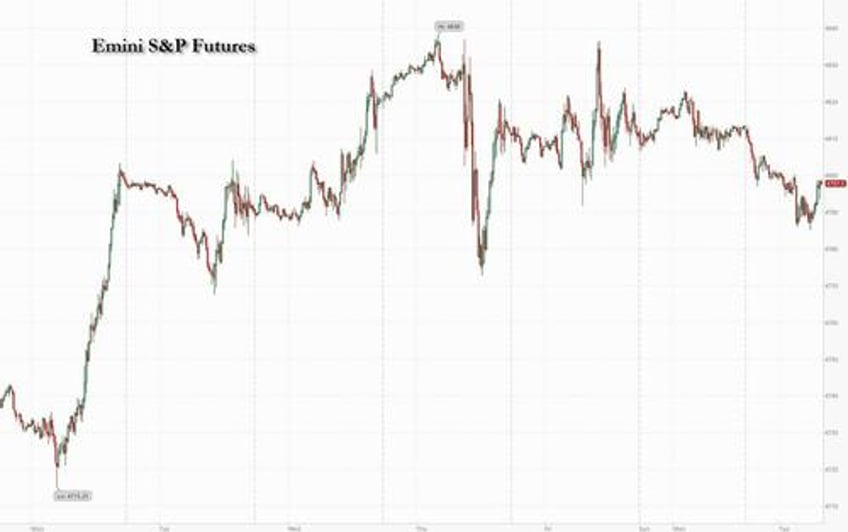

US equity futures fell for a second day as the dollar rose to a one-month high and as 10Y yield pushed back over 4.00% after various central banks pushed back against bets on aggressive interest rate cuts. As of 7:30am, S&P futures were down 0.4%, well off session lows, while Nasdaq futures lost about 0.5%. Meanwhile, Brent rose to around $79 a barrel as Houthi attacks on ships in the Red Sea keep tensions high. In other news, Iowa voters delivered Donald Trump a victory in Monday’s caucuses, moving him one step closer to a White House return. Among corporate highlights, Morgan Stanley and Goldman Sachs Group report earnings before the markets open.

In premarket trading, Boeing slumped again after Wells Fargo downgrades the planemaker to equal-weight from overweight, seeing a higher risk of production and/or delivery impacts with the US Federal Aviation Administration taking a closer look into Boeing’s operations. Elon Musk leaned on Tesla’s board to arrange another massive performance award for him after he sold a significant chunk of his stake in the company to acquire Twitter. Tesla shares slip 2.3% in US premarket trading after Elon Musk said he would rather build AI products outside of the the electric vehicle maker if he doesn’t have 25% voting control, suggesting the billionaire may prefer a bigger stake in the company.

Stocks pared losses after the ECB’s monthly survey showed consumer expectations for euro-zone inflation fell to the lowest in more than 1 1/2 years in November. Money markets held interest-rate cut wagers broadly steady after the ECB data, pricing the first quarter-point reduction by April followed by almost five more by year-end. Economic data in the UK, meanwhile, also supported the case for Bank of England rate cuts in the coming months, with wage growth cooling at one of the fastest paces on record. The pound weakened as much as 0.8% against the dollar and gilt yields edged lower.

Still, sentiment was dented after hawkish comments from the ECB's Nagel on Monday who said that it was too early to discuss rate cuts. A similar comment was made by ECB Governing Council member Robert Holzmann on Monday who indicated that cuts this year were not assured given lingering inflation and geopolitical risks. Their sentiments echoed prior comments from ECB President Christine Lagarde warning that it’s too early to talk about trimming borrowing costs. All were subsequently echoed on Tuesday in Davos, when ECB Governing Council member Francois Villeroy de Galhau said that it's too early to declare victory on inflation. Traders are now awaiting Federal Reserve Governor Christopher Waller’s speech later Tuesday for cues on the timing of a Fed rate cut, with money markets seeing a two-in-three chance of a reduction in March.

"Central banks pushing back on rate cuts is not helping risky assets,” said Mohit Kumar, chief European economist at Jefferies International. “The market has gone a bit ahead of itself.”

And then there are earnings: Morgan Stanley and Goldman Sachs are among the companies reporting results Tuesday, and are expected to reveal the continued lull in investment banking activity as high borrowing costs, geopolitical tensions and recessionary risks dampen deal-making.

European markets were red across the board, extending Monday's losses. The Stoxx 600 is down 0.6%, with food beverage and media shares are the biggest outperformers, while banking shares leading the decline as JPMorgan analysts said lending revenue will be capped by the peak in interest rates. Here are the biggest movers Tuesday:

- Experian gains as much as 3.2%, the most in a month, after the credit-data agency narrowed its expectations for full-year organic revenue growth to the 5%-6% area, compared to the previous 4%-6% forecast and the Bloomberg consensus of 5.16%

- Lindt & Spruengli shares jump as much as 6.8%, most since July 2022, after the Swiss chocolate maker reported 2023 organic sales growth that beat the highest analyst estimate, according to Vontobel

- Dassault Systemes shares gain as much as 1.8%, outperforming a falling tech sector, after Deutsche Bank raises the stock to buy from hold. Industry checks suggest that the adoption of the software firm’s cloud-based design platform 3DExperience is increasing in the automotive industry

- Ocado rallies as much as 7.8%, rebounding from the one-month low hit yesterday, after its grocery business delivered faster sales growth in the fourth quarter than expected

- Publicis rises as much as 1.4%, to its highest intraday level on record after Goldman Sachs raised the stock to buy, and rated media peers including Relx, Wolters Kluwer, Informa and UMG as buy, saying the most compelling stocks within Europe’s internet and media sector are those that benefit from structural tailwinds

- QinetiQ Group shares rise as much as 7.9% to touch a two-month high, after the defense company announced a £100 million share buyback program and issued a trading update detailing a rise in full-year revenue

- DocMorris shares rise as much as 5.7% after full-year 2023 revenue at the Swiss online pharmacy achieved the upper end of its guidance range. The company also reported an increase in active customer numbers for the first time since 2021

- THG rises as much as 9.4%, rebounding after hitting its lowest level since late October on Monday, after the e-commerce retail company’s guidance for FY23 adjusted Ebitda came in ahead of forecasts, and several of its divisions returned to revenue growth in the latest quarter

- Hugo Boss shares dropped as much as 11% in Frankfurt, their worst day in nearly four years, with analysts flagging that the German high-end clothing maker’s Ebit disappointed, even as its fourth-quarter sales performance was robust

- Air France-KLM slips as much as 3.2% to the lowest in six weeks after announcing it would scrap a year-old cargo alliance with container shipping giant CMA CGM, citing a “tight regulatory environment”

- Wise shares fall as much as 3.4% after the money-transfer firm’s results showed that per-user transaction volume fell among both personal and business accounts. The decline was seen by analysts as a headwind to medium-term growth

Earlier in the session, Asian stocks declined, set to snap three days of gains, as risk sentiment took a breather ahead of key economic data from China and after the ECB tamped down rapid rate cut expectations. The MSCI Asia Pacific Index slid as much as 1.2%, with Tencent, Samsung and BHP among the biggest drags. Equity benchmarks in Hong Kong and Australia posted the biggest declines, while Japanese equities fell amid signs that the market may be overbought after eight-straight days of gains for the Topix. China remains in focus ahead of gross domestic product, industrial production and retail sales data due Wednesday. Numbers are projected to show improvement in the economy in a rebound from periods of pandemic restrictions, and some investors have been turning bullish on the country’s beaten-down stock market.

- Hang Seng and Shanghai Comp conformed to the downbeat mood but with the losses in the mainland initially cushioned after a substantial PBoC liquidity operation, while Beijing reportedly told some institutional investors in recent days not to sell stocks.

- Nikkei 225 extended beneath the 36,000 level owing to slightly higher yields and firmer-than-expected PPI data.

- ASX 200 retreated with miners among the worst hit after lower iron ore output and shipments by Rio Tinto.

- Stocks in India posted their first retreat in six sessions on Tuesday, dragged by profit taking in index heavyweight Reliance Industries and information technology firms, which had rallied recently. The S&P BSE SENSEX Index fell 0.3% to 73,128.77 in Mumbai, while the NSE Nifty 50 Index declined by a similar measure. BSE’s measure of real estate companies, which was the best performer among its sectoral gauges in 2023, slipped 1.6% — its biggest single-day drop since Dec. 20.

There have been “a few recent economic data points challenging the consensus view of rapid and deep rate cuts,” said Matthew Haupt, a portfolio manager at Wilson Asset Management. “It’s been enough for equity investors to pause and sell into the recent strength.”

In FX, the Bloomberg dollar index climbed to a one-month high and Treasury yields rose, as trading re-opened after MLK Jr. Day. The risk sensitive Scandinavian currencies and Australian dollar led Group-of-10 losses, as central bankers pushed back on market rate cut bets. The Japanese yen sunk to a one-month low, while the British pound dropped on cooling UK wage growth.

- The Bloomberg Dollar Index rose to its highest level since Dec. 13 as the dollar gained against all Group-of-10 peers, the Australian dollar, Swedish krona and Norwegian krone led losses as risk-off sentiment swept through markets

- USD/JPY climbed as much as 0.6% to 146.65, a one-month high; One-week implied volatility between the currency pair implied traders don’t expected fireworks out of next week’s BOJ meeting but are positioning for the possibility of surprisingly hawkish forward guidance

- GBP/USD dropped as much as 0.7% to 1.2635, the lowest level since Jan. 5; UK wage growth data cooled at one of the fastest paces on record

- EUR/USD fell as much as 0.6% to 1.0883 as the euro fell for a fourth day; Consumer expectations for euro-zone inflation dropped to the lowest in more than one and a half years, ECB’s Villeroy said rate cuts were probable but pushed back on the timing priced by markets

In rates, Treasury yields cheaper by 6bp to 7bp across the curve as cash market reopens following Monday’s close, during which futures were led lower by bunds. Treasury 10-year yields around 4.01%, cheaper by around 7bp vs Friday’s close with higher yields helping the greenback, with the Bloomberg Dollar Spot Index rising 0.6% ahead of a speech by Fed Governor Waller. Curve spreads are broadly within 1bp of Friday levels. Fed-dated OIS have around 17bp of rate cuts priced in for the March policy meeting vs 19bp on Friday. In Europe, the slide in bunds occurred after ECB policymaker Holzmann warned against rate cuts this year. Fed’s Waller is slated to speak at 11am New York time, heavy corporate issuance is expected this week and a 20-year bond auction is ahead Wednesday.

In commodities, oil prices were steady as continued Houthi attacks on ships in the Red Sea that are keeping tensions high in the Middle East were offset by a shaky global economic outlook and gains in the dollar. Global benchmark Brent held above $78 a barrel, while West Texas Intermediate traded around $73. Spot gold fell 0.9% below $2040.

Bitcoin rose +0.4%, holding just below the $43k level with Ethereum also posting modest gains.

Looking to the day ahead now, data releases include UK labor market data, Germany’s ZEW survey for January, Canada’s CPI for December, and in the US, we get the Empire State manufacturing survey for January. From central banks, we’ll hear from BoE Governor Bailey, Fed Governor Waller and the ECB’s Villeroy. Lastly, earnings releases include Goldman Sachs and Morgan Stanley.

Market Snapshot

- S&P 500 futures down 0.5% to 4,793.25

- MXAP down 1.4% to 165.28

- MXAPJ down 1.5% to 503.27

- Nikkei down 0.8% to 35,619.18

- Topix down 0.8% to 2,503.98

- Hang Seng Index down 2.2% to 15,865.92

- Shanghai Composite up 0.3% to 2,893.99

- Sensex down 0.2% to 73,170.25

- Australia S&P/ASX 200 down 1.1% to 7,414.79

- Kospi down 1.1% to 2,497.59

- STOXX Europe 600 down 0.4% to 472.12

- German 10Y yield little changed at 2.22%

- Euro down 0.5% to $1.0894

- Brent Futures up 0.6% to $78.62/bbl

- Gold spot down 0.8% to $2,041.01

- U.S. Dollar Index up 0.70% to 103.12

Top Overnight News from Bloomberg

- China is weighing 1 trillion yuan ($139 billion) of new debt issuance under a so-called special sovereign bond plan, only the fourth such sale in the past 26 years. The sale of ultra-long bonds would fund projects in areas including food and energy, people familiar said. BBG

- William Lai Ching-te won the Taiwan presidential election on Saturday, as expected, securing a 3rd term in power for the Democratic Progressive Party (DPP). Lai took 40% of the vote followed by Hou Yu-I from the Kuomintang (KMT) at 33.5% (the KMT is considered more conciliatory toward China) and Ko Wen-je from Taiwan People’s Party (TPP) at 26.5%. RTRS

- AAPL is offering rare discounts on its iPhones in China, cutting retail prices by as much as 500 yuan ($70) amid growing competitive pressure in the world's biggest smartphone market. RTRS

- ECB’s Holzmann warns markets not to expect the first rate cut in April and says there may not be any decreases this year. CNBC

- Houthi militants hit a US-owned container vessel with a missile in the Gulf of Aden. Gibraltar Eagle, carrying steel products, suffered limited damage. Washington warned its merchant ships to avoid the area. PM Rishi Sunak told Parliament that the UK wants to reduce tensions and its air strikes are “self-defense.” BBG

- Though the Federal Reserve stopped raising interest rates last summer, it is quietly tightening monetary policy through another channel: shrinking its $7.7 trillion holdings of bonds and other assets by around $80 billion a month. Now that, too, may change. Fed officials are to start deliberations on slowing, though not ending, that so-called quantitative tightening as soon as their policy meeting this month. WSJ

- Biden’s campaign raises $97MM in Q4 and has $117MM of cash on hand, formidable numbers that provide an important monetary tailwind for the president heading into November. BBG

- Trump dominates Iowa (as expected) at 51% followed by DeSantis at 21.2% and Haley at 19.1% while Ramaswamy exits the race w/a 7.7% showing. WaPo

- Global core inflation picked up modestly in December on a 1-month basis, but the 3-month annualized rate has slowed further to 2.0%. We still expect the Fed to start easing in March, with a total of 5 cuts in 2024 (slightly less than market pricing). The ECB should follow in April and the BoE in May, and our views on both central banks are somewhat dovish relative to market pricing. By contrast, we expect only modest macro policy easing in China, despite sluggish growth and very low inflation. The combination of falling inflation, easier monetary policy, and solid growth should provide a friendly backdrop for risk asset markets. GIR

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were pressured in the absence of a lead from Wall Street and amid the upside in yields. ASX 200 retreated with miners among the worst hit after lower iron ore output and shipments by Rio Tinto. Nikkei 225 extended beneath the 36,000 level owing to slightly higher yields and firmer-than-expected PPI data. Hang Seng and Shanghai Comp conformed to the downbeat mood but with the losses in the mainland initially cushioned after a substantial PBoC liquidity operation, while Beijing reportedly told some institutional investors in recent days not to sell stocks.

Top Asian News

- PBoC injected CNY 760bln via 7-day reverse repos with the rate at 1.80% for a CNY 695bln net injection.

- Chinese authorities reportedly told some institutional investors in recent days not to sell stocks as the Chinese stock rout resumes, according to FT.

- Chinese President Xi stresses boosting high-quality development of the country's financial sector, according to Reuters citing state media.

- Microsoft (MSFT) CEO says China is not a large business for the Co.

- China is said to be mulling more stimulus with USD 139bln of special bonds, according to Bloomberg sources; proposals include the sale of ultra-long sovereign bonds to fund projects. Projects are related to projects related to food, energy, supply chains and urbanisation, sources added.

- Japanese government is to increase new bond issuance by USD 3.43bln to fund extra budget reserves (following recent earthquakes); there will be no change to JGB issuance sold to market

- Chinese Premier Li says China's economy is making steady progress; Chinese economy rebounded in 2023 and had an estimated growth of 5.2%, higher than the 5% target; says in promoting development, China did not resort to massive stimulus. Comes ahead of the Chinese GDP and activity data on Wednesday.

European equities, Stoxx 600 (-0.5%), are trading on the back-foot having sunk at the open, following a negative handover from APAC trade overnight, in the absence of a lead from Wall Street. European sectors have a strong negative tilt; Media is marginally firmer after a broker upgrade at Publicis (+1.2%). Banks are lower following a slew of downgrades at JPM and a cut in EPS estimates for Commerzbank (-4.5%). US equity futures are lower across the board, in tandem with European counterparts, though with losses slightly more pronounced; the Russell 2000 (-0.9%) underperforms. Earnings from Goldman Sachs and Morgan Stanley due, among others, in the pre-market.

Top European News

- British pension funds are preparing to "flood the market" with billions of GBP's of private assets, according to Bloomberg. As much as GBP 200bln in assets could be offloaded as rising interest rates provide funds with an opportunity to offload the part of the risk of meeting future liabilities.

- BofA January Fund Manager Survey: cash levels up, more investors expect short term rates to be lower in the next 12 months, more expect a weaker Chinese economy than a stronger one.

- Ocado (OCDO LN) Retail CEO is not expecting much impact on business from the Red Sea/Suez Canal disruptions

- German economy is expected to grow 0.3% in 2024, according to German BDI Industry Association; German economy is at a standstill and there is no change of a rapid recovery

- ECB Consumer Inflation Expectations survey (Nov) - 12-months ahead 3.2% (prev. 4.0%); 3-year ahead 2.2% (prev. 2.5%). Economic growth expectations for the next 12 months -1.2% (prev. -1.3%)

FX

- Dollar is firmer alongside the risk averse mood and as US yields rise after cash closure for MLK day; DXY took out 103.00 and surpassed the post-NFP high of 103.10, with the 200DMA at 103.41 now in sight. Fed's Waller at 16:00GMT/11:00EST will be in focus for the Dollar.

- EUR/USD has lost its 1.09 status amid the strength in the USD, less hawkish ECB speak and softer consumer inflation expectations. Today's trough at 1.0881 with yesterday's low at 1.0876 just below.

- Cable is swept up by Dollar buying, with lower UK wage data also not helping the Pound. On release, Cable sank lower before then entirely paring the move.

- Antipodeans are the G10 underperformers, in tandem with the cautious risk tone; support at 0.66 for the AUD/USD has broken in recent trade.

- USD/CNH bid and continuing to lift; focus on earlier sources around potential special bond stimulus and thereafter Premier Li on GDP, ahead of Wednesday's figures.

- PBoC set USD/CNY mid-point at 7.1134 vs exp. 7.1783 (prev. 7.1084).

Fixed Income

- Treasuries pressured to a 112-05 trough, yields bear-flattening as cash reacts to Monday's ECB speak.

- Bunds are struggling for direction & drawn to the mid-point of 134.94-135.42 parameters after Monday's hawkish move on numerous ECB officials. Remarks thus far from Villeroy, Centeno & Valimaki at Davos stress data-dependency.

- Despite the dovish wage figures, Gilts opened 16 ticks lower at 99.91 as the bias from US yields dominates. Since, Gilts have lifted to a 100.33 peak, shy of last week's 100.47-69 highs.

- UK sells GBP 1.5bln 2033 I/L Gilt: b/c 3.04x (prev. 2.68x) and real yield 0.423% (prev. 0.724%)

- Germany sells EUR 3.2bln vs exp. EUR 4.0bln 2.10% 2029 Bobl; b/c 2.1x (prev. 2.07x), average yield 2.12% (prev. 2.56%), and retention 20.0% (prev. 19.2%)

- France is seeing in excess of EUR 74bln in demand for its new green bond, according to lead managers; spread set at 8bps over outstanding June 2044 (initial guidance +10bp)

Commodities

- An upward bias is seen in crude prices this morning, with the complex resilient to the surging Dollar and broader risk aversion as the downside is countered by escalating geopolitics coupled with reports of further Chinese stimulus and Premier Li on GDP; Brent at highs of USD 79.18/bbl.

- Precious metals feel the pressure from the surge in the Dollar and yields stateside; XAU fell from a USD 2,055.22/oz intraday peak to levels under its 21 DMA (USD 2,044.44/oz).

- Base metals are mostly lower but were lifted off worst levels amid reports that China is mulling further stimulus.

- First Quantum is to reduce operating activities at its Ravensthorpe nickel operation and will cut workforce at the site by 30% after a significant downturn in nickel prices during 2023, combined with higher operating costs in Western Australia.

- India's Oil Minister says India has opened up to every possible supplier; Indian demand for energy will not peter off for a while

Central Bank speak

- ECB's Villeroy says it is too early to declare victory over inflation, most monetary policy transmission is more or less over. Will not remark on the season for the next ECB move; but the next move should be a cut this year. Can see a soft landing in both Europe and the US. Estimates R to be around zero within the Euro-area.

- ECB's Centeno says ECB needs to be prepared for all topics, including rate cuts; says recent data confirmed Dec projections, but inflation was slightly below forecast. Inflation is coming down sustainably, should not be worried about resurgence of real wages. Q1 growth could remain around zero. Expects contained wage demand. Inflation trajectory is very positive at this point.

- ECB's Valimaki says inflation is on the right track but job is not done so restrictive monetary policy is still called for; must not jump the gun on rate cuts and best to wait a bit longer than exit prematurely. Soft landing for economy still the baseline but risks tilted towards downside. Wage data so far consistent with ECB's December projections.

- ECB's Nagel (hawk) says it's too early to discuss rate cuts as inflation remains too high, maybe the ECB can wait until after the summer break; markets are sometimes over optimistic - Bloomberg TV interview.

- ECB's Holzmann (hawk) says rate cut expectations are optimistic; shouldn't count on rate cuts at all in 2024 - CNBC interview.

- ECB's Herodotou says it is too soon to contemplate policy easing or the pace of easing - Econostream Media interview

- ECB's Lane, weekend remarks: will have key data by June to decide on rates and that changing rates too fast can be harmful, while he added that once the ECB begins lowering rates, this would not be by a single decision of a rate cut and there would likely be a sequence of rate cuts - Corriere Della Serra.

Geopolitics: Middle East

- Explosions were reported in different areas in Erbil, northern Iraq and in Syria, according to Al Arabiya IRGC said it attacked and destroyed the espionage headquarters of Israel's Mossad in Iraq's Kurdistan and it targeted Islamic State in Syria in response to the group’s recent terrorist attacks in Iran, according to Reuters.

- US State Department said the US strongly condemned Iran's attacks in Erbil on Monday, while US officials said no US facilities were impacted by missile strikes in Erbil, Iraq and there were no US casualties, according to Reuters.

- UK PM Sunak signalled the UK could participate in further strikes against Houthi rebels and told MPs that Britain will not hesitate to protect its interests where required, according to FT.

- Houthi military spokesman said they consider all American and British vessels and warships participating in aggression against them as hostile targets, according to Reuters.

- Iran’s Islamic Revolutionary Guard Corps commanders and advisors are on the ground in Yemen and playing a direct role in Houthi rebel attacks on commercial traffic in the Red Sea, according to SEMAFOR.

Geopolitics: Other

- Ukraine President Zelenskiy asked Switzerland to organise a high-level peace conference, while teams will start on plans today.

- North Korea decided to shut down organisations dealing with unification and inter-Korean tourism, while North Korean leader Kim said they do not want war but have no intention to avoid it. Furthermore, Kim said war will destroy South Korea and deal an unimaginable defeat to the US, according to KCNA.

- South Korean President Yoon said North Korea's recent missile launch and artillery firing are political acts to divide South Koreans and its provocations will be met with response on a multiplied scale, according to Reuters.

US Event Calendar

- 08:30: Jan. Empire Manufacturing, est. -5.0, prior -14.5

Central Bank Speakers

- 11:00: Fed’s Waller Speaks on Economic Outlook and Monetary Policy

DB's Jim Reid concludes the overnight wrap

As we go to print, we have 95% of the votes counted from the Iowa Caucus. Former President Donald Trump has easily won the first test of this election year with 51.1% of the vote so far, according to CNN. Florida Governor Ron DeSantis is in second place (21.2%) followed by a third-place finish for former South Carolina Governor Nikki Haley (19%). Also, Vivek Ramaswamy (7.7%), suspended his presidential campaign after a fourth-place finish. The polling averages in the state before the vote were Trump (53%), Haley (19%), and DeSantis (16%), so DeSantis has slightly outperformed.

The next stop is New Hampshire on Tuesday next we ek , where Haley is running in a strong second, with the current FiveThirtyEight polling average at Trump (43%), Haley (30%) and DeSantis (6%). Her campaign’s hope is they can win New Hampshire, and then also take the third contest in South Carolina on February 3 (where Haley was Governor from 2011-17).

Before the votes, yesterday was a lighter session for markets given the US holiday, but it was fairly negative where trading did take place, since European equities and bonds struggled after several ECB officials pushed back on the possibility of rate cuts. By the close, that meant the STOXX 600 was down -0.54%, whilst yields on 10yr bunds were also up +7.3bps to 2.23%. And that wasn’t just confined to Europe, as US futures markets were also pointing to bonds and equity losses there too. Overnight 2 and 10yr US yields are both +6bps higher and S&P and NASDAQ futures are -0.36% and -0.5% lower, respectively.

In terms of the comments, markets were partly reacting to an interview that had taken place on Saturday, with ECB chief economist Philip Lane. He warned that the “history of high inflation episodes tells us that if central banks try to normalise too quickly, before the problem is really conquered, then we get another inflation wave, and then another wave of interest rate hikes. That would be a far worse scenario.” So there was an open acknowledgement about the risks of easing prematurely, which is what happened in the 1970s and meant inflation became more entrenched as a result.

But it wasn’t just Lane who commented, as we also heard from some of the hawks on the ECB’s Governing Council, who similarly pushed back on the rate cut discussion. For instance, Bundesbank President Nagel said “I think it’s too early to talk about cuts”, and Austria’s Holzmann even said that “We should not bank on the rate cut at all for 2024.” Even Cyprus’ Herodotou, who’s been a more dovish voice, said that “Any discussion regarding the time and potency of the first rate cut, as well as the pace of further cuts thereafter, would be premature at the moment and would not constitute a data-dependent approach”. So there was a consistent message from various speakers on the hawk-dove spectrum that didn’t sound as though a Q1 rate cut was on the agenda.

All that meant investors grew more sceptical that the ECB would be cutting rates soon, and the likelihood of a cut by March fell to 29%, down from 43% on Friday. That was echoed more broadly as well, as the likelihood of a Fed cut by March fell from 83% on Friday to 74% by yesterday’s close, and the likelihood of a BoE cut by then was down from 35% to 31%. And in turn, that led to a sovereign bond sell-off across Europe, with yields on 10yr bunds (+4.8bps), OATs (+5.1bps) and BTPs (+7.3bps) all moving higher. 2yr bund and OATs were +6.1bps and +6.7bps higher respectively, so a slightly deeper inversion.

For equities it was much the same story, with the major indices across Europe all getting the week off to a rocky start. Indeed, for the STOXX 600 (-0.54%) it was the worst start to a week in over three months. That was echoed across the continent, with losses for the DAX (-0.49%), the CAC 40 (-0.72%) and the FTSE 100 (-0.39%). That came as the activity data we did get yesterday was fairly weak, with full-year German GDP growth for 2023 coming in at a contractionary -0.3%, in line with expectations. In fact, apart from the Covid pandemic year of 2020, that’s the weakest annual growth since 2009 as the economy faced the impact of the GFC. A technical recession was avoided though as Q3 was revised up a tenth to 0.0% with Q4 likely to be -0.3% when the flash is released on Jan 30th! It wasn’t all bad news, however, as European natural gas futures fell to their lowest level since August, with the front-month contract down to €29.92/MWh.

Asian equity markets are lower this morning with the Hang Seng (-1.92%) the biggest underperformer and with the Nikkei (-0.71%) also halting its record-breaking gains since the start of the year. Meanwhile, the KOSPI (-0.72%) is also losing ground while the CSI (-0.38%) and the Shanghai Composite (-0.62%) are also declining.

Early morning data showed that Japanese input prices were unchanged last month from a year earlier, marking its weakest reading in almost three years as the yen’s recent gains (now largely unwound) helped cap import costs. The expectation were for -0.3% though. They increased +0.3% m/m in December as against an upwardly revised gain of +0.3% in November and expectations for 0.0%.

To the day ahead now, and data releases include UK labour market data, Germany’s ZEW survey for January, Canada’s CPI for December, and the US Empire State manufacturing survey for January. From central banks, we’ll hear from BoE Governor Bailey, Fed Governor Waller and the ECB’s Villeroy. Lastly, earnings releases include Goldman Sachs and Morgan Stanley.