- US President Trump sanctioned Venezuelan oil. Elsewhere, India has proposed the removal/reduction of tariffs

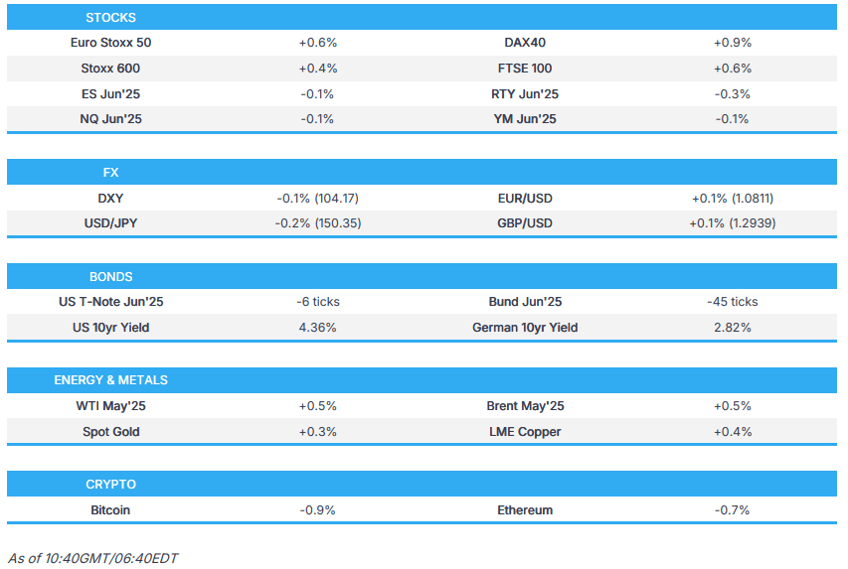

- European bourses defied the lead from futures and opened in the green, US futures in the red but only modestly so and hold onto the bulk of Monday's gains

- DXY steady throughout the morning but most recently at a session low to the benefit of peers across the board, EUR also aided by Ifo

- Fixed benchmarks in the red, weighed on by Ifo and supply; USTs await Fed speak

- Crude bid in an extension of Monday's action, TTF softer on Ukraine updates while Gold has inched to fresh highs

- Looking ahead, highlights include US Richmond Fed Index, Consumer Confidence, Japanese Services PPI, Speakers including Fedʼs Williams & Kugler, Supply from the US

- Click for the Newsquawk Week Ahead.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

TARIFFS/TRADE

- US President Trump signed an order imposing sanctions on countries importing Venezuelan oil and said tariffs for doing business with Venezuela will be on top of existing tariffs but added that not all tariffs will be included on April 2nd.

- India proposed to remove the 6% tariff imposed on online advertisement services offered by companies such as Google (GOOG) and Meta (META), widely known as the Google tax from April 1st, which is a day before Trump's reciprocal tariffs take effect.

- Subsequently, India is reportedly open to cutting tariffs on over half of US imports, worth USD 23bln, via Reuters citing sources; open to cutting tariffs to as low as 0 from a 5-30% range on 55% of US imports. Estimates a hit to USD 66bln worth of exports to the US from reciprocal tariffs. In return for tariff cuts, seeking relief from reciprocal tariffs.

- South Korea's Acting President Han said their mission is to secure national interest in a trade war and will do everything to weather the tariff storm triggered by the US, while it was also reported that South Korea is to launch a special probe on 'made in Korea' violations ahead of US tariffs.

- German Agriculture Ministry said Britain removed import restrictions on German animals and animal products imposed after the foot-and-mouth disease case.

EUROPEAN TRADE

EQUITIES

- European bourses defied the lead from futures and began the session on a firmer footing, Stoxx 600 +0.4%; no significant/fresh driver for the move with it seemingly an extension of Monday's US action.

- Sectors mostly in the green, Energy leads given benchmarks and with Shell (+2.0%) assisting. Retail lags, weighed on by Kingfisher (-11%) after weak results.

- Stateside, futures are modestly in the red but with the benchmarks at the top-end of yesterday’s parameters and as such holding onto the bulk of Monday’s gains; ES -0.2%.

- In specifics, EU is to fine Meta (-0.1%) EUR 1bln; Alibaba (-2.2%) Chair warns on AI data centres; Tesla’s (-0.7%) Europe sales plummet; Boeing (U/C) seeks to withdraw 737 Max guilty plea; KBH (-7.7%) drops after earnings & guidance; CCI (-1.2%) fires its CEO.

- Foreign Leaders and Tech CEOs are reportedly urging the US Administration to rethink AI chip curbs, according to Bloomberg.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- Relatively steady trade for the first part of the European morning but as we approach the US session slightly more pressured has emerged in the USD with the Index at a 104.15 trough. Overall, a session of slightly choppy FX action with moves turning around and extending in recent trade with no clear/overt fresh fundamental driving.

- EUR benefitting from the above move, no specific/fresh driver behind it. Prior to this, the index got back towards the 1.08 mark on the latest Ifo metrics which improved from the prior. Most recently, the USD action has lifted the single currency to a fresh 1.0816 session high.

- USD/JPY initially extended on the prior session's advances, but failed to breach the 151.00 mark and has been easing back since. Currently finds itself at a 150.32 low.

- Again, GBP was steady for the first part of the session but Cable picked up further from the 1.29 handle and is at a 1.2944 high, benefitting from USD moves. Specifics focussed entirely on Wednesday's Spring Statement.

- AUD saw little follow through from the pre-election budget announcement. Benefitting from the above moves and is just above the 0.63 mark in recent trade. Kiwi in the green, but not faring quite as well so far.

- PBoC set USD/CNY mid-point at 7.1788 vs exp. 7.2630 (Prev. 7.1780).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- Benchmarks lower across the board. Bunds weighed on by the latest Ifo metrics with expectations and conditions printing above consensus while climate was in-line. A move which added to the bearish bias in fixed income and sent Bunds below the 128.00 mark around 10-minutes after the print. Currently just off a 127.84 base.

- USTs in-fitting, in a continuation of the sizable moves from Monday, which sent USTs to a 110-15+ base, a low that has since been taken out to a 110-11+ WTD trough.

- Gilts weighed on by the above and also as we count down to the Spring Statement. Fresh reporting ahead of this that the OBR’s growth forecast will be essentially cut in half from the 2% level outlined in the autumn. At a 91.05 base, lowest since March 6th when 90.71 printed.

- Click for a detailed summary

COMMODITIES

- Crude complex remains supported after Monday’s buying, which saw WTI and Brent settle around USD 0.80/bbl higher after numerous catalysts aided the benchmarks. The latter, settling at the highest since late February.

- US remarks around Venezuela and tariffs in focus while we await an update on the geopolitical front.

- On this, Dutch TTF is modestly lower, owing to the “constructive” talks in Riyadh, which US and Ukrainian teams are set to be extending.

- Spot Gold has recouped some losses from overnight and is at a fresh session high of USD 3023/oz, seemingly benefiting from the initially tepid USD and US risk tone.

- Click for a detailed summary

NOTABLE DATA RECAP

- German Ifo Expectations New (Mar) 87.7 vs. Exp. 87.5 (Prev. 85.4); Ifo Current Conditions New (Mar) 85.7 vs. Exp. 85.5 (Prev. 85.0); Ifo Business Climate New (Mar) 86.7 vs. Exp. 86.7 (Prev. 85.2)

NOTABLE EUROPEAN HEADLINES

- UK Chancellor Reeves is to publish the forecast from the OBR which is to roughly halve the UK’s expected growth in 2025 from 2% to about 1%, while her GBP 9.9bln of headroom against her fiscal rule has been wiped out, leaving her about GBP 4bln in the red. Furthermore, Reeves's statement is expected to have more than GBP 5bln of extra cuts to UK public spending and she will claim that Britain is “uniquely positioned” to pursue favourable trading relations with the US and EU, according to FT.

- ECB's Muller says rates are not restricting the economy or investments; tariffs are likely to mean faster inflation in the short term; any further cuts will be tariff dependent.

- ECB's Kazimir says "services inflation is key", open to discuss rate cut or pause in April; already in the zone of the neutral rate.

NOTABLE US HEADLINES

- US Treasury Secretary Bessent said interest rates are going to keep declining as energy costs decline and noted that laid-off workers can go into the private sector.

GEOPOLITICS

UKRAINE

- Ukraine delegation in Saudi Arabia will meet with the US team on Tuesday, according to a Ukrainian broadcaster Suspilne citing an unnamed source in the Ukrainian delegation.

- White House source says talks facilitated by the Trump administration's technical teams in Riyadh are going extremely well, and we expect to have a positive announcement in the near future.

- Russia and US talks in Saudi Arabia were not simple but were useful, while their talks will continue with participation of international community including the UN, according to TASS.

- Ukraine and US teams are said to be holding further Russia-Ukraine talks in Riyadh, according to Bloomberg.

- Russia's Kremlin says there are no plans for a Russian President Putin-US President Trump call yet but it can be organised; the content of the talks will not be disclosed in public.

MIDDLE EAST

- Israeli military says it struck targets at Syrian military bases.

- Houthi military spokesman says they targeted US naval vessels in the Red Sea and Israel's Ben Gurion Airport, according to Al Jazeera and Sky News Arabia.

CRYPTO

- In the red, but Bitcoin has managed to make its way back above the USD 87k mark after slipping to as low as USD 86.3k earlier in the session.

APAC TRADE

- APAC stocks trade mixed after the early momentum from the tariff-related optimism on Wall St wore thin.

- ASX 200 advanced at the open but then gave back most of its gains after stalling near the 8,000 level and as participants await Treasurer Chalmers's pre-election budget which is expected to return to a deficit.

- Nikkei 225 rallied at the start of trade and briefly climbed above the 38,000 level but has since pulled back from intraday highs with recent currency moves influencing price action.

- Hang Seng and Shanghai Comp were pressured with notable underperformance in Hong Kong as tech and auto names lost traction amid recent earnings releases and tariff risk, while there was a lack of details so far regarding the PBoC's MLF operation after the central bank recently unveiled a new method for how MLF operations will be conducted whereby banks will be able to bid for different prices on its one-year loans.

NOTABLE ASIA-PAC HEADLINES

- China is considering including services in the multi-billion dollar subsidy program to stimulate consumption, according to FT.

- BoJ January Meeting Minutes stated most members expressed the recognition that the likelihood of realising the outlook had been rising and some members shared the recognition that real interest rates were expected to remain significantly negative even after the rate hike. The minutes stated that a member expressed the view that if underlying inflation increased, the BoJ would need to raise the policy interest rate accordingly in a gradual manner and a member continued that it would be necessary for the BoJ to adjust the degree of monetary accommodation from the viewpoint of avoiding the yen’s depreciation and the overheating of financial activities. Furthermore, a member said the BoJ should be extremely careful about suggesting the pace of policy interest rate hikes and the terminal policy rate and a member said it would be desirable for the BoJ to bear in mind that the policy interest rate should be at around 1% in the second half of fiscal 2025.

- BoJ Governor Ueda said they still need some time to consider what to do with the BoJ's ETF holdings and must think about valuation and market rout risks when offloading its ETF holdings. Ueda added that the BoJ's JGB holdings would continue to have a stock effect since the reduction pace is extremely slow and the massive JGB holdings have a stock effect that would slightly lower long-term yields.

AUSTRALIAN BUDGET

- Sees 2024-25 budget deficit at AUD 27.6bln; 2025-26 budget deficit AUD 42.1bln vs. Exp. AUD 40bln.

- 2024/25 inflation seen at 2.5%, 2025/26 seen at 3% and 2.5% through 2027/28.

- 2024/25 GDP seen at 1.5%, 2025/26 seen at 2.25% and 2.5% 2026/27.

- 2024/25 Unemployment seen at 4.25% and staying there through 2027/28.

- New tax cuts that will cost AUD 17.1bln over 5 years.