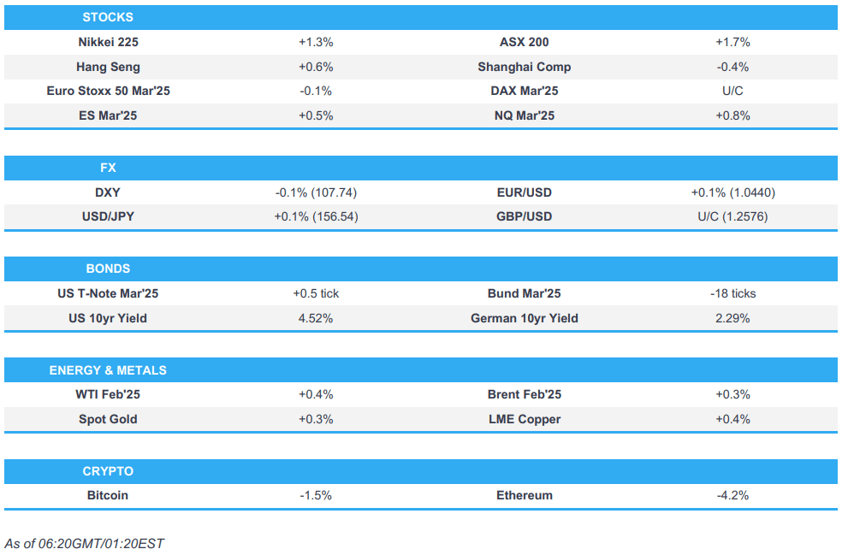

- APAC stocks opened firmer across the board on a holiday-thinned week, following a similar performance from Wall Street on Friday.

- US government has enacted a budget to avert a shutdown, but the deal does not include President-elect Donald Trump's proposal to raise the federal borrowing limit.

- DXY was flat in a 107.68-84 range to start the holiday-thinned week, with quiet news flow; Crude futures showed an upward bias amid the positive risk tone.

- European equity futures indicate a flat/subdued cash open, with the Euro Stoxx 50 down 0.1% after cash closed -0.4% on Friday.

- Looking ahead, highlights include UK GDP (Q3), Canadian GDP (Oct), US Consumer Confidence & supply from the US.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks closed in the green on Friday but still ended the week notably in the red, as they were especially weighed on in wake of the hawkish FOMC on Wednesday.

- To conclude the week there was broad risk-on sentiment through the US afternoon, albeit closing off peaks, highlighted by US equity and Treasury strength, and Dollar weakness, although the latter was still significantly firmer on the week on account of the aforementioned hawkish Fed.

- SPX +1.09% at 5,931, NDX +0.85% at 21,289, DJIA +1.17% at 42,839, RUT +0.86% at 2,241.

- Click here for a detailed summary.

NOTABLE HEADLINES

- US government has enacted a budget to avert a shutdown, but the deal does not include President-elect Donald Trump's proposal to raise the federal borrowing limit, according to BBC.

- Japan's antitrust watchdog is set to conclude that Google (GOOG) violated the law in a search-related case, according to Nikkei.

- US President-elect Trump has selected David Fink to serve as the Administrator of the Federal Railroad Administration, according to Reuters.

- Brian McCormack, a long-time energy consultant, and Andrew Peek, a seasoned Middle East adviser, will take senior roles on Trump's National Security Council, according to CBS' Jacobs citing sources.

- Federal Reserve Vice Chair of Supervision Barr has sought legal advice amid speculation that President-elect Trump might want to remove him, according to Reuters sources.

- US jury has found that Qualcomm (QCOM) did not breach Nuvia's license agreement with Arm (ARM) and determined that Qualcomm's custom CPUs are licensed under its agreement with Arm, according to Reuters.

- Canadian PM Trudeau shuffled his cabinet, keeping the finance, innovation, and foreign ministers in place, according to Reuters.

APAC TRADE

EQUITIES

- APAC stocks opened firmer across the board on a holiday-thinned week, following a similar performance from Wall Street on Friday, with broad risk-on sentiment through the US afternoon, albeit with indices closing off peaks.

- ASX 200 saw its gains supported by gold miners following the rebound of the yellow metal, with IT also among the top performers after a similar stateside sectoral performance on Friday.

- Nikkei 225 conformed to the broader risk tone amid a lack of macro drivers, whilst a stable JPY also boded well for the Nikkei.

- Hang Seng and Shanghai Comp traded firmer alongside the region as sentiment from Wall Street reverberated through APAC. However, macro news flow remained quiet, and the indices drifted off their best levels.

- US equity futures extended Friday's gains, with sentiment also supported by the US government enacting a budget to avert a shutdown. Still, the deal did not include President-elect Donald Trump's proposal to raise the federal borrowing limit.European equity futures indicate a flat/subdued cash open, with the Euro Stoxx 50 down 0.1% after cash closed -0.4% on Friday.

FX

- DXY was flat/subdued in a 107.68-84 range to start the holiday-thinned week, with news flow also quiet.

- EUR/USD traded horizontally in a current 1.0425-45 range and in close proximity to Friday's 1.0447 peak.

- GBP/USD moved within a narrow 1.2557-88 band, well within Friday's 1.2471-1.2613 range, with no reaction seen to reports that BoE Governor Bailey and FCA CEO Nikhil Rathi would reportedly join UK Chancellor Reeves as part of Britain’s delegation to China next month.

- USD/JPY was largely unchanged in holiday-thinned trade, with the pair oscillating on either side of 156.50 in a 156.35-69 range.

- Antipodeans saw little action aside from modest USD-induced movements, despite the broader positive risk tone as participants wound down for the Christmas break.

- PBoC set USD/CNY mid-point at 7.1870 vs exp. 7.2880 (prev. 7.1901)

FIXED INCOME

- 10yr UST futures saw overall flat trade after catching a bid on Friday following softer-than-expected US PCE, and were further supported by easing inflation expectations from UoM alongside Fed speak.

- Bund futures traded horizontally around the 134.00 level amid a lack of macro catalysts ahead of the holiday period.

- 10yr JGB futures faded the initial upward bias as futures initially caught up to action seen stateside following the softer-than-expected US PCE.

COMMODITIES

- Crude futures showed an upward bias amid the positive risk tone, while geopolitics saw no major updates over the weekend, and volumes remained light ahead of the holiday period.

- Spot gold saw largely uneventful trade after the yellow metal rose back above its 100 DMA (USD 2,609.28/oz) on Friday, with drivers quiet as markets wound down for the Christmas holidays.

- Copper futures held a mild upward bias as APAC players reacted to the US PCE, although price action remained limited amid a lack of macro impulses ahead of the holidays.

- Baker Hughes Rig Count: Oil +1 at 483, Nat Gas -1 at 102, Total unch. at 589.

- Qatar has warned that it will "stop" gas sales to the EU if fined under the due diligence law, according to the Financial Times.

- Slovak PM Fico noted that Russian President Putin confirmed Russia's readiness to continue supplying gas to the West and Slovakia, according to Reuters.

- Libya's Acacus Oil Company has achieved oil production of 301.5k BPD, while the Sirte Oil Company has reached 103k BPD over the past two days, its highest output since 2007, according to the NOC spokesman.

- Oil transit through Russia's Druzhba pipeline resumed on Saturday, according to Belarus' BelTa state news agency. Earlier, Reuters reported that oil flows from Russia and Kazakhstan to Hungary, Slovakia, the Czech Republic, and Germany via the Druzhba pipeline had been halted since Thursday due to technical issues at a Russian pumping station.

- Chile's Codelco produced 125.5k metric tonnes of copper in November, 18% above the same month a year earlier, via internal document.

CRYPTO

- Bitcoin was choppy but ultimately traded with modest gains above USD 95k.

NOTABLE ASIA-PAC HEADLINES

- Honda (7267 JT) and Nissan (7201 JT) are considering manufacturing cars in each other's factories to deepen ties, with Honda also exploring the possibility of supplying hybrid vehicles to Nissan as part of a potential merger, according to Kyodo. Honda (7267 JT) and Nissan (7201 JT) aim to conclude merger talks in June, according to Kyodo sources.

- NIO (NIO, 9866 HK) CEO William Li stated that the company will accelerate the construction of battery swapping stations in Europe, with costs for those designed for Firefly EVs reduced by a third compared to stations for NIO-branded cars, according to Reuters.

- Nippon Steel (5401 JT) and US Steel (X) have alleged that the White House exerted impermissible influence over the CFIUS review of their proposed tie-up, a claim the White House denies. The companies have vowed to challenge the expected block of the deal, according to Reuters, citing a letter.

- Nvidia (NVDA) reportedly plans to build an offshore headquarters in Taipei, Taiwan, according to CTEE.

GEOPOLITICS

MIDDLE EAST

- "Israel plans to launch an attack on Yemen", according to Sky News Arabia.

- "Israel is considering helping the Kurds in Syria in a non-military way", according to Sky News Arabia; "Israel is concerned about Turkey's intention to launch a large-scale military operation against the Kurds in northern Syria".

- US military announced that it carried out airstrikes targeting Iran-backed Houthi missile storage and command/control facilities in Yemen, according to Reuters. US military stated that it conducted precision airstrikes targeting a missile storage facility and a command-and-control facility operated by Iran-backed Houthis in Sanaa, according to Reuters.

- Yemeni Houthis have confirmed targeting central Israel with a ballistic missile, according to Reuters

CHINA

- China is considering allowing seafood imports from Japan and may lift the ban as early as the first half of 2025, according to Nikkei.

- China condemned the latest US military aid to Taiwan on Sunday, stating that the USD 571mln package violates the "one China principle" and the terms of the joint communique between China and the US, according to Reuters.

- China's Defence Ministry on Saturday expressed its dissatisfaction over a US report released this week on China's military, which it said distorted its defence policy and "grossly interferes" in its internal affairs, according to Reuters.

- Chinese Foreign Ministry announced that China will take countermeasures against two Canadian institutions and 20 personnel, specifically targeting Canada's Uyghur Rights Advocacy Project and the Canada-Tibet Committee, according to the ministry.

OTHER

- US President-elect Trump's team has informed European officials that the incoming US president will demand NATO member states increase defence spending to 5%, while planning to continue supplying military aid to Ukraine, according to the Financial Times.

EUROPE/UK

NOTABLE HEADLINES

- ECB's Lagarde said still believe that ECB should be very vigilant about service; getting very close to that stage when ECB can declare that we have sustainably brought inflation to our medium-term 2% target, via FT; Coming close to the end of that process where wages have caught up with price.

- ECB's Makhlouf said the outlook for next year was probably clouded by “more uncertainty than there was when we went into lockdown; and argued against calls for the ECB to start cutting rates by 50bps at a time in early 2025, via FT. He said his preference was still “for gradual moves rather than big leaps”, unless “the facts and the evidence” suggest otherwise.

- BoE Governor Bailey and FCA CEO Nikhil Rathi will reportedly join UK Chancellor Reeves as part of Britain’s delegation to China next month, according to Sky News.

- Elon Musk has called for German Chancellor Scholz to resign, according to Reuters.

- Hungarian PM Orban stated that when the dollar strengthens, the forint automatically weakens, adding that the current weakening of the forint is not driven by Hungary's economic fundamentals, according to Reuters.

LATAM

- Panama's President Mulino said that every square metre of the Panama Canal and its surrounding area belonged to Panama after Trump threatened to retake the canal, stressing that the country's independence is non-negotiable, the Panama Canal sovereignty agreement is indisputable, canal fees are not set arbitrarily, and the canal remains free from influence by China or any other country, remaining under Panama's control, according to Reuters.

- US President Biden is considering a tariff exemption for solar modules imported from Mexico, according to Bloomberg News.

- Mexico's Financial Stability Council stated that the country's financial system remains solid and resilient, according to Reuters.

- Mexico's Economy Ministry stated that the government does not agree with the panel's decision on GM corn, but will respect the ruling, emphasising that the USMCA dispute resolution system is a key component of the treaty, according to Reuters.

- El Salvador's president has sent a bill to Congress aimed at overturning the ban on metals mining, according to Reuters.

- Fitch Ratings said that Brazil's fiscal and monetary tensions created a negative feedback loop, according to Reuters.

- BCB's Roberto Campos Neto stated that there is significant uncertainty regarding the factors that will drive global disinflation going forward, adding that the inflationary challenge ahead will be quite tough. He also noted that central bank autonomy is not yet complete and expressed a desire to make the central bank fully autonomous, according to Reuters.

- Brazilian President Lula said he would remain watchful for the need for further fiscal measures and told the upcoming BCB chief Galipolo that he would never interfere in the central bank, according to Reuters.

- Colombia Central Bank cut rates by 25bps to 9.50% (exp. 9.25%), with the decision backed by a "majority" of board members.

- US President-elect Trump has appointed Mauricio Claver-Carone as the Envoy for Latin America, according to Reuters.