By Jan-Patrick Barnert and Michael Msika, Bloomberg Markets Live reporters and strategists

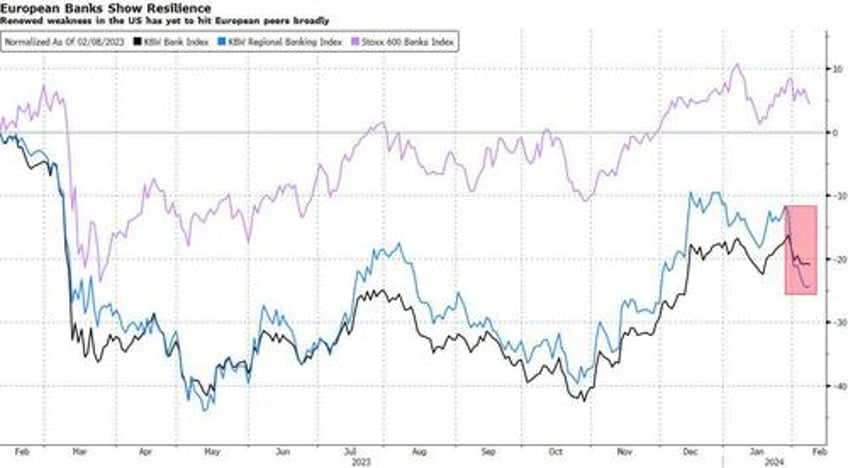

A 20% rally for banks since last March’s lows is now facing another hurdle, with concerns about the troubled commercial property market in the US spreading to Europe’s lenders. But there’s few signs of panic just yet.

Some German lenders with exposure to the property market are feeling the heat: Deutsche Pfandbriefbank is down 15% this week, while Deutsche Bank shares have fallen almost 10%. Both banks have increased their provisions to cover losses in US commercial real estate, and German banking regulator BaFin said this week it is monitoring turmoil in the CRE market.

“The market has somewhat pushed aside concerns about the commercial real estate market,” says Guillermo Hernandez Sampere, head of trading at asset manager MPPM. The big question is “whether the risks in the portfolios have been appropriately managed.”

The fresh worries come as banks were already facing a tougher time, with the tailwind from high interest rates likely to fade soon. And the wobble is just a month after the sector recouped losses induced by the collapse of SVB and Credit Suisse last year. Still, Europe’s lenders are showing remarkable resilience compared with those in the US, where a surprise loss for New York Community Bancorp last week has triggered an 11% drop for the regional banks index.

“US commercial real estate loans, at 1% or less of assets, don’t significantly threaten Europe banks such as Deutsche Bank, HSBC and BNP,” say Bloomberg Intelligence analysts Tomasz Noetzel and Uzair Kundi. “Aareal Bank’s exposure at 16% and Pfandbriefbank at 10% are at more risk, with PBB’s just-raised 2023 loan-loss provision guidance showing how property market weakness isn’t fully reflected,” their analysis shows.

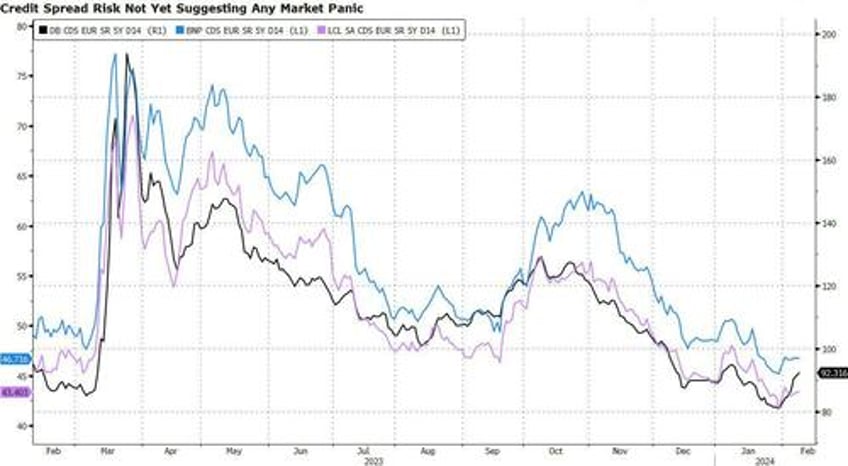

The assessment is also reflected in price action. Implied volatility for the wider banking sector, while rising, is still at a very low level, suggesting no panic or extreme hedging activity at this point.

Major lenders’ credit default swaps offers a similar picture, with spreads far below the levels seen during the US commercial banking crisis a year go. However, it’s worth noting that Deutsche Pfandbriefbank’s subordinated bonds have been slumping this week.

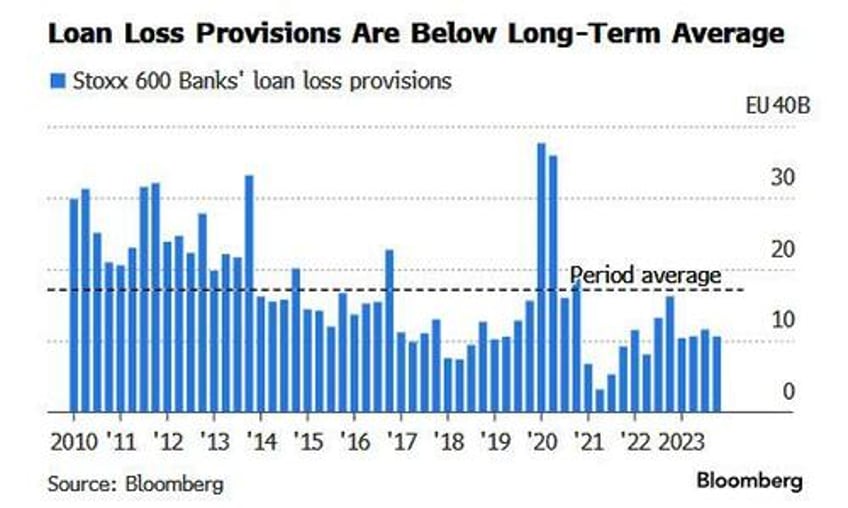

Sentiment could deteriorate further as the full impact of higher interest rates on property values becomes clear. But the balance sheet risks for the sector as a whole still look rather subdued, and are well below the long-term average level seen in the past decade.

According to Goldman Sachs analysts, European banks’ CRE loan exposure amounts to €1.4 trillion, accounting for 9% of total loans as of 1H last year, the latest available data. More than half of that is held by the major listed European banks. Citing European Banking Association data, the analysts say that CRE non-performing loans are about 38% covered by provisions — a reason why CRE exposure alone is unlikely to lead to a systemic crisis.

For Richard Halle, portfolio manager of the M&G (Lux) European Strategic Value Fund, the situation in Europe is very different to that of the US regional banks. “Most European banks are now well-capitalized and have been prudent with their lending policies the last few years. While there may be exceptions, commercial real estate losses shouldn’t fall on the banking sector in Europe,” he says.

That said, the history of the sector — and of PBB’s predecessor, Hypo Real Estate, which was nationalized and wound down during the financial crisis — is naturally making investors jittery when the name comes up in the context of credit risks.

“There are institutions that are heavily concentrated into certain assets, like CRE, or may run unhedged books, which may lead to top-line pressure as interest rates increase,” say KBW analysts Thomas Hallett and Andrew Stimpson. “There will always be an element of interconnectedness, which leaves banks such as Deutsche Bank impacted to some degree.”