- APAC stocks trade mixed after the early momentum from tariff-related optimism on Wall St wore thin.

- US President Trump will announce additional tariffs over the next few days on autos, lumber and chips; may give "a lot" of countries breaks on tariffs.

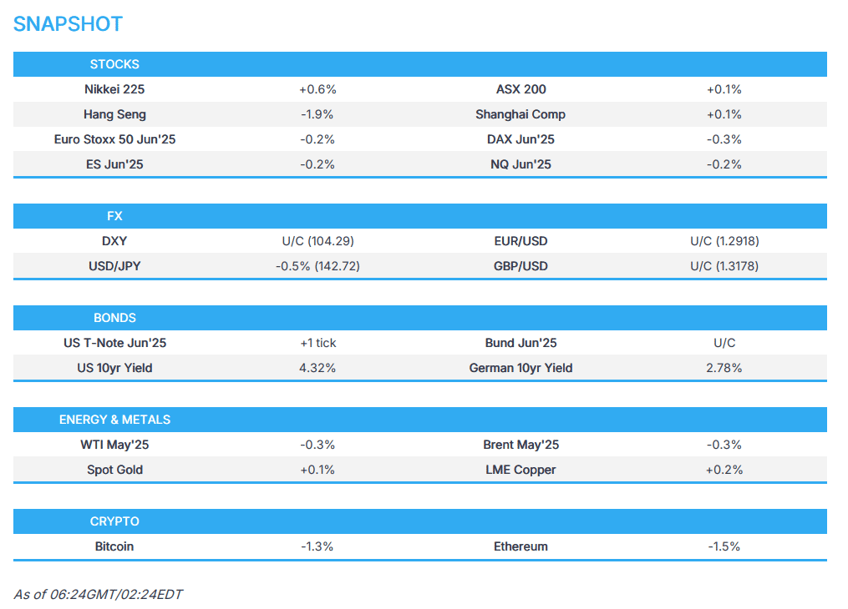

- European equity futures indicate a lower cash market open with Euro Stoxx 50 future down 0.3% after the cash market finished with losses of 0.2% on Monday.

- FX markets are broadly steady with the DXY flat, EUR/USD lingers around the 1.08 mark, JPY marginally outperforms.

- The UK's OBR forecast is to roughly halve the UK’s expected growth in 2025 from 2% to about 1%, FT.

- Looking ahead, highlights include German Ifo, US Richmond Fed Index, Consumer Confidence, Japanese Services PPI, Speakers including Fed’s Williams & Kugler, Supply from Netherlands, UK, Germany & US.

SNAPSHOT

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 day

US TRADE

EQUITIES

- US stocks rallied on Monday following reports that US President Trump's April 2nd tariffs may be more targeted and exclude sector-specific tariffs, while a strong S&P Global Services PMI also supported the risk tone. However, Trump later stated he would be announcing tariffs on autos, lumber and chips over the next few days but may give a lot of countries breaks on tariffs, which helped add to the equity bid. As such, stocks closed around highs and all sectors were in the green with notable outperformance in Consumer Discretionary thanks to near 11% gains in Tesla (TSLA) and 3.6% gains in Amazon (AMZN).

- SPX +1.76% at 5,768, NDX +2.16% at 20,180, DJI +1.42% at 42,583, RUT +2.55% at 2,109.

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump will announce additional tariffs over the next few days on autos, lumber and chips although he may give "a lot" of countries breaks on tariffs.

- US President Trump signed an order imposing sanctions on countries importing Venezuelan oil and said tariffs for doing business with Venezuela will be on top of existing tariffs but added that not all tariffs will be included on April 2nd.

- White House official confirmed that the new 25% tariffs on countries that do business with Venezuela will be on top of other tariffs, meaning China tariffs will go to 45% on April 2nd, according to CNBC.

- UK is working on options to soften the impact of its digital services tax on US technology companies to help secure a tariffs deal with the White House and is open to a range of possibilities, according to FT.

- India proposed to remove the 6% tariff imposed on online advertisement services offered by companies such as Google (GOOG) and Meta (META), widely known as the Google tax from April 1st, which is a day before Trump's reciprocal tariffs take effect.

- South Korea's Acting President Han said their mission is to secure national interest in a trade war and will do everything to weather the tariff storm triggered by the US, while it was also reported that South Korea is to launch a special probe on 'made in Korea' violations ahead of US tariffs.

- WTO said Canada initiated a WTO dispute complaint regarding Chinese duties on agricultural and fishery products.

- German Agriculture Ministry said Britain removed import restrictions on German animals and animal products imposed after the foot-and-mouth disease case.

NOTABLE HEADLINES

- Fed's Barr (Voter) said interest rates are still high for businesses overall while lending standards became tight in the pandemic and remain so.

- Fed's Bostic (2027 voter) said there's a lot of uncertainty about the economy and forecasting is more challenging than in the past, while he added that business leaders, policymakers or consumers do not know where the economy is heading. Bostic noted he does not see inflation returning to target until some time in 2027 and his dot plot moved to one rate cut this year (prev. 2), according to Bloomberg.

- US President Trump hopes the Fed lowers interest rates and said energy prices are coming down, while he was very concerned about the economy six months ago and said they inherited a very bad situation.

- US President Trump said money is pouring in and they want to keep it that way, while he announced that Hyundai is to make a USD 5.5bln investment in a Louisiana steel plant which will create more than 1400 jobs and Hyundai will not pay have to any tariffs. Furthermore, it was stated that the Hyundai Steel (004020 KS) plant is part of a USD 21bln investment in the US and Hyundai Motor (005380 KS) is opening a Georgia plant this week in which production will exceed 1mln units per year.

- US Treasury Secretary Bessent said interest rates are going to keep declining as energy costs decline and noted that laid-off workers can go into the private sector.

- US Senate Minority Leader Schumer said he will summon his caucus this week for a crash course on how to oppose Republican budget reconciliation plans, according to Axios.

APAC TRADE

EQUITIES

- APAC stocks trade mixed after the early momentum from the tariff-related optimism on Wall St wore thin.

- ASX 200 advanced at the open but then gave back most of its gains after stalling near the 8,000 level and as participants await Treasurer Chalmers's pre-election budget which is expected to return to a deficit.

- Nikkei 225 rallied at the start of trade and briefly climbed above the 38,000 level but has since pulled back from intraday highs with recent currency moves influencing price action.

- Hang Seng and Shanghai Comp were pressured with notable underperformance in Hong Kong as tech and auto names lost traction amid recent earnings releases and tariff risk, while there was a lack of details so far regarding the PBoC's MLF operation after the central bank recently unveiled a new method for how MLF operations will be conducted whereby banks will be able to bid for different prices on its one-year loans.

- US equity futures (ES -0.1%, NQ -0.2%) took a breather after yesterday's predominantly one-way upward momentum.

- European equity futures indicate a lower cash market open with Euro Stoxx 50 futures down 0.3% after the cash market finished with losses of 0.2% on Monday.

FX

- DXY traded uneventfully after strengthening the prior day on the back of a surprise surge in Services PMI data which more than offset the manufacturing slump into contractionary territory. There was a recent slew of tariff-related headlines including reports that US President Trump is to announce additional tariffs on autos, lumber and chips but may give some countries breaks on tariffs, while he announced a secondary tariff on Venezuela in which any country that buys oil or gas from Venezuela will be forced to pay a 25% tariff on top of other tariffs.

- EUR/USD languished around the 1.0800 level after failing to sustain yesterday's initial gains, as the dollar ultimately strengthened and amid the tariff threat overhang, while the recent EZ PMI data releases were mixed.

- GBP/USD lacked direction following the recent price swings and after comments from BoE Governor Bailey provided very little to shift the dial as participants await the Spring Statement and CPI data scheduled mid-week.

- USD/JPY initially extended on the prior day's notable advances which were facilitated by the recent dollar strength, firmer US yields and the heightened risk appetite, although the pair has since eased back from recent highs after hitting resistance just shy of the 151.00 level.

- Antipodeans conformed to the uneventful picture across the FX space in the absence of any pertinent data releases and as the risk appetite in Asia gradually waned.

- PBoC set USD/CNY mid-point at 7.1788 vs exp. 7.2630 (Prev. 7.1780).

FIXED INCOME

- 10yr UST futures looked for some reprieve after treasuries were sold across the curve yesterday on tax revenue and tariff reports, while a strong services PMI accelerated the selling ahead of supply.

- Bund futures were rangebound after the prior day's indecisive performance and with participants awaiting German Ifo data, as well as the looming Bobl and Bund issuances.

- 10yr JGB futures tracked the recent losses in major counterparts with demand also hampered amid an enhanced liquidity auction from Japan, while the BoJ Minutes from the January meeting were met with little fanfare given the stale nature of the release.

COMMODITIES

- Crude futures took a breather after advancing yesterday on the broader risk appetite and heightened geopolitical tensions despite several oil-bearish headlines.

- US jet fuel imports are set to hit a two-year high in March after Nigeria's Dangote refinery pushed barrels to North America, which should lower prices of the aviation fuel in the peak summer.

- US issued a Venezuela-related general license which authorises a wind-down of certain transactions related to Chevron (CVX) corporation’s joint ventures in Venezuela through to May 27th.

- Spot gold was indecisive after a recent pullback but retained the psychological USD 3,000/oz status.

- Copper futures eked marginal gains but with the upside capped following the prior day's reversal and as risk appetite in the Asia-Pac region moderated.

CRYPTO

- Bitcoin gradually retreated to beneath the USD 87,000 level as risk appetite waned.

NOTABLE ASIA-PAC HEADLINES

- China is considering including services in the multi-billion dollar subsidy program to stimulate consumption, according to FT.

- BoJ January Meeting Minutes stated most members expressed the recognition that the likelihood of realising the outlook had been rising and some members shared the recognition that real interest rates were expected to remain significantly negative even after the rate hike. The minutes stated that a member expressed the view that if underlying inflation increased, the BoJ would need to raise the policy interest rate accordingly in a gradual manner and a member continued that it would be necessary for the BoJ to adjust the degree of monetary accommodation from the viewpoint of avoiding the yen’s depreciation and the overheating of financial activities. Furthermore, a member said the BoJ should be extremely careful about suggesting the pace of policy interest rate hikes and the terminal policy rate and a member said it would be desirable for the BoJ to bear in mind that the policy interest rate should be at around 1% in the second half of fiscal 2025.

- BoJ Governor Ueda said they still need some time to consider what to do with the BoJ's ETF holdings and must think about valuation and market rout risks when offloading its ETF holdings. Ueda added that the BoJ's JGB holdings would continue to have a stock effect since the reduction pace is extremely slow and the massive JGB holdings have a stock effect that would slightly lower long-term yields.

GEOPOLITICS

MIDDLE EAST

- Israeli military said sirens sounded in several areas in Israel after a projectile was launched from Yemen although the missile was intercepted prior to crossing into Israeli territory. Israel's military separately announced it struck targets at Syrian military bases.

- Israeli military said forces operating in Rafah fired at a building that belonged to the Red Cross as a result of incorrect identification.

- Houthi military spokesman said the group targeted US naval vessels in the Red Sea and Israel's Ben Gurion Airport.

RUSSIA-UKRAINE

- US President Trump said they made a deal on rare earths which is to be signed shortly and are talking about territory and power plant ownership.

- Ukraine's delegation in Saudi Arabia will meet with the US team on Tuesday, while it was separately reported that a White House source said talks facilitated by the Trump administration's technical teams in Riyadh are going extremely well, and they expect to have a positive announcement in the near future.

- US Secretary of State Rubio said the Russia war has to end through negotiation.

OTHER

- Taiwan ordered three mainland Chinese to leave for promoting a military takeover, according to SCMP.

EU/UK

NOTABLE HEADLINES

- BoE Governor Bailey said they face a challenge to raise the potential growth rate of the economy and there are strong headwinds, while he added they must facilitate the growth of AI as the most likely general-purpose technology which can move the needle on growth in the economy. Bailey also said they are seeing businesses delay investment due to uncertainty and that consumption is not climbing with real incomes, as well as noted that businesses are currently keeping all options open on how to respond to national insurance rise.

- UK Chancellor Reeves is to publish the forecast from the OBR which is to roughly halve the UK’s expected growth in 2025 from 2% to about 1%, while her GBP 9.9bln of headroom against her fiscal rule has been wiped out, leaving her about GBP 4bln in the red. Furthermore, Reeves's statement is expected to have more than GBP 5bln of extra cuts to UK public spending and she will claim that Britain is “uniquely positioned” to pursue favourable trading relations with the US and EU, according to FT.

- ECB's Escriva said the current environment is extremely uncertain and downside risks are outweighing upside risks at the moment but noted that more disruptive economic scenarios aren't materialising.