In its quarterly survey of 158 big banks, the European Central Bank (ECB) said that demand for loans from businesses over the last three months fell at the fastest pace on record (the time series began in 2003) and banks tightened their credit standard to consumers over the last three months.

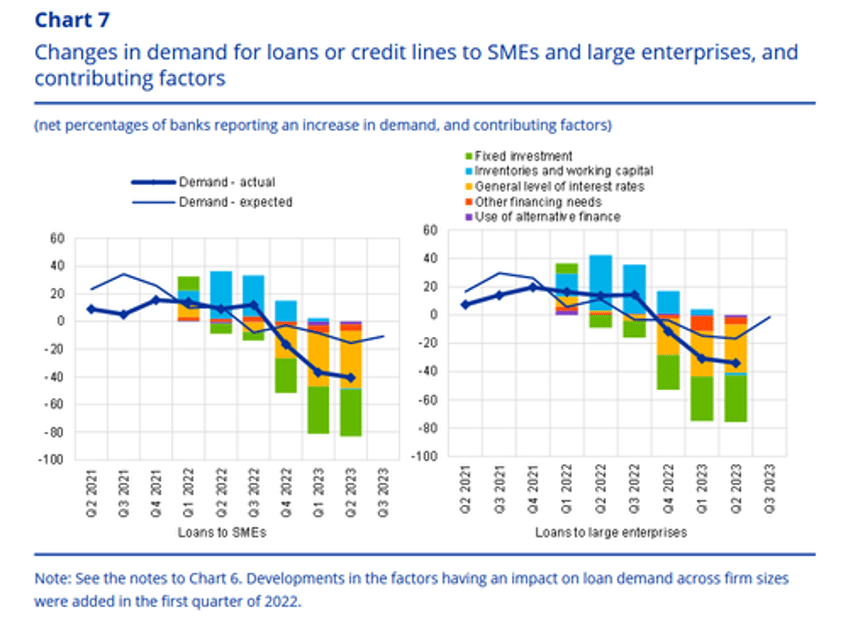

The decline was again substantially stronger than expected by banks in the previous quarter. The net decrease in loan demand was the strongest since the start of the survey in 2003 for SMEs (net percentage of -40%, see Chart 7), while the net decrease in demand for loans to large firms (net percentage of -34%) remained slightly more limited than during the global financial crisis. In addition, the net decrease in demand was the strongest over the history of the survey for long-term loans (-46%), while demand for short-term loans decreased to a lesser extent (-22%) but still close to the historical low of the global financial crisis.

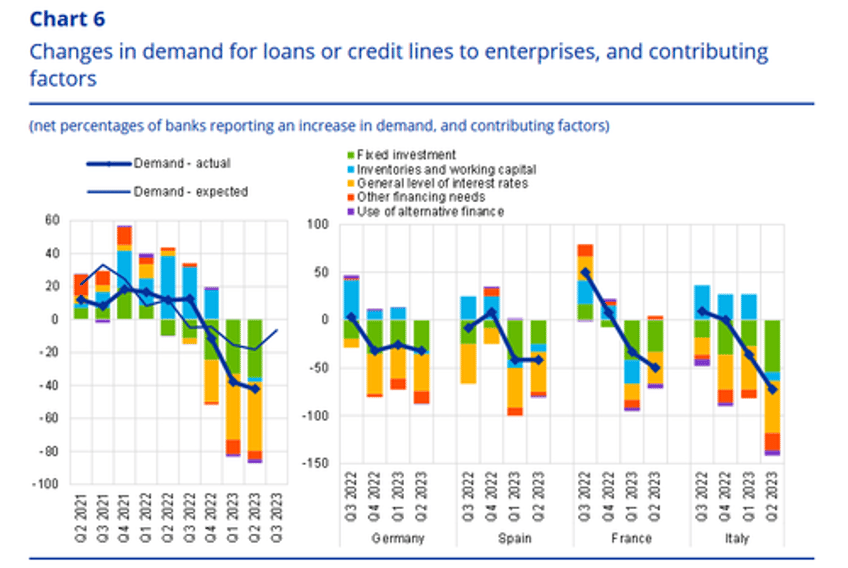

Rising interest rates and declining fixed investment remained the main drivers of the net decrease in loan demand (see Chart 6). Lower financing needs for M&A activity (included in “other financing needs”), available internal funding with improved corporate profits, and, to a smaller extent, debt securities issuance (included in “use of alternative finance”) contributed to firms’ reduced loan demand. There was also a small dampening impact on loan demand from inventories and working capital.

For both SMEs and large firms, the general level of interest rates and firms’ financing needs for fixed investment were the main drivers of reduced loan demand (see Chart 7).

While the percentage of banks reporting tighter credit standards was smaller than in the previous quarter, it remained above the survey's historical average and came on top of already substantial tightening, the central bank said.

Demand for mortgages also dropped sharply, though not as much as the "very large" decrease in the previous two quarters, but a further moderate drop is likely during the third quarter, the ECB added.

Banks said that their stock of non-performing loans (NPL) also pushed them to tighten credit standards.

While NPL ratios have not changed substantially, banks' perception of refinancing and repayment risk increased, the ECB added.

Banks expect to continue tightening credit standards this quarter.

With both credit standards tightening and demand for loans weakening, investment activity is set to weaken further - theoretically helping The ECB's efforts to tamp down sticky inflation (but certainly not helping any hopes of any economic renaissance in the region).

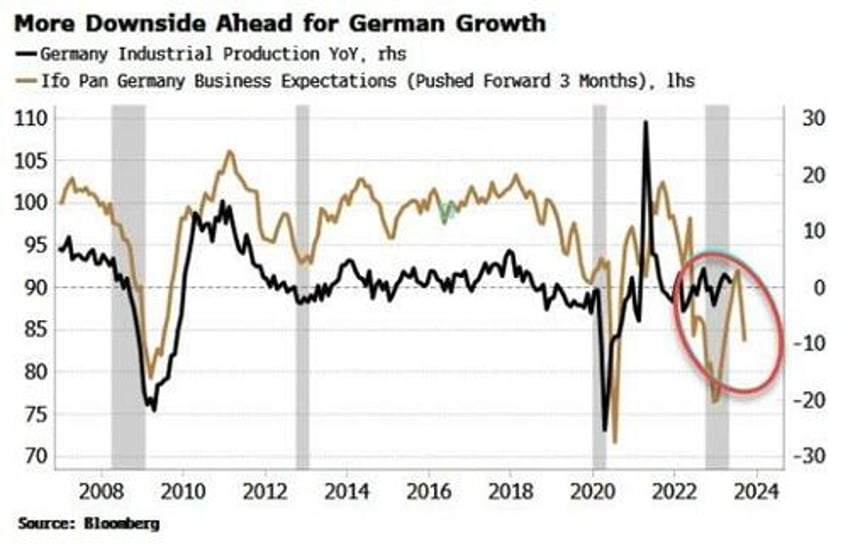

And Germany's IFO data did nothing to help, confirming yesterday's ugly PMIs. The expectations component gives a reliable lead on German growth, and points to re-weakening of the economy after the technical recession in 4Q22 and 1Q23.

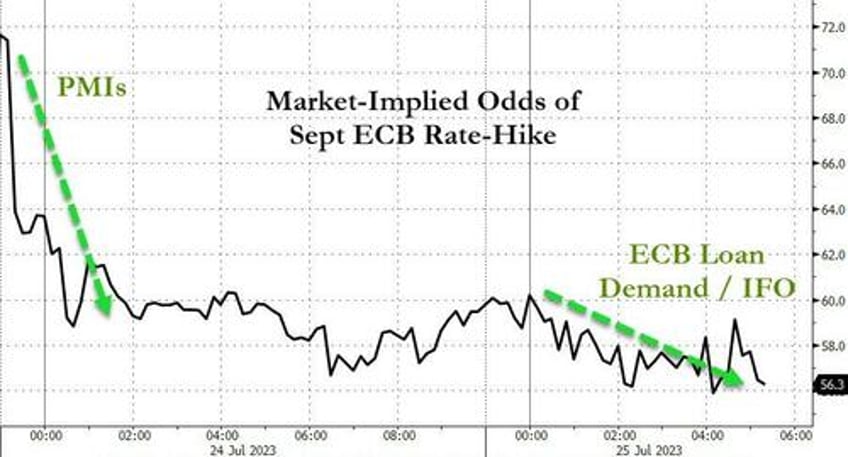

While this news is unlikely to impact this week's decision to hike rates, we are already seeing the odds of a September ECB hike falling dramatically this week (following PMIs, IFO and now the lending survey)...

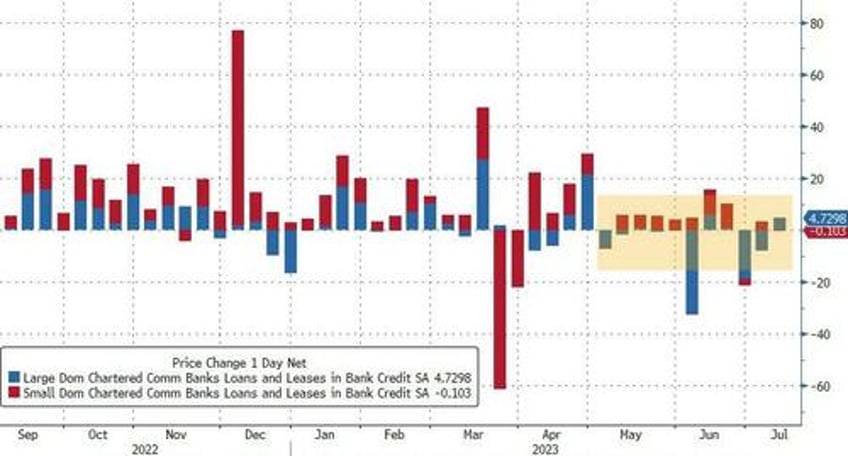

Finally, we ask, will we see the same loan-demand-crash in The Fed's SLOOS data (due imminently) which, we note with anxious anticipation, The Fed will have seen before tomorrow's FOMC statement. A look at the 'actual' reported loan volumes reported by banks shows the last few weeks have seen 'normal' variations (some might argue smaller levels than pre-SVB), but certainly no collapse...

But, given The Fed's warning issued to banks who appear to not be reporting their uninsured deposits correctly, who's to say they are reporting their loan data correctly?

The FDIC hit out at some US banks for incorrectly reporting the amount of their uninsured deposits, after dozens of lenders restated their figures downward earlier this year. The regulator said banks were wrong to exclude deposits that were collateralized by pledged assets. The level of uninsured deposits at banks came into focus after the collapse of SVB and Signature Bank.

When there's no consequences, what does it really matter? As long as the end-result provides ammo for the Biden administration's claims that 'everything is awesome' - 'most jobs created ever' - and so on - then who is going to argue?

But, what if? What if SLOOS shows a massive credit tightening (from the demand side) like in Europe? Will that be the final straaw to get us back to all-time highs in stocks because The Fed may have to lift its boot from the neck of the real economy.