By Michael Every of Rabobank

Frank analysis, tunes, and quotes

Please see our Fed-watcher Philip Marey’s take on the latest FOMC decision here for a thorough breakdown and forecast update.

In a Frank summary, the FOMC came very close to implying only two 25bp cuts this year, not three; reduced the number of cuts expected further out; their economic projections raised the level of GDP growth, didn’t expect any increase in unemployment, and saw core PCE inflation over target until 2026; and the market initially sold off.... Until FOMC Chair said even if rates wouldn’t go back to zero, there was uncertainty about even that; the Fed would need to pivot fast if unemployment rose sharply; and refused to address the loosening of financial conditions evident to everyone with a pulse. In short, Powell started crooning an old Sinatra tune:

“I like rate cuts in June, how about you? I like Wall Street’s tune, how about you?

I love a buy-side election boom when due; I like buy-all-the-dips, bulls-are-right yacht trips, how about you?

I'm mad about unbalanced books, can't get my fill; And Bitcoin and gold’s looks give me a thrill

Cutting rates whatever data show; When inflation ain’t low may not be new

But I like it, how about you?”

And markets, and the dollar, swooned as another Sinatra classic immediately came to their minds.

“Fly me to the moon; Let me trade among the stars

Let me see what stonks are like; On Jupiter and Mars

In other words, don’t hold my rates; In other words, Jay, cut them

Fill my trades with song; And let me punt for ever more

You are all I long for; All I worship and adore

In other words, please be true; In other words, Jay, I love you”

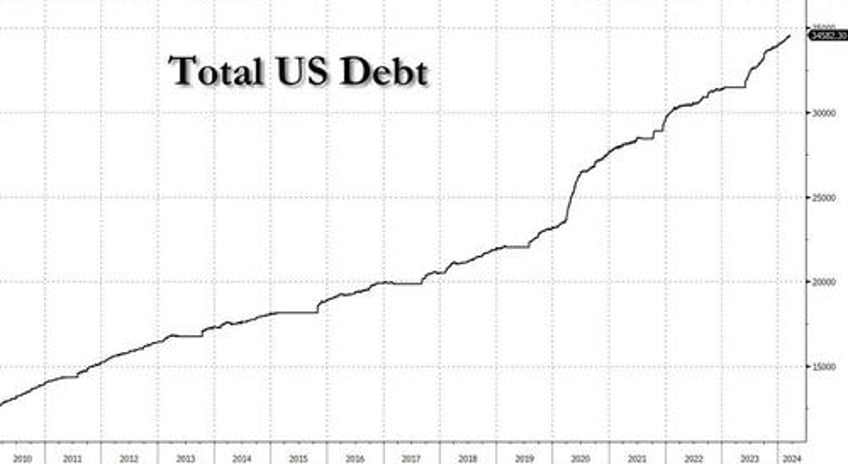

On one hand, the Fed might know something grim we don’t. On the other hand, maybe it really is the election coming up, where both polarised US camps are claiming it will be the end of democracy if the other wins: it’s not like central banks and politics aren’t related, for all the pearl-clutching this comment will prompt from some. Anywhere in-between those two hands is also valid as a view - except assuming we are in normal times, with a normal cycle, normal economy, normal markets, and a normal central-bank function: that we ain’t. Not as the US threw in another $8bn for another semi-conductor plant, in the latest tranche of mercantilism-lite, while the Congressional Budget Office says US public debt is only going one way: up.

So, maybe Powell was singing ‘My Way’, not in defiance as much as a tired resignation on the eventual way out the door; a man who did his best and is happy to be handing this hot mess over to whomever gets the short straw next.

Meanwhile, underlining that this is a global central-bank issue spanning Oceans 11, Australia just saw its composite PMIs at 11-month highs and +116.5K mostly full-time jobs added, taking the unemployment rate -0.4ppts to 3.7% to make an absolute mockery of the RBA’s recent shift from a mild tightening bias, and its claim that rates are “slightly restrictive”.

By contrast, neighbouring New Zealand is officially back in recession again even though inflation there is also not defeated either: so, do they cut anyway, or force the economy to suffer more?

Next up today will be the BOE, who have the latest slightly better set of inflation data as a fig leaf for whatever they opt to say; but also the backdrop of a speech from the almost-certain next Chancellor of the Exchequer (according to polls) quoting Joan Robinson and Karl Polanyi --my kind of mood music-- and saying the next Labour government will embrace industrial policy to ensure a boom in investment spending (with no cuts in consumer spending), which will be inflationary before it is eventually deflationary.

Frankly --or Sinatra-ly-- central banks can twinkle their pretty blue eyes at markets, who will fall for it, or threaten them with their ‘legitimate businessmen’ connections when talking tough, but at the end of the day, it won’t matter if stonks, Bitcoin, gold, house prices, and commodity prices --particularly oil (up 12.3% year-to-date, and 3.4% this month)-- say that what monetary policy is doing is actually their way.

Goldman: "Our interpretation is that Chair Powell and a narrow majority of the Committee feel strongly about not delaying cuts for too long and are targeting the June FOMC meeting for the first cut"

— zerohedge (@zerohedge) March 21, 2024

keep a very close eye on oil

Because then inflation will be going its way, and it won’t be down to 2% again, which is the central bank way. America’s geopolitical rivals will all be going their way with a spring in their stride, and it won’t be in the direction of the US dollar system, perhaps.

Indeed, “I’m gonna live till I die,” another Frank quote, may work well for stonks and those forced to buy them by the motivations and deprivations of neoliberalism, but it doesn’t for the supposed adults in the room, central banks.

Personally, that backdrop leaves me thinking of another Frank quote: “Basically, I'm for anything that gets you through the night - be it prayer, tranquilizers, or a bottle of Jack Daniels.” I may need all three simultaneously.