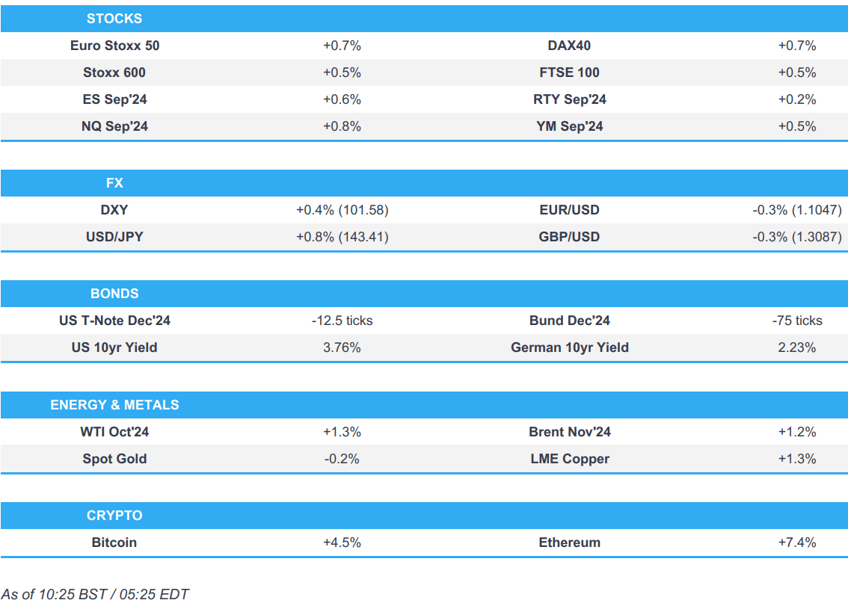

- European equities are entirely in the green, attempting to pare back some of last week's hefty losses; Tech leads whilst Luxury lags

- Dollar is firmer while JPY lags after GDP revisions and risk appetite, with USD/JPY back above 143

- Bonds are entirely in the red and reside near session lows.

- Crude is on the front foot, precious metals are mixed, and base metals are higher across the board despite softer Chinese inflation.

- Looking ahead, US Employment Trends, Wholesale Sales, NY Fed SCE, Apple iPhone Event, Earnings from Oracle.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (+0.5%) began the session on a firmer footing and continued to edge higher as sentiment continued to improve as the session progressed.

- European sectors are entirely in the green; Tech is the best performer, propped up by gains in semi-conductor names, as they attempt to pare back some of the last week's hefty losses; ASML (+2.5%), BE Semi (+2%). Luxury is towards the foot of the pile, hampered by a double broker downgrade for Kering (-2.7%), with poor Chinese inflation metrics also not helping.

- US equity futures (ES +0.6, NQ +0.8%, RTY +0.3%) are entirely in the green, attempting to pare back some of the hefty losses seen in the prior session. Data docket for today is light, but Tech traders will be focused on Apple's iPhone event later today.

- Apple’s (AAPL) new iPhone will use Arm’s (ARM) next-gen chip technology for AI, according to FT.

- Boeing (BA) said it reached a tentative agreement with the International Association of Machinists and Aerospace Workers and district lodges for a 25% wage hike, according to Reuters. Elsewhere, Dalian Airlines Boeing (BA) 737 flight has suffered engine malfunction on Monday en route from Dalian to Beijing, safely returned to Dalian airport, according to Chinese State Media.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is on the march this morning with USD gains strongest vs. CHF and JPY. DXY has picked itself up from a 100.58 base on Friday to a current session peak of 101.59.

- EUR is losing ground to the USD after slipping back onto a 1.10 handle last Friday. The current session low at 1.1046 is still a bit away from last week's 1.1026 trough.

- Cable has slipped below the 1.31 mark and slipped under last week's low at 1.3087 after failing to hold above 1.32 last week. UK-specific newsflow light today, but will see the region's jobs report on Tuesday.

- JPY is the laggard across the majors after posting a run of four consecutive sessions of gains and following downward revisions to Q2 GDP. USD/JPY has picked itself up from a 141.77 base on Friday to a current session high of 143.43 (still sub-Friday's peak at 144.04).

- Antipodeans are both softer vs. the USD but NZD more so with NZD/USD extending on Friday's downside. AUD/USD is seeking some comfort in higher coppers but ultimately is lower vs. the USD following soft Chinese inflation metrics overnight

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are pulling back following a session of gains on Friday in the wake of the August NFP print and comments from Fed's Waller, Williams and Goolsbee. Today's data docket remains light, focus is on NY Fed SCE, but traders will ultimately be attentive of the Presidential Debate on Tuesday and CPI on Wednesday. From a yield perspective, the 10yr has recovered to circa 3.75% after briefly taking out the August low @ 3.667%.

- Bunds are following suit to the losses in global fixed-income markets. Fresh EZ-driver remains light. However, this is not set to remain the case with the ECB rate decision on Thursday looming large. From a yield perspective, the German 10yr is back within the 2.2-25% band after a sharp move on Friday which briefly dragged it as low as 2.147%.

- Gilts are on the backfoot after an indecisive session on Friday. In terms of UK specific updates, a monthly REC/KPMG report showed the UK labour market cooled noticeably in August as job placements declined sharply and pay growth slowed. From a yield perspective, the UK 10yr is just below the 3.95% mark.

- China's Finance Ministry says it will issue up to EUR 2bln of Euro Sovereign Bond in Paris on Sept 23.

- Click for a detailed summary

COMMODITIES

- Crude is on a firmer footing, in what has been a choppy session for the complex thus far. Softer-than-expected Chinese inflation metrics have been unable to cap overnight gains, but also in the context of bullish OPEC+ headlines last week. Brent'Nov currently sits in a USD 71.42-72.21/bbl range.

- Spot gold is incrementally softer, but has clambered off lows in the European session and now looking for a test of USD 2.5k to the upside.

- Base metals are mostly firmer despite the softer-than-expected Chinese inflation metrics overnight and fairly resilient to the Dollar strength seen this morning; positivity may stem from increased bets of Chinese stimulus efforts. 3M LME Copper reclaimed USD 9k/t.

- Morgan Stanley lowers Q4 Brent price forecast to USD 75/bbl (prev. USD 80/bbl); Still estimates surplus in 2025 but slightly smaller than before; unless demand weakens more, Brent likely to remain anchored around mid-USD70/bbl. Lowers Q1 2025 target to USD 75/bbl (prev. USD 78/bbl). Says OPEC+ announcement to delay start of planned oil output increases signal that group remains focused on balancing the market.

- Iraq set October Basrah medium crude OSP to Asia at a discount of USD 0.50/bbl vs Oman/Dubai average, according to SOMO.

- Kuwait’s Emir accepted the resignation of Deputy PM and Oil Minister Al-Atiqi, while Kuwait’s Minister of Finance Al-Fassam was appointed as the acting Minister of Oil, according to Reuters.

- NHC said a system in the Gulf of Mexico is likely to strengthen from Tuesday, increasing the risk of a life-threatening storm surge and damaging winds along the upper Texas and Louisiana coasts by mid-week, according to Reuters.

- NHC says increasing risk of life-threatening storm surge and hurricane-force winds along the Louisiana and upper Texas coasts by mid-week. Says disturbance expected to become a strengthening tropical storm today; threatening storm surge and hurricane-force winds along Louisiana and upper Texas expected by mid-week.

- Goldman Sachs still expects three months of OPEC+ production increases but pushed out the start date to December from October, while it maintained its USD 70-85/bbl Brent forecast range and December forecast of USD 74/bbl. Furthermore, it still sees risk to its forecast range skewed to the downside given high spare capacity, risks to demand from weakness in China and potential trade tensions.

- Trafigura executive said in APPEC that soft China demand is worrying markets and OPEC is sending confused messages to the market, while the executive added that oil market sentiment is soft at the moment.

- Russian Energy Minister said Russian coal exports to China decreased by 8% Y/Y 45mln tons in the first half of 2024 and no sharp growth is expected although coal exports to China are expected to increase to at least 100mln tons starting in 2025, according to TASS.

- Russia forces attacked energy facilities in seven regions in the past day, according Ukraine's Energy Ministry.

- Click for a detailed summary

NOTABLE DATA RECAP

- EU Sentix Index (Sep) -15.4 vs. Exp. -12.5 (Prev. -13.9)

NOTABLE EUROPEAN HEADLINES

- UK PM Starmer defended the decision to scrap winter fuel payments for 10mln pensioners to shore up public finances and said his government must be prepared to be unpopular, according to FT.

- UK labour market cooled noticeably in August as job placements declined sharply and pay growth slowed, according to a monthly survey by the Recruitment and Employment Confederation and KPMG cited by Reuters.

- Italy expects 2025 GDP growth of at least 1.2%, according to a Treasury junior minister cited by Reuters.

- European banks are on course for zero growth in mortgage lending for the first time in a decade this year due to high interest rates but a recovery is expected from next year, according to FT.

- Former ECB President Draghi's report: says EU must spend an additional EUR 750bln per year to compete globally; calls for EU to move towards regular joint debt issuance.

NOTABLE US HEADLINES

- A New York Times survey showed former President Trump ahead of VP Harris at 48% vs 47% among likely voters nationally which was the first major poll to show a drop in the support for Harris, while it lowered Harris’s lead in the overall average of polls to 2.5% and just 0.3% in the key swing state of Pennsylvania, according to the Telegraph.

- Former US President Trump threatened a 100% tariff for countries that turn away from the dollar, according to Bloomberg.

- US is to propose bank capital rule revisions as soon as this month, according to Bloomberg.

- Tesla (TSLA) exported 23,241 China-made vehicles in August vs 27,890 in July, via CPCA.

GEOPOLITICS

MIDDLE EAST

- Israel conducted a strike which killed three Lebanese paramedics in the southern Lebanese town of Faroun, while Hezbollah launched a “squadron of missiles” targeting an Israeli military headquarters in response which resulted in casualties, according to Reuters.

- Lebanese media reported that the Israeli army targeted the town of Kafr Kila in southern Lebanon with surface-to-surface rockets and mortar shells, according to Sky News Arabia.

- Israeli army said three Israeli civilians were killed in a shooting attack on the Jordan border, while Israel closed its land border crossings with Jordan after the deadly attack at the Allenby Bridge crossing, according to Israel’s airport authority, according to Reuters.

- Syrian media reported explosions in the city of Tartous and that Israeli aircraft conducted shelling on the Damascus countryside.

- Yemen’s Houthis claimed they shot down a US MQ-9 drone conducting hostile acts over the Marib governorate’s airspace.

- UK MI6 spy agency head Moore said he suspects that Iran will try to get revenge for the death of Hamas leader Haniyeh, while Moore also commented that it is too early to say how long Ukraine can hang on in Kursk.

OTHER

- Iran officially denied reports that it supplied Russia with ballistic missiles to aid its war in Ukraine, although an Iranian MP admitted to a deal of sending ballistic missiles to Russian forces fighting in Ukraine in exchange for soybeans and wheat, according to The Telegraph. Furthermore, Ukraine expressed concern over reports of a possible Iranian missile transfer to Russia and called on the international community to increase pressure on Tehran and Moscow, according to Reuters.

- Russian military is to join Chinese drills in sea and airspace in Sea of Japan and Sea of Okhotsk in September, according to Xinhua.

- Russian forces took control of Novohrodivka in eastern Ukraine, according to RIA.

- Italian PM Meloni said what must not happen is to think that the Ukrainian conflict can be resolved by abandoning Ukraine to its fate and that the decision to support Ukraine is aligned with Italy’s national interest which will never change. Meloni added that the Western World’s decision to support Ukraine after Russia’s invasion led to the current stalemate which is the pre-condition for peace talks.

- CIA Director Burns said there was a genuine risk of the potential use of tactical nuclear weapons in the fall of 2022, while Burns added that he doesn’t see any evidence today that Russian President Putin’s grip on power is weakening, according to Reuters.

- North Korean Leader Kim Jong Un emphasised the importance of strengthening naval power, according to KCNA. Furthermore, North Korean media also reported that Chinese President Xi called for deeper strategic communication and cooperation with North Korea, while Russian President Putin said a comprehensive partnership between Russia and North Korea will be strengthened in a planned way.

CRYPTO

- A much firmer session for Bitcoin and Ethereum, climbing above USD 54k and USD 2.3k respectively.

APAC TRADE

- APAC stocks suffered firm losses as the region took its opportunity to react to last Friday's disappointing US jobs data, while participants also braced for this week's key events including the latest US CPI report.

- ASX 200 declined with the index pressured by underperformance in gold stocks and the top-weighted financials sector.

- Nikkei 225 gapped beneath the 36,000 level with sentiment not helped by disappointing Japanese Q2 GDP revisions.

- Hang Seng and Shanghai Comp conformed to the negative mood with the former dragged lower by notable weakness seen in the energy-related stocks after recent oil price pressures, while the mainland also reflected on softer-than-expected CPI data and sharper PPI deflation.

NOTABLE ASIA-PAC HEADLINES

- Japan's LDP's says Japan's inflation is still weak when excluding external factors; cannot say Japan has achieved BoJ's 2% inflation target

- PBoC may have sold long-dated bonds and bought short-dated ones last week, signalling a warning that authorities aim to maintain a tight grip on the market, according to Shanghai Securities News.

- US Treasury Secretary Yellen said she would welcome a visit to the US by her Chinese counterpart and that she may return to China, while she added the US relationship with China needs to be prioritised and nurtured.

- Typhoon Yagi killed 21 people and wreaked havoc on infrastructure and factories in Vietnam.

- China Auto Industry Body CPCA says China sold 1.92mln passenger cars in August, -1.1% Y/Y (vs 1.73mln cars in July).

- Acer (2353 TT) August (TWD) Consolidated Revenue 22.82bln, +5.2% Y/Y

DATA RECAP

- Chinese CPI YY (Aug) 0.6% vs. Exp. 0.7% (Prev. 0.5%)

- Chinese PPI YY (Aug) -1.8% vs. Exp. -1.4% (Prev. -0.8%)

- Chinese FX Reserves (USD)(Aug) 3.288T (Prev. 3.256T)

- Chinese Gold Reserves (Aug) 72.8mln ounces (Prev. 72.8mln ounces)

- Japanese GDP Revised QQ (Q2) 0.7% vs. Exp. 0.8% (Prev. 0.8%)

- Japanese GDP Revised Annualised (Q2) 2.9% vs. Exp. 3.2% (Prev. 3.1%)