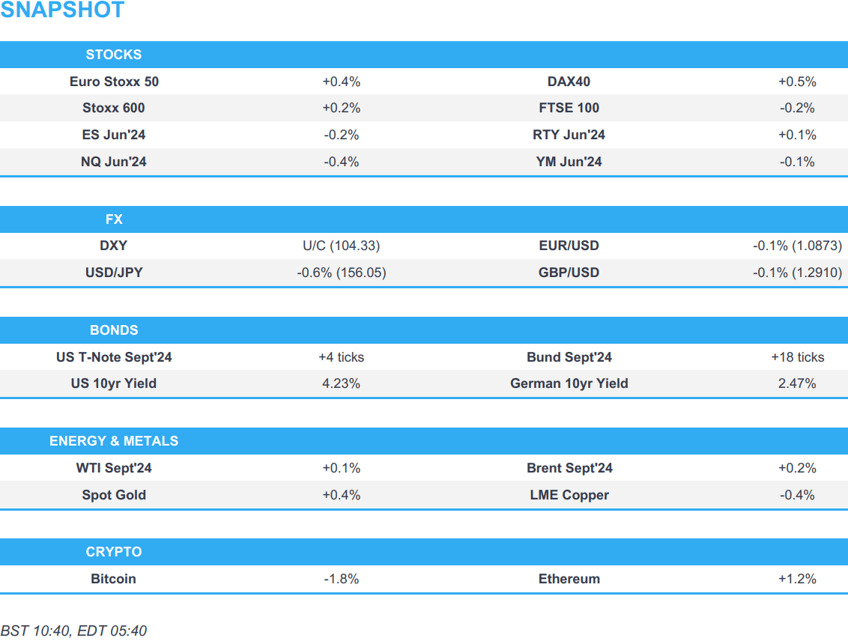

- European bourses are mostly higher whilst US futures are mixed, with underperformance in the NQ following poor NXP (-9%) earnings.

- Dollar is softer vs the JPY but firmer vs other peers, USD/JPY as low as 155.83.

- USTs are caged within a tight range, Bunds are slightly firmer and surpasses 132.00 whilst Gilts lag.

- Crude is choppy and trading on either side of the flat mark, XAU benefits from news that India is to reduce import tax on gold bars and silver bars to 6%; base metals are mostly softer.

- Looking ahead, EU Consumer Confidence, US Richmond Fed Index, CBRT & NBH Policy Announcement, Supply from the US, Earnings from Alphabet, Tesla, Visa, Coca-Cola, General Motors, Philip Morris & Spotify.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (+0.4%), are mostly but modestly higher, in what has been a choppy session thus far.

- European sectors hold a negative bias; Tech takes the top spot, propped up by post-earning strength in SAP (+5%), but chip names are lower, following poor NXP (-9% pre-market) results. Basic Resources is hampered by underlying weakness in the metals complex, whilst Autos lags after Porsche AG cut guidance.

- US equity futures (ES -0.2%, NQ -0.3%, RTY +0.1%) are mixed, with the NQ underperforming, giving back some of the hefty advances seen in the prior session, and with Tech sentiment hit following NXP results.

- Citi Global Equity Strategy: Upgrades UK to Neutral rating. Upgrades Telecoms sector to Overweight. Downgrades Industrials to Neutral from Overweight. Upgrades Consumer Staples to Neutral. Downgrades Emerging Markets to Underweight. Downgrades Basic Resources Sector to Underweight from Neutral.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD is softer vs. JPY but firmer vs. other peers. Fresh US drivers are lacking aside from noise surrounding the 2024 Presidential election race. For now, DXY is caged within yesterday's 104.18-42 range.

- EUR/USD remains stuck below the 1.09 mark after a brief forat to 1.0903 on Monday. Fresh drivers for the EZ may be lacking in the short-term as policymakers at the ECB head for their summer break and see how the data unfolds before its September meeting. Currently trading near session lows at 1.0869.

- GBP is a touch softer vs. the USD in quiet newsflow, ahead of Wednesday's PMI metrics. Cable sits within Monday's 1.2906-42 range.

- JPY once again out-muscling the USD with USD/JPY slipping below Monday's trough at 156.28 to as low as 155.83. Support comes via the 18th July low at 155.36 and 100DMA at 155.32.

- Antipodeans are both softer vs. the USD as sentiment surrounding China remains negative and metals prices stay under pressure.

- PBoC set USD/CNY mid-point at 7.1334 vs exp. 7.2746 (prev. 7.1335).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are steady in quiet newsflow. There has been a lot of noise surrounding the Presidential election. However, there hasn't been much in the way of sustained price action to Harris entering the race. US yields are a touch softer in the belly but marginally so.

- Choppy price action for Bunds with the German 10yr paring early losses, having flown past 132.00 to highs of 132.07; Bunds currently trade near session highs.

- Gilts are the laggard across core fixed income markets with no real obvious catalyst behind price action. Currently trading lower by around 14 ticks, but off worst levels of 97.61 vs current 97.80.

- UK sells GBP 1bln 0.125% 2039 I/L Gilt: b/c 3.0x (prev. 3.16x) & real yield 1.053% (prev. 1.051%)

- Click for a detailed summary

COMMODITIES

- Crude futures are trading indecisively on either side of the flat mark, with crude futures again in consolidation mode in the European morning in the absence of other catalysts. Brent Sep in a USD 82.22-78/bbl parameter.

- Precious metals are mixed with both spot silver and palladium in the red, but spot gold ekes mild gains; the latter benefits from news that India is to reduce import tax on gold bars and silver bars to 6%. Spot gold has inched back above USD 2,400/oz.

- Base metals are mostly softer despite the easing Dollar as the Chinese demand hangover continues, whilst pertinent newsflow for the complex remains somewhat quiet.

- World refined copper market was in a 65k metric tonne surplus in May 2024, according to ICSG.

- Russian senior oil industry source said Lukoil's supplied through the Druzbha pipeline via Ukraine and Hungary have not resumed in July, according to Reuters.

- Germany reportedly plans 10,000km hydrogen grid costing some EUR 19.7bln, according to Bloomberg.

- Iran sets August Iranian Light Crude OSP to Asia at Oman/Dubai +USD 2.10/bbl (prev. +USD 2.60/bbl)

- Click for a detailed summary

NOTABLE EUROPEAN HEADLINES

- ECB's de Guindos said data-wise, September is a much more convenient month for taking decisions than July was; ECB has to be prudent when taking decisions. Inflation data is practically in line with projection. Already seeing wages starting to slow down. Inflation will be at its current levels through 2024. Will particularly closely at wage developments. Would like to see more cross-border banking M&A transactions because we want to have single banking market.

- ECB's Lane's opening remarks at the Joint ECB-IMF-IMFER Conference 2024 [No commentary on policy].

NOTABLE US HEADLINES

- US VP Harris's campaign secured enough delegates to attain the Democratic Presidential nomination.

- Michigan Governor Whitmer endorsed Harris and said she will serve as co-chair of Harris's campaign, while former House Speaker Pelosi also endorsed Harris for President.

- DNC Chair Jaime Harrison said the Democratic Party will deliver a presidential nominee by August 7th which will allow a Vice Presidential nominee in the same time frame, while he added that if only one candidate reaches the 300-delegate threshold to be placed in nomination, virtual voting could occur as soon as August 1st.

- India's 5% import tax cut for mobile phones could result in USD 35-50mln in annual benefits for Apple (AAPL), according to Counterpoint Research.

- NXP Semiconductors NV (NXPI) - Q2 2024 (USD): Adj. EPS 3.20 (exp. 3.21), Revenue 3.13bln (exp. 3.12bln). KEY METRICS: Adj. gross margin 58.6% (exp. 58.5%). Adj. operating income 1.07bln (exp. 1.07bln). Adj. operating margin 34.3% (exp. 34%). Inventory 2.15bln (exp. 1.97bln). Adj. free cash flow 577mln (exp. 854.3mln). Q3 GUIDANCE: Adj. EPS 3.21-3.63 (exp. 3.56). Revenue 3.15-3.35bln (exp. 3.35bln). (NXP IR)

GEOPOLITICS

MIDDLE EAST

- Israeli warplanes broke the sound barrier over Lebanese capital Beirut and other areas of Lebanon on Tuesday, according to Reuters citing Lebanese security sources

- Israeli PM Netanyahu and US President Biden’s meeting was postponed and a US official later stated that President Biden is expected to meet Israeli PM Netanyahu on Thursday at the White House. It was also reported that Vice President Harris will meet with Israeli PM Netanyahu this week at the White House and that Netanyahu requested a meeting with GOP presidential candidate Trump while in the US this week.

- US President Biden said they will keep working to end the war in Gaza and believes a ceasefire is imminent in the Gaza conflict.

- Israeli operation in Khan Yunis killed 70 people and wounded more than 200, according to the health ministry in Gaza cited by AFP News Agency. Furthermore, Israel conducted raids on the town of Aita al-Shaab in southern Lebanon, while Hezbollah said it shelled the Tzuriel colony for the first time with dozens of Katyusha rockets in response to the attack on civilians, according to Al Arabiya and Al Jazeera.

- Japan is to impose its first sanctions on Israeli settlers in the West Bank in which it is arranging an asset freeze on Israeli settlers following similar moves by the US and UK, according to NHK.

- Leaders of Palestinian rival factions Fatah and Hamas will meet with the press in Beijing following reconciliation talks, while Chinese Foreign Minister Wang Yi will attend the meeting, according to CGTN.

- Iraq eyes a drawdown of US-led forces starting September and to formally end the coalition's work by September 2025 with some US forces likely to remain in a newly negotiated advisory capacity, according to four Iraqi sources cited by Reuters.

OTHER

- US official Kritenbrink said the meeting of US-Japan defence and foreign ministers will demonstrate how the two countries will ensure not just the defence of Japan, but also the contribution to regional security.

- Russian overnight attack on energy facility in Sumy region cut power to over 50,000 consumers, according to Ukraine's energy ministry

CRYPTO

- Bitcoin is softer and trades beneath USD 67k, whilst Ethereum continues to advance and holds above USD 3.5k.

- US SEC told issuers US spot ETF products can start trading on Tuesday, according to two firms cited by Reuters.

- Mt. Gox reportedly moved USD 2.8bln worth of Bitcoin (BTC) to a new address, according to The Block Pro.

APAC TRADE

- APAC stocks were mixed and only partially sustained the momentum from the tech-led rebound on Wall St ahead of key data releases and big-tech earnings as sentiment clouded by ongoing China woes.

- ASX 200 was underpinned with tech stocks inspired by the outperformance of the sector stateside, while energy suffered due to recent declines in oil prices and with pressure in Woodside Energy after a mixed quarterly update.

- Nikkei 225 boosted at the open although has since pared the majority of the gains amid a firmer currency and after a recent source report suggested indecision regarding rates at next week’s BoJ meeting.

- Hang Seng and Shanghai Comp. were subdued in which the latter remained the laggard as the PBoC’s recent short-term funding rate cuts and liquidity boost via 7-day reverse repos, left the market wanting more.

NOTABLE ASIA-PAC HEADLINES

- China Human Resources Ministry said China added 6.98mln urban new jobs in H1 and the employment situation is generally stable, while it will intensify the employment and entrepreneurship of young people such as college graduates.

- Indian Budget: India's inflation is low and stably moving to target; uncertainties remain. Fiscal deficit seen at 4.9% vs 5.1% in interim budget. To reduce import tax on gold bars and silver bars to 6%. Long-term capital gains tax to be 12.5%. Click for full details.

- Chow Tai Fook Jewellery (1929 HK) Quarterly Retail Sales -20%; SSS mainland China -26.4%; SSS Hong Kong & Macau -30.8%.