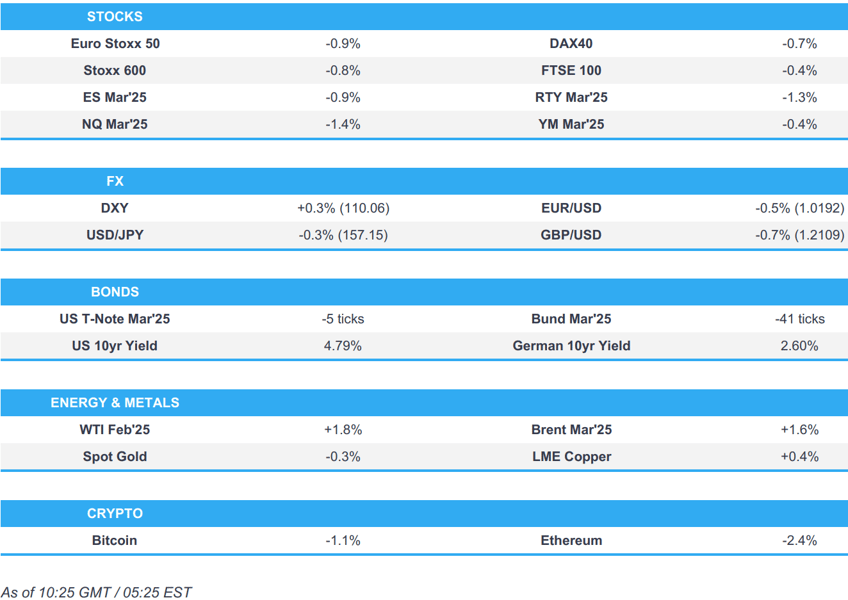

- Equities continue to slip in a continuation of the downside seen following the strong NFP report.

- DXY is stronger and briefly topped 110.00, GBP remains the underperformer.

- Fixed benchmarks weighed on in a continuation of the post-NFP trade, Gilts hit another incremental contract low.

- Crude surges on US-Russia oil sanctions, with some choppiness surrounding Gaza ceasefire talks.

- Looking ahead, US NY Fed SCE.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses began the week entirely in the red and have gradually edged lower as the morning progressed; as it stands, indices reside at worst levels with downside in excess of 1.0% for the Euro Stoxx 50.

- European sectors hold a strong negative bias, with only a handful of industries residing in positive territory. Energy is by far the clear outperformer today, buoyed by the strength in oil prices. Tech is the underperformer today, swept away by the risk-off sentiment and as traders digest comments from Apple watcher Ming-Chi Kuo, who said the iPhone maker is facing challenges in 2025, including stagnant iPhone growth and declining Chinese market share.

- US equity futures are entirely in the red, in a continuation of the downside seen following the strong NFP report; NQ -1.4% the underperformer given the broad tone, yield advances and specific Tech pressure.

- Barclays European Equity Strategy: Cuts UK FTSE 250 to Neutral from Overweight.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD has kicked the week off on a strong footing, in extension of Friday's post-NFP buying. As it stands, markets no longer fully price a 25bps cut by the Fed this year vs. 41bps pre-NFP. For today's docket, US NY SCE is the main highlight. DXY has cracked above 110 for the first time since 10th Nov 2022; 110.99 was the high that day.

- Last week's selling pressure in EUR/USD has continued into this week with the pair slipping onto a 1.01 handle for the first time since 11th Nov 2023; 1.0163 was the low that day. This week's EZ macro calendar is a light one. However, we did hear from ECB Chief Economist Lane over the weekend, noting that there is probably more easing to come.

- JPY is the marginal outperformer across the majors with not much in the way of fresh macro drivers for Japan with Japanese markets closed today. Nonetheless, attention remains on the finely-poised 24th January policy announcement which sees a 25bps hike vs. unchanged rate as a near coin-flip. USD/JPY currently sits just below Friday's 157.22-158.87 range but is yet to breach 157.00 to the downside.

- GBP has kicked the week off on a negative footing in an extension of the selling pressure seen last week. Cable has delved to its lowest level since Nov 2023 at 1.2124. Nothing incremental from a UK standpoint has happened over the weekend, however, the ongoing advances in the UK rates space are clearly acting as a drag on the pound.

- Antipodeans are both steady vs. the broadly mildly stronger USD. Both saw some support overnight amid mild strength in the CNH after the PBoC continued to defend the currency with a firmer-than-expected reference rate setting and raised its cross-border macro adjustment parameter for the first time since July 2023 to 1.75 from 1.50.

- PBoC set USD/CNY mid-point at 7.1885 vs exp. 7.3442 (prev. 7.1891).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs start the week under pressure, continuing the hawkish impulse from NFP on Friday with strong Chinese export data not helping; on this, we wait to see if President-elect Trump comments on the data with reference to his touted tariffs. As it stands, USTs are at the low-end of a 107-06+ to 107-15 band, which marks another contact trough. Amidst this, yields are firmer across the curve with the short-end leading and reflecting the trimming of Fed easing expectations.

- Bunds are pressured, in-fitting with the above. The data docket has been particularly light in Europe with Italian supply the only scheduled update. A few ECB speakers have appeared today, but have had little impact on price action. Currently towards the trough of a 130.57-90 band which marks a fresh contract low. Technicians tout support at 130.48 before looking to the 130.00 mark.

- Gilts opened 59 ticks lower at the 89.00 mark, matching last week’s contract low, before extending to an incremental fresh base at 88.96. Since, the benchmark has stabilised just above opening levels. While the benchmark hit a new contract low the 10yr yield remains just shy of last week’s peak. Thus far, today’s best is 4.905% vs 4.925% from last Thursday.

- Italy sells EUR 2.75bln vs exp. EUR 2.50-2.75bln 2.70% 2027 and EUR 3bln vs exp. EUR 2.75-3bln 3.15% 2031 BTP; no real reaction in BTPs.

- Click for a detailed summary

COMMODITIES

- WTI and Brent prices are firmer this morning despite the stronger Dollar but against the backdrop of geopolitics. Prices gained from the open amid expectations of Russian crude supply disruption after the US recently toughened sanctions on Russia's energy sector targeting more than 200 entities and individuals, while it was also reported that Israel struck a number of Hezbollah targets in southern Lebanon.

- That being said, a couple of short-lived downticks were seen on reports that a breakthrough has been reached in Doha, a final draft of the Gaza Ceasefire and hostage release has been sent to Hamas and Israel for approval, according to an official cited by Reuters. However, it was then reported that Israel has reportedly not received a draft proposal for the Gaza ceasefire deal, according to an Israeli official.

- WTI trades towards the upper end of a USD 76.54-78.58/bbl range while Brent resides in a USD 79.76-81.68/bbl parameter.

- Spot gold is subdued amid the dollar strength but losses are cushioned by ongoing geopolitics alongside the risk-off sentiment. Currently resides in a USD 2,679.31-2,693.55/oz parameter and within Friday's USD 2,664.07-2,697.95/oz range.

- Copper holds a mild upward bias despite the dollar's strength and risk aversion, possibly on the back of better-than-expected Chinese trade data overnight coupled with hopes of a Chinese stimulus. Desks also suggested iron ore prices gained almost 2% on the back of stimulus prospects.

- Iran shipped out nearly 3mln bbls of oil stockpiled in China in which the proceeds could reportedly be used to fund its allied militias in the Middle East, according to WSJ.

- Goldman Sachs said tougher US and UK sanctions on Russian oil could lift oil prices above USD 85/bbl, while it also commented that TTF price risks remain skewed to the upside despite moderation in cold weather. Goldman Sachs also commented that while the latest round of sanctions has mostly focused on oil and the potential impact on LNG supply is very limited, it keeps global gas balances more vulnerable at the margin to tightening shocks and to the risk that TTF might need to price oil-switching in a EUR 65-86/MWh range this summer.

- Saudi Energy Minister says Saudi Arabia to enrich, sell and produce yellow cake from Uranium.

- Middle East crude benchmarks jump to premiums of around USD 3/bbl above Dubai quotes, highest since Oct 2023, according to Reuters data.

- Russia's Kremlin says hope Russia will be able to counteract the US attempt to undermine Russian companies; says the US sanctions are bound to destabilise global energy markets. Will monitor the new sanctions and seek to minimise them.

- Indian Government source is examining the impact of US sanctions on Vostok Project; says the spike in oil prices in a knee-jerk reaction; will not take Russia oil from sanctioned entities and in sanctioned vessels, via Reuters

- Six EU nations call for a lower G7 price cap on Russian oil, according to a document cited by Reuters.

- Click for a detailed summary

NOTABLE EUROPEAN HEADLINES

- ECB's Vujčić says under current uncertainty, better to move gradually as the ECB is doing; expectations for gradual meeting-by-meeting approach justified; near-term expectations of markets seem justified; developments broadly in line with ECB projections. Exchange rate has not weighed much on ECB policy decisions so far, but must monitor.

- UK Chancellor Reeves said the fiscal rules set in the October Budget are non-negotiable and that there undoubtedly have been moves in global financial markets. Reeves said that they will take action to ensure that they meet fiscal rules and she is committed to having one Budget a year which will be in Autumn. Reeves also announced that the UK will earn GBP 600mln from five-year agreements made with China.

- UK Chancellor Reeves is set to tell British regulators that they need to embrace risk and "strip back" overly cautious rules that are stifling economic growth, according to The Times.

- ECB's Lane said Europe's economy is still in recovery from the pandemic and their baseline for Europe is a recovery but noted a modest Europe recovery has a downside alternative, while he expects consumption to improve this year and said there is probably more easing to come. In a separate interview, Lane said we need to make sure that the economy does not grow too slowly, via Der Standard; need to work out the middle path of being neither too aggressive or too cautious in our actions For inflation to be sustainably at target, there would need to be a further decline in services inflation from around 4% currently.

- ECB's Rehn said Europe must not get caught off guard regarding a trade war and the EU should not take a beating in the case of tariffs. Adds, the direction of rates is clear, speed and scale of cuts depends on data, via Bloomberg TV. Inflation is moving in the correct direction, quite confident it is stabilising at 2%

- Brussels Airlines said it will need to cancel a significant number of flights at Brussels Airport on Monday due to a strike.

- Fitch affirmed Austria at AA+; outlook revised to negative, while it stated the outlook for Austria’s economy remains subdued with a forecast of weak real GDP growth of 0.8% for 2025.

NOTABLE US HEADLINES

- Russian Kremlin says there are no specific preparations underway for a possible US President-Elect Trump and Russian President Putin meeting.

- Barclays expects Fed to deliver one 25bps rate cut in June 2025 (vs prev. forecast of one cut in March and one in June).

GEOPOLITICS

MIDDLE EAST - EUROPEAN MORNING

- A breakthrough has been reached in Doha, a final draft of the Gaza Ceasefire and hostage release has been sent to Hamas and Israel for approval, according to an official cited by Reuters.

- Israeli Finance Minister says the Gaza ceasefire deal is a catastrophe for Israel's national security. Says will not be a part of surrender deal that will include the release of terrorists and the cessation of war.

- Israel has reportedly not received a draft proposal for the Gaza ceasefire deal, according to an Israeli official.

- Israeli official says they are "Waiting for Hamas' answer, the hostage deal outline is clear. Israel has come a long, long way", according to Reporter Stein.

MIDDLE EAST

- Israeli PM Netanyahu is to send the head of Mossad to Qatar for hostage talks, according to the PM’s office cited by Reuters.

- Israeli PM Netanyahu spoke with US President Biden on Sunday in which they discussed negotiations for a Gaza ceasefire and a hostage deal, while Biden stressed the immediate need for a ceasefire and return of hostages, as well as the need for a surge in humanitarian aid enabled by a stoppage in the fighting.

- Israel's Foreign Minister said Tel Aviv is determined to reach a truce agreement in Gaza, according to Israeli media cited by Asharq News.

- Israel's army said it targeted a number of Hezbollah targets in southern Lebanon based on intelligence information, according to Sky News Arabia.

- Syria’s de facto ruler Al-Sharaa said he discussed with Lebanon’s caretaker PM Mikati the issue of Syrian deposits in Lebanese banks, while Mikati said they will work with Syria to secure the land borders and follow up on land and sea border delineation.

- Western and Arab foreign ministers and diplomats began a regional conference with Syrian Foreign Minister Shibani in Riyadh on Sunday.

- German Foreign Minister said Germany proposes a smart approach to sanctions so the Syrian population gets relief and a quick dividend from the transition of power, while Germany will provide an additional EUR 50mln to Syria for food, emergency shelters and medical care.

RUSSIA-UKRAINE

- Ukrainian President Zelensky said Ukrainian soldiers captured North Korean military personnel in Russia’s Kursk region, while he later commented that Kyiv is ready to hand over North Korean soldiers if North Korean leader Kim can organise their exchange for Ukrainians captive in Russia. It was separately reported that a South Korean lawmaker said North Korean troop fatalities in Ukraine exceeded 3,000.

- Russia took control of the settlements of Shevchenko, Kalynove and Yantarne in eastern Ukraine, according to TASS.

- Russian Foreign Ministry said new US sanctions against the energy sector are an effort to harm Russia’s economy at the cost of risking destabilisation of global markets and Russia will respond to Washington’s hostile actions.

- US President Biden said on Friday that as long as they keep Western Europe united on Ukraine, there is a real chance Ukrainians can prevail, while he added that Russian President Putin is in tough shape right now and it is important that Putin does not have more breathing room to do what he is doing.

- US President-elect Trump’s incoming National Security Adviser Waltz said he expects a call between Trump and Russian President Putin in the coming days and weeks, according to an ABC News interview.

OTHER

- White House said US President Biden discussed trilateral maritime security and economic cooperation with the leaders of Japan and the Philippines, while they discussed China’s dangerous, unlawful behaviour in the South China Sea and agreed on the importance of continued coordination in the Indo-Pacific.

- Denmark’s government sent private messages to the Trump team expressing a willingness to discuss increased US military and security presence in Greenland, according to Axios.

- Japan will test hypersonic missile tracking with space sensors and will deploy sensors which is set for a first launch in fiscal 2025 to resupply the International Space Station, according to Nikkei.

CRYPTO

- Bitcoin is on the backfoot and holds just shy of the USD 93k mark; Ethereum continues to edge lower and looks to test USD 3.1k to the downside.

APAC TRADE

- APAC stocks were mostly negative in reaction to the hot NFP jobs report and subsequent rise in yields as Fed rate cut bets were unwound, while risk sentiment was also not helped by the holiday closure in Japan and failed to benefit from Chinese trade data.

- ASX 200 was lower with underperformance in tech, financials and consumer discretionary sectors, while energy bucked the trend owing to a surge in oil prices.

- Hang Seng and Shanghai Comp were pressured at the open as participants awaited the latest Chinese trade data but pared some of the losses following comments from PBoC Governor Pan that they have the confidence and means to overcome difficulties in the economy and will use interest rate and RRR tools to keep liquidity ample, while sentiment then remained subdued amid the broad risk-aversion and failed to benefit from the better-than-expected Chinese trade figures.

NOTABLE ASIA-PAC HEADLINES

- PBoC raised the cross-border macro adjustment parameter to 1.75 (prev. raised to 1.50 in July 2023), while it held a meeting for the FX market in Beijing and pledged to strengthen FX market management, as well as discussed to resolutely keep yuan exchange rate basically stable at reasonable and balanced levels. PBoC also said it will increase forex market resilience, strengthen the forex market, deal with behaviours disrupting market orders and prevent exchange rate overshooting risks. Furthermore, it reiterated the yuan rate will stay at a reasonable and balanced level.

- PBoC Governor Pan said China's economy addressed risks and challenges in recent years, while they have confidence and means to overcome difficulties in the economy and will use the interest rate and RRR tools to keep liquidity ample. Pan reaffirmed China is to raise the fiscal deficit and will continue to be the world economy's engine. Furthermore, he said policy should shift to investment and consumption but also noted that challenges remain in China's economic development.

- PBoC Governor Pan met with BoE Governor Bailey in Beijing on Saturday and discussed financial stability and cooperation, while Pan also met with top executives from HSBC, Standard Chartered and the London Stock Exchange. It was separately reported that UK and China will explore a wealth connect program and they announced the launch of an OTC bond business with China to launch a sustainable government bond in London this year.

- HKMA said China is to encourage listings and debt issuance in Hong Kong, while the HKMA and PBoC will set up a CNY 100bln liquidity facility for trade finance. HKMA also announced to extend trading hours for the Bond Connect Southbound Scheme with the settlement time for the Bond Connect to be extended to 04:30 pm local time (08:30GMT/03:30EST) which includes USD and EUR bonds, while it is to expand onshore investor choices for international bonds through the link.

- South Korean impeached President Yoon’s lawyer said Yoon will be absent from the first hearing in the impeachment trial out of safety concerns.

- Chinese Auto Industry Association official says China's vehicles sales estimated to grow 4.7% in 2025 (vs 4.5% growth in 2024 and 12% in 2023), NEV sales seen growing 24.4% in 2025, and vehicle exports estimated to grow 5.8% to 6.2mln units in 2025. China 2024 vehicle sales +4.5% Y/Y (prev. +12% in 2023), according to the industry association; December vehicle sales +10.5% Y/Y (prev. 11.7% in November); 2024 NEV sales +39.7% Y/Y, Dec NEV sales +34% Y/Y.

DATA RECAP

- Chinese Trade Balance (USD)(Dec) 104.84B vs. Exp. 99.8B (Prev. 97.44B)

- Chinese Exports YY (USD)(Dec) 10.7% vs. Exp. 7.3% (Prev. 6.7%); Imports YY (USD)(Dec) 1.0% vs. Exp. -1.5% (Prev. -3.9%)

- Chinese Yuan-Denominated Trade Balance (Dec) 752.90B (Prev. 692.80B)

- Chinese Yuan-Denominated Exports (Dec) 10.9% (Prev. 5.80%); Imports (Dec) 1.30% (Prev. -4.70%)