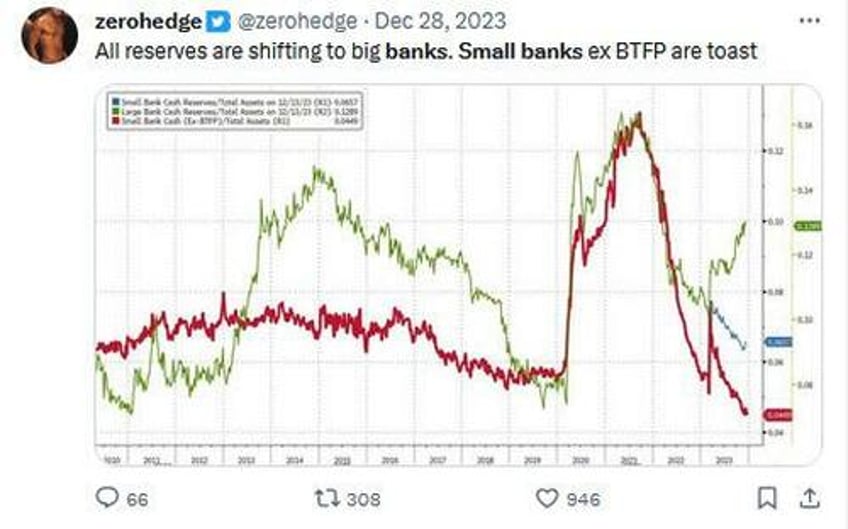

While Wall Street's interest in the banking sector promptly peaked and then fizzled after the March bank failures and BTFP bailout, we continued to keep track of bank deposit and liquidity data weekly, sharing updates with our readers week after week. Why did we do this? Simple: because as we concluded in late December, "all reserves are shifting to big banks" and that without access to the BTFP "small banks toast."

The reason why this was critical was laid out in another ZH post: as we said at the start of December in the "Sudden Spike In SOFR Hints At Mounting Reserve Shortage, Early Restart Of QE", the rapidly shrinking liquidity across the banking sector - and especially small banks - resulted in a sudden spasm in funding markets which pushed the SOFR - RRP spread to the highest since Jan 2021...