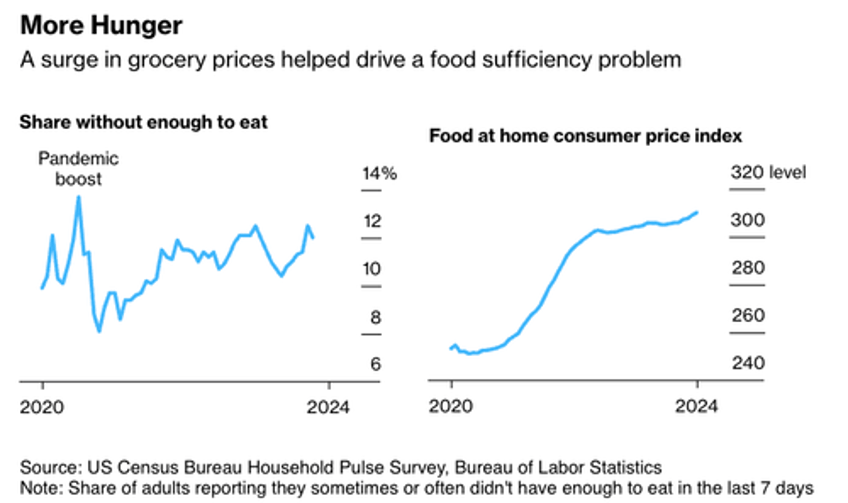

Emily Engelhard, Vice President of Research at Feeding America, told Bloomberg that elevated and persistent inflation ushered in a "new era of food insecurity," emphasizing that "this is no longer an unemployment issue."

Feeding America, the largest charity working to end hunger in the US, has a nationwide network of more than 200 food banks that feed more than 46 million people through food pantries, soup kitchens, shelters, and other community-based agencies.

"Everyone sees prices getting high — for food, clothes, everything," Kersstin Eshak told Bloomberg, who recently visited a food bank in Loudoun County, Virginia. She said the inflation nightmare over the last several years depleted her pocketbook.

America's cost-of-living crisis mostly erupted during the Biden-Harris regime's first term.

Ethan Amos, the head of the Flagstaff Family Food Center in Arizona, said his food bank broke records in 2022 by serving an average of 28,000 meals per month. That figure has now surged to a staggering 40,000 meals per month, driven by the inflationary pressures unleashed during the Biden-Harris administration's disastrous "Bidenomics."

Believe it or not, Washington, DC, has a hunger crisis. The largest food bank in the area, Capital Area Food Bank, distributed 64 million meals last year—five million more than the previous year. Data from the food bank shows that food insecurity has risen most sharply among households earning $100,000–$150,000.

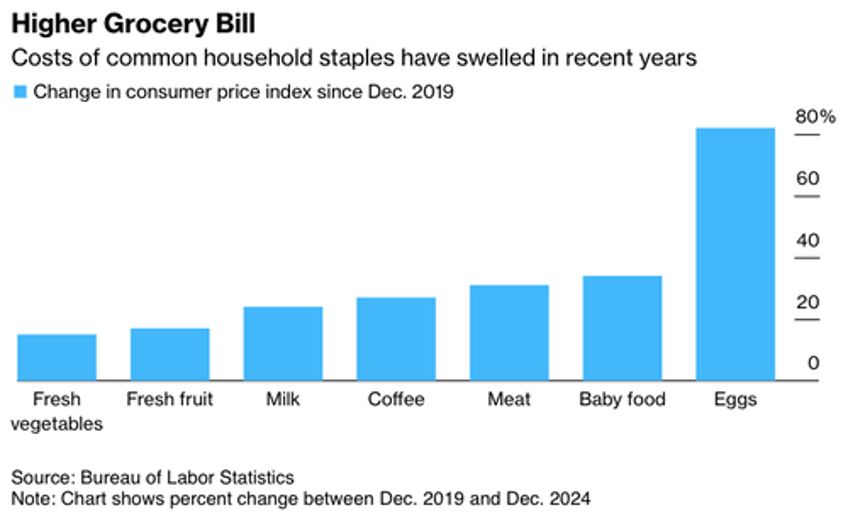

In the past five years, supermarket food prices have jumped 28%—roughly matching the increase seen in the 15 years before the onset of Covid. While wages have also increased, inflation eroded much of those gains. Low- and mid-tier consumers have been most battered in the multi-year inflation storm.

"Everything has gone up," said Norma Rivera, a working single mother of two, during an interview at the Food For Others food pantry in Fairfax, Virginia, adding, "Fifty dollars is nothing" in the grocery store, she said.

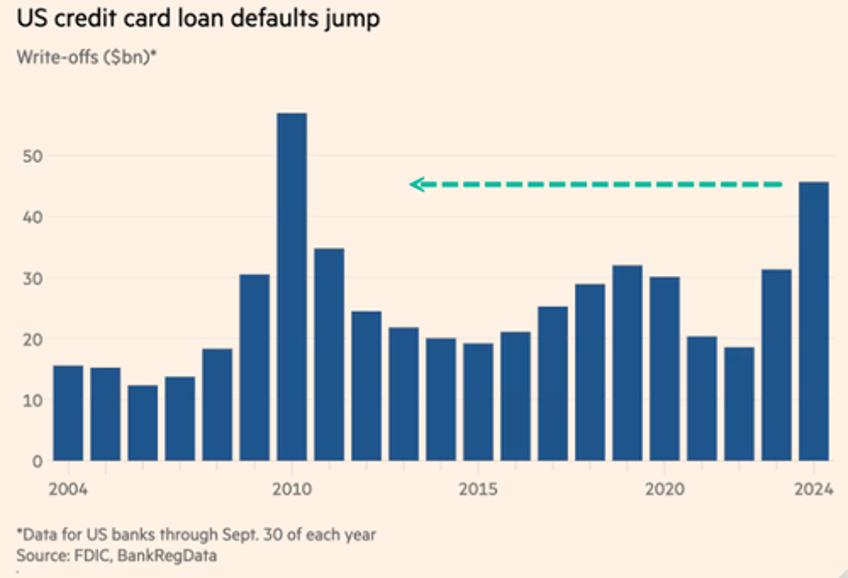

Last week, consumer services company Bankrate released a new report finding that most Americans could not afford a $1,000 emergency expense.

59% Of Americans Don't Have Enough Savings For A $1,000 Emergency: Report https://t.co/d4hQ4otQk7

— zerohedge (@zerohedge) January 26, 2025

More bad news for consumers...

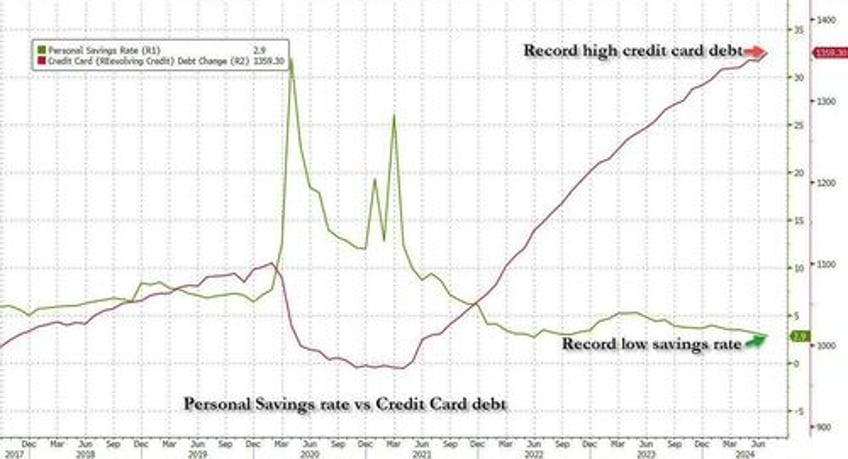

Many consumers have maxed-out credit cards and depleted personal savings.

"Increasingly, those who are food insecure are middle income and more highly educated," Radha Muthiah, CEO of Capital Area Food Bank, said, adding, "We don't suffer from people not being employed."

Just wait until all those woke federal workers in the Mid-Atlantic find themselves jobless in the era of gov't efficiency.

Also, for those who can still afford to shop, the inflation storm has transformed much of the nation into Walmart shoppers.

To combat Biden Harris' inflation storm, Trump signed an executive order early last week titled: Delivering Emergency Price Relief for American Families ...