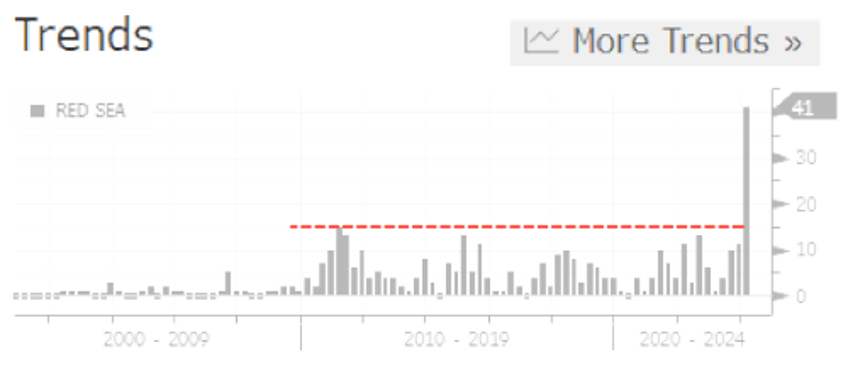

Earnings-call mentions of "Red Sea" surged to record highs in recent weeks as the fourth-quarter earnings season kicks off.

Management teams and analysts are particularly worried about shipping disruptions as major shippers suspend sails through the critical waterway. At the same time, US and allied forces unleashed bombing raids on Iran-backed Houthis in Yemen. Still, the rebels have been able to strike commercial vessels with missiles and drones this past week, as the chaos in the region could last months.

Using the Document Search function on Bloomberg, earnings-call mentions of "Red Sea" topped 41 this week, a record high. As the earning season progresses, the mentions will likely increase.

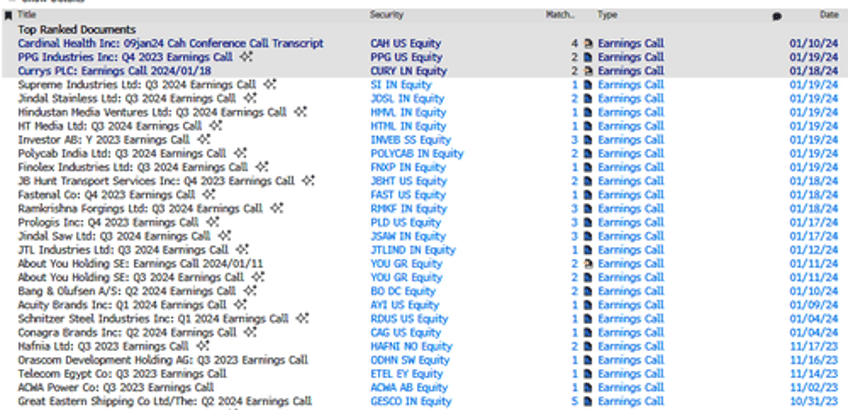

Here's a list of corporate executives discussing the Red Sea situtaion in the latest earnings calls.

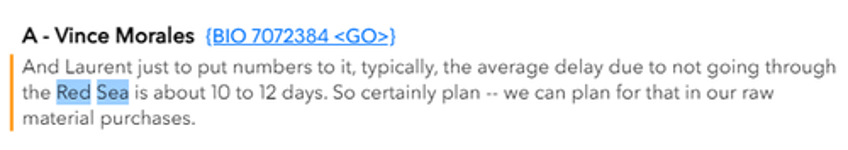

In one earnings call, paint and coating company PPG Industries executives mentioned Red Sea disruptions could affect their raw material purchases.

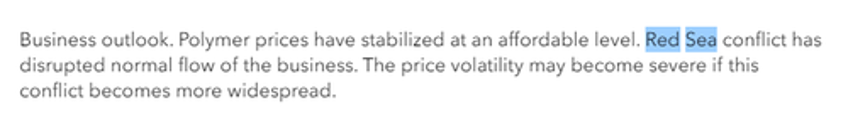

An Indian executive at plastics company Supreme Industries warned that the Red Sea chaos "has disrupted the normal flow of business."

"And just to build on that, zooming out a bit. Of course, if the conflict in the Red Sea were to escalate or to endure, it's going to affect everybody," the CEO of British electrical and telecommunications retailer and services company Currys plc said.

Disruptions in the critical waterway could have significant consequences for global growth.