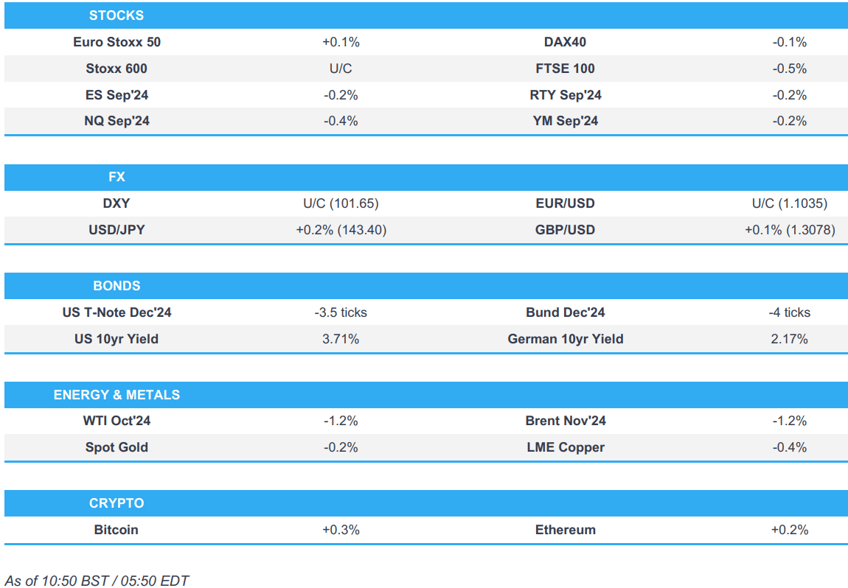

- European equities are mixed, with initial early-morning strength trimmed; US equity futures are modestly in the red with slight underperformance in the NQ following an Apple tax order.

- Apple (AAPL) has lost the fight against the EUR 13bln EU tax order to Ireland, according to Reuters; Apple said EU regulators are trying retroactively to change the rules; AAPL -1.2% in the pre-market.

- DXY is flat, GBP gains post-jobs data which were mixed; Bloomberg reported that the BoJ sees little need to hike rates at its next meeting had little impact on the Yen.

- Bonds are very modestly softer; Gilts are weighed on by the region’s mixed jobs report.

- Crude continues to pull back and towards session lows, XAU and base metals also on the backfoot.

- Looking ahead, EIA STEO, OPEC MOMR, Comments from BoC Governor Macklem, Fed's Barr, BoE's Breeden.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European equities, Stoxx 600 (+0.3%) began the session flat/mixed but quickly turned positive as sentiment improved since the cash open. Since, sentiment has deteriorated and indices now sit towards the bottom end of today's ranges.

- European sectors are mixed; Real Estate takes the top spot, with Tech also on a firmer footing. Healthcare is the clear underperformer, dragged down by AstraZeneca (-5%) after its lung cancer drug trial failed to significantly improve survival.

- US equity futures (ES -0.2%, NQ -0.2%, RTY -0.2%) are entirely in the red, paring some of the gains made in the prior session; the NQ marginally lags, hampered by Apple (-1% pre-market), after a EU tax order.

- EU to lower proposed tariffs on Tesla's (TSLA) and other EVs from China. Tesla's tariff rate reportedly to fall to under 8% from 9%, according to Bloomberg sources.

- Apple (AAPL) has lost fight against EUR 13bln EU tax order to Ireland, according to Reuters; Apple said EU regulators are trying retroactively to change the rules.

- EU top court dismissed Alphabet's (GOOG) fight EUR 2.42bln EU antitrust fine.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY has paused for breath after a two-session winning streak which has taken the index from a 100.58 base on Friday to a current session high at 101.72. Data docket for the remainder of the day is light so the next risk event for the USD comes via the Presidential debate overnight.

- EUR is steady vs. the USD with EUR-specific drivers light in the run up to Thursday's ECB decision which ultimately may prove to be an event lacking in volatility. If the pair's recent downtrend resumes, support comes via the 3rd September low at 1.1026.

- GBP is the marginal outperformer across the majors post-UK jobs data which showed a decline in the unemployment rate and a sharp jump in employment. For cable, the pair has moved back above its 21DMA at 1.3080 but failed to sustain a move above 1.31 after topping out at 1.3107.

- JPY is on the backfoot vs. the USD in an extension of yesterday's price action. For now, the pair has been unable to top yesterday's best at 143.80.

- Antipodeans are steady for both of the antipodes vs. the USD. AUD is a touch softer post disappointing confidence data which overshadowed broadly encouraging Chinese trade metrics. AUD/USD is back below its 100DMA at 0.6646.

- PBoC set USD/CNY mid-point at 7.1136 vs exp. 7.1140 (prev. 7.0989).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs have pulled back a touch in-fitting with some of the downside seen in European peers. Tonight's US Presidential debate could offer some impetus, whereby a strong showing from Trump could reignite some of the bear-steepening bets seen post-his debate with Biden in the summer; US2s10s is still in positive territory whilst the 10yr yield is currently sitting within yesterday's 3.691-763% range.

- Bunds are a touch softer in a move which coincided with UK jobs data. Fresh macro drivers for the Eurozone are light in the run up to Thursday's ECB decision which ultimately may prove to be an event lacking in volatility. German 10yr yield is back below the 2.2% mark at 2.178%.

- Gilts are slightly lower, in-fitting with European peers. The main macro update from the UK has come via labour market/earnings data which saw a downtick in unemployment, jump in employment change and slightly softer earnings components. UK 10yr yield is currently contained within yesterday's 3.856-944% range.

- Orders for Italy's new BTP are over EUR 108bln, spread set at 13bps over 2053 BTP, according to Reuters.

- UK sells GBP 900mln 0.625% 2045 I/L Gilt: b/c 3.44x (prev. 3.88x) & real yield 1.20% (prev. 1.304%).

- Germany sells EUR 0.462bln vs exp. EUR 0.5bln 2.10% 2029 Green Bobl and EUR 0.485bln vs exp. EUR 0.5bln 0.00% 2050 Green Bund.

- Click for a detailed summary

COMMODITIES

- Crude is on the backfoot amid quiet newsflow for the complex, and after yesterday's modestly firmer settlement. Chinese trade data added more concerns regarding Chinese demand after imports missed expectations. Tropical Storm Francine, which is expected to strengthen into a hurricane today before making landfall tomorrow; Brent sits in a USD 70.71-72.28/bbl parameter.

- Precious metals are mixed with spot gold and silver subdued and palladium once again outperforming, albeit off highs in recent trade.

- Base metals tilt lower in subdued trade after the Chinese trade data reinforced weak domestic demand as imports missed forecasts. 3M LME copper trades in a narrow 9,070.50-9,150.50/t range.

- Spot gold is slightly softer, but with trade fairly rangebound in the European morning; XAU currently sits just above USD 2.5k/oz in a narrow USD 2500.26-2507.72/oz range.

- Base metals are almost entirely in the red,

- NHC said Francine is expected to become a hurricane soon with storm surge and hurricane warnings in effect for the Louisiana coast.

- US Coast Guard ordered the closure of Brownsville and other small Texas ports, while the port of Corpus Christi remained open under vessel traffic restrictions, according to an advisory.

- NHC said strong winds and dangerous storm surge expected along the Louisiana coast tomorrow.

- NHC said Francine is likely to become a hurricane today

- Chevron (CVX) announced to evacuate all staff and shut in oil and gas production at two US Gulf of Mexico platforms.

- Shell (SHEL LN) announced to shut oil production at Perdido offshore platform in US Gulf of Mexico citing downstream impacts.

- Goldman Sachs said strong production and disappointing demand pose a downside risk to their US gas price forecast, while it added that Tropical Storm Francine is expected to further reduce power demand and potentially impact LNG exports out of the Gulf.

- China oil industry researcher said China oil products demand is projected to fall by an average of 1.1% annually between 2023-2025.

- India Steel Minister said the Indian steel ministry backs taxing imports

- Click for a detailed summary

NOTABLE DATA RECAP

- UK Avg Earnings (Ex-Bonus) (Jul) 5.1% vs. Exp. 5.1% (Prev. 5.4%); Avg Wk Earnings 3M YY (Jul) 4.0% vs. Exp. 4.1% (Prev. 4.5%, Rev. 4.6%)

- UK ILO Unemployment Rate (Jul) 4.1% vs. Exp. 4.1% (Prev. 4.2%); The estimated number of vacancies in the UK in June to August 2024 was 857k, a decrease of 42k or 4.7% from March to May 2024

- UK Claimant Count Unem Chng (Aug) 23.7k (Prev. 135.0k, Rev. 102.3k); Employment Change (Jul) 265k vs. Exp. 115k (Prev. 97k); HMRC Payrolls Change (Aug) -59k (Prev. 24k)

- Norwegian Core Inflation MM (Aug) -0.7% vs. Exp. -0.8% (Prev. 0.8%); Core Inflation YY (Aug) 3.2% vs. Exp. 3.2% (Prev. 3.3%)Consumer Price Index YY (Aug) 2.6% vs. Exp. 2.7% (Prev. 2.8%); Consumer Price Index MM (Aug) -0.9% vs. Exp. -0.9% (Prev. 0.5%)

- German HICP Final YY (Aug) 2.0% vs. Exp. 2.0% (Prev. 2.0%); HICP Final MM (Aug) -0.2% vs. Exp. -0.2% (Prev. -0.2%); CPI Final YY (Aug) 1.9% vs. Exp. 1.9% (Prev. 1.9%); Final MM (Aug) -0.1% vs. Exp. -0.1% (Prev. -0.1%)

- Swedish New Orders Manuf. YY (Jun) -0.1% (Prev. -8.9%, Rev. 1.0%)

- Italian Industrial Output MM SA (Jul) -0.9% vs. Exp. -0.1% (Prev. 0.5%); Industrial Output YY WDA (Jul) -3.3% (Prev. -2.6%)

NOTABLE EUROPEAN HEADLINES

- Kantar: UK Grocery inflation 1.7% (prev. 1.8%), UK Grocery sales +3% in value terms in the 4 weeks to Sep 1st Y/Y.

- Germany's Chemical Industry Association VCI said Q2 production +3.7% Y/Y, or +8.4% without pharmaceuticals.

NOTABLE US HEADLINES

- Largest US banks’ capital hike was reduced in half under the latest plan by regulators in which banks would face a 9% increase in capital requirements instead of the 19% that was originally called for by the Fed, FDIC and the Office of the Comptroller of the Currency, according to Bloomberg citing sources familiar with the matter.

- US VP Harris is ahead of former President Trump at 49%-46% in a North Carolina poll by Quinnipiac, while Trump is ahead by 3 points in a Georgia poll by Quinnipiac.

GEOPOLITICS

MIDDLE EAST

- Israeli military said it conducted an air strike which targeted a Hamas command centre in Khan Younis, while Hamas media reported the death toll from the Israeli strike on a Gaza tent encampment was at least 40.

- US President Biden was reported to convene his national security team to discuss the impasse in negotiations on the hostage deal, according to Axios’s Barak Ravid citing sources.

- Yemeni Houthis noted that they downed US MQ-9 drone in Saada

OTHER

- Moscow's Vnukovo and Domodedovo Airports stopped flights after reports of nearby drone attacks, while it was separately reported that a fire broke out at a multi-storey residential building in Moscow's Ramenskoye district as a result of a drone attack.

- North Korean leader Kim said they must prepare North Korea's nuclear capability and readiness to use it properly at any given time, while they are implementing a nuclear force construction policy to increase the number of nuclear weapons exponentially, according to KCNA.

- Russian forces have attacked energy infrastructure in eight Ukrainian regions in the last 24 hours, according to the energy ministry cited by Reuters.

- Russian Security Council Secretary Shoigu said Russia has enough forces and continues its offensive, according to Ria

CRYPTO

- Bitcoin continues to edge higher, now sitting above USD 57k whilst Ethereum holds around USD 2.3k.

APAC TRADE

- APAC stocks mostly took impetus from the gains on Wall St where the major indices rebounded amid light newsflow ahead of looming key events, although Chinese markets lagged amid mixed Chinese trade data.

- ASX 200 was led higher by strength in financials and utilities but with gains capped after weak consumer and business surveys.

- Nikkei 225 edged higher albeit with trade contained in the absence of any major pertinent catalysts.

- Hang Seng and Shanghai Comp were mixed as the former was indecisive with Alibaba the biggest gainer after its Stock Connect inclusion, while WuXi AppTec was at the other end of the spectrum after the US House passed the Biosecure Act which would prohibit the US government from contracting with certain biotech firms. Conversely, the mainland lagged behind regional peers amid mixed Chinese trade data and after protectionist measures by the US House which also voted to pass the Countering CCP Drones Act that would bar new drones by DJI from operating in the US.

NOTABLE ASIA-PAC HEADLINES

- BoJ reportedly sees little need to hike interest rate next week, according to Bloomberg sources; officials are not ruling out another hike later this year or in early 2025 contingent on the economy and market.

- US House passed the Biosecure Act with broad bipartisan support which would prohibit the US government from contracting with, or providing grants to, companies that do business with a “biotechnology company of concern”, while it specifically named five Chinese companies which were BGI Genomics, MGI Tech, Complete Genomics, WuXi AppTec, and Wuxi Biologics.

- US House voted to bar new drones from Chinese drone maker DJI from operating in the US, according to Reuters.

- TSMC (2330 TW/TSM) August (TWD) Revenue 250.87bln, -2.4% M/M

- Chinese August vehicles sales -5% Y/Y (prev. -5.2% in July), Jan-Aug vehicles sales +3% Y/Y (prev. +8% a year ago); NEV sales +30% Y/Y.

- China's Vice Commerce Minister said China is willing to engage in dialog and consultations to appropriately resolve China-EU economic and trade frictions

DATA RECAP

- Chinese Trade Balance (USD)(Aug) 91.02B vs. Exp. 82.05B (Prev. 84.65B)

- Chinese Exports YY (USD)(Aug) 8.7% vs. Exp. 6.5% (Prev. 7.0%)

- Chinese Imports YY (USD)(Aug) 0.5% vs. Exp. 2.0% (Prev. 7.2%)

- Chinese Trade Balance (CNY)(Aug) 649.34B (Prev. 601.90B)

- Chinese Exports YY (CNY)(Aug) 8.4% (Prev. 6.5%)

- Chinese Imports (CNY)(Aug) 0.0% (Prev. 6.6%)

- Australian West Consumer Confidence MM (Sep) -0.5% (Prev. 2.8%)

- Australian Westpac Consumer Confidence Index (Sep) 84.6 (Prev. 85.0)

- Australian NAB Business Confidence (Aug) -4.0 (Prev. 1.0)

- Australian NAB Business Conditions (Aug) 3.0 (Prev. 6.0)