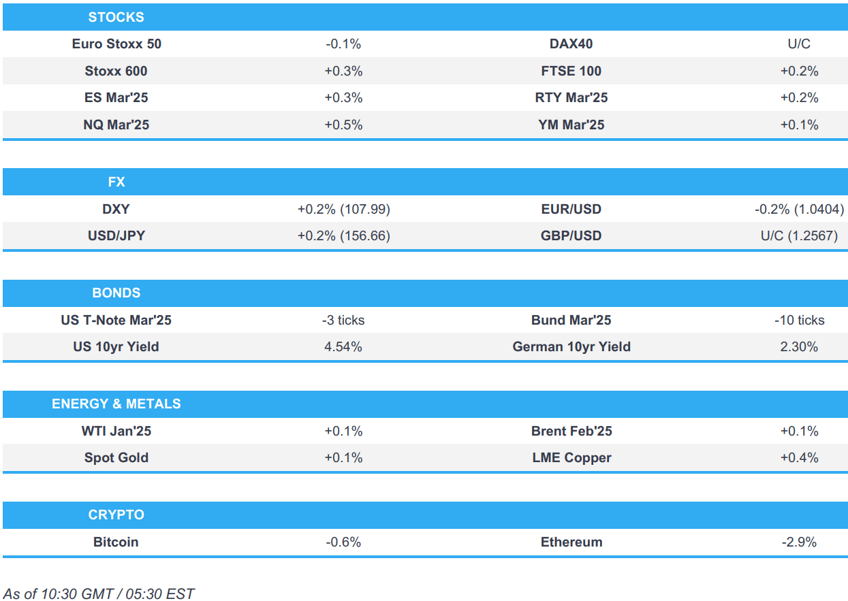

- European bourses are mostly lower, US futures higher with modest outperformance in the NQ.

- Dollar is firmer and holding around 108.00, GBP little changed after UK shows no growth in Q3.

- Bunds & Gilts pressured in thin trade, USTs flat into data.

- Gas heats up on updates out of Qatar and Russia; Crude/XAU flat.

- Looking ahead, Canadian GDP (Oct), US Consumer Confidence & Durable Goods, supply from US.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses are generally sitting in negative territory, despite a mostly positive handover from overnight APAC trade. In recent trade, a couple of indices are attempting to climb into the green.

- European sectors opened with a strong negative bias, but are now mixed. Healthcare is by far the clear outperformer today, as Novo Nordisk (+6%) attempts to pare some of the hefty losses seen on Friday. Autos sits towards the lower half of the pile, but with downside in the sector pretty much in-fitting with peers. Volkswagen (-1%) initially opened higher after traders digested news that VW reached a deal with IG Metall to cut 35k jobs and avert a strike; though, did slip into negative territory thereafter.

- US equity futures are modestly firmer, with slight outperformance in the NQ, in a continuation of the gains seen on Wall St in the last trading day.

- Honda (7267 JT) and Nissan (7201 JT) announce the signing of the basic agreement to consider integration; Cos and Mitsubishi Motors (7211 JT) sign an MOU on collaborative considerations. Intend to set up the holding Co. in August 2026. Aim to conclude talks around June 2025. Click for full details.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is slightly firmer and currently trades towards the upper end of a 107.68-108.01 range, just eclipsing the round 108.00 mark, but still someway off Friday’s best at 108.54. Docket ahead includes, US Consumer Confidence & Durable Goods.

- EUR is incrementally softer vs the Dollar and also losing vs the GBP; EUR/USD currently holds towards the upper end of Friday’s 1.0342-1.04471 range. German Import Prices printed above expectations, metrics which ultimately sparked little move in the Single-Currency.

- JPY is incrementally lower, with USD/JPY sitting within a very tight 156.33-80 range, given the holiday-thinned conditions. If some pressure appears in the pair, could see a test of Friday’s low at 155.94.

- Cable is flat and currently trades within a 1.2554-1.2588, a little short of the 1.26 mark at best. Further upside could see a test of Friday’s peak at 1.2613 and then its 21 DMA at 1.2659 thereafter. From a macro perspective, the UK posted its Q3 GDP metrics, which saw the YY and QQ both revised a touch lower, with the QQ figure showing no growth within the period. Figures which had little impact on the Pound.

- Antipodeans are very modestly in positive territory, with modest outperformance in Aussie. The Aussie holds towards the upper end of Friday’s 0.6214-0.6274 range; NZD is also a little firmer, and holds around 0.5660.

- PBoC set USD/CNY mid-point at 7.1870 vs exp. 7.2880 (prev. 7.1901)

- Click for a detailed summary

FIXED INCOME

- USTs are contained in narrow ranges with catalysts light so far. A very slight bearish-bias in play as the US risk tone is robust following the nation avoiding a gov’t. shutdown. As it stands, in a narrow 108-27+ to 109-00+ band which is entirely within Friday’s 108-19+ to 109-08+ parameters, ahead of US Consumer Confidence and Durable Goods.

- Bunds came under modest pressure early doors and remains the fixed income underperformer. Pressure which occurred in limited trade with volumes very light and as such is perhaps not worth reading extensively into, though a better than expected set of import data likely influenced. Spent the morning at the low-end of a 133.72 to 134.06 band, dipping below Friday’s base and matching last week's trough; however, in recent trade the benchmark has trimmed some downside.

- Gilts opened lower by 21 ticks before extending to a 92.48 base. Pressure which came given the lead from peers and despite downward revisions to UK Q3 GDP and very bleak CBI commentary from its latest indicator. 92.48 base remains comfortably above Friday’s 92.18 low and the contract trough from Thursday thereafter at 91.87.

- Click for a detailed summary

COMMODITIES

- WTI & Brent were firmer, taking impetus from the APAC/US risk tone; however, they have succumbed to some recent selling pressure to trade around flat currently. Brent Feb'25 briefly dipped below USD 73/bbl, currently pivoting the mark.

- Gold is marginally firmer, benefitting from the tepid European risk tone though with any real advance prohibited by the indications from US futures. At a USD 2633/oz peak, resistance comes into play at USD 2643/oz where the 21-DMA resides and coincides with the peak from last Wednesday.

- Dutch TTF was around flat, but caught a slight bid after Russia's Kremlin said the situation with European countries that get Russian gas is complicated and needs further attention (somewhat in contrast to weekend comments where Fico said Russia confirmed a readiness).

- US NatGas outperforms on commentary from Qatar.

- 3M LME is firmer, continuing action from APAC trade which saw modest gains for the complex in-fitting with the broader risk tone. However, 3M LME Copper is still yet to comfortably/lastingly eclipse the USD 9k handle.

- Qatar has warned that it will "stop" gas sales to the EU if fined under the due diligence law, according to the Financial Times.

- Slovak PM Fico noted that Russian President Putin confirmed Russia's readiness to continue supplying gas to the West and Slovakia, according to Reuters.

- Libya's Acacus Oil Company has achieved oil production of 301.5k BPD, while the Sirte Oil Company has reached 103k BPD over the past two days, its highest output since 2007, according to the NOC spokesman.

- Oil transit through Russia's Druzhba pipeline resumed on Saturday, according to Belarus' BelTa state news agency. Earlier, Reuters reported that oil flows from Russia and Kazakhstan to Hungary, Slovakia, the Czech Republic, and Germany via the Druzhba pipeline had been halted since Thursday due to technical issues at a Russian pumping station.

- Russia's Kremlin says Putin discussed gas, Ukraine and bilateral ties with Slovakia's Fico; situation with European countries that get Russian gas is complicated and needs further attention.

- Click for a detailed summary

NOTABLE DATA RECAP

- German Import Prices MM (Nov) 0.9% vs. Exp. 0.5% (Prev. 0.6%); Import Prices YY (Nov) 0.6% vs. Exp. 0.3% (Prev. -0.8%)

- UK GDP QQ (Q3) 0.0% vs. Exp. 0.1% (Prev. 0.1%); UK GDP YY (Q3) 0.9% vs. Exp. 1.0% (Prev. 1.0%)

- UK Business invest YY (Q3) 5.8% (Prev. 4.5%, Rev. 1.4%); Business Invest QQ (Q3) 1.9% (Prev. 1.2%, Rev. 1.8%)

- UK Current Acc GBP (Q3) -18.099B vs. Exp. -22.75B (Prev. -28.397B, Rev. -24.002B)

- Spanish GDP YY (Q3) 3.3% vs. Exp. 3.4% (Prev. 3.4%); GDP Final QQ (Q3) 0.8% vs. Exp. 0.8% (Prev. 0.8%)

NOTABLE EUROPEAN HEADLINES

- ECB's Lagarde said still believe that ECB should be very vigilant about service; getting very close to that stage when ECB can declare that we have sustainably brought inflation to our medium-term 2% target, via FT; coming close to the end of that process where wages have caught up with price.

- ECB's Makhlouf said the outlook for next year was probably clouded by “more uncertainty than there was when we went into lockdown; and argued against calls for the ECB to start cutting rates by 50bps at a time in early 2025, via FT. He said his preference was still “for gradual moves rather than big leaps”, unless “the facts and the evidence” suggest otherwise.

- BoE Governor Bailey and FCA CEO Nikhil Rathi will reportedly join UK Chancellor Reeves as part of Britain’s delegation to China next month, according to Sky News.

- Hungarian PM Orban stated that when the dollar strengthens, the forint automatically weakens, adding that the current weakening of the forint is not driven by Hungary's economic fundamentals, according to Reuters.

NOTABLE US HEADLINES

- US Trade Representative Office has launched a new investigation into Chinese-made legacy chips, may lead to more tariffs.

- US government has enacted a budget to avert a shutdown, but the deal does not include President-elect Donald Trump's proposal to raise the federal borrowing limit, according to BBC.

- Japan's antitrust watchdog is set to conclude that Google (GOOG) violated the law in a search-related case, according to Nikkei.

- US President-elect Trump has selected David Fink to serve as the Administrator of the Federal Railroad Administration, according to Reuters.

- Brian McCormack, a long-time energy consultant, and Andrew Peek, a seasoned Middle East adviser, will take senior roles on Trump's National Security Council, according to CBS' Jacobs citing sources.

- US jury has found that Qualcomm (QCOM) did not breach Nuvia's license agreement with Arm (ARM) and determined that Qualcomm's custom CPUs are licensed under its agreement with Arm, according to Reuters.

GEOPOLITICS

MIDDLE EAST

- Iranian Foreign Ministry says the nuclear deal will be discussed with Europe in January.

- "Israel plans to launch an attack on Yemen", according to Sky News Arabia.

- "Israel is considering helping the Kurds in Syria in a non-military way", according to Sky News Arabia; "Israel is concerned about Turkey's intention to launch a large-scale military operation against the Kurds in northern Syria".

- US military announced that it carried out airstrikes targeting Iran-backed Houthi missile storage and command/control facilities in Yemen, according to Reuters. US military stated that it conducted precision airstrikes targeting a missile storage facility and a command-and-control facility operated by Iran-backed Houthis in Sanaa, according to Reuters.

- Yemeni Houthis have confirmed targeting central Israel with a ballistic missile, according to Reuters

CHINA

- China is considering allowing seafood imports from Japan and may lift the ban as early as the first half of 2025, according to Nikkei.

- China condemned the latest US military aid to Taiwan on Sunday, stating that the USD 571mln package violates the "one China principle" and the terms of the joint communique between China and the US, according to Reuters.

- China's Defence Ministry on Saturday expressed its dissatisfaction over a US report released this week on China's military, which it said distorted its defence policy and "grossly interferes" in its internal affairs, according to Reuters.

- Chinese Foreign Ministry announced that China will take countermeasures against two Canadian institutions and 20 personnel, specifically targeting Canada's Uyghur Rights Advocacy Project and the Canada-Tibet Committee, according to the ministry.

CRYPTO

- Bitcoin is on a slightly softer footing and holds just shy of USD 96k; ETH sees losses to a larger magnitude, and holds around USD 3.3k.

LATAM

- Panama's President Mulino said that every square metre of the Panama Canal and its surrounding area belonged to Panama after Trump threatened to retake the canal, stressing that the country's independence is non-negotiable, the Panama Canal sovereignty agreement is indisputable, canal fees are not set arbitrarily, and the canal remains free from influence by China or any other country, remaining under Panama's control, according to Reuters.

- US President Biden is considering a tariff exemption for solar modules imported from Mexico, according to Bloomberg News.

- Mexico's Financial Stability Council stated that the country's financial system remains solid and resilient, according to Reuters.

- Mexico's Economy Ministry stated that the government does not agree with the panel's decision on GM corn, but will respect the ruling, emphasising that the USMCA dispute resolution system is a key component of the treaty, according to Reuters.

- El Salvador's president has sent a bill to Congress aimed at overturning the ban on metals mining, according to Reuters.

- Fitch Ratings said that Brazil's fiscal and monetary tensions created a negative feedback loop, according to Reuters.

- US President-elect Trump has appointed Mauricio Claver-Carone as the Envoy for Latin America, according to Reuters.

APAC TRADE

- APAC stocks opened firmer across the board on a holiday-thinned week, following a similar performance from Wall Street on Friday, with broad risk-on sentiment through the US afternoon, albeit with indices closing off peaks.

- ASX 200 saw its gains supported by gold miners following the rebound of the yellow metal, with IT also among the top performers after a similar stateside sectoral performance on Friday.

- Nikkei 225 conformed to the broader risk tone amid a lack of macro drivers, whilst a stable JPY also boded well for the Nikkei.

- Hang Seng and Shanghai Comp traded firmer alongside the region as sentiment from Wall Street reverberated through APAC. However, macro news flow remained quiet, and the indices drifted off their best levels.

NOTABLE ASIA-PAC HEADLINES

- NIO (NIO, 9866 HK) CEO William Li stated that the company will accelerate the construction of battery swapping stations in Europe, with costs for those designed for Firefly EVs reduced by a third compared to stations for NIO-branded cars, according to Reuters.

- Nippon Steel (5401 JT) and US Steel (X) have alleged that the White House exerted impermissible influence over the CFIUS review of their proposed tie-up, a claim the White House denies. The companies have vowed to challenge the expected block of the deal, according to Reuters, citing a letter.

- Nvidia (NVDA) reportedly plans to build an offshore headquarters in Taipei, Taiwan, according to CTEE.