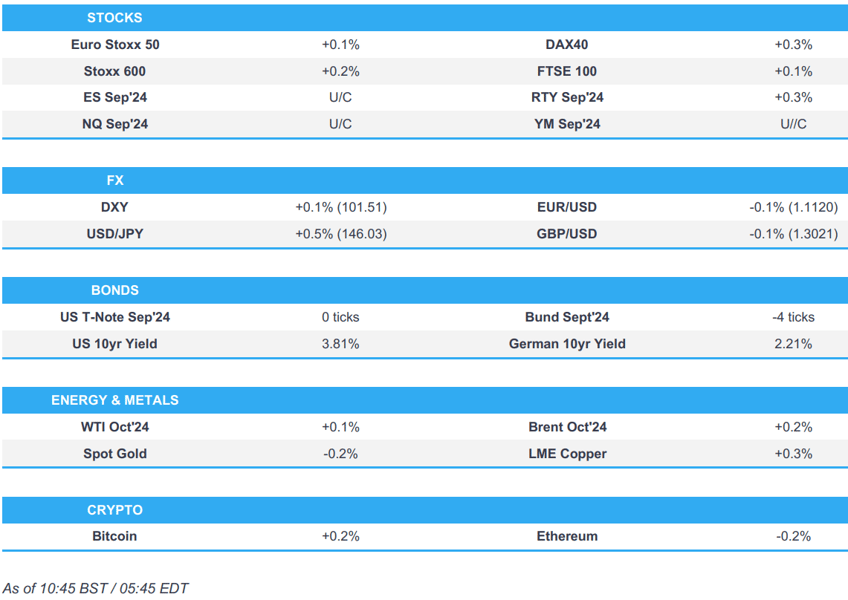

- European bourses are mostly modestly firmer; US futures rangebound ahead of US Payroll Revisions and the FOMC Minutes

- Dollar is incrementally firmer, JPY is the clear underperformer with USD/JPY around 146.00

- Bonds are flat with traders mindful of today’s key risk events

- Crude is flat, XAU is rangebound and holds just above USD 2500/oz, base metals entirely in the green

- Looking ahead, Canadian Producer Prices, US Payrolls Benchmark NSA Prelim, FOMC Minutes, Democratic Convention, Comments from ECB's Panetta, Supply from the US, Earnings from Target, Analog Devices, TJX & Synopsys

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (+0.2%) are mostly firmer, in contrast to a largely subdued APAC session overnight.

- European sectors are mixed and with the breadth of the market fairly narrow. Basic Resources takes the top spot, benefiting from gains in underlying metals prices. Energy is found at the foot of the pile, hampered by losses in the crude complex.

- US Equity Futures (ES U/C, NQ U/C, RTY +0.3%) are flat/firmer, finding its footing following the modest pressure seen in the prior session. There are two notable releases on the docket for today; US Payrolls Revisions and the FOMC Minutes thereafter.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is sitting just above the 101.50 mark with the USD mostly marginally firmer vs peers. US payrolls revisions will be in focus today with Goldman Sachs suggesting that the data series in the year to March could be revised lower by as much as 1 million, a potential driver for Dollar selling.

- EUR is trivially lower vs. the USD but still holding onto a 1.11 handle. The next upside target for EUR/USD comes via the December 2023 high at 1.1139.

- GBP is marginally softer vs. the USD but with Cable still maintaining its position on a 1.30 handle.

- JPY is the laggard across the majors with not much in the way of fresh fundamental drivers. USD/JPY still has some way to go before approaching yesterday's 147.34 peak.

- Antipodeans are both a touch softer vs. the USD in quiet newsflow after a recent run of gains. AUD/USD has maintained a footing on the 0.67 handle.

- PBoC set USD/CNY mid-point at 7.1307 vs exp. 7.1303 (prev. 7.1325).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are unchanged ahead of payroll revisions, and within a six tick range and holding in proximity to Tuesday's 113-20 peak. Significant downward revisions could spark a dovish move as it adds to the factors in favour of the Fed commencing the easing cycle in September.

- Bunds are slightly softer after being the relative outperformer in Tuesday's European session. Currently holding just above the 134.50 mark with a double-bottom from Monday/Tuesday at 134.09 providing near-term support. Bunds were unreactive to the German 2034 auction.

- Gilts are flat and pivoting the 100.00 mark. No real move to the morning's PSNB release or the region's auction.

- UK sells GBP 3.75bln 3.75% 2027 Gilt: b/c 3.33x (prev. 3.26x), average yield 4.068% (prev. 4.441%) & tail 0.3bps (prev. 0.4bps)

- Germany sells EUR 3.67bln vs exp. EUR 4.5bln 2.60% 2034 Bund: b/c 2.0x (prev. 1.8x), average yield 2.22% (prev. 2.43%), retention 18.44% (prev. 17.16%).

- Click for a detailed summary

COMMODITIES

- Crude is flat/choppy start to the European session following a subdued APAC trade after recent declines amid China demand concerns and Gaza ceasefire efforts, while the latest private sector inventory data showed a surprise build in headline crude stockpiles. Brent Oct in a USD 76.95-77.46/bbl parameter.

- Mixed/uneventful trade across precious metals with the complex taking a breather following yesterday's price action. XAU within a tight USD 2,507-519/oz range.

- Base metals are mostly firmer but to varying degrees despite the firmer Dollar and tentative risk tone.

- ANZ Research sees Gold price to hit fresh highs to USD 2550/oz later this year.

- Earthquake of magnitude 5.58 strikes the Jujuy province in Argentina, according to GFZ.

- US Private Inventory Data (bbls): Crude +0.3mln (exp. -2.7mln), Distillate -2.2mln (exp. -0.2mln), Gasoline -1.0mln (exp. -0.9mln), Cushing -0.6mln.

- Click for a detailed summary

NOTABLE DATA RECAP

- UK PSNB Ex Banks GBP (Jul) 3.101B GB vs. Exp. 1.5B GB (Prev. 14.513B GB, Rev. 13.476B GB); PSNB, GBP (Jul) 2.177B GB (Prev. 13.589B GB, Rev. 12.552B GB); PSNCR, GBP (Jul) 19.232B GB (Prev. 6.622B GB, Rev. 6.490B GB)

- South African CPI YY (Jul) 4.6% vs. Exp. 4.9% (Prev. 5.1%); CPI MM (Jul) 0.4% (Prev. 0.1%); Core Inflation YY (Jul) 4.3% (Prev. 4.5%); Core Inflation MM (Jul) 0.3% (Prev. 0.4%)

NOTABLE EUROPEAN HEADLINES

- UK Chancellor Reeves plans to increase social housing rents by more than inflation for the next 10 years to boost the building of affordable homes, according to FT.

GEOPOLITICS

MIDDLE EAST

- "Israel Broadcasting Corporation: The meeting between Blinken and Netanyahu did not succeed in reducing the gaps and did not make progress on the deal", according to Al Jazeera"Differences on outstanding issues have not been resolved despite optimistic US statements".

- Israeli raids were reported on towns in Baalbek, eastern Lebanon, while Hezbollah said it confronted an Israeli warplane that violated Lebanese airspace in the southern region with a surface-to-air missile, according to Sky News Arabia. Furthermore, Lebanese media reported that 4 people were killed and 10 others wounded in Israeli raids on the Bekaa region.

- Islamic Resistance in Iraq said it attacked a vital target in Eilat, according to Al Jazeera.

- A deal to bring an end to the fighting in Gaza was said to be on the brink of collapsing and there is no clear immediate alternative agreement that could be put forward in its place, according to two US and two Israeli officials cited by POLITICO.

- Israeli PM Netanyahu met with Finance Minister Smotrich over the past two days to convince him to support the hostage deal, according to sources cited by Walla News.

- Hamas refuted US President Biden's claim that it is backing away from a Gaza ceasefire and hostages deal, while it insisted that the US is yielding to Israel's interests in negotiations, according to FT.

- US Secretary of State Blinken said they need to get a ceasefire and hostage release agreement over the finish line now, while he said they will do everything possible over the coming days to get Hamas on board with the bridge proposal.

- UK Foreign Secretary Lammy said he spoke with US Secretary of State Blinken to discuss the ongoing Gaza ceasefire negotiations, while he added that an immediate cessation of fighting in Gaza and release of all hostages is vital.

- Qatari Foreign Minister told US Secretary of State Blinken that Qatar is committed to its mediating role with Egypt and the US to end the war in Gaza.

OTHER

- Russian air defences repelled a Ukraine drone attack on Moscow, according to the Moscow Mayor.

- Russia's foreign intelligence agency said, without providing evidence, that Ukraine's incursion into Kursk was prepared with the participation of the US, UK, and Poland, while it added that NATO advisers are providing assistance to Ukraine in its incursion into Kursk, according to TASS.

CRYPTO

- Bitcoin is steady and holds just beneath USD 60k; Ethereum briefly topped USD 2.6k, but has since slipped below the level.

- Mt.Gox transferred USD 75mln in Bitcoin to BitStamp, according to Arkham cited by Block Pro.

APAC TRADE

- APAC stocks were subdued following the lacklustre performance stateside where the major indices traded sideways and finished with mild losses amid the absence of macro drivers ahead of the FOMC Minutes.

- ASX 200 declined amid a deluge of earnings with underperformance in energy following a retreat in oil prices and with Santos shares pressured after it reported an 18% drop in H1 underlying profit.

- Nikkei 225 slumped at the open amid pressure from recent currency strength but is off worst levels.

- Hang Seng and Shanghai Comp. retreated with the former ragged lower by tech weakness as JD.com suffered a double-digit drop after reports Walmart is seeking to offload its USD 3.5bln stake in the Co. However, the losses in the mainland are limited following the PBoC's firm liquidity effort.

NOTABLE ASIA-PAC HEADLINES

- China Automobile Manufacturers Association firmly opposes the EU Commission's final draft on high tariffs on Chinese-made electric vehicles and said the tariff decision brings enormous risks and uncertainty for Chinese firms’ operations and investment in the EU, according to CCTV.

- Chinese Commerce Ministry launched an anti-subsidy investigation into dairy products imported from the EU from August 21st; dairy product probe includes Ireland, Austria, Italy, Belgium and Finland.

- China Financial Regulator Official says will strengthen supervision of the behaviour of major shareholders of small and medium size financial institutions.

- Chinese Chamber of Commerce for Machinery and Electronics says China will continue to respond on behalf of China's EV industry and will resolutely defend the rights of their firms through various means.

- Xiaomi (1810 HK) Q2 (CNY): Revenue 88.9bln (85.8bln), Adj. Net 6.2bln (exp. 4.8bln), Repurchase programme of HKD 10bln; June MAUs reached another record high at 675.8mln.

DATA RECAP

- Japanese Trade Balance Total Yen (Jul) -621.8B vs. Exp. -330.7B (Prev. 224.0B)

- Japanese Exports YY (Jul) 10.3% vs. Exp. 11.4% (Prev. 5.4%); Imports 16.6% vs. Exp. 14.9% (Prev. 3.2%)