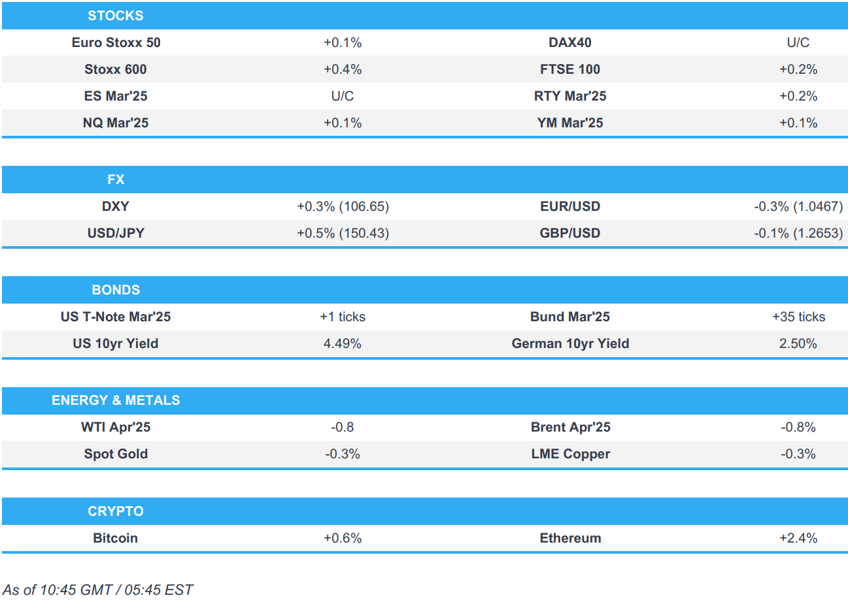

- European bourses are mostly higher after paring initial pressure following dire French PMIs; US futures are modestly mixed.

- DXY attempts to recoup lost ground, EUR weighed on by PMIs, JPY hit by Ueda remarks.

- BoJ Governor Ueda said if markets make abnormal moves, the BoJ stands ready to respond nimbly, such as through market operations, to smooth market moves.

- Bunds bolstered by soft PMI metrics; Commodities are pressured by the firmer Dollar.

- Looking ahead, US Flash PMIs, Canadian Retail Sales, Speakers include ECB’s Lane, BoC’s Macklem & Fed's Kugler & Jefferson.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 +0.3%) opened with a modest positive bias, but sentiment slipped a touch, to display a more mixed picture. Thereafter, sentiment in Europe was hit following the release of the French PMI metrics, but the downside largely stabilised after the German and EZ figures.

- European sectors hold a positive bias, but with the breadth of the market fairly narrow aside from the day’s leader. Chemicals tops the pile, lifted by post-earning strength in Air Liquide (+2.9%). Energy resides at the foot of the pile, given the weakness in oil prices in today’s session.

- US equity futures are mixed and trading on either side of the unchanged mark with the RTY up a tenth after significant losses in the prior session.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is attempting to recoup some lost ground after printing a YTD trough overnight at 106.35. Downside in the prior session stems from the opening up the prospect of a US-China trade deal, softer-than-expected US data and the US curve flattening on the back of Treasury Secretary Bessent's recent comments. If upside for the DXY extends, the next target comes via the 107 mark with yesterday's peak just above at 107.15.

- EUR was knocked lower in early trade following a dismal outturn for French flash PMI data which saw the services metric print below the lower end of expectations, dragging the composite metrics further into negative territory and to its lowest reading since 2023. EUR/USD printed a session low at 1.0469 before recouping some ground after a beat on German manufacturing PMI was able to move the composite metric further into expansionary territory. Attention now turns to Sunday's German election with focus on what the outcome will mean for the nation's fiscal agenda. ECB's Lane due to speak at 14:30GMT.

- JPY is the clear laggard across the majors with a firmer-than-expected outturn for Japanese national CPI overshadowed by comments from BoJ Governor Ueda. Ueda declared that the Bank will respond to any abnormal upside in long-term interest rates with purchases of government bonds. As such, after initially printing a fresh YTD trough overnight at 149.29, the pair has returned to a 150 handle.

- Cable printed a fresh YTD peak in early European trade following a solid retail sales report for January with the headline print coming in above the top end of estimates. On the data slate, flash PMIs for January were a mixed bag with a beat on services offset by a miss in manufacturing, leaving the composite in-line with estimates at 50.5.

- Antipodeans are both marginally softer vs. the stronger USD. AUD/USD was able to print another fresh YTD peak and breach the 0.64 threshold (0.6408 peak) before succumbing to the strength in the greenback.

- PBoC set USD/CNY mid-point at 7.1696 vs exp. 7.2433 (prev. 7.1712).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are marginally firmer but only posting gains of a handful of ticks in rangebound/choppy trade with US-specifics so far somewhat lighter than has been the case in recent sessions. Overnight, USTs caught a bid alongside the discussed move in JGBs. Specifically, at the upper-end of a 109-03+ to 109-11+ band, eyeing the 109-15 peak from Monday. Ahead, while we await updates to the tariff and geopolitical narratives we get data via US Flash PMIs and then an appearance from Fed’s Jefferson (Voter) on Fed Communication, from this we expect both a text release and a Q&A.

- Bunds are firmer, leading the EGB space. At the upper-end of a 131.56 to 132.20 band which has eclipsed Tuesday’s best but yet to approach Monday’s 132.58 WTD peak. Into the morning’s data Bunds were around 15 ticks off the above base and in the red. The French numbers hit first and came in softer than expected with the Composite at its lowest since 2023 and particular concern around the Services figures. A release which lifted Bunds to the session high, but soon faded into the German figures which were mixed but far better than the French metrics earlier. The pan-EZ figure came in mixed vs consensus and spurred no real reaction.

- Gilts are moving with the above but with magnitudes more contained into its own data. A release which didn’t really spark much of a reaction given it was quite mixed. Services came in marginally better than expected while Manufacturing missed and printed outside the forecast range leaving Composite in-line with consensus and only incrementally down from the prior. Prior to the Flash PMIs, UK Retail metrics came in stronger than expected though the PNSB figures, while at a record surplus, actually posted a smaller surplus than the OBR forecast at the time of the October Budget; a ‘surplus’ which, given the OBR compare, isn’t as much of a welcome indicator for the Chancellor as it may appear on face value.

- JGBs were supported overnight by BoJ Governor Ueda, remarks which more than offset any pressure from hotter-than-expected Japanese CPI. Ueda said that the BoJ stands ready to respond nimbly such as through market operations if markets make abnormal moves.

- Orders for the 8yr BTP Plus have hit EUR 14bln across the offer period

- Click for a detailed summary

COMMODITIES

- Subdued price action across the crude complex, with prices weakening as the European session went underway and the dollar trending higher. Sentiment for the complex could also be subdued by the downbeat commentary from the EZ flash PMIs, which suggested "Economic output in the eurozone is barely moving at all." Brent sits in a USD 75.89-76.75/bbl.

- Lower trade across precious metals as the Dollar attempts a recovery from its recent tumble and in turn prompting downside across metals. It was also reported that record gold prices have dampened demand at top Asian hubs, with buyers in India and China reportedly "sitting back" and waiting for a drop in prices. Spot gold resides in a USD 2,916.82-2,949.93/oz range.

- Base metals are lower across the board amid the aforementioned recovery in the Dollar coupled with flimsy risk sentiment, albeit in the absence of macro newsflow. 3M LME copper trades with mild losses between a USD 9,455.95-9,570.80/t range.

- EU's Energy Commissioner said the EU is looking for more gas, including from the likes of the US, to replace Russian supplies, via Reuters; the draft shows that the EU is aiming for long-term LNG contracts to stabilise prices. The EU is also looking for renewable energy to cut its overall reliance on fuel.

- Oil flows from Tengiz field via Caspian Pipeline Consortium are uninterrupted, according to Ifax citing Tengizchevroil.

- Click for a detailed summary

NOTABLE DATA RECAP

- UK Retail Sales MM (Jan) 1.7% vs. Exp. 0.3% (Prev. -0.3%, Rev. -0.6%); Ex-Fuel MM 2.1% vs. Exp. 0.9% (Prev. -0.6%, Rev. -0.9%)

- UK Retail Sales YY (Jan) 1.0% vs. Exp. 0.6% (Prev. 3.6%, Rev. 2.8%); Ex-Fuel YY 1.2% vs. Exp. 0.5% (Prev. 2.9%, Rev. 2.1%)

- UK PSNB Ex Banks GBP (Jan) -15.442B GB vs. Exp. -20.0B GB (Prev. 17.811B GB, Rev. 18.119B GB)

- UK GfK Consumer Confidence (Feb) -20.0 vs. Exp. -22.0 (Prev. -22.0)

- Italian CPI (EU Norm) Final YY (Jan) 1.7% vs. Exp. 1.7% (Prev. 1.7%); Final MM (Jan) -0.8% vs. Exp. -0.7% (Prev. -0.7%)

PMIs

- French HCOB Services Flash PMI (Feb) 44.5 vs. Exp. 48.9 (Prev. 48.2); HCOB Manufacturing Flash PMI (Feb) 45.5 vs. Exp. 45.5 (Prev. 45); HCOB Composite Flash PMI (Feb) 44.5 vs. Exp. 48 (Prev. 47.6); "Overall, there is little hope to be drawn from the slightly improved index figures, as the outlook for output is still viewed pessimistically and layoffs are commonplace".

- German HCOB Services Flash PMI (Feb) 52.2 vs. Exp. 52.5 (Prev. 52.5); HCOB Composite Flash PMI (Feb) 51.0 vs. Exp. 50.8 (Prev. 50.5); HCOB Manufacturing Flash PMI (Feb) 46.1 vs. Exp. 45.5 (Prev. 45)

- EU HCOB Manufacturing Flash PMI (Feb) 47.3 vs. Exp. 47 (Prev. 46.6); HCOB Services Flash PMI (Feb) 50.7 vs. Exp. 51.5 (Prev. 51.3); HCOB Composite Flash PMI (Feb) 50.2 vs. Exp. 50.5 (Prev. 50.2)

- UK Flash Services PMI (Feb) 51.1 vs. Exp. 50.8 (Prev. 50.8); Flash Composite PMI (Feb) 50.5 vs. Exp. 50.5 (Prev. 50.6); Flash Manufacturing PMI (Feb) 46.4 vs. Exp. 48.4 (Prev. 48.3)

NOTABLE EUROPEAN HEADLINES

- UK reportedly lines up a new ambassador to help rebuild China ties, according to Reuters.

NOTABLE US HEADLINES

- Fed's Kugler (voter) said she believes the Fed should hold the policy rate in place for some time and noted there is currently a lot of uncertainty about the potential effect of President Trump's tariffs, as well as noted they are looking at potential scenarios on tariff impacts and tariffs could put up price pressures, but the extent is less known. Kugler said it is unknown how much tariffs will be passed through to consumers as higher prices and to assess tariff effects "we have to wait", while she added they will need to stop balance sheet shrinkage at some point, while still above ample reserves.

- China Foreign Ministry says Vice Premier He Lifeng will speak with US Treasury Secretary Bessent, "will communicate important issues in the economic field between China and US over video call".

- "Senate continues vote-a-rama through the night to develop budget framework for Trump agenda.", according Fox's Pergram.

- "Senate GOP budget resolution passes with Rand Paul voting no", according to Punchbowl's Bresnahan.

- Tesla (TSLA) recalling 376,241 US vehicles, according to NHTSA, amid a loss of power steering assist which can increase the risk of a crash.

GEOPOLITICS

MIDDLE EAST

- Israeli police received reports of two explosions in Bat Yam and one in Holon on Thursday night, while four explosive devices were found in buses in Bat Yam and Holon. Israeli PM's office said there was an attempt to carry out a series of attacks on buses and Israeli PM Netanyahu has instructed the military to carry out an intense operation in the West Bank against "terror" hubs.

- Israel military said two bodies released by Hamas on Thursday were identified as Israeli hostages Kfir and Ariel Bibas, while it demanded for Hamas to return Shiri Bilbas along with all hostages. It was separately reported that the IDF said the exchange with Hamas on Saturday will continue as planned, according to Asharq News.

RUSSIA-UKRAINE

- "AFP quoting Ukrainian source: Kiev and Washington continue negotiations on strategic minerals", according to Sky News Arabia.

- Russia Security Council says threats to Russian port infrastructure from NATO have intensified, according to RIA. Adds, NATO considers maritime transport and major oil terminals as targets for attacks.

- US Secretary of State Rubio said the meeting between US President Trump and Russian President Putin will largely depend on whether progress can be made on ending the war in Ukraine.

- US opposes language on 'Russian aggression' in G7 statement on Ukraine, according to FT

- Polish PM Tusk called for financing aid for Ukraine from frozen Russian assets and urged stronger defences along EU borders with Russia.

- China's Foreign Minister Wang Yi said China supports all efforts conducive to peace in Ukraine including the recent consensus reached by the US and Russia, while he added that China is willing to continue playing a constructive role in political resolution of the crisis.

- "German Chancellor: Ceasefire in Ukraine is still elusive", according to Sky News Arabia.

- Russian Kremlin says there is an understanding for a Trump-Putin meeting; no concrete details yet. Special military operation is continuing and goals will be achieved. Have goals related to security and ready to achieve this via negotiations.

OTHER

- China’s military warned and drove away three Philippine aircraft that ‘illegally intruded’ into the airspace near the Spratly Islands and reefs on Thursday.

- There has been a new cable break in the Baltic Sea, according to information to TV4 News, The Armed Forces confirm that they are aware of the information.

- Sweden's PM says they are looking into a breach of an undersea cable within the Baltic Sea; Coast Guard adds that the suspected breach occurred in Sweden's EEZ.

- European Commission is to propose a new surveillance mechanism for submarine cables, according to a document cited by Reuters.

CRYPTO

- Bitcoin is a little firmer and trading just above USD 98k; Ethereum continues to climb as it approaches USD 2.8k.

APAC TRADE

- APAC stocks traded mostly higher albeit with mixed price action seen following the subdued handover from Wall St where stocks declined amid geopolitical uncertainty, disappointing data and weak Walmart guidance, while participants in the region digested earnings releases and central bank commentary.

- ASX 200 marginally declined amid a deluge of earnings releases and after Australia's flash manufacturing PMI improved but remained in contraction territory, while RBA Governor Bullock reiterated a cautious approach to further rate cuts.

- Nikkei 225 swung between gains and losses with initial pressure owing to recent currency strength and after mostly firmer-than-expected CPI data, although the index then rebounded and the yen weakened amid comments from BoJ Governor Ueda who said if markets make abnormal moves, they stand ready to respond nimbly, such as through market operations.

- Hang Seng and Shanghai Comp are positive with notable outperformance in the Hong Kong benchmark which was led by a tech surge as Alibaba shares climbed by a double-digit percentage post-earnings, while the PBoC and Chinese Premier Li recently pledged efforts to smooth financing and stimulate consumption, respectively.

NOTABLE ASIA-PAC HEADLINES

- BoJ Governor Ueda said BoJ's massive monetary easing including YCC was a necessary process towards achieving the price target and they acknowledged the BoJ's massive stimulus caused various side effects, Ueda said they expect long-term interest rates to fluctuate to some extent depending on the market's view on the economic outlook and if markets make abnormal moves, they stand ready to respond nimbly, such as through market operations, to smooth market moves. Ueda said he won't comment on where long-term interest rates could eventually converge and cannot say specifically when exactly the BoJ could conduct emergency market operations to soothe yield moves. Furthermore, he said there could be more side effects from monetary easing and that more interest rate hikes could come into sight if the price outlook continues to improve, and there might be some unpredictable impact on the economy, while he reiterated the accommodative environment continues and BoJ will adjust monetary policy if underlying prices rise.

- RBA Governor Bullock said the board is committed to being guided by incoming data and evolving risk assessments, while she added there is no pre-commitment to any specific course of action on interest rates and the board remains cautious about further policy easing.

DATA RECAP

- Japanese National CPI YY (Jan) 4.0% vs. Exp. 3.9% (Prev. 3.6%); Ex. Fresh Food YY (Jan) 3.2% vs. Exp. 3.1% (Prev. 3.0%)

- Japanese National CPI Ex. Fresh Food & Energy YY (Jan) 2.5% vs. Exp. 2.5% (Prev. 2.4%)