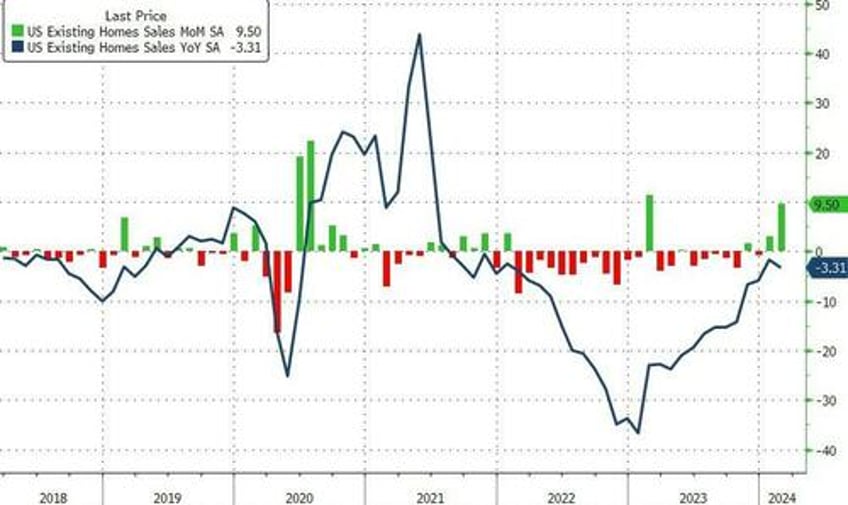

Existing home sales soared a stunning 9.5% MoM in February, smashing the expectation of a 1.3% decline and building on the 3.1% MoM in January. However, even with the big monthlyu jump, existing home sales remain down 3.3% YoY...

Source: Bloomberg

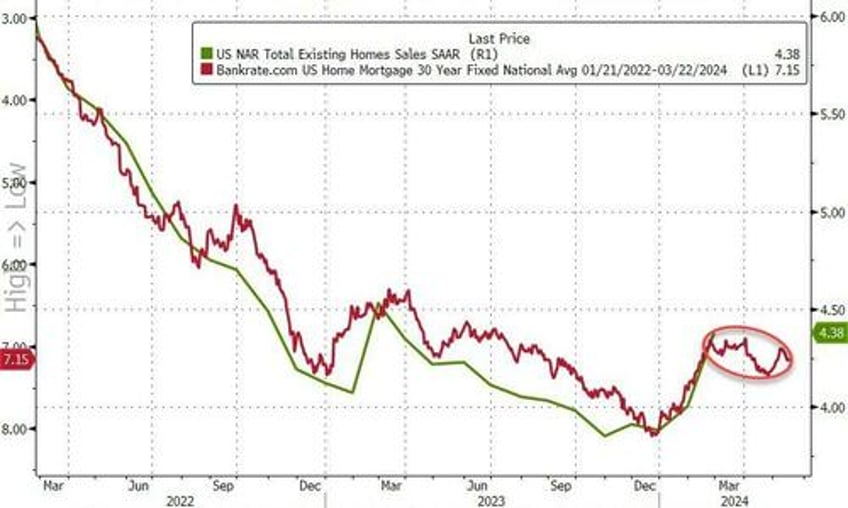

Total existing home sales SAAR surged to 4.38mm - a 12 month high...

Source: Bloomberg

Homeowners may be accepting that mortgage rates are settling into a new normal and can’t delay moving any longer, NAR Chief Economist Lawrence Yun said on a call with reporters.

“Additional housing supply is helping to satisfy market demand,” Yun said in a statement.

“Housing demand has been on a steady rise due to population and job growth, though the actual timing of purchases will be determined by prevailing mortgage rates and wider inventory choices.”

With a 2-month lag, we can see why existing home sales may have risen, but with mortgage rates rising since then, we suspect the fun and games may come to an end again soon (even if the NAR economist thinks otherwise)...

The number of previously owned homes for sale climbed to about 1.07 million last month, and Yun said he expects that will continue to go up. At the current sales pace, selling all the properties on the market would take 2.9 months, the lowest in about a year.

Realtors see anything below five months of supply as indicative of a tight market.

Even with greater inventory, strong demand put upward pressure on prices. The median selling price advanced 5.7% to $384,500 from a year ago, the highest for any February in data back to 1999.

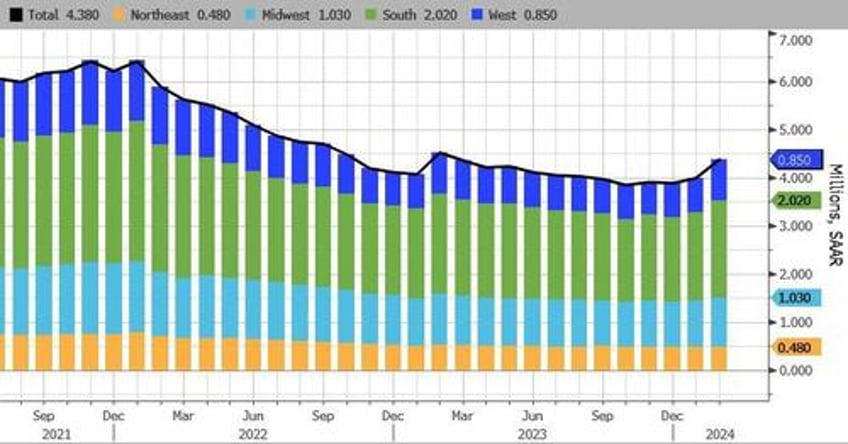

Sales rose in three of four regions, led by a 16.4% surge in the West

First-time buyers made up 26% of purchases in February, matching the lowest on record.