By Jan-Patrick Barnert and Michael Msika, Bloomberg Markets Live reporters and strategists

Sticky inflation? Premature easing bets? Shaky earnings? Nowadays, these aren’t obstacles for equity investors, whose buy-the-dip mindset remains strong in the absence of very good reasons to sell.

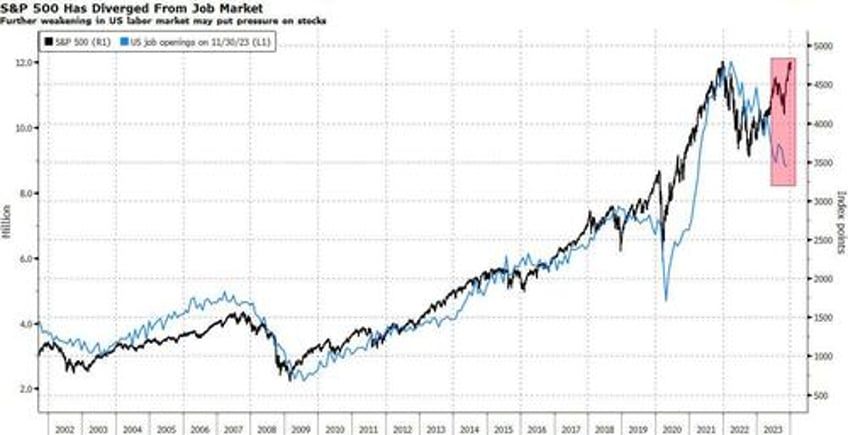

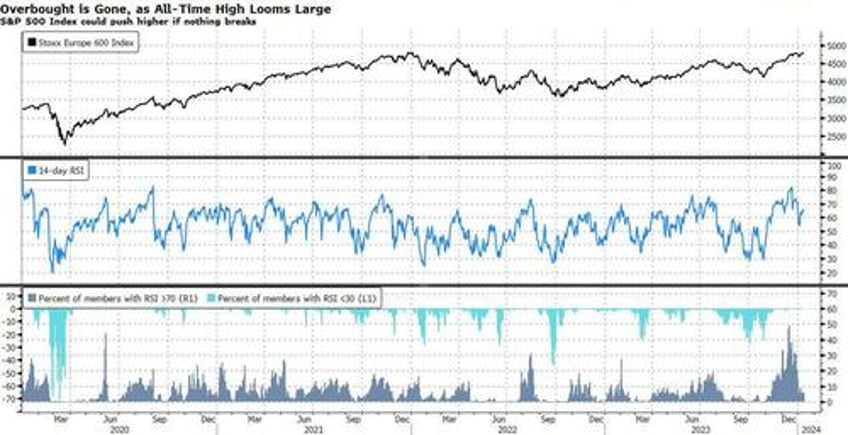

Stocks, as well as bonds, have become quite reluctant to give up their gains as investors wait to see more evidence whether something big will break. Despite a higher US inflation print last week and comments from Fed officials that it’s too early for rate cuts, the bond market is still pricing in 150 basis points of easing this year, with a nearly 70% chance that policymakers will start reducing borrowing costs in March. The S&P 500 looks at its all-time high with confidence, while the Stoxx 600 Europe hovers just below its 2022 peak and the economy still looks resilient.

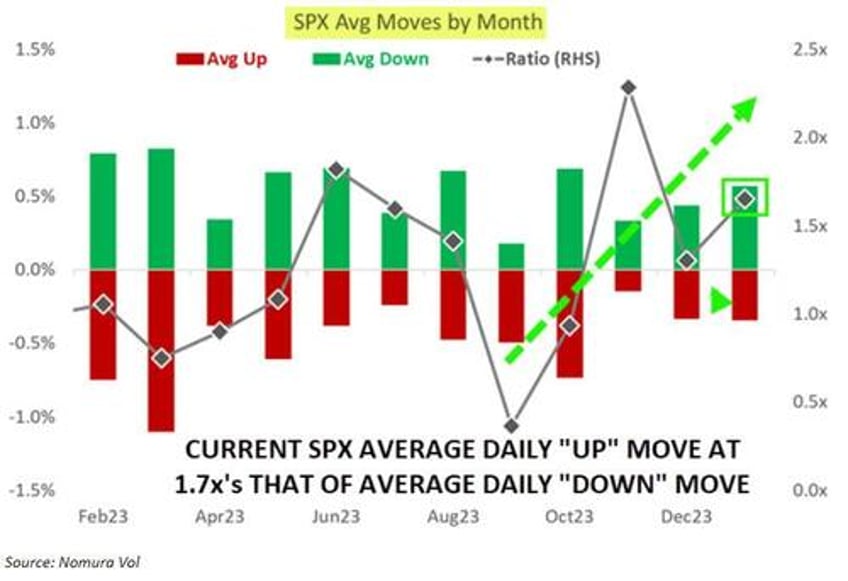

“The fear of a crash-up continues in equities,” notes Nomura strategist Charlie McElligott. He sees “relentless buying of dips” as the probability distribution of concern for stock traders is tilted far more to avoid missing a fast move upward than possibly walk into a bull trap.

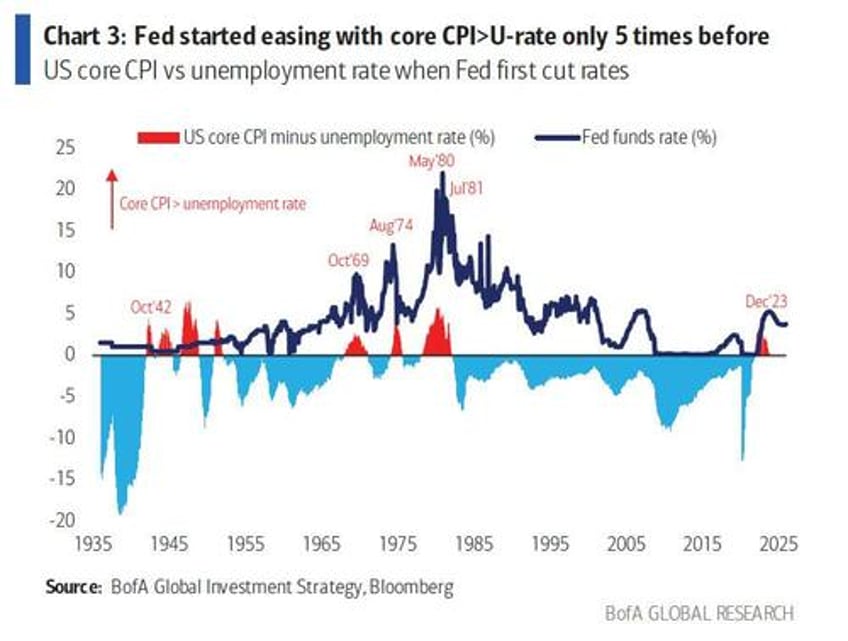

That’s not saying that the market is exuberant as risks are well flagged and monitored. According to Bank of America strategists Michael Hartnett, only five times in the past 90 years has the Fed cut rates with core CPI higher than unemployment, and they were always triggered by either a major conflict or a recession — in other words factors that are absent for now.

For Hartnett, that’s the reason why Wall Street is likely to stay risk-on at least until the dollar index weakens below 100, which he said would indicate a “policy mistake,” or US labor market transitions to redundancies with negative payroll numbers.

Reports by US banks on Friday are another helpful hint. Yes, numbers missed here and there, but rather due to idiosyncratic reasons. Meanwhile, the underlying message is still positive: credit is healthy, as is the consumer, and higher rates are benefiting earnings more than they hurt solvency.

And while inflation data continued to show a gradual decline for core numbers, surprises on CPI are not out of the picture, especially as the situation in the Middle East escalates. For Hartnett, geopolitic risks are inflationary, with transit volumes through the Red Sea and Suez Canal down 35%-45% in the past four weeks. That’s substantial as the Red Sea accounts for 12% of world trade and 30% of container traffic. In the meantime, crude oil has bounced to a two-week high of $75. More inflation data out of Europe this week will offer clues of direction.

“Disinflation remains broadly on track, and we think the direction of travel is toward a more market-friendly policy regime,” say Barclays strategists, led by Emmanuel Cau. “But the timing and pace of rate cuts are still up for debate, so beware of near-term volatility.”

So where else could short-term volatility come from? With the S&P 500 Index near its all-time peak, it’s always tricky to specify where the downside can quickly accelerate via technical selling, should indeed something unexpected go wrong. The Russell 2000’s Z-score is 3.96 - that means the index is currently trading nearly four standard deviations higher than its one-year average, while the Dow Jones’ Z-score is 2.74 and the Nasdaq’s is 2.36.

Hence Stephen Auth, Chief Investment Officer for equities at Federated Hermes, says that while optimistic for stocks he would not recommend investors “buy everything.” Rather, they should look under the surface and allocate capital not in the Magnificent 7 but in left behind areas, including dividend payers and other value stocks, small caps and emerging markets.