Death, taxes and the Biden admin reporting a stellar jobs beat... then revising it sharply lower one month later.

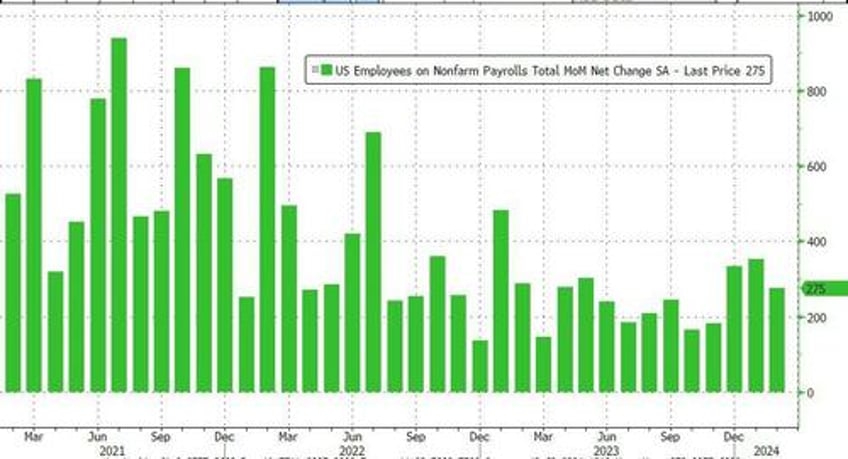

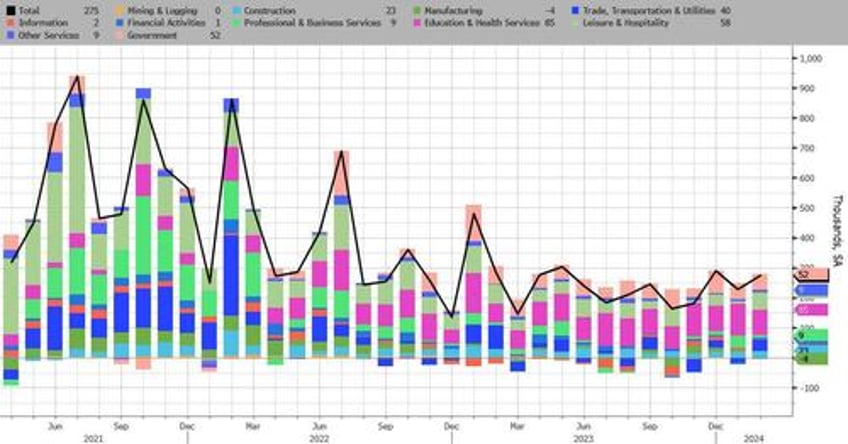

That was certainly the case moments ago when the BLS reported that in February a whopping 275K jobs were added, smashing both the median estimate of 200K and the whisper number of 215L. In fact, just one Wall Street forecaster - Seiji Katsurahata at Dai-Ichi - had a higher forecast at 286K.

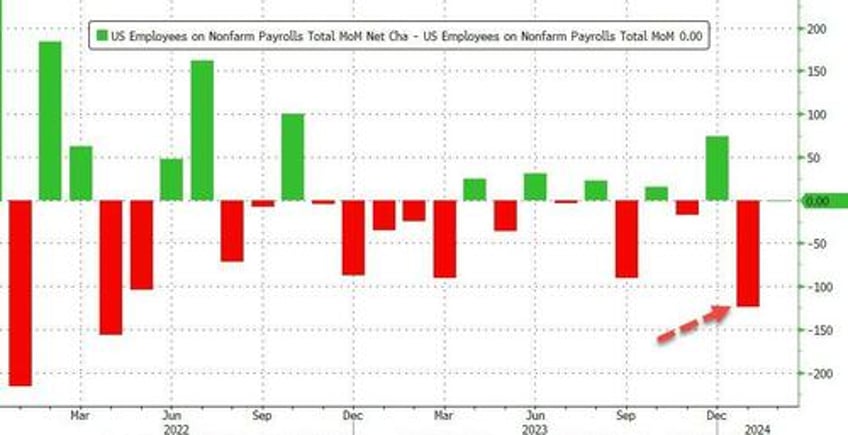

And while February was a strong print, it's just a placeholder until next month's downward revision: that's because January's blowout 353K print was revised sharply lower to just 229K, down by a whopping 35%.

However, as usual, there was an ugly divergence between the Establishment survey (payrolls) and the Household survey (actual number employed), which declined once again, sliding to 160.968 million from 161.152 million, or down 184,000.

This means that the divergence between Payrolls and Employment extended as more people are forced to take on more than one job.

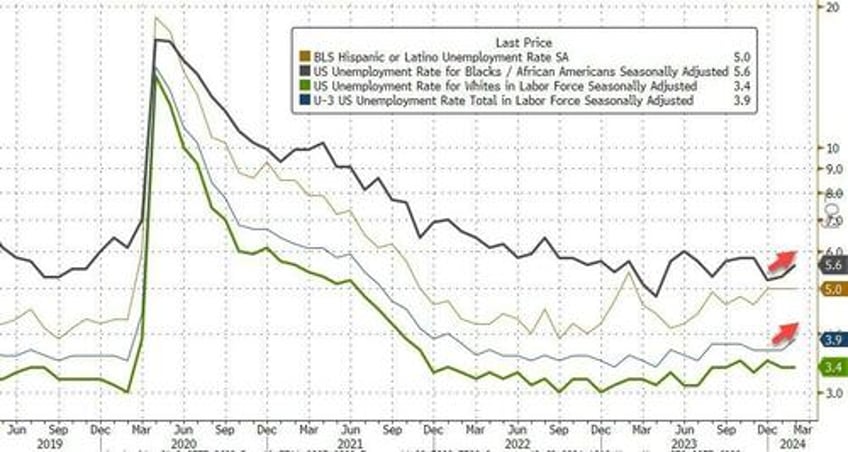

That wasn't the only problem with today's jobs report: despite the sharp jump in monthly payrolls, the unemployment rate unexpectedly rose to 3.9%, the highest since January 2022, vs estimates of a 3.7% unchanged print. Among the major worker groups, the jobless rates for Whites was unchanged at 3.4%, for Blacks rose 0.3% to 5.6%, Asians was flat at 3.4% as were Hispanics at 5.0%.

We also saw discrepancy between men and women. On International Women’s Day, the unemployment rate for adult women climbed by 0.3 percentage point, to 3.5%, while the jobless rate for men dipped. That said, the rates are now the same.

While the unemployment rate rose, the labor force participation rate was unchanged at 62.5%, disappointing expectations for a modest increase to 62.6%.

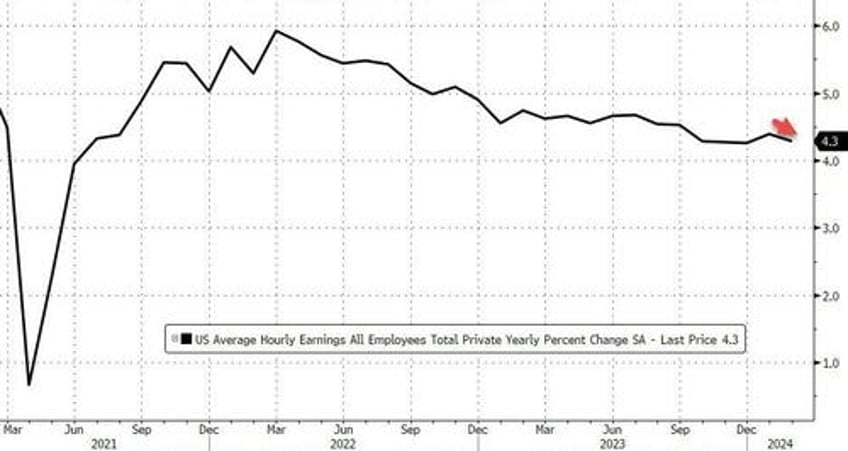

There was some more good news on the wage front, well if you are the Fed that is: the average hourly earnings growth dipped to 4.3% YoY from 4.4%, in line with expectations, while the monthly increase was just 0.1%, below the 0.2% estimate and down from a downward revised 0.5% print in January.

The average hourly earnings for all employees on private nonfarm payrolls edged up by 5 cents to $34.57, following an increase of 18 cents in January. Average hourly earnings were up by 0.1 percent in February and 4.3 percent over the year. In February, average hourly earnings of private-sector production and nonsupervisory employees edged up by 7 cents, or 0.2 percent, to $29.71.

In February, the average workweek for all employees on private nonfarm payrolls edged up by 0.1 hour to 34.3 hours, following a decline of 0.2 hour in January. In manufacturing, the average workweek was little changed at 39.9 hours, and overtime increased by 0.2 hour to 3.0 hours in February. The average workweek for production and nonsupervisory employees on private nonfarm payrolls increased by 0.3 hour to 33.8 hours, following a decline of 0.3 hour in January.

Taking a closer look at the job composition, we find that in February job gains occurred in health care, in government, in food services and drinking places, in social assistance, and in transportation and warehousing.

Some more details:

- Health care added 67,000 jobs in February, above the average monthly gain of 58,000 over the prior 12 months. In February, job growth continued in ambulatory health care services (+28,000), hospitals (+28,000), and nursing and residential care facilities (+11,000).

- Government employment rose by 52,000 in February, about the same as the prior 12-month average gain (+53,000). Over the month, employment continued to trend up in local government, excluding education (+26,000) and federal government (+9,000).

- Employment in food services and drinking places increased by 42,000 in February, after changing little over the prior 3 months.

- Social assistance added 24,000 jobs in February, about the same as the prior 12-month average gain of 23,000. Over the month, job growth continued in individual and family services (+19,000).

- Employment in transportation and warehousing rose by 20,000 in February. Couriers and messengers added 17,000 jobs, after losing 70,000 jobs over the prior 3 months. In February, job growth also occurred in air transportation (+4,000), while warehousing and storage lost 7,000 jobs.

- Employment continued to trend up in construction (+23,000), in line with the average monthly gain of 18,000 over the prior 12 months. Over the month, heavy and civil engineering construction added 13,000 jobs.

- Retail trade employment changed little in February (+19,000). Over the month, job gains in general merchandise retailers (+17,000); health and personal care retailers (+6,000); and automotive parts, accessories, and tire retailers (+5,000) were partially offset by job losses in building material and garden equipment and supplies dealers (-6,000) and electronics and appliance retailers (-2,000).

- Employment showed little change over the month in other major industries, including mining, quarrying, and oil and gas extraction; manufacturing; wholesale trade; information; financial activities; professional and business services; and other services.

Commenting on the report, Bloomberg economics chief Ana Galvao writes that “the combination of a mild upside surprise to payrolls but an unexpected increase in the unemployment rate muddles the picture for markets. BE’s Macro-Finance SHOK model suggests forecasts for Treasury yields would be little changed.”

And here is Capital Economics, which - very naively - had the second lowest payrolls forecast for February as if the Biden admin would ever admit the ugly truth: “The downward revisions to previous months gains leave recent growth looking less strong than previously thought. Alongside the rise in the unemployment rate to a two-year high and a much weaker rise in wages, there is less reason now to be concerned that renewed labor-market strength will drive inflation higher again.”

One thing is certain: markets loved the print with futures spiking to a new all time high and the dollar sliding to a new one-month low, as the BLS mandate of doing everything in its power to push markets ever higher until the election - reality and facts be damned - comes into full view. As for the reality, the following chart showing the correlation between private payrolls and the NFIB survey's Small Business hiring plans (because in America it's the small business that are responsible for most of the hiring), should tell you all you need to know.