Orders for Durable Goods in America were expected to rise for the 4th straight month in this mornings preliminary June data and it did...bigly.

The headline orders printed a 4.7% MoM surge (almost 4x the expected 1.3% rise) - that is the biggest monthly rise in durable goods orders since July 2020.

Source: Bloomberg

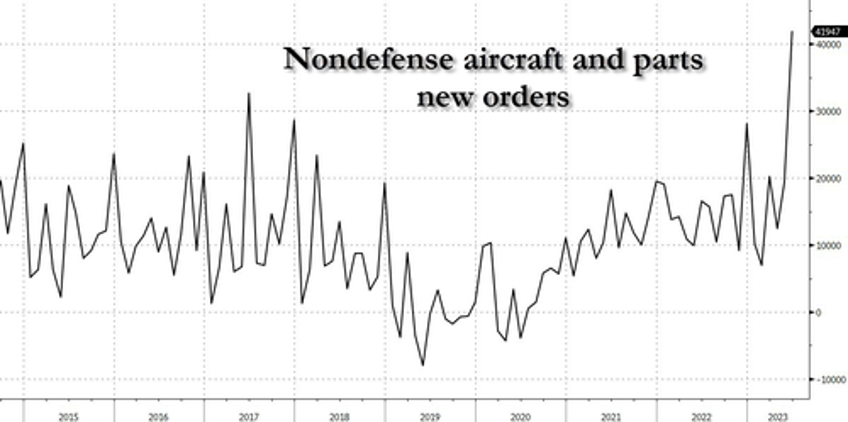

Excluding transportation, orders climbed only 0.6%, which makes sense given the 69.6% surge in non-defense aircraft orders...

The 9.3% YoY rise in durable goods orders is the largest since June 2022.

The value of core capital goods orders, a proxy for investment in equipment that excludes aircraft and military hardware, increased 0.2% last month after a downwardly revised 0.5% gain in May.

Of course, this data is nominal - not adjusted for inflation - but still, does any of that sound like a disinflationary economy 'impacted' by 500bps of rate-hikes?