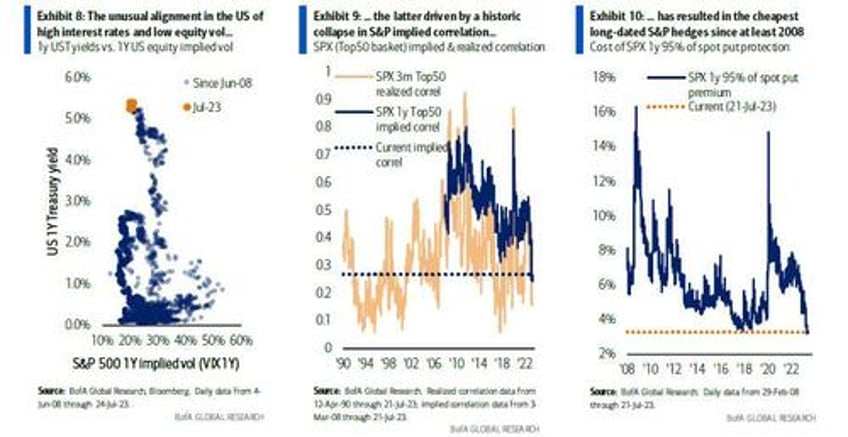

It has never cost less to protect against an S&P drawdown in the next 12 months, according to Bank of America's derivatives strategists, who note that high rates align with low implied vol and correlation to offer a historic entry point (at least since 2008 when the bank's records start) for hedges.

Why is the cost of longer-dated S&P protection at record lows today?