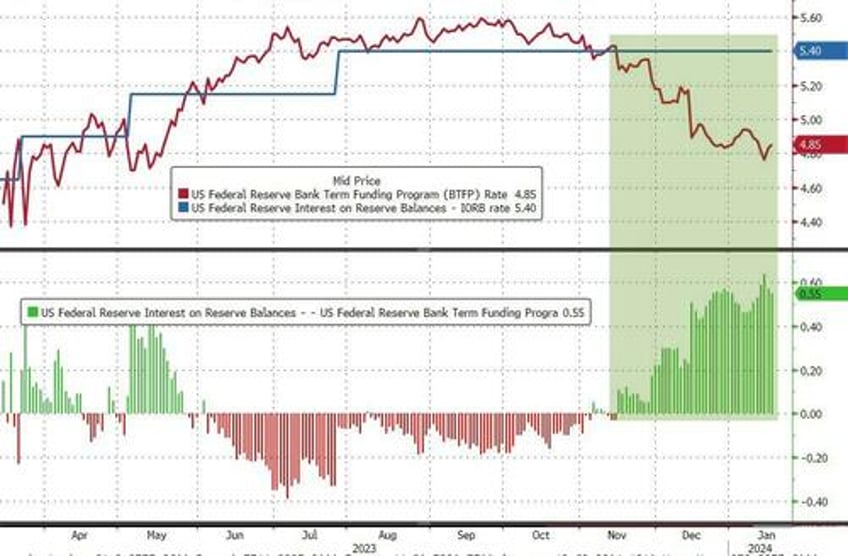

With The Fed having practically lost control of their bank bailout facility (BTFP) due to banks pilings 10s of billions into a free-money arbitrage in recent weeks (enabled since Powell pivoted)...

Source: Bloomberg

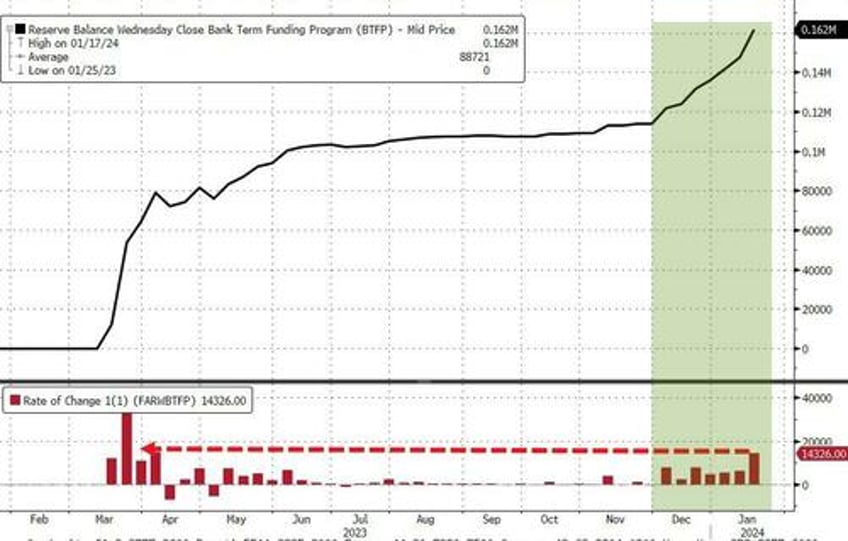

...it was no surprise they pushed back a little yesterday, hoping to encourage (wean off) banks to use the discount window instead - because the $161BN BTFP will go extinct in March.

Source: Bloomberg

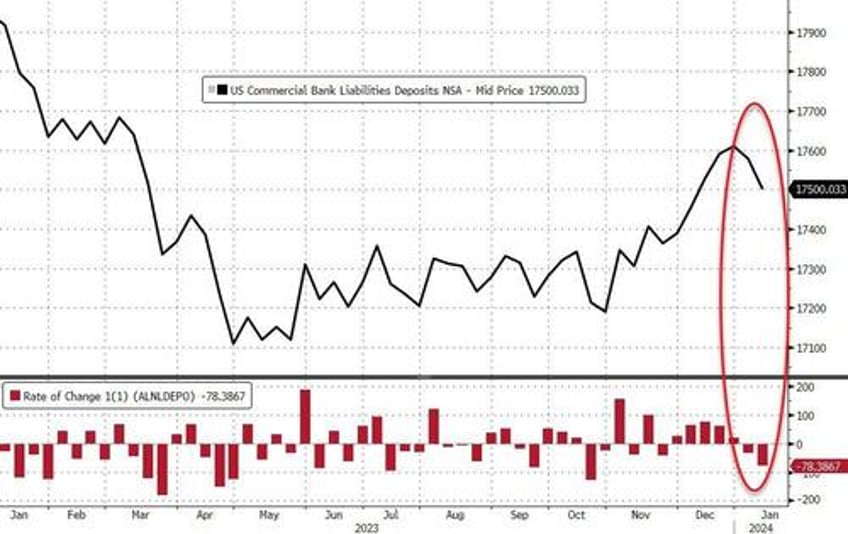

Amid all this free-money for the banks, total deposits (seasonally-adjusted) fell for the second week in a row (down $12.3BN)...

Source: Bloomberg

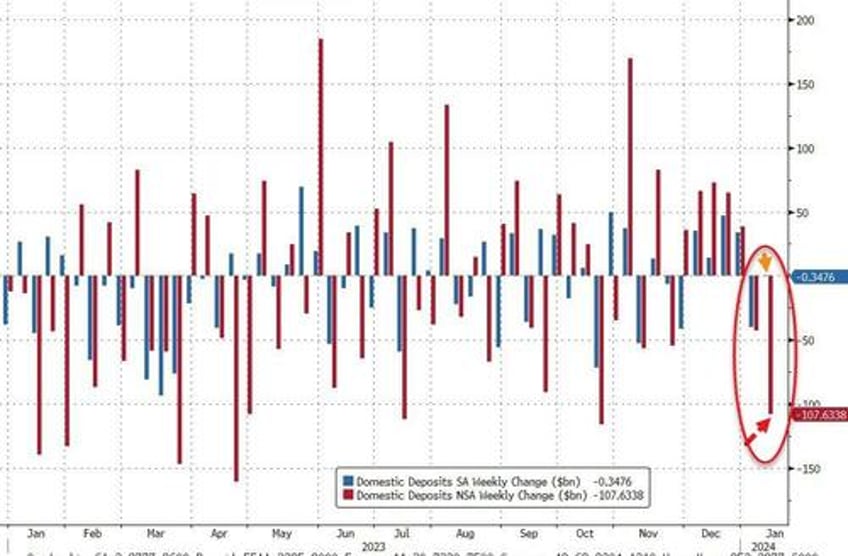

On a non-seasonally-adjusted basis, banks have seen deposit outflows of $111BN in the first two weeks of 2024...

Source: Bloomberg

And Fed Fuckery is back on display...

Excluding foreign banks, Domestic bank deposits plunged $107BN (NSA) last week (Large banks MSA -$87.3BN, Small banks NSA -$20.3BN), while they were practically unchanged on an SA basis -$348MN (Large banks SA +5.13BN, Small banks SA -$5.48BN)...

Source: Bloomberg

Interestingly, since NSA domestic deposits reached their pre-SVB levels, they have seen major outflows...

Source: Bloomberg

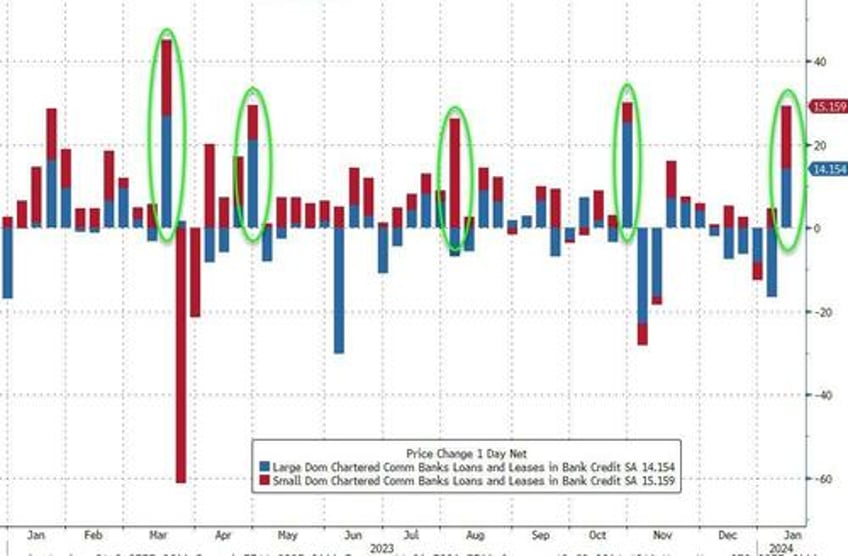

On the other side of the ledger, loan volumes surprisingly (given the deposit outflows) surged back last week with large bank loan volumes up $14.2BN (the first rise in loans in 6 weeks) while Small Banks saw loan volumes up $15.2BN on the week...

Source: Bloomberg

All of which means - as we pointed out previously - "March will be lit"...

March will be lit:

— zerohedge (@zerohedge) January 8, 2024

1. Reverse repo ends

2. BTFP expires

3. Fed cuts (allegedly)

4. QT ends (allegedly)

Because without the help of The Fed's BTFP, the regional banking crisis is back bigly (red line), and large bank cash needs a home - green line - like picking up a small bank from the FDIC...

Source: Bloomberg

And now you know why The Fed will cut rates in March - no matter what jobs or inflation is doing.