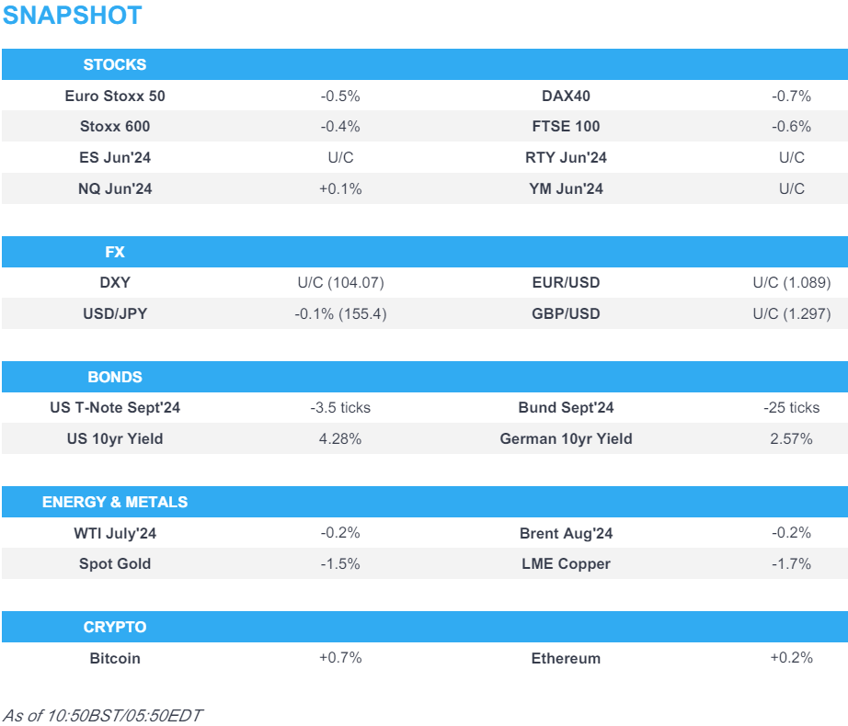

- European equities are entirely in the red and at session lows; US futures trade tentatively ahead of US NFP

- Dollar is flat alongside G10 peers as markets await key employment data

- USTs trade within a contained range, Bunds are softer post-German data and unreactive to a slew of ECB speakers who mainly stuck to the data-dependent script; EGBs hit on Q1 wages

- Crude is flat, XAU dragged down on data which indicates that China halts Gold buying for reserves after an 18-month stretch

- Looking ahead, US NFP, Canadian Employment, US Wholesale Sales, ECB’s Schnabel; Lagarde; Fed's Cook

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (-0.2%) began the session on a tentative footing, in what was initially directionless trade. However, as the morning progressed, sentiment quickly waned and stocks trundled lower to session lows, where they currently reside.

- European sectors hold a negative bias, and with the breadth of the market fairly narrow. Tech takes the spot, continuing to build on the past week’s outperformance. Real Estate is found at the foot of the pile after Morgan Stanley downgraded Vonovia (-3.7%) and Leg Immobilien (-3.8%).

- US Equity Futures (ES U/C, NQ +0.1%, RTY U/C) are mixed and with trade tentative ahead of today’s US employment report, where expectations are for the headline to tick higher to 185k from 175k.

- Click here for the sessions European pre-market equity newsflow and here for additional news.

- Click here for more details.

FX

- USD is steady vs. peers ahead of the crucial jobs report due at 13:30BST. Levels to the downside for DXY include; 103.99 a double bottom from overnight and Tuesday. To the upside, focus remains on whether the index can move beyond its 200 and 100DMAs at 104.40 and 104.43 respectively.

- EUR is flat vs. the USD as the dust settles on yesterday's ECB rate cut, and unreactive to the slew of ECB speakers today. As it stands, the next 25bps reduction is not fully priced in until December. Upside for EUR/USD sees the 1.09 mark.

- GBP is flat against both USD and EUR. Cable remains within yesterday's 1.2763-1.2809 range, which could be tested by the upcoming NFP release. Tuesday's 1.2818 high was the highest since March 14th.

- JPY is the marginal outperformer vs the Dollar, currently within a 155.13-93 range. NFP could prove an inflection point for the pair ahead of BoJ next week.

- Antipodeans are both steady vs. the USD in quiet newsflow with not much follow-through from Chinese trade data overnight. AUD/USD for now is contained within yesterday's 0.6633-83 range with the pair having traded on a 0.66 handle all week.

- PBoC sets USD/CNY mid-point at 7.1106 vs exp. 7.2430 (prev. 7.1108)

- Click here for more details.

FIXED INCOME

- USTs are marginally in the red, with no real reaction to the morning's data points or extensive ECB speak. Focus entirely on payrolls before CPI and the FOMC next Wednesday; USTs in narrow 110-06 to 110-10 bounds which are entirely contained by Thursday's 110-03 to 110-13 parameters.

- Bunds is softer, weighed on by the softer than expected German Industrial Output data, though were unreactive to the extensive number of ECB officials this morning; speak for the most part stuck with the party script of meeting-by-meeting and data-dependency; Bunds were essentially unchanged and at the top-end of initial 130.78-131.05 parameters but dipped to a 130.65 base on the latest EZ Q1 wage number; ECB's Q1 Key wage indicator accelerated to 5.1% Y/Y vs. prev. 4.9% (Q4'23)

- Gilts are rangebound and unreactive to the morning's Halifax House Price data which unexpectedly declined on the month, though the note described this as essentially unchanged.

- Click here for more details.

COMMODITIES

- Crude benchmarks are marginally in the red but have essentially been pivoting the unchanged mark in limited APAC/European trade ahead of the NFP print. Brent currently around USD 79.80/bbl.

- Precious metals were relatively contained but tumbled on the release of China's monthly gold reserves which showed they were maintained at 72.8mln/oz. XAU slipped from USD 2373/oz to USD 2358/oz over the course of five minutes; thereafter, tumbled further to a USD 2342/oz fresh low for the session.

- Base metals are entirely in the red, with sentiment hit following the Chinese gold reserves headline.

- Chinese gold reserves 72.8mln/oz vs. prev. 72.8mln/oz; The maintained figure for the China gold reserves seemingly breaks the 18-month streak of purchases for the yellow metal.

- Chinese May iron ore imports 102.03mln tons (vs 101.82mln tons in April) Jan-May iron ore imports +7% Y/Y.

- Chinese May crude oil imports 46.97mln metric tons (vs 44.72mln tons in April); Jan-May crude oil imports -0.4% Y/Y.

- SPDR Gold Trust GLD reports holdings up 0.4% to 837.10 tonnes by June 6th.

- Chile's state-run Codelco is said to be looking for partners on a major new lithium project slated to begin production in 2030, according to documents cited by Reuters.

- Goldman Sachs said, "Even assuming comfortable European end-October 2024 storage, we still see winter global gas price risks skewed to the upside, led by TTF."

- Natural gas flow has restarted from the UK to Norway via Langeled pipeline, according to UK national gas data.

- Click here for more details.

CRYPTO

- Bitcoin is very modestly firmer and sits around the USD 71k mark.

NOTABLE DATA RECAP

- ECB's Q1 Key wage indicator accelerated to 5.1% Y/Y vs. prev. 4.9% (Q4'23)

- German Industrial Output MM (Apr) -0.1% vs. Exp. 0.3% (Prev. -0.4%); Trade Balance, EUR, SA (Apr) 22.1B vs. Exp. 22.6B (Prev. 22.3B); Imports MM SA (Apr) 2.0% vs. Exp. 0.6% (Prev. 0.3%); Exports MM SA (Apr) 1.6% vs. Exp. 1.1% (Prev. 0.9%)

- UK Halifax House Prices MM (May) -0.1% vs. Exp. 0.2% (Prev. 0.1%); YY 1.5% vs Exp. 1.2% (prev. 1.09%)

- French Trade Balance, EUR, SA (Apr) -7.579B (Prev. -5.473B, Rev. -5.381B); Exports, EUR (Apr) 51.181B (Prev. 52.224B, Rev. 52.112B); Current Account (Apr) -1.8B (Prev. 1.3B, Rev. 0.6B); Imports, EUR (Apr) 58.76B (Prev. 57.698B, Rev. 57.493B)

- EU GDP Revised YY (Q1) 0.4% vs. Exp. 0.4% (Prev. 0.4%); GDP Revised QQ (Q1) 0.3% vs. Exp. 0.3% (Prev. 0.3%); Employment Final YY (Q1) 1.0% vs. Exp. 1.0% (Prev. 1.0%); Employment Final QQ (Q1) 0.3% vs. Exp. 0.3% (Prev. 0.3%)

NOTABLE EUROPEAN HEADLINES

- German Economy Minister says if things go well will have 1-1.5% growth next year.

ECB SPEAK

- ECB's Kazaks says victory over inflation is not yet on hand; any further rate cuts should be gradual; the next steps are data dependent and will be meeting by meeting, via Bloomberg.

- ECB's Muller says they need to be cautious when making decisions and should not be in a rush to cut.

- ECB's Nagel says ECB policy is not on auto pilot when it comes to rate cuts; inflation is proving to be stubborn, especially in the case of services. Negotiated wages are expected to rise particularly sharply this year and continue to see strong growth thereafter. The decision to cut was logical, tendency is there that inflation is going down. Decision to cut was not premature. Still acting restrictively despite lowered rates. Not on autopilot, will look at the data and make a decision at each meeting. Says "well on the way" when it comes to the balance sheet reduction

- ECB's Vasle says cannot predetermine path of ECB interest rates.

- ECB's Simkus says more than one cut this year is a possibility. Data clearly show disinflation and inflation returning to target but the road is bumpy.

- ECB's de Guindos says inflation will be around 2% next year, sees huge uncertainties on the economy.

- ECB's Rehn says inflation will continue to decline, rate cuts will also bolster the economies recovery.

- ECB's de Guindos says sometimes in order to attain cross-border merger, need to engage with national consolidation first.

- ECB's Makhlouf says unsure how fast the ECB will carry on with rate reductions, or if at all.

- ECB's Schanbel says the lack of fiscal consolidation, despite high debt levels may impede monetary policy and heighten the risk of fiscal dominance.

- ECB's Holzmann says "my decision on rates was based on the latest data and forecasts; fight against inflation is not over yet". "Currently I see little risk of a second inflation wave but inflation is stickier than expected".

NOTABLE US HEADLINES

- A federal judge in San Francisco dismissed a proposed class action against Google (GOOG), which had alleged the company misused personal and copyrighted data to train its AI systems, including its Bard chatbot, according to Reuters.

- South African ANC Leader Ramaphosa said they have agreed that they will invite parties to form a government of national unity, according to Reuters.

GEOPOLITICS

MIDDLE EAST

- Hamas reportedly said that it will reject the Israeli ceasefire proposal, arguing that the proposal does not ensure a permanent end to hostilities. Hamas will continue to reject proposals until it secures a “permanent ceasefire”, via Critical Threat on X

- Israeli PM Netanhayu is to address US Congress on July 24th, according to Punchbowl's Sherman. However, Times of Israel sources suggested July 27th.

- US military said it destroyed eight Houthi drones and two Houthi uncrewed surface vessels in the Red Sea, according to Reuters.

OTHERS

- Philippine Coast Guard reports that the Chinese Coast Guard intentionally rammed a Philippine Navy rubber boat transporting sick personnel, according to Reuters.

APAC TRADE

- APAC stocks traded mixed in cautious and tentative trade and macro newsflow on the quieter side ahead of the US jobs report.

- ASX 200 was kept afloat by gains in gold miners, alongside Resources and Materials names. while Real Estate and Healthcare lagged.

- Nikkei 225 was subdued following softer-than-expected household spending data. On an index level, gains in Pharma and Mining failed to counter the downside from Banking and Autos, with the latter continuing to feel the woes from its domestic safety scandal.

- Hang Seng and Shanghai Comp both dipped into the red after opening modestly firmer, whilst CATL shares tumbled some 7% after US lawmakers said Chinese EV battery manufacturers rely on forced labour and should be blocked from importing goods into the US. No reaction was seen on the Chinese trade data.

NOTABLE ASIA-PAC HEADLINES

- Japanese Foreign Reserves USD 1.2316tln at end-May (vs USD 1.2790tln at end-April), according to MOF. "Japan’s holdings of foreign securities dropped sharply in May, indicating that the government likely financed most of its recent record currency market intervention by selling Treasuries and other foreign securities and still has ample firepower to step into markets again." - via Bloomberg.

- Japanese Finance Minister Suzuki said the drop in Japan's foreign reserves as of end-May partially reflects FX intervention; and will take action against excessive forex moves. Forex intervention was conducted to address excessive moves. Forex intervention should be done in a restrained manner. Not taking into account the limit to reserves for forex intervention.

- BoJ offered to buy JPY 150bln in up to 1yr JGBs, JPY 375bln in 1-3yr JGBs, JPY 425bln in 5-10yr JGBs and JPY 150bln in 10yr-25yr JGBs; all unchanged.

- PBoC injected CNY 2bln via 7-day reverse repos with the rate at 1.80%.

- RBI maintained its Repo Rate at 6.50% as expected and maintained its policy stance as expected. FY25 real GDP growth was upgraded to 7.2% vs 7% previously. RBI Chief said risks to growth and inflation are evenly balanced and the RBI will remain resolute in commitment to aligning inflation to target.

- TSMC (TSM / 2330 TT) May Sales TWD 229.6bln, +30.06% Y/Y

- BoJ may drop clue on bond tapering plans next week, via Reuters citing sources; there is no consensus yet. Could trim monthly purchases or clarify plans to proceed with a slow but steady taper, according to the sources.The decision could be delayed if the bond market becomes too volatile. Focus would be to avoid abut spikes in yields.

- China extends anti-dumping duties on the imports of some chemicals from India for a five-year period as of 8th June.

DATA RECAP

- Chinese Trade Balance USD (May) 82.62B vs. Exp. 73.0B (Prev. 72.35B)

- Chinese Imports YY (May) 1.8% vs. Exp. 4.2% (Prev. 8.4%); Exports YY (May) 7.6% vs. Exp. 6.0% (Prev. 1.5%)

- Chinese May trade surplus with the US at USD 30.8bln (vs USD 27.24bln in April), according to customs data

- New Zealand Manufacturing Sales (Q1) -0.4% (Prev. -0.6%)

- Japanese All Household Spending MM* (Apr) -1.2% vs. Exp. 0.2% (Prev. 1.2%)

- Japanese All Household Spending YY* (Apr) 0.5% vs. Exp. 0.6% (Prev. -1.2%)