In a deal that would be transformational for the US energy sector, and spark another shale revolution, the WSJ writes that US supermajor, the largest US energy E&P and formerly the world's largest company by market cap, Exxon - the company that according to the Big Guy made more money than God in 2021, is closing in on a deal to shale giant Pioneer Natural Resources, a blockbuster takeover that could be worth roughly $60 billion and reshape the U.S. oil industry.

The deal, which the WSJ first leaked back in April and has described as "seismic" (metaphorically but also literally, ha ha) could be sealed in the coming days, though it is still possible there won’t be one, sources told the Journal.

After posting a record profit in 2022, and flush with cash, Exxon has been exploring options that would push it deeper into West Texas shale. An acquisition of Pioneer, with a market cap of around $50 billion, would be Exxon’s largest deal since its megamerger with Mobil in 1999, and would give Exxon a dominant position in the oil-rich Permian Basin, a region the oil giant has said is integral to its growth plans.

Such a deal would not only eclipse the U.S. oil industry’s most recent blockbuster, Occidental’s 2019 acquisition of Anadarko Petroleum for about $38 billion, and top Exxon’s 2010 purchase of XTO Energy for more than $30 billion, it would make Exxon the second most important energy company in the world after Saudi Aramco.

It would also be a legacy-shaping move for Exxon CEO Darren Woods, whose tenure at the company has seen its peaks and valleys.

Woods, an Exxon-lifer who became CEO in 2017, initially promised to dramatically grow Exxon’s oil production only to see his plans felled by the pandemic. An oil-market collapse in 2020 led to Exxon’s first annual loss in decades—more than $22 billion. It lost a historic proxy fight in 2021 to investment firm Engine No. 1, which excoriated Exxon’s finances and argued it had no long-term strategy.

And yet, without any handouts from the Biden admin unlike so many of its unionized corporate peers, Exxon rebounded to a record profit of $55.7 billion last year, propelled by soaring global demand for oil and gas as economies reopened. Exxon has used its prolific cash flows to reward investors with buybacks and dividends and pledged disciplined spending, though many wondered whether the company would dip into its coffers for a megadeal in the oil patch.

We now know the answer. The acquisition marks Woods’s second significant acquisition, coming only a few months after Exxon scooped up CO2 pipeline operator Denbury for $4.9 billion. It would add vast swaths of West Texas acreage considered the core of the U.S. shale boom.

As the WSJ notes, Pioneer’s acreage in the Midland Basin (the eastern portion of the Permian Basin, which straddles West Texas and New Mexico) is one of the largest collections of fertile oil land in the U.S., and the company holds one of the largest numbers of untapped drilling locations of any Permian player, analysts have said. In the wake of the pandemic, Pioneer snapped up two other large Permian operators, Parsley Energy and DoublePoint Energy, for a combined $11 billion in 2021.

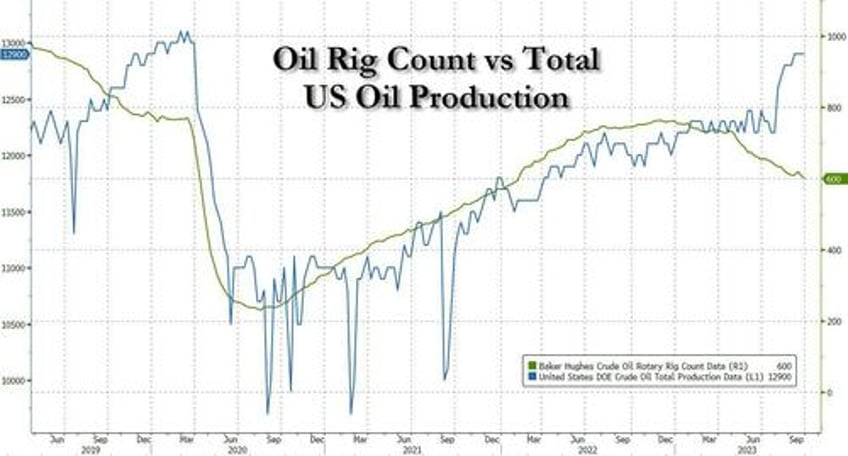

The tie-up will presage a wave of consolidation among shale companies. The industry has shifted from the rapid growth it pursued for more than a decade to a mature business underpinned by fiscal restraint and hefty investor payouts. But producers are contending with dwindling drilling locations. Drilling for new oil discoveries has fallen out of favor with investors, leaving many companies with few options other than to acquire rivals to extend their runway.

Producers have deep coffers at their disposal to pursue deals after Russia’s invasion of Ukraine last year sent global prices soaring to more than $127 a barrel. Prices have retreated and been volatile since then. Exxon’s acquisition of Pioneer could be the first of a series of deals in the Permian, which contains shale wells that produce rapidly and don’t bind companies to decadeslong megaprojects that have fallen out of favor with some investors who fear a future decline in oil demand.

The best news, however, is that Exxon just slapped the progressive lobby in its sanctimonious face. While environmentalists, lawmakers and others have hoped oil and gas companies would invest their record profits into green energy, that won't be happening. And while Woods has pledged Exxon will invest $17 billion through 2027 in cutting the company’s carbon emissions and building a business that would help other companies reduce theirs too, investing in areas including carbon capture, biofuels and lithium mining, all that the shrewd CEO is doing is getting to the front of the line of the government's green handouts.

The bottom line: Exxon’s move to purchase Pioneer, even after its acquisition of Denbury, the CO2 pipeline operator, signals the company is still primarily planning to lean on its traditional oil-and-gas business for decades.

That said, nothing is guaranteed in the energy sector which together with crypto, has emerged as the most hated industry of the so-called Democrats. In 2020, when the price of oil collapsed, and when many were doubting that Exxon would avoid bankruptcy, it subsequently emerged (again via the WSJ) that Exxon was considering a merger with Chevron, the energy sector's 2nd largest company. Back then, talks between Exxon and Chevron were preliminary and yielded no result.

Then again, if Exxon manages to become not only the biggest it has ever been but also a cash flow machine and the world's 2nd most important energy company under a Democratic administration, one can only imagine what will happen in 13 months time when the senile teleprompter reader is finally kicked out.