Tesla shares surged more than 7% in premarketing trading in New York after Elon Musk announced on X late Wednesday that both Tesla shareholder resolutions—one involving a 2018 pay package nixed by a Delaware judge earlier this year and another on moving the company's legal home from Deleware to Texas—passed by 'wide margins.'

Both Tesla shareholder resolutions are currently passing by wide margins!

— Elon Musk (@elonmusk) June 13, 2024

♥️♥️ Thanks for your support!! ♥️♥️ pic.twitter.com/udf56VGQdo

The votes come ahead of Tesla's annual meeting on Thursday in Austin, Texas.

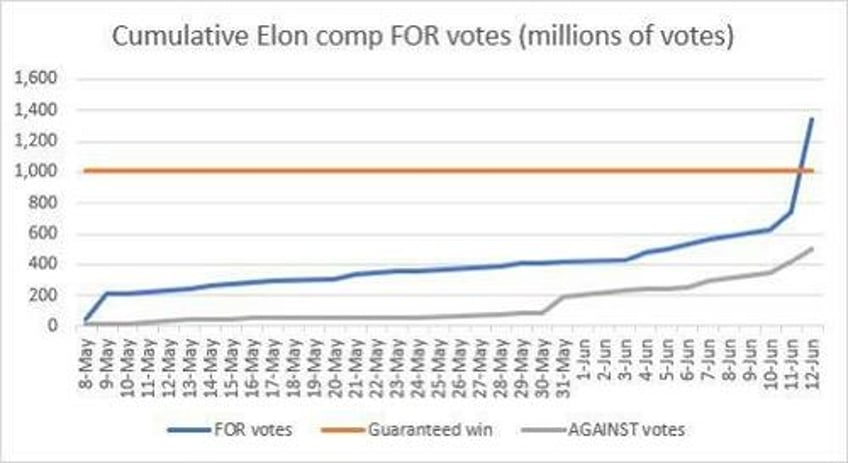

Here's the breakdown of the votes for Musk's pay package - the largest ever awarded in corporate America (worth as much as $56 billion). Recall that a Delaware judge invalidated the pay package earlier this year, arguing board director conflicts of interest and other problems. Over the years, Musk has been granted stock options as the EV company hits valuation milestones.

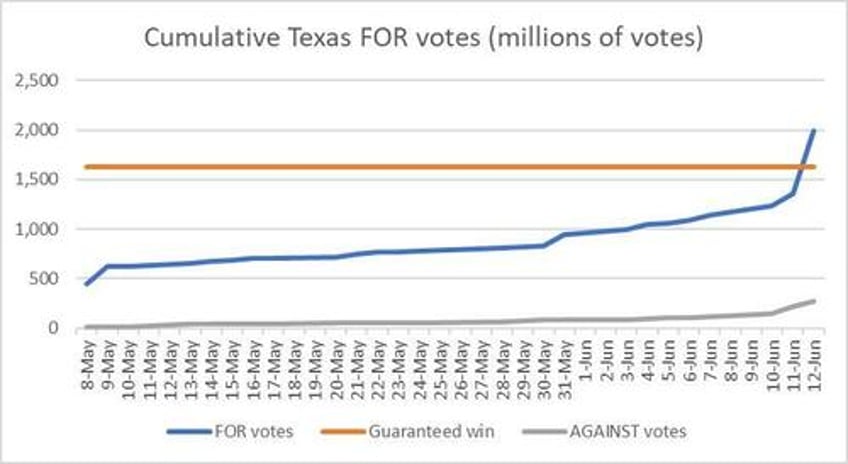

The second vote shows that shareholders unanimously voted 'Yes' to move the company's legal home from Deleware to Texas.

Earlier this year, Musk wrote on X, "Never incorporate your company in the state of Delaware" due to the disputes with the Deleware judge over his pay package.

Never incorporate your company in the state of Delaware

— Elon Musk (@elonmusk) January 30, 2024

The voting outcome sent Tesla shares as high as 7.2% in premarket trading.

"This doesn't fully settle the matter; the compensation package can still be deemed illegal," Piper Sandler analyst Alexander Potter wrote in a note to clients.

Potter added, "We expect the stock to respond favorably to this news, though the upside is perhaps unlikely to be as violent as the downside would have been, had shareholders rejected the deal."

Bloomberg provided a detailed Q&A for investors to consider following the vote:

If Tesla shareholders approved the revived package, does Musk get his pay?

Not quite. The shareholder vote is mostly one of confidence — a chance for the board to show that investors still want to reward Musk handsomely. It has no direct impact on the legal dispute over the 2018 compensation package. The judge can take notice of it or ignore it. Same with the Delaware Supreme Court, which would hear any appeal. That court could overturn McCormick's decision and clear the way for Musk's pay, though that would be a surprising outcome. If it did, the legal obstacle to the compensation package would be removed no matter how the current shareholder vote comes out, according to Charles Elson, a retired University of Delaware professor and corporate governance expert. The value of Musk's stock option award has declined with the drop in Tesla's shares, from around $56 billion when the company achieved a series of milestones to $46.8 billion now, according to the Bloomberg Billionaires Index.

So what happens next in the Delaware fight?

McCormick will hear arguments July 8 on whether lawyers for the Tesla shareholder who successfully challenged Musk's pay deserve a legal fee of more than $5 billion. The lawyers are asking for their fee in Tesla stock. That request has drawn more than 1,300 letters and over 180 emails to McCormick from individual investors opposing the request, according to court filings. Once McCormick decides on the fee, she'll issue a final ruling in the case. Musk then has 30 days to appeal it to the Delaware Supreme Court.

If shareholders signed off on the Texas move, how fast can that happen?

"As soon as practicable" following the annual general meeting, Tesla said in its proxy statement. Assuming Tesla's lawyers have prepared the necessary paperwork ahead of the vote, the process to shift the company's legal home out of Delaware can take place quickly. Once the required documents are filed with the Texas secretary of state, it can take as little as 24 hours, or as long as five business days, for the move to be processed and recognized by the state.

Once that's done, could Tesla's board reinstate Musk's pay package?

Again, not quite. Moving Tesla's state of incorporation to Texas means the board has to start from scratch on Musk's compensation. Tesla couldn't just approve the same plan as in 2018, because Texas courts are legally obligated to honor the Delaware court's decision, said Elson, the corporate governance expert. The board would have to make substantial changes to the plan — ensuring that directors with conflicts of interest don't participate in considerations of Musk's pay, for example — and not just "put a Band-Aid on it," he said. Shareholders would then have to vote on Musk's compensation once more. And if an investor wanted to then challenge it, as one did in the Delaware legal battle, they would have to sue in Texas.

Does Texas even have a business court like Delaware's?

Not yet. The state's business courts are scheduled to open in September, but Texas officials are currently struggling to recruit judges with the requisite experience in complex business litigation. The starting salary for a judge on a Texas business court would be $140,000, while a Delaware Chancery judge starts at almost $185,000. So it's unclear how long a suit challenging Musk's pay would take to be processed by Texas' new courts.

Why do Musk and Tesla want to move to Texas anyway?

Musk and his fellow directors dismiss McCormick's ruling as an injustice and are banking on Texas' new business courts to give them the latitude to resurrect his pay plan. Tesla directors contend Musk should be fairly compensated for sending the EV maker's shares soaring over the years after they arranged his compensation in 2018. Others, such as Elson, argue that to go back and give one of the world's richest people stock options worth more than $46 billion at this point is a waste of corporate assets.

Has anyone challenged the new proxy vote itself?

A shareholder sued Tesla directors this month alleging they breached their legal duties in agreeing to the do-over vote on Musk's pay and made misleading disclosures about the vote. He accuses Musk personally of using "strong-arm tactics" to win shareholders' backing for the proxy proposals. But he didn't specifically ask McCormick to block the vote. Instead, he wants her to declare that the company needs more than a simple majority to move its incorporation out of Delaware. He contends directors need more than 66% of the votes cast to legally make the move.

Why was Tesla incorporated in Delaware in the first place?

Delaware is the nation's epicenter of business incorporations, with more than 1 million businesses registered in the state. Almost 70% of Fortune 500 companies are incorporated there, mostly to take advantage of Delaware's nearly 100 years of corporate law rulings and its chancery court, which can quickly hear corporate litigation without a jury. The court's jurists, such as McCormick and Travis Laster, are recognized as business law experts.