- APAC stocks were ultimately mixed with cautiousness seen after Trump's latest tariff salvo

- The US is to impose 25% tariffs on all cars made outside of the US effective on April 2nd

- Trump reiterated that reciprocal tariffs are also set for next week but stated they will be lenient

- European equity futures indicate a lower cash market open with Euro Stoxx 50 future down 0.5% after the cash market closed with losses of 1.2% on Wednesday

- DXY lower after yesterday's session of gains, EUR is firmer despite Trump tariff plans, GBP is attempting to nurse recent losses

- Ukraine and the US discussed a halt of strikes on civilian facilities, but the US did not get support on this from Russia

- Looking ahead, highlights include US GDP & PCE Final (Q4), Jobless Claims, Japanese Tokyo CPI, Norges Bank & Banxico Policy Announcements, BoJ SOO, BoE’s Dhingra, Riksbank’s Bremen, Fed’s Collins & Barkin, ECB’s Schnabel, de Guindos & Lagarde, Norges Bank's Bache, Supply from UK & US

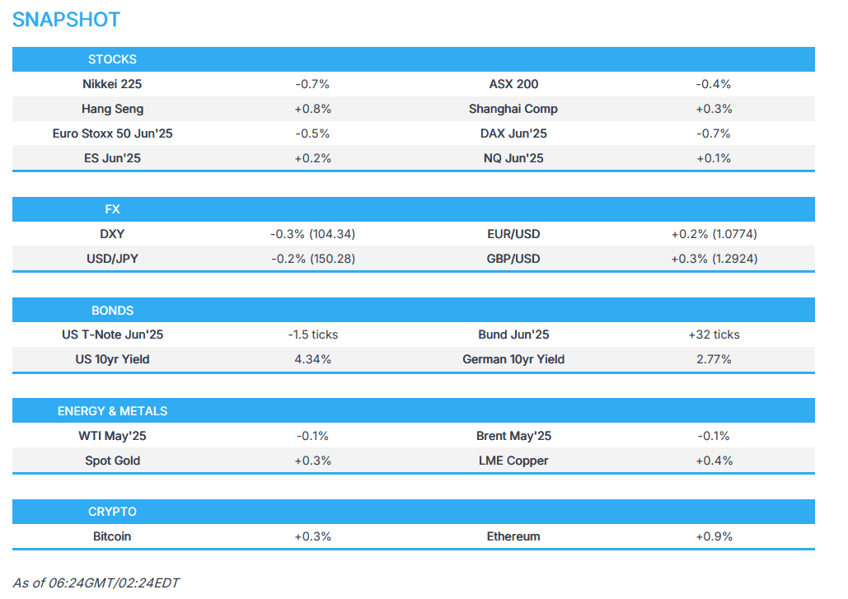

SNAPSHOT

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 day

US TRADE

EQUITIES

- US stocks closed notably in the red and were hit by risk-off trade due to a combination of factors including Trump tariff developments and with an FT article noting that Chinese energy efficiency rules could hit Nvidia (NVDA) sales. As such, Technology was the clear laggard among sectors with mega-cap names Communication Services and Consumer Discretionary the next worst performers.

- SPX -1.12% at 5,712, NDX -1.83% at 19,917, DJI -0.31% at 42,455, RUT -1.03% at 2,074.

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump announced the US is to impose 25% tariffs on all cars not made in the US, while he said they will be doing tariffs on pharmaceuticals and tariffs on lumber. Trump stated auto tariffs are going into effect on April 2nd and will start being collected on April 3rd, as well as noted that he will have a news conference on April 2nd which is the real Liberation Day. Furthermore, reciprocal tariffs on April 2nd will be on all tariffs but they will be lenient and in many cases, the tariffs will be less than the tariff charged on the US.

- US President Trump said there will be some form of a deal on TikTok and if the deal is not finished, it will be extended. Trump said there are numerous ways to buy TikTok and there is a lot of interest in TikTok, while he added that China has to play a role and he may give China a little reduction in tariffs to get it done.

- US President Trump posted on Truth "If the European Union works with Canada in order to do economic harm to the USA, large scale Tariffs, far larger than currently planned, will be placed on them both in order to protect the best friend that each of those two countries has ever had!"

- White House official said Commerce Secretary Lutnick informed President Trump that national security concerns raised in the earlier autos probe remain and may have escalated. The official stated the 25% tariff applies to autos and auto parts, in addition to any other duties or fees, while the new 25% tariff will be added to the existing 25% tariff on light trucks and cars coming to the US under USMCA will be tariffed according to their foreign part content. Furthermore, the official stated that tariffs take effect after midnight on April 3rd and it was also reported that Trump's autos proclamation provides a one-month tariff exemption for auto parts imports until May 3rd.

- Canadian PM Carney said Trump's tariff announcement is a direct attack on Canadian workers and they will defend their country, while he will convene a high-level meeting on Thursday to discuss trade options and noted that tariffs will hurt Canada but the country will emerge stronger. Furthermore, he said if retaliatory tariffs are appropriate, Canada will take steps in its own interest and that Ottawa will react soon in which it can introduce retaliatory tariffs, while he is sure he will speak to Trump soon.

- Ontario's Premier said he spoke to PM Carney and they agreed Canada needs to stand firm, strong and united, while he fully supports the government preparing retaliatory tariffs to show that Canada will never back down.

- Unifor said regarding US auto tariffs that President Trump fails to understand the chaos and damages tariffs will inflict on workers and consumers in both Canada and the US.

- Mexico's Foreign Minister held a call with US Deputy Secretary of State Landau in which they talked about security, migration and commerce, while they agreed to exchange information regularly and to schedule a face-to-face meeting in the near future, according to Mexico's Exterior Ministry

- European Commission President Von der Leyen said she deeply regrets the US decision to impose tariffs on European automotive exports, while the European Commission will assess the announcement along with other measures the US is expected to unveil in the coming days and the EU will continue to seek negotiated solutions while safeguarding its economic interests.

- EU’s top trade negotiator Sefcovic expects US President Trump to hit the bloc with tariffs of about 20% next week, while it was reported that a White House official said “no final decisions have been made” on what the reciprocal tariff rates will be for US trading partners, according to FT.

- EU expects US President Trump to set a flat, double-digit tariff on April 2nd and it was suggested that the tariff rate applied to the EU could be as high as 20% or 25%, according to Politico citing two diplomats.

- Japanese PM Ishiba said various options are on the table for consideration regarding US auto tariffs and need to think about the appropriate response. Ishiba added that Japan is making the largest investment in the US and questions whether it makes sense to apply higher auto tariffs equally to all countries, which is a point it has made and will continue to make to the US.

- China's ambassador to the US said using fentanyl as an excuse to raise taxes for no reason will only turn another point of cooperation into a point of friction, while the ambassador added that the development of China-US relations has reached a new and important juncture and hopes the US will work with China in the same direction.

NOTABLE HEADLINES

- Fed's Musalem (2025 voter) said risks that inflation will stall above 2% or move higher in the near term appear to have increased and patience with current policy is appropriate as the Fed gathers evidence inflation is returning to the target. Musalem said he is wary of assuming all tariff-related price increases will be temporary as second-round effects could be more persistent, while he added that if the labour market remains strong and second-round tariff effects become apparent, the Fed may need to keep rates higher for longer or consider more restrictive policy. Musalem also commented that the labour market is at or close to full employment and it is appropriate for policy to remain where it is given inflation is above target.

- US President Trump announces the appointment of Brandon Beach as the next Treasurer of the United States.

- US President Trump effectively cut 10% of funding for the Commerce Department's Bureau of Industry and Security which is the key agency in the US-China tech race, according to Bloomberg.

APAC TRADE

EQUITIES

- APAC stocks were ultimately mixed with cautiousness seen after Trump's latest tariff salvo in which he announced the US is to impose 25% tariffs on all cars made outside of the US effective on April 2nd and reiterated that reciprocal tariffs are also set for next week but stated they will be lenient, and in many cases, tariffs will be less than the tariffs charged on the US.

- ASX 200 declined with the index dragged lower by underperformance in tech, real estate and financials but with further downside stemmed by resilience in utilities and the commodity-related sectors.

- Nikkei 225 slipped back beneath the 38,000 level with automakers among the worst hit following Trump's 25% auto tariff announcement.

- Hang Seng and Shanghai Comp kept afloat with outperformance in Hong Kong amid a slew of earnings releases and after US President Trump also suggested he may give China a little reduction in tariffs to get a TikTok deal done, while China's Vice Premier vowed to push forward reforms to help high-quality economic growth in a speech at the Boao Forum.

- US equity futures (ES +0.1%, NQ U/C) partially rebounded from the prior day's selling but with the recovery limited amid tariff concerns.

- European equity futures indicate a lower cash market open with Euro Stoxx 50 future down 0.5% after the cash market closed with losses of 1.2% on Wednesday.

FX

- DXY gradually softened overnight in a reversal of the prior day's advances which had been spurred by tariff-related headlines, stronger-than-expected Durable Goods data and the downbeat risk tone.

- EUR/USD rebounded from the prior day's trough despite the latest US tariff announcement and expectations for more tariff pain next week on 'Liberation Day' with EU trade chief Sefcovic anticipating US President Trump to hit the bloc with tariffs of about 20%. However, President Trump also suggested during his tariff announcement that people will be pleasantly surprised about reciprocal tariffs and that he will be much more lenient on tariffs on April 2nd.

- GBP/USD nursed losses after retreating yesterday on soft CPI data and Chancellor Reeves's Spring Statement.

- USD/JPY pulled back after the prior day's choppy performance and amid the underperformance in Tokyo stocks.

- Antipodeans recouped lost ground as the major currencies took advantage of the reversal in the greenback.

- PBoC set USD/CNY mid-point at 7.1763 vs exp. 7.2728 (Prev. 7.1754).

- BoC Minutes stated that ahead of the announcement, the BoC was generally assigning less weight to downside risks to inflation and generally agreed new data had shifted the balance, with somewhat less risk of lower inflation outcomes. Minutes stated they would probably have left rates unchanged at 3% had there not been a tariff threat and increased uncertainty but decided a 25bps cut would provide some help to Canadians to manage the uncertainty related to tariffs. The Minutes also revealed that some governing council members suggested keeping the rate unchanged until there was more clarity on the effects of tariffs and other members felt the threat of tariffs and uncertainty had changed the outlook enough to warrant a cut.

FIXED INCOME

- 10yr UST futures struggled for direction after yesterday's choppy performance amid strong durable goods data and the downbeat risk tone, while participants now await incoming supply including a 7-year note auction.

- Bund futures were underpinned amid tariff concerns after the EU's top trade negotiator Sefcovic said he expects US President Trump to hit the bloc with tariffs of about 20% next week, while EU's Von der Leyen voiced deep regret regarding the US decision to impose tariffs on autos.

- 10yr JGB futures were ultimately little changed in the absence of any tier-1 data releases and with only brief support seen after a mixed 40yr JGB auction which resulted in a higher bid-to-cover but a lower price at the highest accepted yield.

COMMODITIES

- Crude futures traded sideways amid cautiousness following the latest Trump tariff announcement.

- US DoE considering cutting funding to four of seven US hydrogen hubs, according to Reuters sources.

- Spot gold gradually edged higher and topped this week's peak on the back of a softer dollar.

- Copper futures initially trickled lower with demand hampered amid the mostly negative risk appetite in the region, but then recovered amid the resilience in its largest buyer, China.

CRYPTO

- Bitcoin steadily gained overnight after prices bounced back above the USD 87,000 level.

NOTABLE ASIA-PAC HEADLINES

- China's Vice Premier Ding Xuexiang said at the Boao Forum that there is a significant rise in uncertainties in the world and that China will resolutely oppose protectionism, as well as promote globalisation and safeguard free trade. Ding said China's economy has had a good start this year and the improving trend in China's economy has become more consolidated, while he is confident in China achieving its growth target and contributing to Asia and world growth. Furthermore, he said they will push forward key reforms to help high-quality economic growth, promote the development of private firms and make greater efforts to promote the healthy development of the property and stock market.

DATA RECAP

- Chinese Industrial Profits YTD (Feb) -0.3% (Prev. -3.3%)

GEOPOLITICS

MIDDLE EAST

- US President Trump said US attacks on Houthis will continue for a long time.

- Hamas spokesperson Abdel Latif al-Qanoua was killed in an Israeli airstrike on northern Gaza, according to Hamas media cited by Reuters. In relevant news, Lebanese media reported an Israeli march targeted a car on a road in Tyre in southern Lebanon, according to Sky News Arabia.

RUSSIA-UKRAINE

- Ukrainian President Zelensky said he expects the US to ensure the ceasefire is without conditions despite Russian claims, while he added that sanctions against Russia should remain in place. Zelensky also stated that Ukraine and the US discussed a halt of strikes on civilian facilities, but the US did not get support on this from Russia. It was separately reported that Zelensky said they will never give up their lands to Russia, according to a journalist via X.

- US Secretary of State Rubio said the agreement with Russia and Ukraine is one in principle and the Russians detailed a number of conditions afterwards which the US is going to evaluate. Rubio added that after they evaluate and understand their position, they'll present it to the President.

- US Treasury Secretary Bessent said President Trump would not hesitate to raise sanctions on Russia if it gives him a negotiating advantage, according to a Fox News interview.

- French President Macron said Russia is reinterpreting what was agreed in ceasefire talks and France is to provide military support to Ukraine of EUR 2bln. Macron also stated they want to mobilise partners on Thursday to increase military support to Ukraine.

- NATO Secretary General Rutte said there will be no normalisation of relations with Russia even after the war in Ukraine is over.

OTHER

- North Korean leader Kim supervised tests of kamikaze drones and the nation was presumed to send at least 3,000 more troops to Russia, according to Yonhap.

EU/UK

NOTABLE HEADLINES

- UK Chancellor Reeves defended the digital services tax and said they believe that companies should pay tax in the countries in which they operate, which is why they introduced the digital services tax in the first place, and their views on that have not changed".

- UK DMO CEO said a reduction in long-dated Gilt issuance in 2025/26 represents an "important shift" and the shift to shorter-dated Gilts reflects "cost and risk for the exchequer".

- ECB's Centeno said there is no reason to deviate from the interest rate path incorporated in projections, while a weak economy and neutral rate estimates argue for more cuts and he does not see any reason for an April pause. Centeno added that neutral rates might not be enough to sustain inflation at 2% and would like to see rates closer to 2% sooner rather than later.

- ECB's Kazaks says we can probably keep cutting rates if the baseline holds, adds uncertainty is really high and geopolitics is the main cause.