The Federal Reserve held interest rates steady at the September FOMC meeting, but the committee indicated that it plans to hold rates higher for longer than originally projected.

As you digest the Fed meeting, it’s important to remember that there is a big difference between “saying” and “doing.”

While the Fed didn’t raise rates this month, it indicated that it plans to hike one more time this year.

The FOMC was widely expected to stand pat this month. The question was how will the central bankers proceed in the months ahead. Based on projections released after the meeting, the Fed is leaning toward keeping monetary policy restrictive for longer.

As a Reuters article put it, the Fed “stiffened its hawkish stance.”

The official FOMC statement was virtually identical to the one issued after the July meeting.

“The Committee will continue to assess additional information and its implications for monetary policy. In determining the extent of additional policy firming that may be appropriate to return inflation to 2 percent over time, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.”

The committee also stuck to its “data dependent” mantra, saying it will “continue to monitor the implications of incoming information for the economic outlook” and adjust monetary policy if “risks emerge that could impede the attainment of the Committee’s goals.”

The Committee’s assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.”

In a nutshell, the Fed continued to give itself plenty of wiggle room to justify any action it takes in the future.

During his post-meeting press conference, Federal Reserve Chairman Jerome Powell said the committee is “in a position to proceed carefully in determining the extent of additional policy firming.” But he also said the committee members would like to see more progress in its inflation fight.

We want to see convincing evidence really that we have reached the appropriate level, and we’re seeing progress and we welcome that. But, you know, we need to see more progress before we’ll be willing to reach that conclusion.”

The CPI came in hotter than expected in August, throwing some cold water on the disinflation narrative.

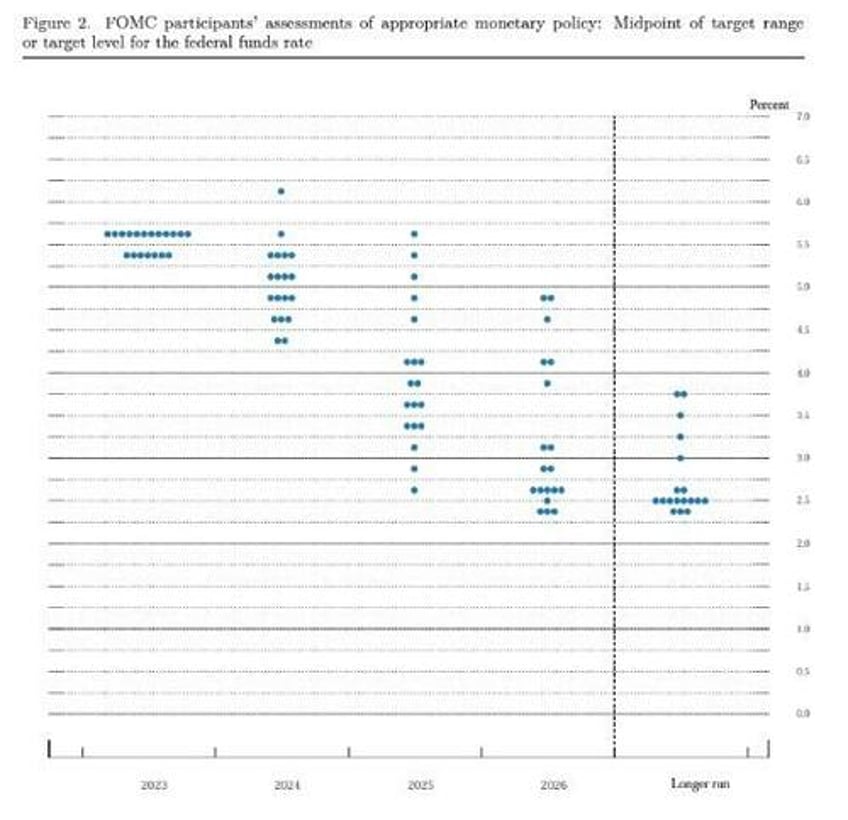

While there were no surprises in policy or official rhetoric, the so-called “dot-plot” released by the committee was slightly more hawkish than the one released after the June meeting.

Twelve FOMC members indicated that they expect one additional hike this year while seven opposed it.

Meanwhile, committee members projected two rate cuts in 2024. That’s two fewer than the June forecast and would put rates around 5.1% at the end of 2024. Over the longer term, FOMC members projected rates to come in around 2.9% in 2026.

Powell indicated that optimism about the economy was driving the anticipation of fewer cuts next year more than worry about persistent price inflation.

The FOMC statement said, “The committee characterized economic activity as “expanding at a solid pace,” and the Fed upped its economic forecast significantly, projecting GDP to increase 2.1% this year. That’s more than double the 1% estimate from June. They expect growth to slow to 1.5% next year, up from June’s 1.1% projection. Any talk of a recession is completely out of the discussion.

Broadly, stronger activity means we have to do more with rates, and that’s what that meeting is telling you.”

Saying Isn’t Doing

Powell and Company say they will raise rates one more time. And they say they will leave rates higher for longer. But saying and doing are two different things.

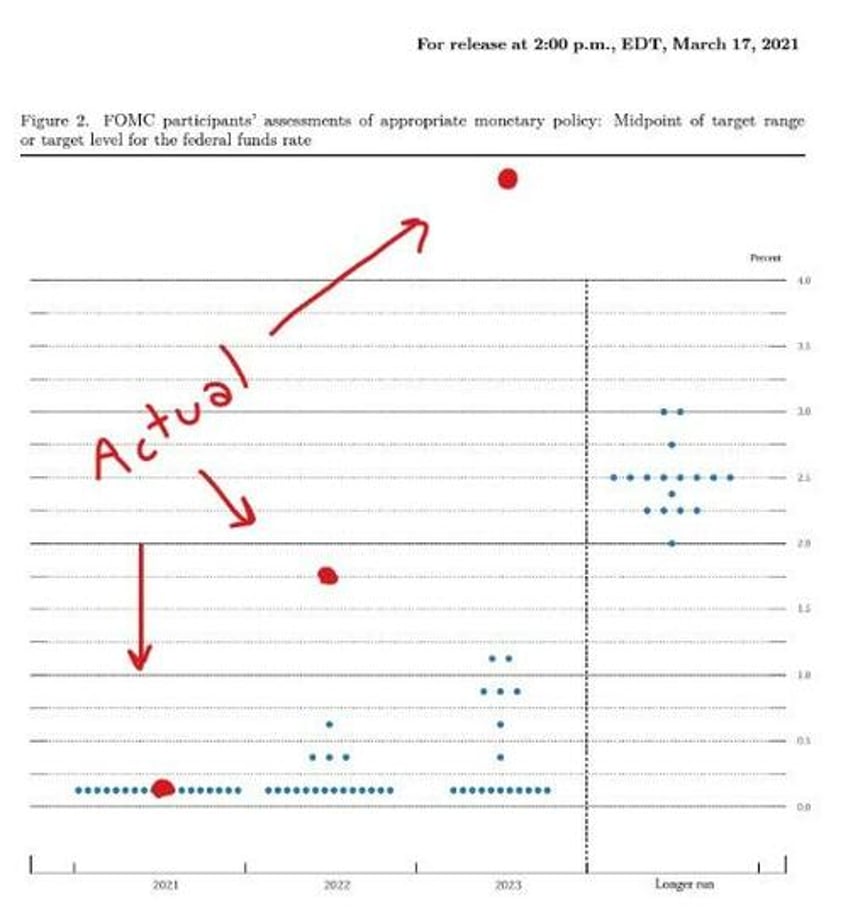

In fact, the Fed’s track record at projecting the trajectory of interest rates is abysmal. The central bankers would likely offer more accurate projections if they just threw darts at a dart board.

According to fund manager David Hay, the Fed has only gotten interest rate projections right 37% of the time. And as Hay pointed out, “They control interest rates!”

Just consider that in March 2021, the FOMC projected the interest rate would still be zero in 2022. The actual 2022 rate was 1.75%. And in 2023, the vast majority of FOMC members thought the rate would still be zero percent. The actual rate – over 5%.

This is just one example of how horribly wrong the Fed has been. I can cite other examples.

Remember back in 2006 when the central bankers insisted there was no housing bubble? Then when things started to unravel, they promised the problem was contained to subprime.

In 2008, Ben Bernanke launched quantitative easing and swore that it wasn’t debt monetization. He said the Fed would sell all of the bonds it planned to buy once the emergency was over. Today, virtually all of those bonds remain on the Fed’s balance sheet.

It’s almost like the Fed people are wrong about everything.

So, why should we put any stock at all in the most recent dot-plot or the Fed’s economic projections?

The problem is the central bankers are disconnected from reality. This also seems typical. Remember “transitory” inflation?

The point here is there is no reason to believe anything Powell and Company said today or to think their musings will aid in projecting the central bank’s next moves. Given the Fed’s track record, it’s more likely that rates will be at zero by the end of next year and the US economy will be in the clutches of a deep recession.

The fact is the Fed can afford to be hawkish as long as the economy is limping along with no obvious hiccups. The real test will come when something breaks in the economy.

And something will break with interest rates at 5.5%. It’s just a matter of time.

As the saying goes, things happen slowly and then all at once.

Interest rates are higher than they were in June 2006, the peak of that hiking cycle that burst the housing bubble. The Fed held them there until Bernanke cut rates in September 2007 when home sales started to collapse. In other words, rates are currently at levels that set off the 2008 financial crisis and the Great Recession. The difference is today we have even more debt and malinvestments in the economy. One has to wonder why anybody thinks things will turn out differently this time.

Consider this; the last time rates were this high, the national debt was a mere $5.6 trillion. Today the debt stands at over $33 trillion and the federal government is running huge deficits month after month.

Meanwhile, there were more corporate defaults through the first six months of 2023 than we had in all of ’22, and “healthy” American consumers have blown through their savings and have turned to using credit cards with 20 percent-plus interest rates to make ends meet.

The fact is the Federal Reserve has screwed up everything that is a function of interest rates. Rate hikes have already precipitated a financial crisis. Despite the Fed’s insistence that “the US banking system is sound and resilient,” we’ve already witnessed three major bank failures. The Fed’s bank bailout papered over those problems and plugged that hole in the dam (Banks are still getting bailout money.), but it’s only a matter of time before something else breaks. (Commercial real estate is a good candidate.)

Cuts are coming, no matter how tough Powell talks today, or what the rest of his crew put on a dot plot. It doesn’t matter what they say. It’s all about what they do.