Summary

- The ECB Governing Council is widely expected to cut policy rates by a further 25bp at its January 30 meeting, the fifth consecutive rate cut since the ECB started its easing cycle June 2024. The incoming indicators have been broadly in line with the December staff projections, pointing to subdued growth and ongoing disinflation. ECB officials have guided towards further policy rate cuts, arguing this week that the direction for policy is “very clear.”

- Goldman expects a steady message at today's meeting without any changes to the key policy language; the bank expects Lagarde will strike a similar tone to her comments in Davos earlier this week, with much of the Q&A focused on the potential economic implications of the Trump policy agenda.

- A further 25bp cut at the March meeting is highly likely, while the subsequent rhythm and depth of cuts depends on the data. We maintain our forecast for sequential cuts to 1.75% in July, given our forecast for subdued growth.

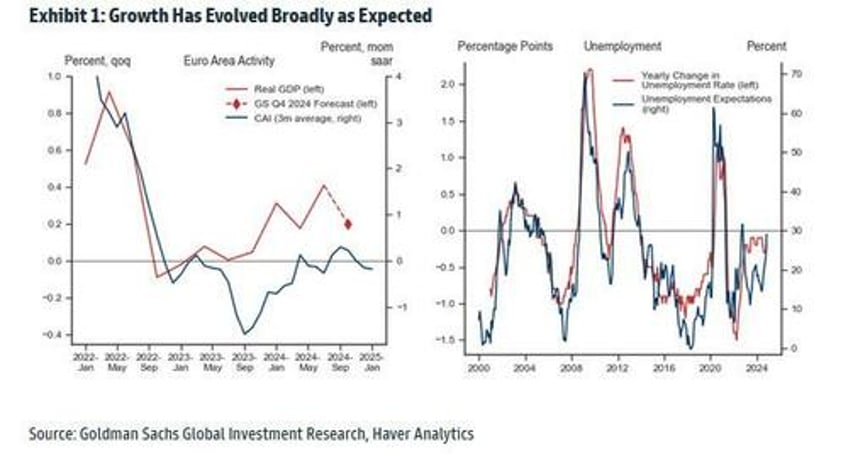

The incoming activity indicators have been broadly in line with the December staff projections. While there is downside risk to the staff’s 0.2% Q4 GDP growth number after Germany’s unexpectedly weak GDP release, the early indications for the Q4 GDP composition look firmer and the PMIs have recovered somewhat. The unemployment rate remained at its all-time low of 6.3% in November, but some forward-looking employment indicators have deteriorated (including the unemployment expectations component in the European Commission survey). Consistent with this, recent ECB commentary has noted that the incoming activity data remains weak but in line with the staff’s forecast.

Some more details on what to expect courtesy of Newsquawk

OVERVIEW:

The ECB is unanimously expected to deliver another 25bps cut to the Deposit Rate - the fifth in a row - despite a recent uptick in inflation given concerns around the growth outlook and the view that policy is still currently restrictive. Focus will be on any hints over future easing plans. However, policymakers will likely retain a meeting-by-meeting and data-dependent approach. Looking beyond the upcoming meeting, markets see an additional 66bps (i.e. excluding this week's 25bps cut) of loosening by year-end with the terminal rate seen at around 2%.

PRIOR MEETING:

As expected, the ECB delivered a 25bps cut to the deposit rate, taking it to 3.0%. The main takeaway from the policy statement was the Governing Council s decision to drop the reference to ‘keep policy rates sufficiently restrictive for as long as necessary". Elsewhere, the ECB stated it will continue to follow a data-dependent and meeting-by-meeting approach. The accompanying macro projections saw a reduction in the HICP forecasts for 2024 and 2025 with the 2026 forecast held below target at 1 9%, whilst growth forecasts were cut across the horizon At the follow-up press conference. Lagarde was careful to note that the GC is not yet declaring victory on inflation, whilst later adding that risks to inflation are two-sided. With regard to the policy decision. Lagarde noted that all members agreed with the policy proposal. Adding that a 50bps move was discussed, however, this failed to gain any traction. The President stated that whilst not pre-committing to a specific policy path, the direction of travel is clear. Lagarde also refused to engage in discussions of where the GC sees the neutral rate, stating that it was not discussed at the meeting.

RECENT ECONOMIC DEVELOPMENTS:

The economic backdrop to the upcoming meeting has seen an expected uptick in headline Y/Y inflation to 2.4% from 2.2%, core Y/Y hold steady at 2.7% and services inflation nudge higher to 4.0% from 3.9%. The 5y5yr inflation forward has picked up from around 2% at the time of the prior meeting to current levels of circa 2.08% (has been as high as 2.1489%). At this stage, policymakers have looked through the uptick in inflation and continue to expect a return to target in 2025. Greater concern remains on the growth outlook. However, on a mildly encouraging footing, flash PMI data for January saw the Composite metric move back into expansionary territory. The accompanying report noted ‘The private sector is back in cautious growth mode after two months of shrinking' Note, that Q4 GDP data is not available until the morning of the announcement. In the labour market, the unemployment rate remains at the historic low of 6.3%.

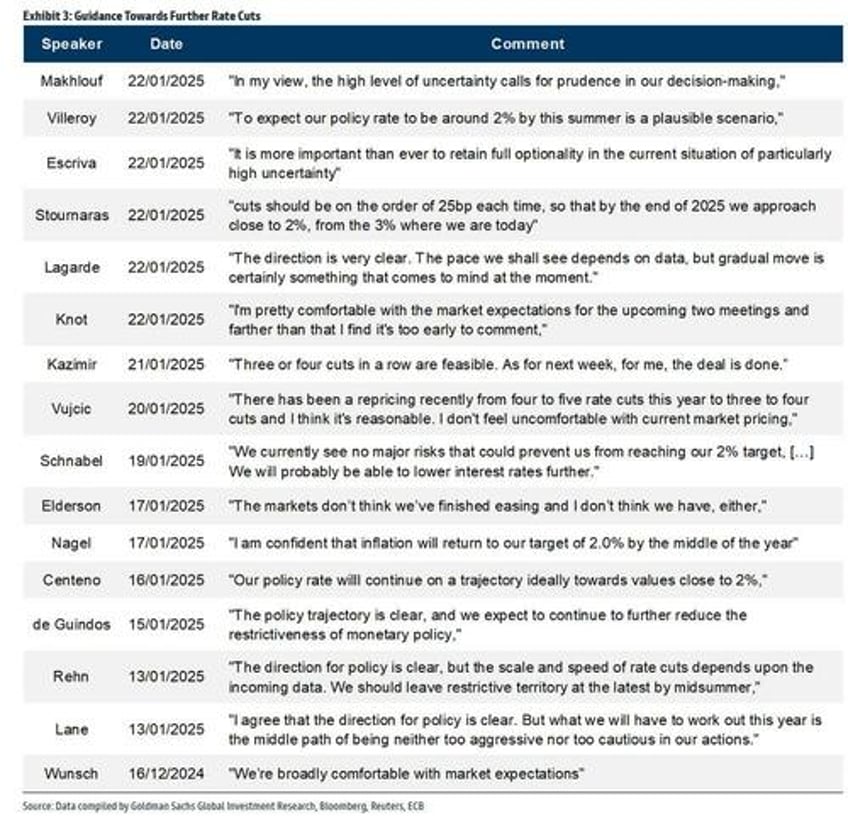

RECENT COMMUNICATIONS:

In an interview at Davos. President Lagarde remarked that she is confident that inflation will return to target over the course of the year, whilst the growth outlook is subject to downside risks. On the trade front, she remarked that it was her expectation that there would be no immediate tariffs from the US and expects the US to be more selective when it comes to tariffs. Chief Economist Lane has stated that the ECB needs to work out a middle path where it is not too aggressive or too cautious in its actions. The influential Schnabel of Germany has noted that the ECB is "getting closer and closer to the point where we need to take a closer look at whether and how much further we can cut interest rates.” Her German counterpart Nagel has stressed that the Bank should not rush things when it comes to policy normalization. At the most hawkish end of the spectrum, Austria's Holzmann has stated that a cut at the upcoming meeting is not a foregone conclusion. At the dovish end of the spectrum. Greece's Stournaras is of the view that "cuts should be on the order of 25bp each time, so that by the end of 2025 we approach close to 2%, from the 3% where we are today". Elsewhere on the rate path. France's Villeroy suggests that "to expect our policy rate to be around 2% by this summer is a plausible scenario ".

RATES:

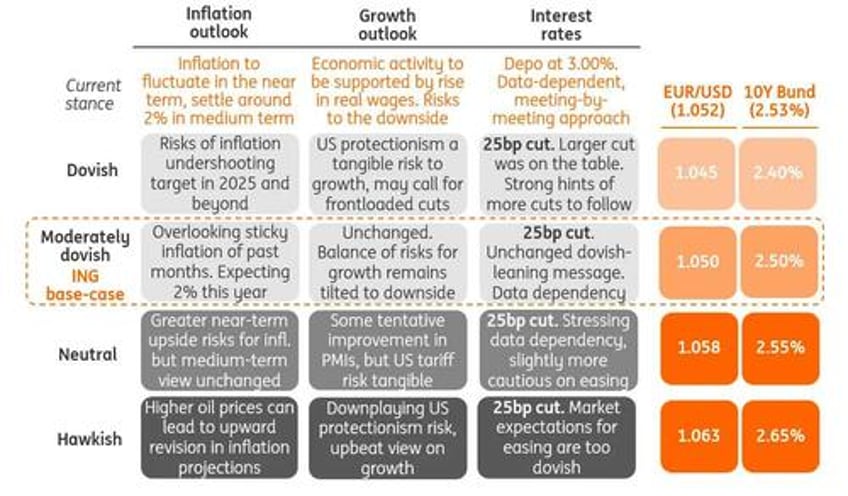

Expectations are for the ECB to deliver a 25bps cut in the Deposit Rate to 2.75%, according to all analysts surveyed by Reuters; markets assign a 91% chance of such an outcome on the basis that policy is still viewed as being restrictive and the recent uptick in inflation is seen as temporary. Looking beyond the upcoming meeting, markets see an additional 66bps of loosening by year-end with the terminal rate seen at around 2%; a level that some desks view as neutral. A further deterioration in the growth outlook and a moderation in inflation could see pricing slip closer to 1 50-1.75%. ING posits that such levels could also come to fruition in the event of a more dovish Fed.

HOW TO TRADE THE CUT:

As usual, the folks at ING Economics have published a matrix on how to trade the ECB decision. The bank's baseline is that a reiteration of the broadly dovish message can pave the way for lower eurozone rates. While the ECB remains a negative for the euro, the dollar correction might have a bit more to run