- The US is to impose 25% tariffs on all cars made outside of the US effective on April 2nd

- Trump reiterated that reciprocal tariffs are also set for next week but stated they will be lenient

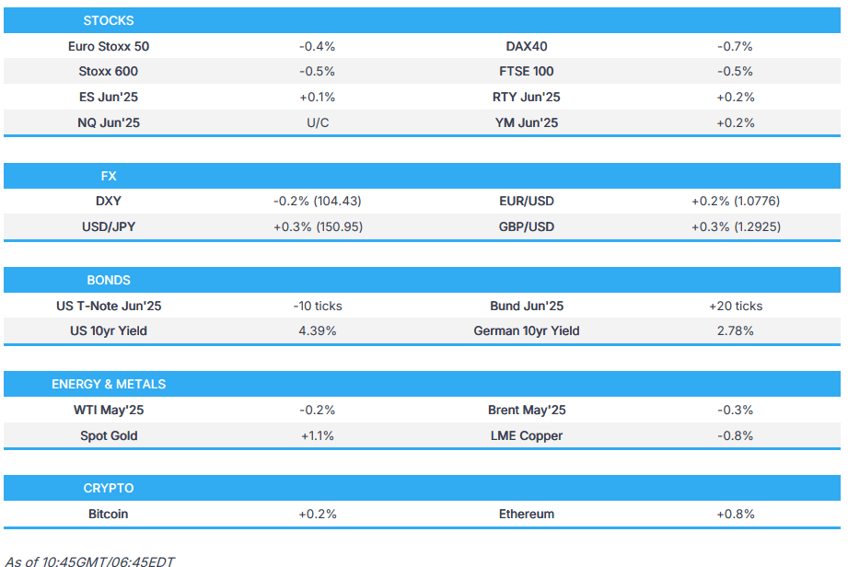

- Updates which weigh on European equities with Auto names lagging, US futures mixed/firmer

- DXY mixed with GBP outperforming in an attempted recovery from Wednesday's action while JPY lags

- EGBs and USTs diverge as they focus on growth and inflationary implications of the latest rhetoric respectively

- Crude benchmarks lower, TTF choppy, XAU gains and base metals slip

- Looking ahead, highlights include US GDP & PCE Final (Q4), Jobless Claims, Japanese Tokyo CPI, Banxico Policy Announcement, Speakers including BoEʼs Dhingra, Fedʼs Collins & Barkin, ECBʼs Schnabel, de Guindos & Lagarde, Supply from the US

- Click for the Newsquawk Week Ahead.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

TARIFFS/TRADE

- US President Trump announced the US is to impose 25% tariffs on all cars not made in the US, while he said they will be doing tariffs on pharmaceuticals and tariffs on lumber. Trump stated auto tariffs are going into effect on April 2nd and will start being collected on April 3rd, as well as noted that he will have a news conference on April 2nd which is the real Liberation Day. Furthermore, reciprocal tariffs on April 2nd will be on all tariffs but they will be lenient and in many cases, the tariffs will be less than the tariff charged on the US.

- US President Trump said there will be some form of a deal on TikTok and if the deal is not finished, it will be extended. Trump said there are numerous ways to buy TikTok and there is a lot of interest in TikTok, while he added that China has to play a role and he may give China a little reduction in tariffs to get it done.

- Thereafter, China rejects Trump's offer of tariff waivers in exchange for TikTok deal, according to AFP

- US President Trump posted on Truth "If the European Union works with Canada in order to do economic harm to the USA, large scale Tariffs, far larger than currently planned, will be placed on them both in order to protect the best friend that each of those two countries has ever had!"

- White House official said Commerce Secretary Lutnick informed President Trump that national security concerns raised in the earlier autos probe remain and may have escalated. The official stated the 25% tariff applies to autos and auto parts, in addition to any other duties or fees, while the new 25% tariff will be added to the existing 25% tariff on light trucks and cars coming to the US under USMCA will be tariffed according to their foreign part content. Furthermore, the official stated that tariffs take effect after midnight on April 3rd and it was also reported that Trump's autos proclamation provides a one-month tariff exemption for auto parts imports until May 3rd.

- Canadian PM Carney said Trump's tariff announcement is a direct attack on Canadian workers and they will defend their country, while he will convene a high-level meeting on Thursday to discuss trade options and noted that tariffs will hurt Canada but the country will emerge stronger. Furthermore, he said if retaliatory tariffs are appropriate, Canada will take steps in its own interest and that Ottawa will react soon in which it can introduce retaliatory tariffs, while he is sure he will speak to Trump soon.

- Ontario's Premier said he spoke to PM Carney and they agreed Canada needs to stand firm, strong and united, while he fully supports the government preparing retaliatory tariffs to show that Canada will never back down.

- Unifor said regarding US auto tariffs that President Trump fails to understand the chaos and damages tariffs will inflict on workers and consumers in both Canada and the US.

- Mexico's Foreign Minister held a call with US Deputy Secretary of State Landau in which they talked about security, migration and commerce, while they agreed to exchange information regularly and to schedule a face-to-face meeting in the near future, according to Mexico's Exterior Ministry

- European Commission President Von der Leyen said she deeply regrets the US decision to impose tariffs on European automotive exports, while the European Commission will assess the announcement along with other measures the US is expected to unveil in the coming days and the EU will continue to seek negotiated solutions while safeguarding its economic interests.

- Japanese PM Ishiba said various options are on the table for consideration regarding US auto tariffs and need to think about the appropriate response. Ishiba added that Japan is making the largest investment in the US and questions whether it makes sense to apply higher auto tariffs equally to all countries, which is a point it has made and will continue to make to the US.

- China's ambassador to the US said using fentanyl as an excuse to raise taxes for no reason will only turn another point of cooperation into a point of friction, while the ambassador added that the development of China-US relations has reached a new and important juncture and hopes the US will work with China in the same direction.

EUROPEAN TRADE

EQUITIES

- European bourses were primed for a softer open with losses accelerating modestly thereafter given the latest US tariff rhetoric, Euro Stoxx 50 -0.5%. Auto names lag given the focus of Trump's commentary with marked pressure in names across the board though they are off lows.

- Stateside, futures are more mixed despite the European pressure; ES U/C, RTY +0.2%. Price action so far fairly tentative as we await updates on the tariff narrative, though futures have managed to make their way off overnight lows.

- H3C says NVIDIA (NVDA) H20 chip stocks are nearly depleted, new shipments are due Mid April, according to a client notice; H3C will distribute the chips based on profit margins.

- Microsoft (MSFT) mulls developing own high-end generative AI, according to Nikkei citing Microsoft CEO Nadella; CEO added that having its proprietary platform will make it easier to provide services optimised for its business software.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY in the red after gaining on Wednesday, currently posting a slightly mixed performance against peers. DXY pivoting the 104.50 mark and awaiting tariff developments alongside a handful of other drivers.

- EUR is modestly firmer but off a 1.0787 high against the USD, yet to make its way back onto a 1.08 handle and approach yesterday's peak @ 1.0803. To the downside, attention is on the 200DMA @ 1.0729.

- Cable is back above the 1.29 handle with the recovery from Wednesday's pressure a tentative one and we are still shy of that session's 1.2949 peak. Specifics light thus far, with commentary very much just digesting the statement and tariff implications.

- USD/JPY has extended on yesterday's upside with JPY the worst performer across the majors. Fresh macro drivers for Japan are light as markets look ahead to Tokyo CPI overnight. Finds itself at a 150.96 peak.

- NOK picked up on the Norges Bank announcement (details below), with EUR/NOK knee jerking to a 11.3374 low before then paring modestly.

- Antipodeans attempting to recoup lost ground and take advantage of USD downside, of note is the suggestion that Trump could give China some tariff relief for a TikTok deal.

- Norges Bank maintains its Key Policy Rate at 4.50% as expected; current assessment of the outlook implies that the policy rate will most likely be reduced in the course of 2025; Q4-2025 Repo Path 4.21% (prev. 3.80%).

- PBoC set USD/CNY mid-point at 7.1763 vs exp. 7.2728 (Prev. 7.1754).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- Modest divergence between EGBs and USTs with Bunds firmer and yields lower given the growth implications of the latest tariff commentary, though Bunds have faded from early 128.69 peaks and are at session lows some 40 ticks below but still just in the green.

- USTs meanwhile find themselves in the red, with yields picking up on the global and US inflationary implications of such action, as such yields are firmer with the curve steepening ahead of data and 7yr supply; a sale which follows a robust 2yr and more a tepid 5yr outing earlier in the week.

- Gilts in the red despite opening with very modest gains. Pressure which comes given the inflationary implications of the above and despite officials in the UK stressing that they do not plan to retaliate to US action and are seeking favourable deals. Thus far, at a 90.55 trough, below Wednesday’s 90.75 low which printed during the statement.

- Reuters calculations suggest China stepped up fiscal support and accelerated bond issuance to the highest on record in Q1 2025, issuing a total of CNY 3.28tln.

- Click for a detailed summary

COMMODITIES

- Crude benchmarks are both in the red with sentiment feeling heavy amid the US administration's ongoing tariff rhetoric. Otherwise, rhetoric has been light but prices found somewhat of a floor around the time that Russia's Deputy Foreign Minister said that given the current circumstances, it is impossible that Russia will make any concessions on strategic stability, and there is no concrete agreement on the Black Sea deal.

- WTI May resides in a USD 69.22-69.96/bbl range while its Brent counterpart trades in a USD 73.35-73.97/bbl.

- Dutch TTF shifts between modest gains and losses in early European hours, with complex-specific newsflow light this morning but with traders cognizant of the heating season coming to an end, with stockpiling season ahead.

- Precious metals are mostly firmer with gold gaining on haven flows and most recently extending above the USD 3050/oz mark, a much which occurred without a fresh fundamental driver and may be more technically driven.

- Base metals hit on the risk tone and tariff commentary. 3M LME copper current resides in a USD 9,828.80-9,997.75/t range at the time of writing.

- Click for a detailed summary

NOTABLE DATA RECAP

- EU Money-M3 Annual Growth (Feb) 4.0% vs. Exp. 3.8% (Prev. 3.6%)

- EU Loans to Non-Fin (Feb) 2.2% (Prev. 2.0%); Households (Feb) 1.5% (Prev. 1.3%)

NOTABLE EUROPEAN HEADLINES

- ECB's Kazaks says we can probably keep cutting rates if the baseline holds, adds uncertainty is really high and geopolitics is the main cause.

- ECB's Wunsch says the ECB is facing a difficult balancing act as tariffs would be bad for the economy and inflationary, via CNBC; a pause should be on the table in April. Unclear what the impact of the recent German fiscal announcement will be. Inflation risks might be on the upside.

- ECB's Villeroy says France needs to bring the deficit back to the 3% mark Earlier: French 2024 budget deficit at 5.8% of GDP vs gov't exp. 6.0% (5.4% in 2023), via INSEE.

- UK Chancellor says UK is in “intense negotiations” with the US on all tariffs and “working on” exempting the UK because “we don't run a surplus”, via BBC.

NOTABLE US HEADLINES

- US President Trump announces the appointment of Brandon Beach as the next Treasurer of the United States.

- US President Trump effectively cut 10% of funding for the Commerce Department's Bureau of Industry and Security which is the key agency in the US-China tech race, according to Bloomberg.

GEOPOLITICS

MIDDLE EAST

- US President Trump said US attacks on Houthis will continue for a long time.

- Hamas spokesperson Abdel Latif al-Qanoua was killed in an Israeli airstrike on northern Gaza, according to Hamas media cited by Reuters. In relevant news, Lebanese media reported an Israeli march targeted a car on a road in Tyre in southern Lebanon, according to Sky News Arabia.

- "US official to Al-Arabiya: The Pentagon is considering plans to deploy additional forces in the Middle East", according to Al Arabiya.

OTHER

- Russia's Foreign Ministry says recent Russia-US contacts are at the beginning of a long and difficult process of restoring relations, according to RIA.

- Russian Deputy Foreign Minister says given the current circumstances, it is impossible that Russia will make any concessions on strategic stability, via Tass; no concrete agreement on Black Sea deal.

- European Council President Costa says EU must keep the pressure on Russia via sanctions and he will convey this message in today's leaders' meeting on Ukraine.

RUSSIA-UKRAINE-US

North Korean leader Kim supervised tests of kamikaze drones and the nation was presumed to send at least 3,000 more troops to Russia, according to Yonhap.

CRYPTO

- Firmer, with Bitcoin above the USD 87k mark but off best levels in a USD 86.61-87.77k band.

APAC TRADE

- APAC stocks were ultimately mixed with cautiousness seen after Trump's latest tariff salvo in which he announced the US is to impose 25% tariffs on all cars made outside of the US effective on April 2nd and reiterated that reciprocal tariffs are also set for next week but stated they will be lenient, and in many cases, tariffs will be less than the tariffs charged on the US.

- ASX 200 declined with the index dragged lower by underperformance in tech, real estate and financials but with further downside stemmed by resilience in utilities and the commodity-related sectors.

- Nikkei 225 slipped back beneath the 38,000 level with automakers among the worst hit following Trump's 25% auto tariff announcement.

- Hang Seng and Shanghai Comp kept afloat with outperformance in Hong Kong amid a slew of earnings releases and after US President Trump also suggested he may give China a little reduction in tariffs to get a TikTok deal done, while China's Vice Premier vowed to push forward reforms to help high-quality economic growth in a speech at the Boao Forum.

NOTABLE ASIA-PAC HEADLINES

- China's Vice Premier Ding Xuexiang said at the Boao Forum that there is a significant rise in uncertainties in the world and that China will resolutely oppose protectionism, as well as promote globalisation and safeguard free trade. Ding said China's economy has had a good start this year and the improving trend in China's economy has become more consolidated, while he is confident in China achieving its growth target and contributing to Asia and world growth. Furthermore, he said they will push forward key reforms to help high-quality economic growth, promote the development of private firms and make greater efforts to promote the healthy development of the property and stock market.

- Chinese FX Regulator Deputy Head says will resolutely prevent overshooting risks in CNY exchange rates; will keep CNY exchange rate basically stable.

DATA RECAP

- Chinese Industrial Profits YTD (Feb) -0.3% (Prev. -3.3%)