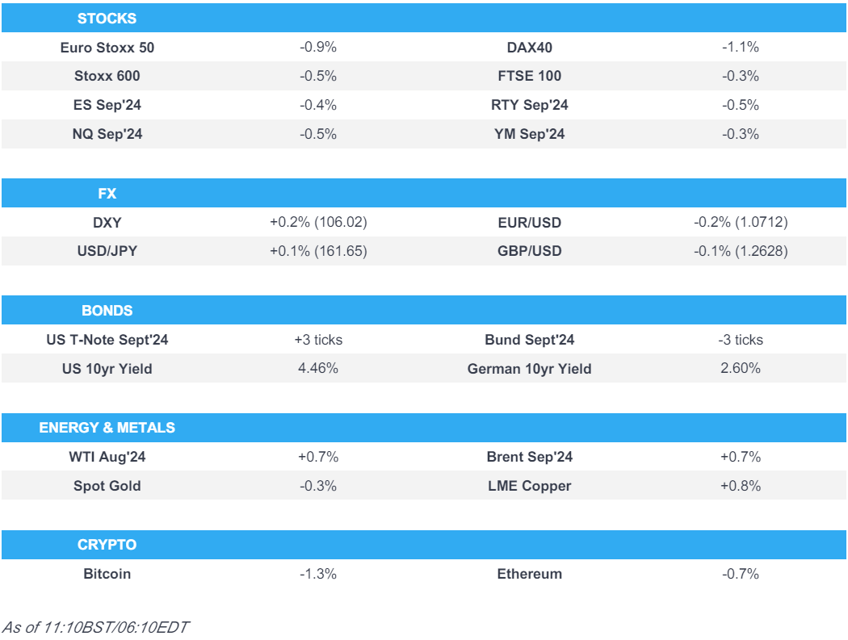

- European bourses pressured despite a lack of fresh drivers with US futures softer ahead of Chair Powell

- DXY firmer and above 106.00, USD/JPY hit another peak of 161.75, EUR unreactive to HICP

- EGBs slipped incrementally on sticky super-core EZ HICP but remain near the unchanged mark overall, USTs slightly firmer

- Crude continues to climb while XAU pivots its 21-DMA and base metals lift marginally

- ECB's Lane said conditions around France are not disorderly, added that July is a live meeting

- Looking ahead, highlights include Canadian Manufacturing PMI, US JOLTS, Comments from Fed's Powell, ECB's Lagarde, Schnabel, BCB's Neto

- Click for the Newsquawk Week Ahead

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses are softer across the board to varying degrees with losses deepening since the cash open despite a lack of fresh fundamentals, Stoxx 600 -0.5% & Euro Stoxx 50 -0.9%.

- Energy bucks the trend and is the only sector in the green given ongoing crude upside; other sectors lower but choppy. Insurance names in focus as Hurricane Beryl continues to intensify and has made landfall.

- US futures are lower across the board (ES -0.4%, NQ -0.5%, RTY -0.6%) with price action generally in-fitting with European peers ahead of Fed's Powell & JOLTS; Tesla (-1.2%) in focus ahead of their Q2 delivery report.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY broadly firmer against peers and holding above the 106.00 mark in proximity to the current 106.05 peak, ahead of Powell and data.

- EUR continues to fade Monday's French-driven relief rally, down to a 1.0710 low and not finding any real support from sticky super-core EZ HICP; Friday's trough at 1.0685.

- Sterling softer but against the USD is towards the mid-point of 1.2616-1.2653 parameters. Cable is currently back below its 100 and 50DMAs @ 1.2641 and 1.2654 respectively; last week's base at 1.2612 before the figure.

- USD/JPY at a fresh multi-decade peak of 161.75 overnight, has pulled back incrementally from this in relatively contained trade since but remains in close proximity. Largely unreactive to comments from outgoing FX head Kanda.

- Antipodeans pressured alongside the general risk tone; RBA minutes overnight said a hike might be needed if the Board judged policy was not "sufficiently restrictive".

- PBoC set USD/CNY mid-point at 7.1291 vs exp. 7.2774 (prev. 7.1265)

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- OAT-Bund 10yr yield spread around 76bps, towards the top-end of Monday's range, updates thus far somewhat limited and very much focused on the dropping out of candidates in three/four-way races ahead of tonight's deadline before Sunday's second round.

- Bunds slipped to the unchanged mark ahead of Flash EZ HICP where the data which came in as expected aside from the slightly hotter-than-expected super-core Y/Y rate, a print which sent Bunds to a fresh 130.35 base.

- Gilts treading water for the most part. Nothing by way of fresh specific driver for the complex as we continue to countdown to Thursday's election.

- USTs incrementally firmer into Chair Powell & JOLTS, no reaction to earlier remarks from Fed's Goolsbee; support comes in at 109-00 and then 108-17+ below while any further upside brings into play Monday's 109-24 peak and thereafter 109-27+.

- Click for a detailed summary

COMMODITIES

- Crude benchmarks have extended on yesterday's gains, after settling higher by over USD 1.50/bbl; complex remains support by several factors incl. geopols, Hurricane Beryl and summer demand.

- WTI Aug and Brent Sep up to highs of USD 84.13/bbl and USD 87.34/bbl respectively.

- Gas contracts relatively contained after pressure on Monday, downside some have attributed to higher inventories.

- Precious metals somewhat mixed but XAU is holding around its 21-DMA at USD 2326/oz, within Monday's USD 2,318.36-2,338.52/oz parameter.

- Base metals are higher across the board though with upside limited given the general risk tone.

- NHC says Hurricane Beryl is expected to bring life-threatening winds and storm surge to Jamaica on Wednesday, Hurricane watch issued for Cayman Islands.

- Click for a detailed summary

NOTABLE DATA RECAP

- EU HICP Flash YY (Jun) 2.5% vs. Exp. 2.5% (Prev. 2.6%); Ex-Food & Energy 2.8% vs. Exp. 2.8% (Prev. 2.9%); Ex-Food, Energy, Alcohol & Tobacco 2.9% vs. Exp. 2.8% (Prev. 2.9%)

- UK BRC Shop Price Index YY (Jun) 0.2% (Prev. 0.6%)

ECB SPEAKERS

- ECB's Lane says they will have to see what the French gov't decides, via Bloomberg TV; do not currently have the conditions for disorder regarding the French election (when asked on TPI). June inflation data appears to be in-line with the ECB's assessment. Going forward will need more information around services, information that will not be provided in June, a comment which was made pre-data. Adds, July is a live meeting.

- ECB's Wunsch says that barring any major negative surprises, the ECB has space for a second rate reduction. Adds, subsequent moves should only follow when the ECB has confidence that inflation is falling to target.

- ECB's Kazaks says if inflation moves sideways and the outlook does not change then a September cut is a possibility, via Econostream; if the economy & lending growth remain weak, then this opens "more possibilities" for cutting. Do not have to move at only projection meetings. Re. strategic review: no need for a massive overhaul. Would like a balance sheet discussion next year, though there is no rush to attain a conclusion.

- ECB's de Guindos says the ECB does not have a predetermined path, inflation to hover around current levels but with some ups and downs this year. Evolution of the French market has been quite orderly.

- ECB's Muller says they can probably cut more if the baseline holds, need to be patient with further rate cuts; risk of underestimating price stickiness.

- ECB's Centeno says we must be prudent on rates, but we are confident, via CNBC. Expects a few more cuts in 2024.

- ECB's Vasle says rates can be lowered further if things go as planned. Tightness of the labour market is causing pressure in wages. Need additional data to confirm the inflation trajectory.

NOTABLE US HEADLINES

- US President Biden said regarding the presidential immunity ruling that there are no kings in America and no one is above the law, while he added the decision means there are virtually no limits on what a president can do and it is a dangerous precedent. Biden said it is highly unlikely that a decision on Trump and January 6th will come before the election and the American people must decide whether Trump's assault on democracy makes him unfit to be president, as well as noted that Trump will be more emboldened to do what he wants to do. In relevant news, former President Trump moved to overturn his Manhattan conviction citing the Supreme Court immunity decision, according to NYT.

- Fed's Goolsbee (2025 voter) says US unemployment rate is still quite low but has been rising, via BBG TV interview; US rates are restrictive now. Monthly inflation readings feel like path to 2%. Acknowledges many data points will be released between now and the next Fed meeting. US is still grappling with housing inflation. There are some warning signs in the job market. Reiterates data dependency when asked about rate cutting cycle.

GEOPOLITICS

- North Korea said it successfully test-fired a new tactical ballistic missile on Monday that is capable of carrying a 4.5-ton super large warhead, according to KCNA.

- "Security sources for Channel 12: The military achievement in Gaza now allows the cessation of fighting if Israel is forced to move the file of negotiations", according to Al Jazeera.

- "Belarus defense (official): a demonstration of tactical nuclear missiles sent by Russia in Minsk tomorrow", according to Al Arabiya

CRYPTO

- Under modest pressure as the USD remains bid and BTC takes a breather from Monday's upside around this time.

APAC TRADE

- APAC stocks were ultimately mixed amid the backdrop of rising global yields and recent soft US data.

- ASX 200 was subdued by weakness in real estate and miners, while RBA Minutes did little to shift the dial.

- Nikkei 225 recouped early losses and eventually reclaimed the 40,000 level for the first time since early April.

- KOSPI retreated after North Korea claimed it successfully test-fired a new tactical ballistic missile on Monday capable of carrying a super large warhead, while index heavyweight Samsung Electronics traded indecisively after its workers' union announced a 3-day strike.

- Hang Seng and Shanghai Comp. were marginally positive as the former gained on return from the long weekend in which property stocks briefly lifted the index to just shy of 18,000, while the mainland index was rangebound and attempted to reclaim the 3,000 status.

NOTABLE ASIA-PAC HEADLINES

- China's Vice Premier He said China is willing to work with Switzerland to deepen and expand cooperation in economic and trade fields, while he added that China welcomes Japanese firms to further expand investment and cooperation in the country, according to Xinhua.

- RBA Minutes from the June meeting stated the Board judged the case for holding rates steady was stronger than for hiking, while they needed to be vigilant to upside risks in inflation and data suggested upside risk for May CPI. RBA stated that economic uncertainty meant it was difficult to rule in or out future changes in policy and recent data was not sufficient to change the outlook for inflation returning to target by 2026, as well as noted that inflation expectations are still anchored, but market premia had drifted higher. Furthermore, the RBA judged it is still possible to bring inflation to target while keeping employment gains but stated a hike might be needed if the Board judged policy was not "sufficiently restrictive" and that a material rise in inflation expectations could require significantly higher rates.

- Outgoing Japanese top currency diplomat Kanda says recent FX moves are showing signs of speculative activity.

DATA RECAP

- South Korean CPI MM (Jun) -0.2% vs. Exp. 0.1% (Prev. 0.1%); YY 2.4% vs. Exp. 2.7% (Prev. 2.7%)

- New Zealand NZIER Business Confidence (Q2) -44.0% (Prev. -25.0%); QSBO Capacity Utilisation 88.7% (Prev. 90.2%)