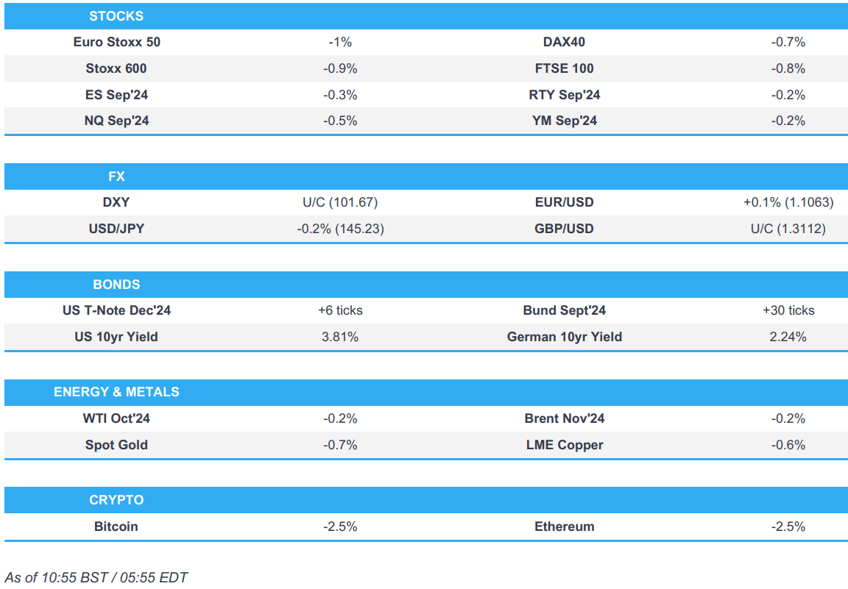

- Equities are entirely in the red, continuing the risk-off sentiment seen in the prior session

- Dollar is flat ahead of US JOLTS Job Openings, haven currencies benefit from risk tone

- Bonds are incrementally firmer, taking impetus from the subdued risk sentiment; EZ/UK PMIs had little impact on the complex

- Crude slumped in early European trade, but has since bounced on China support measures, XAU and base metals lower

- Looking ahead, US International Trade, US Durable Goods, JOLTS Job Openings, BoC & NBP Policy Announcement, ECB’s Elderson; BoC Governor Macklem & Rogers

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (-1%) began the session significantly lower, taking impetus from a weak APAC session overnight as it continued the AI-led pressure seen on Wall St. on Tuesday. Thereafter, sentiment gradually improved, but remains firmly in the red.

- European sectors are entirely in the red; Food Beverage and Tobacco takes the top spot, whilst Tech is the clear laggard. The likes of ASML opened lower by around 6%, playing catch-up to the NVIDIA weakness seen on Tuesday.

- US Equity Futures (ES -0.3%, NQ -0.5%, RTY -0.2%) are on the backfoot, continuing the NVIDIA-led weakness seen in the prior session, as risk sentiment continues to remain subdued.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- Dollar is flat and trading within a fairly busy 101.57-73 range; currently within the confines of the prior day’s range. Today see's US JOLTS job openings data.

- EUR is incrementally firmer and trading towards the upper end of today’s 1.1039-62 range, and generally unmoved by a number of ECB speakers. EZ Composite Final PMIs were revised marginally lower, but ultimately had little impact on the Single-Currency.

- GBP is flat and holds within a tight 1.3102-27 range. Cable holds well within the confines of the prior day’s fairly wide 1.3088-3148 range; the docket ahead remains thin from a UK-specific standpoint.

- JPY is firmer today, largely attributed to its safe haven status, given the continued slump in risk sentiment; price action which is largely a continuation of the hefty pressure seen in USD/JPY in the prior session. USD/JPY towards the mid-point of a 144.76-145.56 range.

- The Antipodeans are the slight laggards vs G10 peers, weighed on by the continued risk-off sentiment seen across markets. Alongside this, Chinese Caixin Services PMIs was weaker than the prior, adding to the already weak Chinese demand narrative.

- PBoC set USD/CNY mid-point at 7.1148 vs exp. 7.1167 (prev. 7.1112)

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are slightly firmer ahead of US JOLTS Job Openings, which marks the first jobs release ahead of ADP and NFP throughout the week. Currently, toward the mid-point of 114-00+ to 114-09 bounds, eclipsing yesterday's best.

- Bunds are bid given the general risk tone. A busy morning of data and ECB speak but nothing that has sparked any real price action. Bunds have run into a bit of resistance around the 134.37 peak, with the 28th Aug. high just above at 134.39.

- Gilts are firmer, in-fitting with the above. UK Final PMIs were subject to modest upward revisions, but in-fitting with EZ metrics sparked no reaction. Gilts holding at Tuesday's 99.25 WTD peak.

- Germany sells EUR 0.438bln vs exp. EUR 0.5bln 1.00% 2038 Bund & EUR 0.818bln vs exp. 1bln 2.60% 2041 Bund.

- Click for a detailed summary

COMMODITIES

- Crude in the red once again. In short, the price action is a continuation of the moves on Tuesday which were driven by Libya/returning of various refineries/risk tone with further pressure coming from soft Chinese PMIs. Benchmarks are currently off lows amid reports that China is planning to cut mortgage rates. Brent'Nov holds around USD 73.85/bbl, after going as low as USD 72.63/bbl.

- Spot gold is in the red, slipping further from the USD 2500/oz mark despite the downbeat risk tone with the JPY once again outmuscling XAU; currently down to a USD 2480/oz low, just below the 21-DMA at USD 2483/oz.

- Base metals are trading on the backfoot, in-fitting with the general tone. 3M LME Copper continues to fall below the USD 9k mark.

- Russia's Deputy Energy Minister Sorokin, says global LNG demand may rise to 580-600mln tons per year in the next few years; Western sanction against Russia will not halt development of LNG sector.

- Teamsters at Marathon Petroleum's Detroit refinery (140k bpd) go on strike on Sept 4th.

- Click for a detailed summary

NOTABLE DATA RECAP

- Spanish Services PMI (Aug) 54.6 vs. Exp. 54.5 (Prev. 53.9)

- German HCOB Composite Final PMI (Aug) 48.4 vs. Exp. 48.5 (Prev. 48.5); HCOB Services PMI (Aug) 51.2 vs. Exp. 51.4 (Prev. 51.4)

- French HCOB Composite PMI (Aug) 53.1 vs. Exp. 52.7 (Prev. 52.7); Services PMI (Aug) 55.0 vs. Exp. 55.0 (Prev. 55.0)

- Italian HCOB Composite PMI (Aug) 50.8 (Prev. 50.3); HCOB Services PMI (Aug) 51.4 vs. Exp. 52.6 (Prev. 51.7)

- EU HCOB Composite Final PMI (Aug) 51.0 vs. Exp. 51.2 (Prev. 51.2); Services Final PMI (Aug) 52.9 vs. Exp. 53.3 (Prev. 53.3)

- UK S&P Global PMI: Composite - Output (Aug) 53.8 vs. Exp. 53.4 (Prev. 53.4); Service PMI (Aug) 53.7 vs. Exp. 53.3 (Prev. 53.3)

- EU Producer Prices YY (Jul) -2.1% vs. Exp. -2.5% (Prev. -3.2%, Rev. -3.3%); Producer Prices MM (Jul) 0.8% vs. Exp. 0.3% (Prev. 0.5%, Rev. 0.6%)

NOTABLE EUROPEAN HEADLINES

- ECB's Kazaks said the ECB can take steps to lower rates at the next meeting; pace of wage growth is slowing; says we can lower rates but must remain cautious.

- ECB's Cipollone said investment remains weak, which suggest that firms do not believe a strong recovery, via Le Monde; broadly on track to for inflation; data so far confirms our direction of travel and hopes that this will allow the ECB to continue to be less restrictive. Adds, there is a real risk that the stance could become too restrictive.

- ECB's Stournaras says even with more rate cuts policy will remain restrictive.

- German economy is seen contracting 0.1% in 2024 (prev. forecast +0.2%), via IFW/Kiel; 2025 0.5% (prev. forecast 1.1%)

- Volkswagen (VOW3 GY) CFO sees industry-wide demand in Europe 2mln cars below peak; Europe's car market will not return to former size; its Europe overcapacity is 500k cars or two plants. Needs to increase productivity and reduce costs/reduce complexity.

- UK banking representatives are expected to meet Chancellor Reeves in the coming days to discuss concerns over a possible increase in bank taxes, via Reuters citing sources; sources expect the Treasury will seek to increase an existing surcharge on profits

NOTABLE US HEADLINES

- NVIDIA (NVDA) has received a DoJ subpoena in escalating antitrust investigation, according to Bloomberg. NVIDIA (NVDA) responded to the DoJ subpoena and said customers can choose whatever solution is best.

- TSMC (2330 TT) exec. says there are good opportunities for growth from AI.

- Intel (INTC) money woes throw Biden team's chip strategy into turmoil, via Bloomberg

GEOPOLITICS

MIDDLE EAST

- "Estimates that Washington will present its new plan for the exchange deal by Friday", according to Sky News Arabia citing Walla News.

- Israeli Broadcasting Authority said Israeli officials informed mediators of Tel Aviv's approval to withdraw from the Philadelphi corridor in the second phase of the deal, via Sky News Arabia.

- "US military announces destruction of Houthi missile system in area under their control in Yemen", according to Sky News Arabia.

RUSSIA-UKRAINE

- Ukraine's air defence engaged in repelling the second wave of Russian air attacks on Kyiv overnight, according to the country's military; engaged in repelling a drone attack on the western city of Lviv, near the Polish border.

- Poland activated aircraft to ensure airspace security for the third time in eight days after Russia launched strikes on Ukraine, according to Polish armed forces.

- Russia's Kremlin said Russia takes into account that Ukraine "will" use US long-range weapons in its attacks deep into Russian territory.

- Russia's Kremlin said work on changing Russia's nuclear doctrine is caused by actions of the West, according to Ria.

OTHER

- Russia and China are working on President Xi's participation in the BRICS summit in Russia's Kazan, according to Ria.

CRYPTO

- Bitcoin continues to slip, amid the risk-off sentiment; BTC now below USD 57k, whilst ETH holds around USD 2.4k.

APAC TRADE

- APAC stocks traded with losses across the board following the dire session on Wall Street, which saw a tech rout led by downside in chips, with a similar picture seen in APAC with the likes of SK Hynix opening lower by over 9%.

- ASX 200 saw losses led by miners and tech following a similar sectoral picture stateside, whilst the downside was somewhat cushioned by heavyweight healthcare and telecoms. The index extended on losses after the QQ GDP miss.

- Nikkei 225 felt a double-whammy from the tech-led downside coupled with the stronger JPY, with the index slipping under 38k and eventually 37k from a 38,728.50 close on Tuesday.

- Hang Seng and Shanghai Comp also fell victim to the regional losses, with the former seeing its large-cap oil names with the deepest losses, whilst the mainland saw shallower losses. Caixin Services PMI deteriorated, but accompanying commentary was rosier.

NOTABLE ASIA-PAC HEADLINES

- Bank of America cut its 2024 China GDP forecast to 4.8% (prev. 5.0%).

- Japan's Chief Cabinet Secretary Hayashi said closely watching domestic and overseas market moves with a sense of urgency; will conduct fiscal and economic policy management while working closely with BoJ; Important to make assessment of market moves calmly.

- PBoC injected CNY 700mln via 7-day Reverse Repo at a maintained rate of 1.70%

- China August prelim retail car sales -1% Y/Y, via PCA; +11% M/M.

- China mulls cutting mortgage rates in two steps to shield banks, via Bloomberg citing sources; regulators have proposed reducing rates on outstanding mortgages by a total of 80bpsPart of a package incl. an accelerated timeline for when mortgages become eligible for refinancing.

DATA RECAP

- Chinese Caixin Services PMI (Aug) 51.6 (Prev. 52.1); Compose 51.2 (Prev. 51.2); Caixin said “Market optimism was retained. Businesses expressed confidence in further market improvement, keeping the corresponding gauge in positive territory. But it was still below the historical average, indicating the optimistic sentiment needed to be strengthened."

- Australian Real GDP QQ SA (Q2) 0.2% vs. Exp. 0.3% (Prev. 0.1%)

- Australian Real GDP YY SA (Q2) 1.0% vs. Exp. 1.0% (Prev. 1.1%, Rev. 1.3%)

- Australian GDP Chain Price Index (Q2) -0.9% (Prev. 0.8%)

- Australian Final Consumption Exp QQ SA (Q2) 0.3% (Prev. 0.6%)

- Australian Gross Fixed Capital Exp SA (Q2) -0.1% (Prev. -0.9%)

- Australian Judo Bank Composite PMI Final (Aug) 51.7 (Prev. 51.4)

- Australian Judo Bank Services PMI Final (Aug) 52.5 vs. Exp. 52.2 (Prev. 52.2)

- Australian AIG Manufacturing Index (Aug) -30.8 (Prev. -19.5)

- Australian AIG Construction Index (Aug) -38.1 (Prev. -23.2)