By Michael Every of Rabobank

“Your task will not be an easy one. Your enemy is well trained, well equipped, and battle-hardened. He will fight savagely ... I have full confidence in your courage, devotion to duty and skill in battle. We will accept nothing less than full Victory! Good Luck! And let us all beseech the blessing of Almighty God upon this great and noble undertaking.” General Eisenhower

The Bank of Canada became the first G7 central bank to cut rates in this cycle yesterday with a 25bp reduction from 5.00% to 4.75% alongside a clear signal more will come. However, it is also aware that the fight against inflation may not yet have been won.

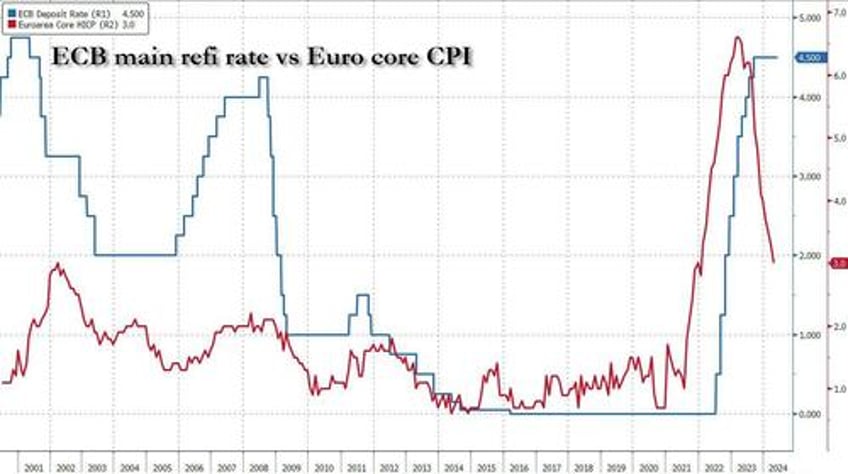

Today, it’s the turn of the ECB, where a 25bp cut from 4.00% to 3.75% is the universal expectation. Some in Europe are lobbying for this to be followed up by a further move to 3.50% as soon as next month. But where after that? It’s a good question.

With recent US labour market data suddenly looking wobbly, many in the market are again thinking the battle of ideas has been won by “rate cuts!”, and that the war against inflation is over for good. In places that can be true, and advances will be made.

Unfortunately, in others the structural forces driving inflation are well trained, well equipped, battle-hardened, and will fight savagely. Indeed, as Bloomberg notes today, ‘The Fed Can’t Conquer Inflation If Washington Keeps on Spending’. That’s one of the key structural inflation forces at play, but not the only one. As such, were central banks to try to cut too fast ahead, they could easily find themselves outflanked and forced to retreat – a humiliating Dunkirk for them and their battered reputations, not a D-Day.

On which, on 6 June 1944, 150,000 soldiers from the US, UK, and Canada invaded Nazi-occupied France to begin the liberation of Europe from the West. Today, the leaders of the US, UK, Canada, France, Germany, and Ukraine rather than Russia will thank the dwindling band of heroes who bled on Normandy’s beaches for the freedoms Europeans still hold today. This event is doubly poignant: it’s probably the last which D-Day survivors will be able to attend; and the current geopolitical backdrop has many serious commentators again worrying about the risks of world war, as eastern Europe and the Middle East already experience today.

The 80th commemoration of D-Day ironically takes place against EU elections in which Politico notes, ‘As the far right surges, Europe heads toward its Donald Trump moment,’ and, “If the polls are correct,…will reorder the Continent’s political landscape.” If so, this reflects the failure of the neoliberal policy framework put in place post-1990 when the West felt war and Cold War were over forever. It could also have implications for the “radical change” the EU needs to push back against a geopolitical atmosphere akin to the 1930s or early 1910s.

The scale of the problems Europe faces is voiced by Bret Stephens: ‘This D-Day, Europe needs to resolve to get its act together’. He notes D-Day celebrations will see “sombre and anxious reflections about the fate of the Atlantic alliance. Sombre because the last of the Greatest Generation will soon no longer be with us. Anxious because former President Donald Trump, and his evident disdain for that alliance, may soon be with us again. The anxiety is partly misplaced. Trump’s truculent brand of American nationalism is a terrible idea for many reasons, not least in the encouragement it gives to Vladimir Putin and Xi Jinping to target weaker US allies. But Trump is also the messenger of a warning Europeans desperately need to heed. In a nutshell: Shape up.”

He then lists the set of structural challenges –growth/dynamism; military power; demographics; purpose/will (“If Russia defeats Ukraine and decides in a few years’ time to attack one of the Baltic countries, is there a deep pool of young Germans, Belgians or Spaniards willing to die for Tallinn or Vilnius?”)-- which parallel those we noted in December.

One implication is vastly more needs to be spent on defence. Experts agree the target of 2% of GDP is irrelevant and a realistic figure is 3.5% - 4%. That’s on top of subsidies for industrial policy to retain production; welfare to ensure the populace supports preparations for warfare; and the energy transition. Together, we could be talking 6% of GDP of spending a year, immediately. To think this is not going to be inflationary is to imagine one wins a war by declaring it.

The same problems are evident in the US, which is no longer the ‘arsenal of democracy’ yet faces a Chinese-Russian,-Iranian-North Korean arsenal of autocracy. Foreign Affairs is now arguing the Pentagon needs to plan for a three-theatre war --Asia, Europe, and the Middle East-- even as Asia could have multiple fronts, ‘Monroe Doctrine’ Latin America can’t be taken for granted, and North Africa is falling under Russia’s influence.

The budgetary implications are so enormous this is argued to require integrating the US military defence base with those of its key Anglosphere allies, Japan and South Korea - the latter two providing shipbuilding while the US restarts its own industry, for example.

The geopolitical implications are a loss of US strategic autonomy, or the others’ to the US. Moreover, it would mean Canada, the UK, Australia, (New Zealand?), Japan, and South Korea all increasing their defence spending further than already pledged to contribute to multi-theatre war preparations, perhaps by another 1.5 to 2% of GDP. That’s inflationary, not disinflationary.

But freedom isn’t free. Or just free markets. Indeed, while we will be inspired by the speeches we hear today from Normandy, others had far blunter warnings for the troops ahead of D-Day:

“War is a bloody, killing business. You’ve got to spill their blood, or they will spill yours. Rip them up the belly. Shoot them in the guts. When shells are hitting all around you, and you wipe the dirt off your face and realise that instead of dirt it’s the blood and guts of what once was your best friend beside you, you’ll know what to do! I don’t want to get any messages saying, ‘I am holding my position.’ We are not holding a goddamned thing. Let the Germans do that. We are advancing constantly, and we are not interested in holding onto anything except the enemy’s balls. We are going to twist his balls and kick the living sh*t out of him all of the time.” General George S. Patton

The same needs to be accepted by those thinking rate cuts are going to be a flood, not a trickle; or that rate cuts solve our larger problems. They probably aren’t, and they certainly won’t.

Our war against inflation won’t be won until politics and geopolitics stabilise in tandem. There are many battles ahead before either happens, and we have only just started to wargame how the two can join up to achieve any victory.

Central banks have a key role to play in that: but not the neoliberal one of rate cuts and ‘buy all the things.’ For example, Aussie home loans soared 4.8% m-o-m today vs. 1.5% expected with investor loans +5.6%. Nothing in that says rates that need to be cut. And every A$ allocated to future home ownership or short-term speculation on it is an A$ that didn’t go into the military-industrial sector thinking about Australia’s future. That’s the game – until it isn’t.

Moreover, see ‘US Battles for ‘Hearts and Minds’ in a Conflicted World’, interviewing a key architect of the sanctions regime imposed on Russia, Daleep Singh; and @matthew_pines comment: “Overall, I detect a sense of desperation - that he was brought back into get a few key items across the finish line before the November elections, but the scale and scope of US adversaries’ challenge (and the limited effectiveness of Executive tools) is immense… and time is running out.”