US HEADLINES

- US President Biden announced he is stepping aside as a candidate and will focus on fulfilling his duties for the remainder of his term, while he endorsed Vice President Harris and will speak to the nation later this week.

- US Vice President Harris said she is honoured to have the President’s endorsement and she intends to earn and win the nomination, while she added that she will do everything in her power to unite the Democratic Party and unite the nation to defeat Donald Trump.

- Super PAC Priorities USA and liberal super PAC Unite the Country said they will support Kamala Harris as the 2024 Democratic presidential nominee, while Bill and Hillary Clinton announced their endorsement of Harris. It was separately reported by CBS News that California Governor Newsom and Michigan Governor Whitmer do not plan to challenge Harris and Newsom later endorsed Harris for the Democratic Presidential nomination.

- Democratic National Committee Chair Harrison said the American people will hear from the Democratic Party on the next steps and the path forward for the nomination process.

- Independent Senator Manchin is weighing to re-register as a Democrat as part of a potential bid to replace Biden as candidate, according to a source familiar cited by Reuters

- Republican presidential candidate Donald Trump said he thinks that Kamala Harris will be easier to defeat than President Biden in the November election, according to a CNN reporter via X.

GEOPOLITICS

MIDDLE EAST

- Israeli military called on Gazans to clear out of eastern parts of the Khan Younis ahead of a 'forceful' operation which comes after 'significant terrorist activity and rocket fire'.

- Israel conducted a strike on Yemen’s Hodeidah on Saturday which killed six people and injured 80, while it was separately reported that Yemen’s Houthis said they fired missiles at Israel’s Eilat.

- Israeli PM Netanyahu will meet with US President Biden on Tuesday, while Netanyahu said the port that Israel conducted a strike on was an entry port for weapons from Iran and the port attack reminds enemies that there is no place that Israel cannot reach. Israeli PM Netanyahu also said Israel will send a delegation to hostage deal talks on Thursday.

OTHER

- Ukrainian President Zelensky called for long-range weapons after drone attacks on Kyiv. In relevant news, Russia's Defence Ministry announced their forces captured two settlements in Ukraine.

- Philippine Foreign Ministry said China and the Philippines reached an understanding on a provisional arrangement for resupply missions in the disputed South China Sea shoal.

CRYPTO

- Bitcoin is flat and holding around USD 67k, whilst Ethereum slips below USD 3.5k.

APAC TRADE

- APAC stocks mostly began the week on the back foot after last Friday's selling pressure on Wall St and despite China’s surprise cuts, while markets also reflected on President Biden's decision to bow out of the election race.

- ASX 200 was led lower by the commodity-related sectors with energy the worst hit after oil prices tumbled on Friday, while miners also suffered including South32 with its shares down by a double-digit percentage following its output update where it also flagged an impairment charge of USD 554mln for its Worsley Alumina operations.

- Nikkei 225 extended on its recent declines after gapping beneath the key 40,000 level.

- Hang Seng and Shanghai Comp. were mixed in which the former bucked the trend owing to the resilience in local tech-related stocks, while the mainland was pressured after President Xi noted China’s development entered a period of coexistence of strategic opportunities, risks and challenges, as well as increasing uncertainties and unpredictable factors. Furthermore, the PBoC’s surprise announcement to cut its 7-day reverse repo rate by 10bps, which Chinese banks followed through with similar cuts to the benchmark LPRs, failed to spur risk appetite as some viewed the cut to short-term funding rates as underwhelming and not the big measures needed to revive the economy and China’s slowing property industry.

NOTABLE ASIA-PAC HEADLINES

- PBoC 1-Year Loan Prime Rate (Jul) 3.35% vs Exp. 3.45% (Prev. 3.45%)

- PBoC 5-Year Loan Prime Rate (Jul) 3.85% vs Exp. 3.95% (Prev. 3.95%)

- PBoC cuts Standing Lending Facility (SLF) rate by 10bps across all maturities, according to a statement. Overnight rate from 2.65% to 2.55%7-day rate from 2.80% to 2.70%. 1-month rate from 3.15% to 3.05%.

- China will change the release time of the monthly LPR fixing to 09:00 local time (02:00BST/21:00EDT) from 09:15 local time (02:15BST/21:15EDT) on the 20th of each month.

- PBoC announced a cut to the 7-day reverse repo rate to 1.70% from 1.80% and will strengthen counter-cyclical adjustment to better support the real economy, while it is to lower collateral requirements for the Medium-term Lending Facility Loans from July with the move meant to increase the size of tradable bonds in the market and to alleviate pressure on supply and demand of bonds in the market.

- Chinese President Xi said China’s development has entered a period of coexistence of strategic opportunities, risks and challenges, increasing uncertainties and unpredictable factors, while he added that various black swan and grey rhinoceros events may occur at any time, according to state media.

- China’s reform plan will push the collection stage of the consumption tax back and delegate it to local governments steadily, while it will study merging urban maintenance, construction tax, education surcharge and local education surcharge into a local surcharge and authorise local governments to determine specific applicable tax rates within a certain range. China will improve the coordination of investment and financing in the capital market, prevent risks, strengthen supervision and promote the market’s healthy and stable development. Furthermore, China will create a market-oriented, law-based and internationalised first-class business environment, while it will protect the rights and interests of foreign investment in accordance with the law.

- Chinese Finance Ministry said will extend tariff exemptions for imports of some US products until Feb 28th 2025

- Indian FY25 GDP growth seen between 6.5-7%, according to Reuters sources citing Indian Economic survey.