House hunters are keeping a close eye on the 30-year mortgage rate, trending over 7%, as home prices continue rising to new record highs. The combination of high rates and elevated home prices has sparked the worst affordability conditions in nearly four decades, a harsh reality for millions of Americans.

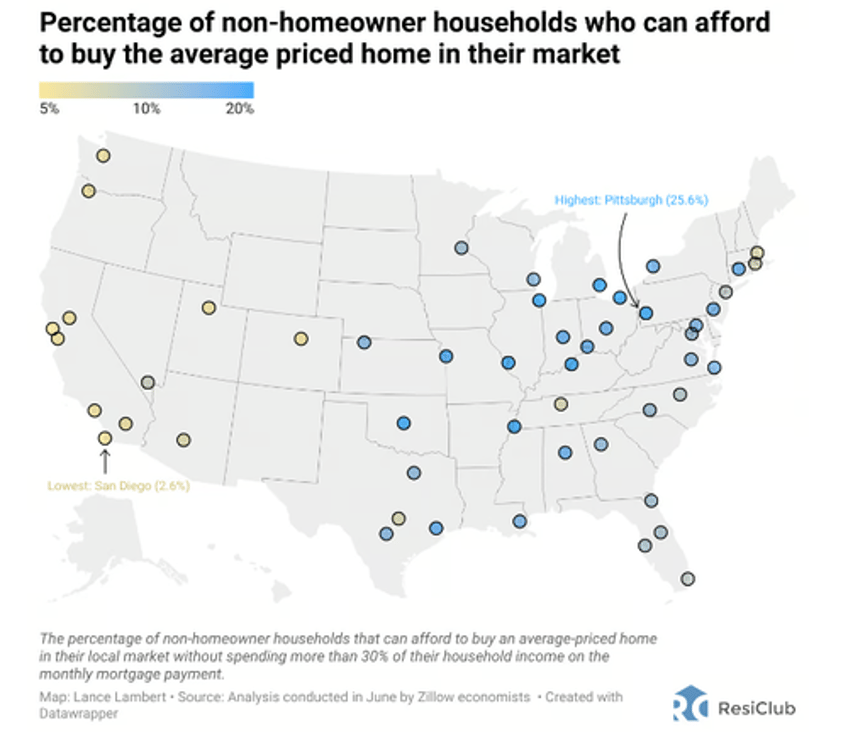

A new report from real estate research firm ResiClub analyzed Zillow data, revealing the five most affordable and unaffordable housing markets among the fifty largest metro areas.

Let's begin with the five markets with the highest percentage of non-homeowner households who can afford the purchase of an average-priced home in their market:

Pittsburgh, PA (25.6%)

Detroit, MI (23.1%)

St. Louis, MO (22.6%)

Oklahoma City, OK (22.5%)

Cleveland, OH (22.4%)

Pittsburgh and Detroit might not be glamorous metro areas—full of deindustrialization and crime—but a family may have a better shot at finding an affordable home than many metro areas located on the West Coast.

As for the five markets that have the lowest percentage of non-homeowner households who can afford the purchase of an average-priced home in their market... Many are located in California:

San Diego, CA (2.6%)

San Jose, CA (2.7%)

Los Angeles, CA (2.8%)

San Francisco, CA (3.7%)

Salt Lake City, UT (3.8%)

ResiClub pointed out that a whopping 52.3 million out of 134 million US families do not own a home. Given the tight lending conditions, only 7.9 million, or 15.1%, can afford to buy an average-priced home in their local market.

We must note that the supply of available homes recently increased to 481,000, which is still the highest level since 2008.

And noted a week ago, "The Housing Tide Starts Turning: National Inventory Rose 4% In Q1 2024," as well as numerous notes about rising housing inventory, including this one: "Housing Downturn in Austin, Texas Is "Remarkable" As Inventory Spikes To Record High."