- The Fed cut rates by 25bps, as expected, to 4.25-4.5% in an 11-1 split, with Hammack voting to leave rates unchanged; the median dot plot for 2025 and 2026 FFR forecasts were lifted above expectations.

- Fed Chair Powell said the decision was a "closer call", but the "right call", suggesting there was a discussion surrounding holding rates at this meeting, and that "extent and timing language" shows Fed is at or near the point of slowing rate cuts, and the slower pace of cuts reflects expectation.

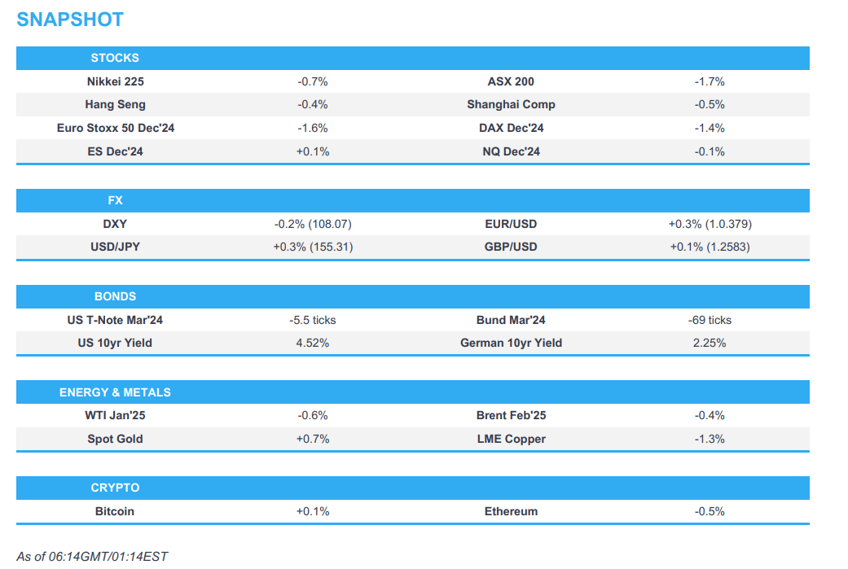

- APAC stocks traded with losses across the board amid the fallout from the hawkish Fed, as sentiment from Wall Street reverberated to the region.

- BoJ maintained its rate at 0.25% as expected, with an 8-1 vote; Board Member Tamura dissented, advocating for a 25bps hike to 0.50%; eyes on Governor Ueda's presser.

- European equity futures are indicative of a softer open following the late selling stateside, with the Euro Stoxx 50 future -1.6% after cash closed +0.3% on Wednesday.

- Looking ahead, highlights include US Jobless Claims, Philly Fed Index, NZ Trade Balance, Japanese CPI, BoE, Riksbank, Norges, CNB, Banxico Policy Announcements, BoJ Governor Ueda, Norges Bank’s Bache, Riksbank’s Theeden, Supply from the UK.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

FOMC MEETING

FOMC STATEMENT & PROJECTIONS:

- The Federal Reserve cut rates by 25bps, as expected, to 4.25-4.5% in an 11-1 split, with Hammack voting to leave rates unchanged. The statement was little changed from the November meeting, but added in considering the "extent and timing" of additional rate adjustments (prev. In considering additional adjustments), the Fed will assess incoming data, evolving outlook and balance of risks.

- However, the further hawkish skew came in the updated Summary of Economic Projections (SEPs) whereby the median dot plot for 2025 and 2026 FFR forecasts were lifted above expectations. Recapping, the median 2025 dot rose to 3.9% from 3.4% (exp. 3.6%), while the 2026 median rose to 3.4% (exp. 3.1%, prev. 2.9%). 2027 and longer run median dot plots rose to 3.1% (prev. 2.9%) and 3.0% (prev. 2.9%), as expected. As such, the 2025 median dot plot looks for just two cuts in 2025.

- Elsewhere, Core PCE inflation is now seen at 2.5% for 2025 (exp. 2.3%, prev. 2.2%) and 2.2% for 2026 (exp. 2.0%, prev. 2.0%). Forecasts for the unemployment rate were largely as expected, with all horizons, ex-longer run, seen at 4.3%, although 2027 was expected. In addition, and as was alluded to in the latest Minutes, the Fed lowered the repo rate by 30bps to 4.25% (lower end of FFR target, vs 5bps above lower end previously).

FED CHAIR POWELL PRESSER:

- In Chair Powell's pre-prepared remarks he stated the Fed is squarely focused on two goals, and that the economy is strong, the labour market remains solid, and inflation is much closer to the 2% goal. Ahead of November PCE on Friday, Powell said total PCE probably rose 2.5% in the 12 months ending in November, while core PCE prices probably rose 2.8% in November.

- The Chair added that the policy stance is now significantly less restrictive, and going forward they can be more cautious, something which was indicated from the updated SEPs and statement tweak.

- In the Q&A, the distinct hawkish remark came from the first question, which accentuated hawkish market moves, as Powell said that today's decision was a "closer call", but the "right call", suggesting there was a discussion surrounding holding rates at this meeting. Powell added risks are two-sided, and trying to steer between those two risks.

- Chair Powell stated that "extent and timing language" shows Fed is at or near the point of slowing rate cuts, and the slower pace of cuts reflects expectation. Powell said that cuts they make in 2025 will be in response to data and as long as the labour market and economy are solid, they can be cautious as they consider further cuts. In addition, looking at US President-elect Trump's term, Powell said some people did take a very preliminary step and incorporated conditional effects of coming policies in their projections.

- NOTE: One committee member sees no cuts in 2025, and one sees five 25bps rate cuts - showing a wide range of views on the Fed, but many were centred around the median. Continuing to look ahead, Powell said it will be looking for further progress in inflation to make those cuts, and added that from here is a new phase, and the Fed is going to be cautious about further cuts.

FED MARKET REACTION

- STOCKS: Sold off across the board and SPX saw its worst "Fed day" since 2001, according to Bloomberg.

- FX: DXY surged against major peers to a 108.27 high as the Fed delivered a hawkish cut - i.e. a 25bps cut as expected, but raising FFR projections above expectations, particularly in 2025.

- BONDS: Dived after Fed signals slower rate path ahead; US 10-year yield rose above 4.50%.

- COMMODITIES: Sold off post-settlement after the hawkish FOMC.

- CRYPTO: Extended on recent losses with Bitcoin slipping under USD 101k.

- MARKET IMPLIED FED RATE CUT PRICING: January 2bps (prev. 4bps), March 12bps (prev. 17bps), May 15bps (prev. 23bps), December 2025 34bps (prev. 48bps); (prev. = pre-FOMC and incorporated for today's rate cut).

BOJ MEETING

BOJ STATEMENT:

- BoJ maintained its rate at 0.25% as expected, with an 8-1 vote; Board Member Tamura dissented, advocating for a 25bps hike to 0.50%. The central bank said inflation expectations were heightening moderately, and inflation was likely to reach a level generally consistent with the BoJ's price target in the second half of the three-year projection period through fiscal 2026.

- However, uncertainty regarding Japan's economic and price outlook remains high, the central bank said. BoJ highlighted the need to scrutinise FX and market movements, along with their impact on Japan's economy and prices.

- BoJ said the impact of FX volatility on inflation could be greater than in the past due to changes in corporate wage and price-setting behaviour. Meanwhile, Japan's economy was recovering moderately despite some weaknesses, with private consumption increasing.

REACTION

- Little action was seen outside of Japanese assets; USD/JPY and JGB futures saw upside, Nikkei trimmed some earlier losses (more details below).

- NOTE: Traders typically get more colour on the BoJ's thinking via Governor Ueda's press conference, which is slated for 06:30GMT.

US TRADE

EQUITIES

- US stocks saw considerable downside (SPX -2.95%, NDX -3.6%, DJIA -2.58%, RUT -4.4%) in wake of the hawkish FOMC cut, while sectors were all notably in the red with Consumer Discretionary plunging 4.75% and weighed on by Tesla's (TSLA) (-8.5%) weakness.

- SPX -2.95% at 5,872, NDX -3.60% at 21,209, DJIA -2.58% at 42,327, RUT -4.39% at 2,232

- Click here for a detailed summary.

NOTABLE HEADLINES

- Morgan Stanley now expects the Fed to deliver two 25 bps rate cuts in 2025 (prev forecast of three 25 bps cuts) following the December FOMC meeting, according to Reuters.

- US President-elect Trump said he's totally against stopgap bill, Fox News reported. President-elect Trump and Vance called for a temporary funding bill without "Democrat giveaways" combined with an increase in the debt ceiling; Congress should debate the debt limit now.

- Micron Technology Inc (MU) - Q1 2025 (USD): Adj. EPS 1.79 (exp. 1.77), Adj. Revenue 8.71bln (exp. 8.71bln). Adjusted gross margin 39.5% (exp. 39.5%). Adjusted operating income 2.39bln (exp. 2.34bln). Adjusted operating income margin 27.5% (exp. 27%). Cash flow from operations 3.24bln (exp. 4.1bln). Guidance: Sees return to growth in H2 of FY. Q2 adj. revenue 7.7-8.1bln (exp. 8.99bln). Q2 adj. gross margin 37.5-39.5% (exp. 41.3%). Q2 adj. EPS 1.33-1.53 (exp. 1.92). Fiscal Q2 bit shipment outlook weaker than expected. Prioritizing investments to ramp 1β & 1γ tech nodes. Commentary: The PC refresh cycle is unfolding more gradually. Sees sale of projects to China-headquartered customers to be concentrated in high-end customer portfolios for the remainder of 2025. Shares fell 15% after-market.

- Micron (MU) executive said see conditions for margin expansion occurring after Q3, and added they saw some moderation in purchases of data centre SSDs after several quarters of rapid growth.

- Apple (AAPL) said Meta (META) has made 15 requests for potentially far-reaching access to Apple's technology, and it raises concerns about users' privacy and security as it made more requests than other firms, according to Reuters.

- Apple (AAPL) is reportedly in talks with Tencent (700 HK) and ByteDance to integrate their AI features into iPhones sold in China, according to Reuters sources.

- Teamsters launch the largest strike against Amazon (AMZN) in US history; workers to strike nationwide on Thursday, according to Reuters.

APAC TRADE

EQUITIES

- APAC stocks traded with losses across the board amid the fallout from the hawkish Fed, as sentiment from Wall Street reverberated to the region.

- ASX 200 was pressured by its IT and gold sectors following the post-Fed tech downside and the slide in the yellow metal.

- Nikkei 225 pared some losses following the BoJ's decision to maintain rates, but choppy trade was seen thereafter ahead of Governor Ueda's presser.

- Hang Seng and Shanghai Comp were both lower as China conformed to the broader post-Fed risk tone, with Fed Chair Powell also suggesting that some Fed members had taken a very preliminary step and incorporated conditional effects of coming policies in their projections - i.e. potential Trump tariffs.

- US equity futures (ES +0.1%) consolidated and took a breather after the Fed-induced selling stateside as traders in APAC and Europe digested the FOMC announcement and press conference. Meanwhile, Micron shares extended its fall to -16.2% following their earnings call.

- European equity futures are indicative of a softer open following the late selling stateside, with the Euro Stoxx 50 future -1.6% after cash closed +0.3% on Wednesday.

FX

- DXY held onto a bulk of its gains and remained above 108.00 (albeit briefly dipped under the level at one point) after surging from levels around 107.00 before the Fed statement, with the hawkish dot plots and tone from Powell keeping the buck underpinned overnight. DXY took out the 22nd Nov 2024 high (108.09) - next upside levels include the peak from 11th Nov 2022 (108.44), with clean air then seen until near 111.00.

- EUR/USD slumped to a 1.0343 low in the aftermath of the FOMC, with the next support level seen at the 22nd Nov 2024 (and YTD) low (1.0333) before looking at levels from late 2022.

- GBP/USD traded in a narrow APAC range ahead of the BoE and after the prior day's Dollar-induced hit. Levels to the downside included the 26th Nov low (1.2503) and then the 22nd Nov trough (1.2484).

- USD/JPY reached a 154.86 post-Fed peak which later extended to 155.44 as the BoJ opted to maintain its rate, although Board Member Tamura dissented and called for a 25bps hike to 0.50%, with eyes on Governor Ueda for more volatility.

- Antipodeans remained subdued after the FOMC also dealt a blow to base metals, whilst the Kiwi narrowly underperformed after seeing some downside on its GDP data, which showed its economy had shrunk by 1% in Q3 Q/Q (vs exp. -0.2%, prev. -0.2%).

- Yuan saw some strenght following the PBoC fixing, possibly as the fix itself did not rise as much as expectations for the fix rose post-Fed. Note, the fix was expected at 7.3165 (prev exp. 7.2838); fix set at 1.911 (prev. fix 7.1880).

- PBoC set USD/CNY mid-point at 7.1911 vs exp. 7.3165 (prev. 7.1880)

FIXED INCOME

- 10yr UST futures maintained a downward bias after T-Notes had dived in US hours following the Fed signalling a slower rate path ahead.

- Bund futures also traded lower but after German debt futures had reacted most of the Fed just before ceasing trade on Wednesday.

- 10yr JGB futures saw choppy trade with an initial slump at the open in reaction to the Fed, before recoiling after the BoJ decision, with the contract almost wiping out its Fed-induced downside.

COMMODITIES

- Crude futures held onto losses after the Fed decision sparked selling in the complex, with prices subdued in APAC hours as the region digested the demand implications of fewer projected Fed rate cuts.

- Spot gold trimmed some post-Fed losses, possibly amid geopolitics as Israel and Yemen exchanged fire. Earlier, the yellow metal was pressured by the stronger buck, with the yellow metal sliding from a pre-Fed level of around USD 2,640/oz, through its 100 DMA (USD 2,605.30/oz), to a USD 2,585/oz post-Fed trough.

- Copper futures were softer as LME futures played catchup to the price action seen in CME counterparts in the wake of the Fed.

- Sinopec Energy Outlook said China’s petroleum consumption is expected to peak in 2027 at up to 800mln metric tons, according to Reuters.

CRYPTO

- Bitcoin extended on recent losses with prices briefly slipping under USD 100k amid the Fed follow-through in APAC hours, although the complex later found a floor.

OTHER NOTABLE ASIA-PAC HEADLINES

- BoJ's comprehensive review of past monetary easing steps highlighted it was deemed appropriate for the bank to continue conducting monetary policy with the aim of achieving the price stability target of 2% in a sustainable and stable manner. The bank stated that no specific measures should be excluded at this point when considering the future conduct of monetary policy. Regarding the effectiveness of monetary easing, it was noted that the quantitative degree of its effects remains uncertain compared with conventional monetary policy measures. While monetary easing influenced inflation expectations to some degree, it was not sufficiently effective in anchoring inflation at 2%. In terms of its impact on interest rates and the economy, long-term interest rates were reduced by approximately 1ppt since 2016. Large-scale monetary easing contributed to GDP growth by an estimated 1.3% to 1.8%, while its effect on CPI was between 0.5 and 0.7ppts. Note, the policy review was initiated by Ueda when he took office in April 2023.

- Honda (7267 JT) and Nissan (7201 JT) talks to start as early as next week, according to Nikkei.

- HKMA cut its base rate by 25bps to 4.75%, as expected in lockstep with the Fed.

- South Korean Finance Minister said market-stabilising measures will be taken if volatility is deemed excessive; will prepare FX stability and liquidity measures in 2025 policy plan, according to Reuters.

- South Korean financial regulator said it has asked banks to flexibly adjust FX transactions and loan maturity for firms, according to Reuters.

- South Korea's National Pension Service (NPS) and BOK to extend and expand their FX swap agreement, according to Reuters.

- Indonesia's central bank said it is committed to stabilising the IDR in case of any excessive volatility, according to Reuters.

- Westpac now forecasts the RBNZ to cut the cash rate to 3.25% by May 2025 following the NZ GDP data.

DATA RECAP

- New Zealand GDP Prod Based QQ, SA (Q3) -1.0% vs. Exp. -0.2% (Prev. -0.2%, Rev. -1.1%)

- New Zealand GDP Exp Based QQ, SA (Q3) -0.8% vs. Exp. -0.4% (Rev. -0.8%)

- New Zealand GDP Prod Based YY, SA (Q3) -1.5% vs. Exp. -0.4% (Prev. -0.5%)

- New Zealand GDP Prod Based, Ann Avg (Q3) 0.1% vs. Exp. -0.1% (Prev. -0.2%, Rev. 0.6%)

- New Zealand ANZ Business Outlook (Dec) 62.3% (Prev. 64.9%)

- New Zealand ANZ Own Activity* (Dec) 50.3% (Prev. 48.0%)

GEOPOLITICS

MIDDLE EAST

- "Israel-Hamas hostage deal not imminent", according to Al Jazeera citing Jerusalem Post.

- "IDF: Sirens sound in several areas of central Israel, including Tel Aviv", according to Sky News Arabia.

- Senior Israeli official said IDF attacked in Sana'a (Yemen), according to Axios' Ravid.

- Yemeni Houthi spokesperson posted "An important statement for the Yemeni armed forces in the coming hours.", via X.

- "Arab media reported attacks in the area of the Yemeni capital Sana'a, the port of al-Hodeidah in the west of the country, and an oil facility in the Ras al-Issa area", according to Kann News.

OTHER

- Ukrainian drone attack on Russia's Rostov region starts fire at Novoshakhtinsk oil refinery, according to the regional governor.

EU/UK

NOTABLE HEADLINES

- Marine Le Pen, the populist French leader, said on Thursday that she was preparing for an early presidential election to succeed Emmanuel Macron, whom she claimed is “finished or almost finished", via The Telegraph.

DATA RECAP

LATAM

- Brazilian Finance Minister Haddad does not believe the proposal over military pension would be voted on this week, according to Reuters.

- Brazil Congress leaders reached an agreement to reject stricter rules for social benefit BPC, local press reports.

- BCB announces spot Dollar auction for December 19th; to offer up to USD 3bln.