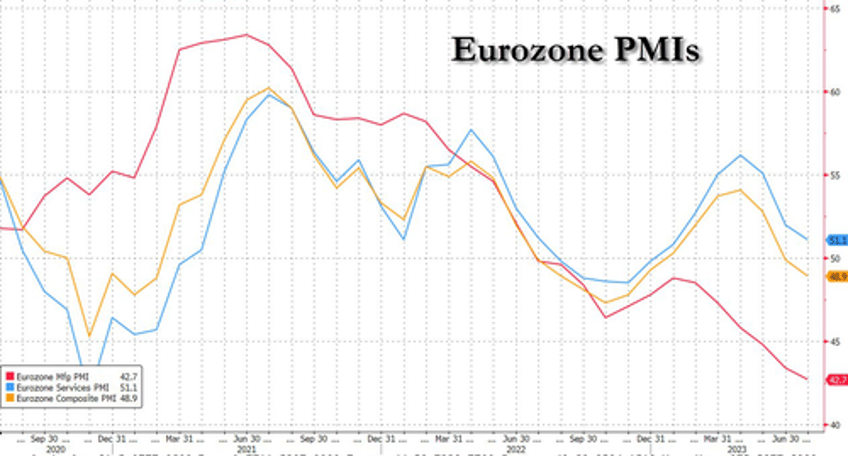

The eurozone’s downturn deepened at the start of the third quarter as the region's composite flash PMI decreased by 1.0pt to 48.9, below consensus expectations, on the back of a broad-based decline across sectors., with weakening demand triggered the steepest decline in manufacturing orders since 2009, while the services sector suffered its first drop in orders for seven months.

Euro Area Composite PMI (July, Flash): 48.9, consensus 49.6, last 49.9.

Euro Area Manufacturing PMI (July, Flash): 42.7, consensus 43.5, last 43.4.

Euro Area Services PMI (July, Flash): 51.1, consensus 51.6, last 52.0.

“The eurozone economy will likely move further into contraction territory in the months ahead, as the services sector keeps losing steam,” said Cyrus de la Rubia, chief economist at Hamburg Commercial Bank, adding that there was “an increased probability” of the German economy sliding into recession in the second half of this year.

The composition of the July report showed a broad-based moderation across new orders, new export orders, backlogs, and employment. Firms' future output expectations also declined further, reflecting a more pessimistic outlook in both sectors. Turning to price pressures, both input and output price components continued to decline in both sectors, although the pace of this moderation remains slower and the level of the these component series remains much higher in the services sector.

Across Euro area regions:

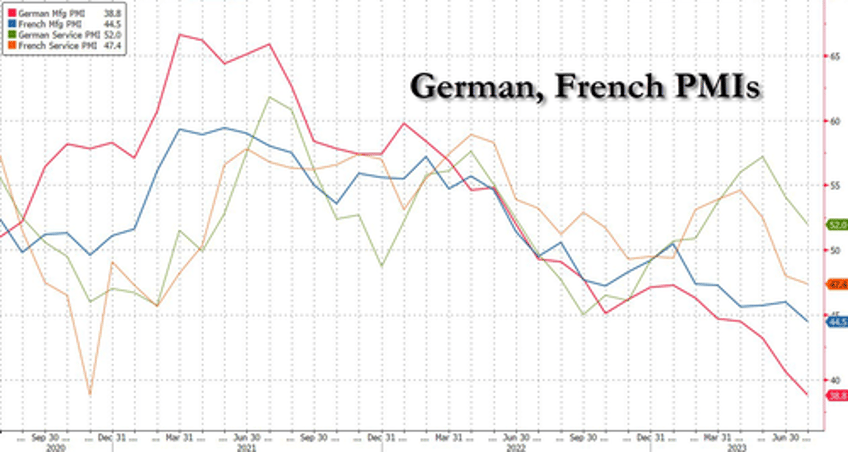

France: The French composite flash PMI decreased by 0.6pt to 46.6, below consensus expectations. The composite decline was broad-based across sectors, with both services activity and manufacturing output remaining in contractionary territory.

Germany: The German composite flash PMI decreased by 2.3pt to 48.3, also below consensus expectations. The decline in the composite index was broad-based across sectors, but led by manufacturing as the manufacturing output index fell to a 38-month low; services activity remains in expansionary territory.

Periphery: The periphery composite PMI edged down slightly to 50.8, driven by a small decline in manufacturing output—which remains below 50—that was offset partially by a modest improvement in services, which remains in expansionary territory.

The UK composite flash PMI decreased by 2.1pt to 50.7, also below consensus expectations. The decline in the composite index was broad-based across sectors but skewed towards services.

Goldman sees see three main takeaways from today's data.

First, Euro area growth momentum continues to weaken across both sectors, driven in particular by France and Germany, where press releases attributed today's weak print to a range of factors, including consumer hesitancy, inventory de-stocking, high inflation, and rising interest rates.

Second, price pressures continue to moderate but the slower pace of moderation in the services sector continues to point towards stickiness in underlying inflationary pressures. This appears to be particularly true in Germany, where the services price components edged up surprisingly in July.

Third, growth momentum in the UK also appears to be slowing, but remains in positive territory.

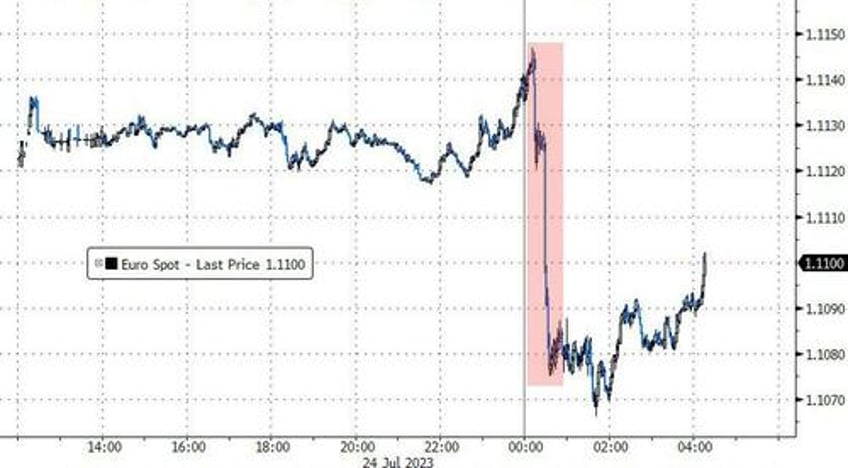

“Given what could be a mildly hawkish Fed event risk on Wednesday and the prospect of the ECB less than wholeheartedly backing the idea of a follow-up September rate hike, we see some downside risks to EUR/USD this week,” Chris Turner, head of fx strategy at ING. wrote in a note, forecasting EUR/USD to weaken to 1.1050

And sure enough EURUSD has started to fade...

However, the central bank has said in recent weeks it is concerned high wage growth and rising services prices could keep inflation above its 2 per cent target for too long.