The roller-coaster ride that is 'Durable Goods New Orders' continues this morning after the last six months of so have seen monthly swings higher and lower with no trend discernible whatsoever (especially noteworthy given yesterday's slump into contraction for the Manufacturing PMI) amid the on-again-off-again turmoils of Boeing's orders.

Preliminary March data showed a slightly better than expected 2.6% MoM rise (2.5% exp) in the headline orders print. However, thanks to the downward revisions, Durable goods orders are now down 2.2% YoY... the biggest YoY drop since the COVID lockdowns...

Source: Bloomberg

This is the 8th downward revision of durable goods orders in the last year...

Source: Bloomberg

Under the hood, defense and non-defense capital goods orders rose with non-defense aircraft orders surging over 30% MoM...

Source: Bloomberg

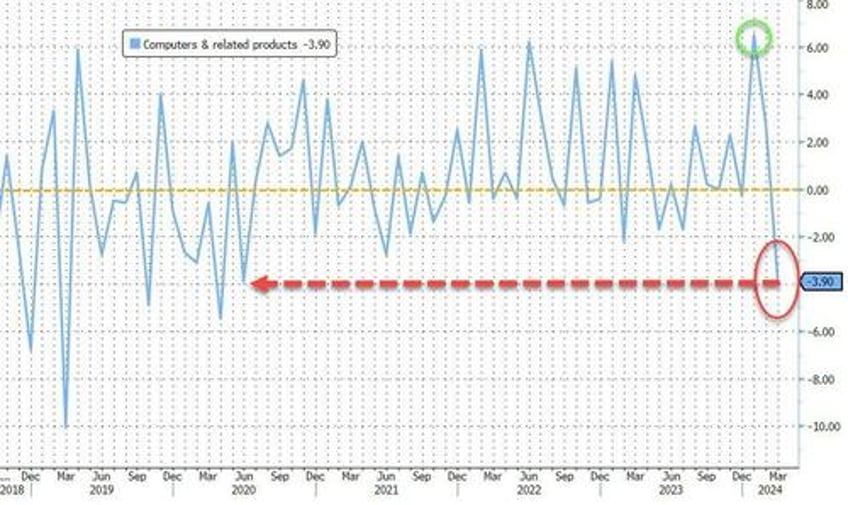

But... it looks like the AI bubble just burst as Computer & related Products orders plunged 3.9% MoM - the biggest drop since COVID lockdowns...

Source: Bloomberg

Finally, and more problematically, core capital goods shipments - a figure that is used to help calculate equipment investment in the government’s gross domestic product report - saw only a small 0.2% MoM rise, which left core shipments down 1.2% YoY - the biggest YoY drop since the COVID lockdowns...

Source: Bloomberg

More 'bad' news to BTFD?