After the post rate-cut meltup sent stocks to record highs on Thursday - even though the S&P was actually flat during the cash session with all gains taking place during the Asian/European sessions...

... the sweet taste of victory for the bulls was diluted moments ago when one of the most important logistic bellwethers for the US economy left a proverbial turd in the punchbowl after Fedex stock tumbled as much as 11% after hours when it cut the top end of its full-year profit outlook and reported quarterly earnings below expectations on softer demand for package deliveries.

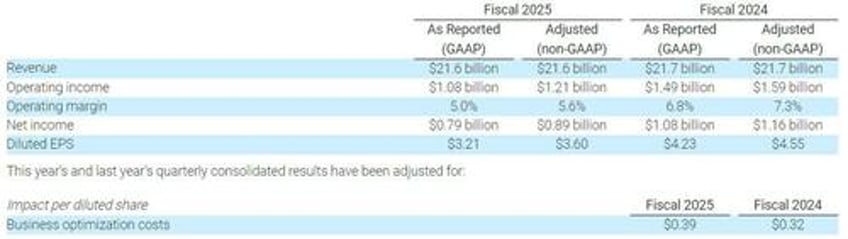

This is what FedEx reported for fiscal Q1:

- Revenue $21.6 billion, missing estimates of $21.93 billion

- Adjusted EPS $3.60, down from $4.37 YoY, and missing estimates of $4.77

- Adjusted operating income $1.21 billion, missing estimate $1.63 billion

- Adjusted operating margin 5.6%, missing estimate 7.41%

The company said that Q1 results were negatively affected by a mix shift, which reduced demand for priority services, increased demand for deferred services, and constrained yield growth. In addition, higher operating expenses and one fewer operating day negatively affected the quarter’s results. A reduction of structural costs from the company’s DRIVE program initiatives partially offset these factors.

“Despite a challenging quarter, we remain focused on transforming our network, improving our efficiency, lowering our cost-to-serve, and enhancing our ability to adapt with speed to evolving market dynamics,” said Raj Subramaniam, FedEx Corp. president and chief executive officer. “Overall, I remain confident in the value-creation opportunities ahead as we focus on reducing our structural cost, growing revenue profitably, and leveraging the insights from our vast collection of data as we continue to build the world’s most flexible, efficient and intelligent network.”

While not as ugly as the Q1 miss, the fiscal 2025 guidance was also cut, as follows:

- A low single-digit percentage revenue growth rate year over year, compared to the prior forecast of a low-to-mid single digit percentage increase;

- Adjusted EPS of $20.00 to $21.00 compared to the prior forecast of $20.00 to $22.00 per share

- Capital spending of $5.2 billion, same as the previous forecast and below the consensus estimate of $5.26 billion.

- Permanent cost reductions from the DRIVE transformation program of $2.2 billion;

“Our revised outlook reflects our continued confidence in the execution of our DRIVE initiatives and the effects of our recent pricing actions, which we expect to help offset weaker-than-expected demand trends,” said John Dietrich, FedEx Corp. executive vice president and chief financial officer. “We will continue to manage our capital prudently, and remain committed to our plan to return $3.8 billion to stockholders this fiscal year.”

Well aware the market would throw up all over its earnings, the company also announced it completed a $1 billion accelerated share repurchase (ASR) transaction during the quarter (approximately 3.4 million shares were delivered under the ASR agreement, with the decrease in outstanding shares benefiting first quarter results by $0.03 per diluted share) and also annnounced a new stock repurchase program for an additional $1.5 billion of common stock during fiscal 2025, for a buyback total of $2.5 billion. However, that was not enough, and the stock plunged as much as 11% after hours, before stabilizing some 9% lower, and erasing virtually all the stock price gains since its much better than expected Q4 earnings report 3 months ago...

... and in doing so, confirming that there was nothing unexpected about Powell's "emergency/crisis" 50bps rate cut.