Having been hammered like a nail for much of 2024 as a result of incident after incident involving its flying paperweights (most recently this morning), Boeing stock enjoyed a modest rebound this morning when the airplane maker reported revenues, EPS and cash flow that were all stronger than expected, while assuring investors that "demand across its portfolio was incredibly strong."

Here is what the company reported for Q1:

- Revenue of $16.57BN, down from $17.9BN in Q1 2023 but beating estimates of $16.25BN

- Commercial Airplanes revenue: $4.65BN, missing est. of 5.45BN

- Defense. Space & Security revenue: $6.95BN, beating est of 6.38BN

- Global Services revenue: $5.05BN, beating est of 4.98BN

- Adjusted EPS of -1.13, beating the estimate of an even bigger loss at -$1.76

- Defense. Space & Security operating earnings: USD 151mln, (exp. 62.7mln)

- Global services operating earnings: USD 916mln, (exp. 824.7mln)

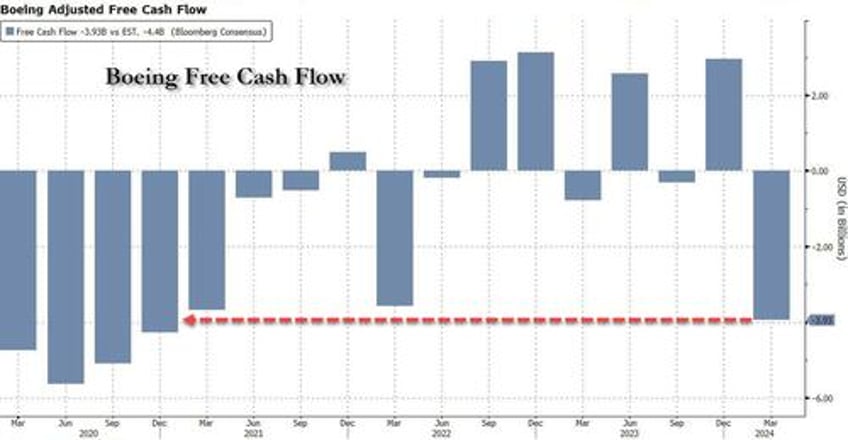

- Free Cash Flow $(3.93BN), worse than the $(0.8BN) cash burn a year ago, but beating estimates of a $(4.4BN) burn.

The latest loss reflected slower 737 Max production, lower 737 deliveries and compensation to customers after a door panel blew out on a commercial flight.

“Our first-quarter results reflect the immediate actions we’ve taken to slow down 737 production to drive improvements in quality,” said chief executive Dave Calhoun.

But while Boeing is "driving improvements", its cash flow is imploding and in Q1 plunged the most in three years. Well, nobody said DEI comes cheap...

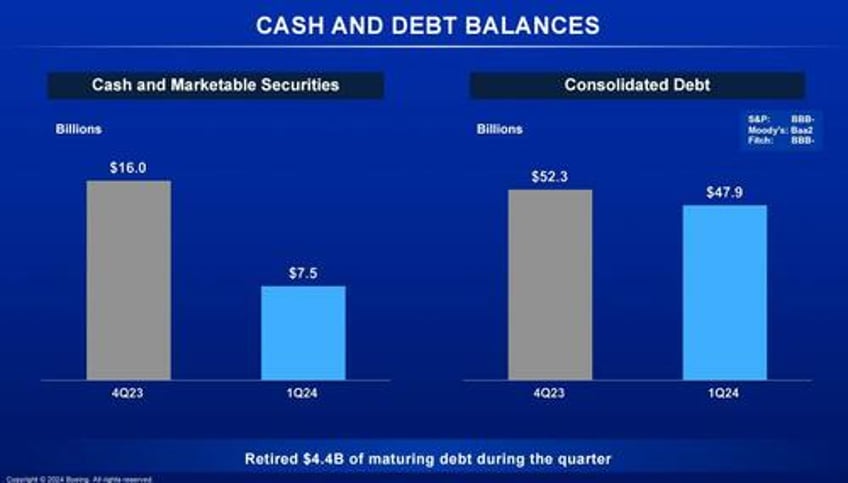

And with Boeing incinerating cash at a near record pace, which fell by $8.5BN, even as maturing debt declined by just $4.4BN, net debt actually rose by $4.1BN!

A closer look at the various divisions, staring with Commercial Airplanes, which saw revenue tumble from $6.7BN to $4.7BN

- Undertaking comprehensive actions to strengthen quality and safety.

- Secured 125 net orders, including 85 737-10 for American Airlines and 28 777X airplanes

- Delivered 83 airplanes

- Backlog of USD 448bln: over 5.600 airplanes

... and Defense, Space & Security, where thanks to the myriad US wars, revenue rose from $6.5BN to $7.0 BN

- Awarded 17 P-8 aircraft for Canada and Germany

- Secured final contract from the U.S. Navy for 17 F/A-18 production aircraft

- Awarded MQ-25 cost-type contract modification from the U.S. Navy, including two additional test aircraft

- Orders valued at USD 9bln; backlog of USD 61bln.

As Bloomberg notes, while the defense business posted a slim, $151 million operating profit for the first time in more than a year, the division is still grappling with cost overruns on fixed-price defense contracts, a hangover from its strategy of bidding aggressively to secure military contracts last decade. “Results also reflect $222 million of losses on certain fixed-price development programs,” the earnings release stated, without elaborating.

In any early morning message, Boeing CEO Dave Calhoun touted the progress Boeing is making in tackling its quality breakdowns. He touted a 500% increase in employee “Speak Up” submissions compared to 2023. Speak Up is a program that Boeing started in 2019 to encourage employees to internally report potential safety issues. In total, more than 70,000 employees have participated in these "quality stand downs."

The company has been hyping the program in recent months, as it faces allegations from whistleblowers who say they were punished in the past for raising concerns. That includes recent claims from a union that represents Boeing employees, which on Tuesday alleged the company retaliated against two engineers who raised concerns about its 777 and 787 jets in 2022.

“Near term, yes, we are in a tough moment. Lower deliveries can be difficult for our customers and for our financials. But safety and quality must and will come above all else,” Calhoun said.

The gloriously incompetent and virtue signaling Boeing chief also acknowledged his plans to step down as CEO “around the end of the year,” adding he would spend his remaining time working to rebuild confidence in Boeing, and to earn that idiotic comp package he received for burning the stock price to the ground.

Turning to M&A, Boeing confirmed last month that it’s in talks to buy back fuselage maker Spirit AeroSystems but there was no update on the deal in the earnings materials. In the meantime, Boeing is providing a $425 million cash advance to Spirit to help stabilize its operations while deliveries slow and the supplier works to improve quality control

This latest bailout by Boeing of one of its most important suppliers may signal the acquisition is taking longer to negotiate, RBC analyst Ken Herbert wrote in a note. The deal talks have hit a snag over pricing for factories that make components for Airbus SE jets, Bloomberg News Reported this week.

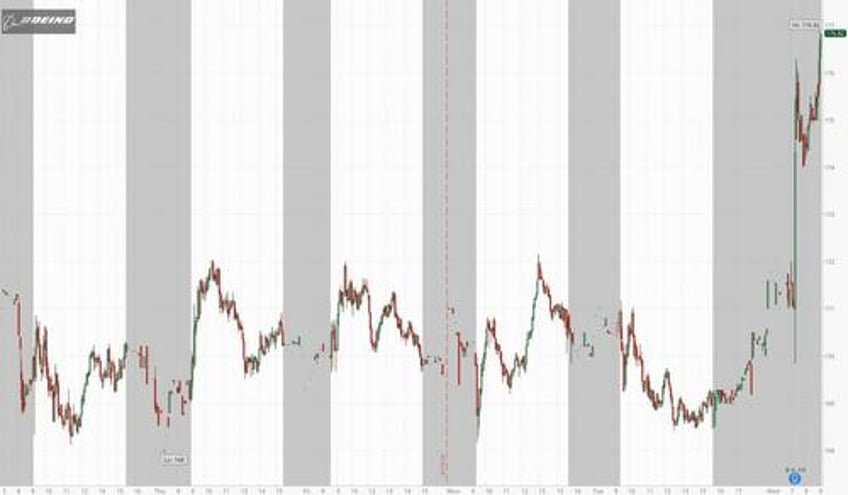

Still, while the results were terrible they were not as terrible as Wall Street's apocalyptic expectations - and that's even with the US engaged in multiple illicit wars - and BA stock managed to stage a modest short squeeze in premarket trading, which is not saying much: the bounce comes after a sharp selloff in the stock this year that made Boeing one of the worst performers in the S&P 500 Index. Also, whether the surge can stick is a different matter.

The company's Q1 investor presentation is here.