USDJPY extended its decline overnight as BoJ rate-hike rumors continued to build.

Reuters reports that the Bank of Japan is warming to the idea of raising interest rates and considering a new quantitative monetary policy framework.

Specifically, Jiji news agency reported on Friday that the BoJ is reviewing its Yield Curve Control framework and considering a new framework that will show the outlook for upcoming government bond buying amount (reportedly mulling buying nearly 6tln of JGBs under new quantitative policy framework).

As we detailed here, recent wage gains and optimism that this year's annual wage negotiations will yield strong results, have seen a growing number of BoJ policymakers to support ending negative interest rates this month, four sources familiar with its thinking said.

"The yen is rising as speculation mounts that the BoJ will buck the global central bank trend and hike interest rates later this month," said Kathleen Brooks, research director at XTB.

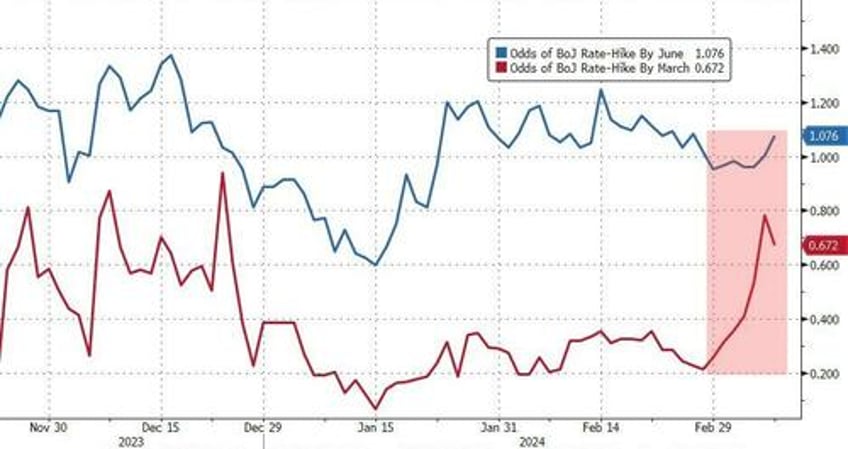

The market is now fully pricing in a BoJ rate-hike by June and a 65-80% chance of a hike at the next meeting in March...

Source: Bloomberg

Interestingly, this morning's (apparently 'bad') payrolls print prompted dollar-selling (more yen strength), erasing all of the Japanese currency's losses since the last payrolls print (which was massively revised lower)...

Source: Bloomberg

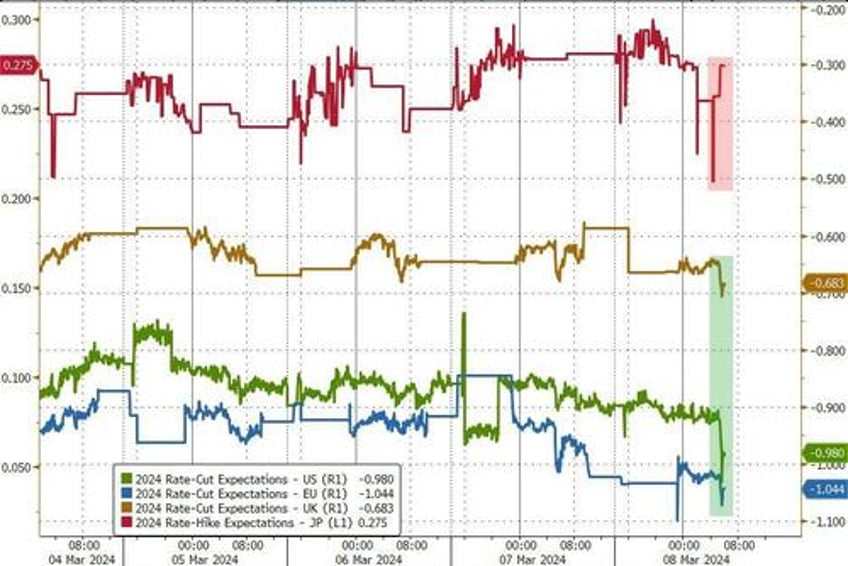

Today's "bad" jobs data prompted a jump in rate-cut expectations for The Fed, The ECB, and The BoE...

Source: Bloomberg

"In the short term, a powerful downtrend seems to be building for USD/JPY, and we believe that this pair could test 145.00," Brooks added, especially if now that we have seen a moderation in U.S. payrolls growth.