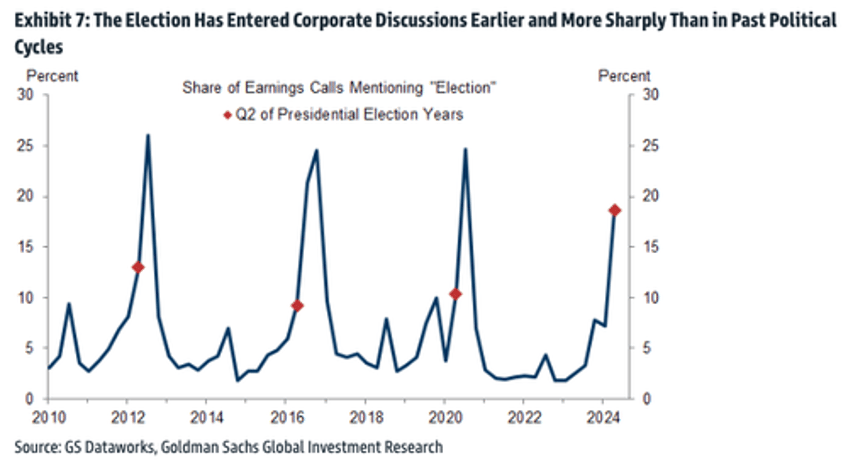

With 93% of S&P 500 companies reporting, Goldman analysts have found a sharp increase in earnings calls mentioning election uncertainty, likely dampening capital expenditure growth for companies through the end of the year. There are currently 76 days (as of Tuesday) until the November 5th US presidential elections.

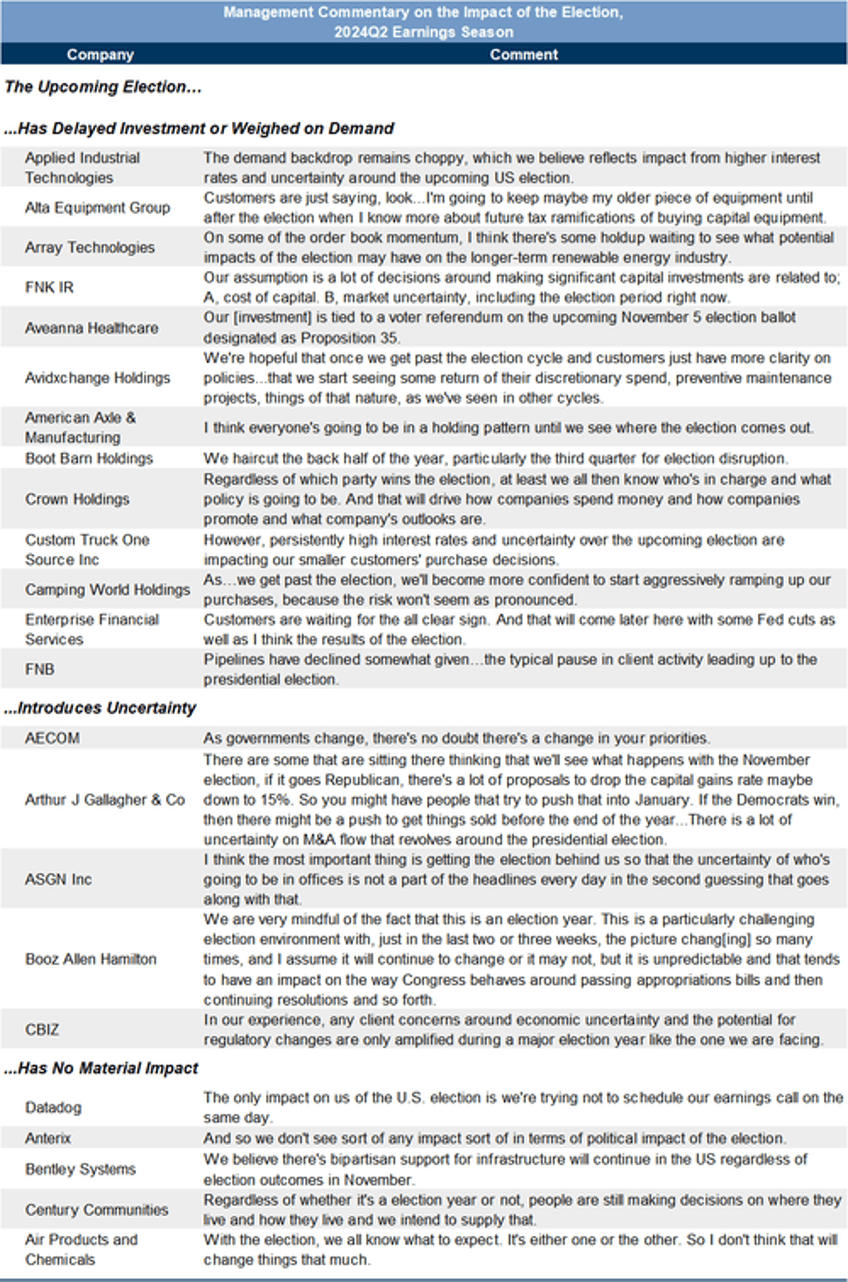

"Election discussions have entered management commentary earlier than in past election cycles, with some companies—particularly financials, government contractors, and those with exposure to the Inflation Reduction Act—noting that either they or their customers are postponing some investment decisions until after the election," a team of Goldman analysts led by Jan Hatzius wrote in a note to clients.

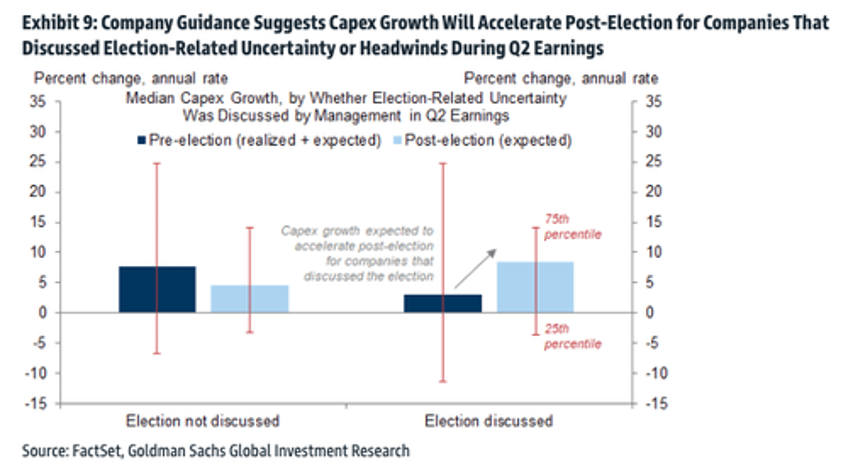

The bank's chief economist said, "Consistent with an election drag, we find that capex growth has been 5pp lower for companies citing election uncertainty on Q2 earnings calls, and that capex growth is expected to accelerate disproportionately post-election for those same companies."

The analysts pointed out that election discussions during the current earnings season has been "more abruptly than in previous election cycles."

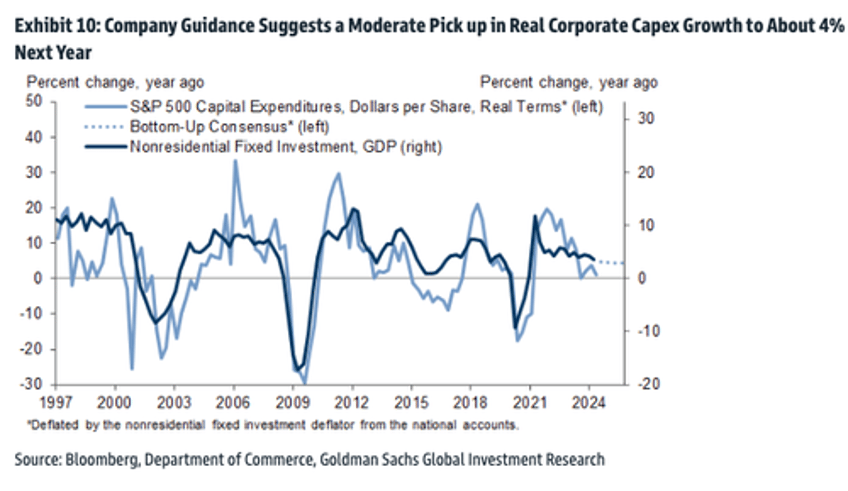

In the bank's mid-year capex update, Goldman highlighted that policy uncertainty leading up to the November election is expected to impact business investment modestly.

Here's a list of companies mentioning election uncertainty:

Companies citing election uncertainty on the earnings calls are facing lower capex growth. However, capex growth is expected to tick higher after more economic clarity is realized after the elections.

"We expect business investment growth in the national accounts to slow from a roughly 5% pace in 2024H1 to a roughly 3% pace in 2024H2. That's in part because there could be an election drag worth a few tenths, but mostly because the factory-building boom catalyzed by CHIPS Act and Inflation Reduction Act subsidies—which played such a large role in business investment growth over the last year and a half—has now peaked," the analysts said.

Wall Street is certainly on edge as this is one of the most important presidential elections in the nation's history. Folks will choose between VP Harris' communist-style price controls and or former President Trump's pro-America agenda.