Our latest housing note showed May's US existing home sales data slumped for the third consecutive month while prices hit a record high. This highlights the ongoing affordability crisis in the housing market, with a 30-year mortgage interest rate of around 7%. However, there is evidence that home buyers might soon find some relief as inventories nationwide increase.

Let's jump right into our latest housing note from Friday:

The supply of homes on the market increased 18.5% from the same month last year to 1.28 million, but it's still well below the level seen before the pandemic when mortgage rates were much lower.

"Eventually, more inventory will help boost home sales and tame home price gains in the upcoming months," NAR Chief Economist Lawrence Yun wrote in a statement.

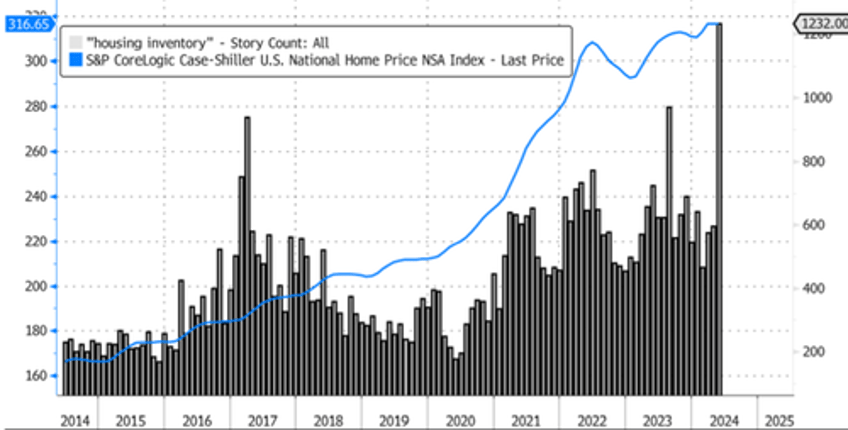

According to Bloomberg data, the number of corporate media news stories featuring "housing inventory" has surged this month to a record high of 1,232, with data going back to 2014. This may suggest that inventory is coming online in certain parts of the country.

A simple Google News search for "housing inventory" shows several stories detailing rising inventory trends city by city.

Drilling down into the inventory story, Nick Gerli, CEO and Founder of real estate analytics firm Reventure Consulting, pointed out Austin, Texas' inventory has "now spiked to the highest level on record."

Gerli said, "Values down nearly 20% already and could have another 15% decline to go."

The downturn in Austin, TXs housing market is remarkable.

— Nick Gerli (@nickgerli1) June 21, 2024

Inventory has now spiked to the highest level on record.

More than 25% higher than the previous, pre-pandemic high.

And the listings just keep coming.

Values down nearly 20% already and could have another 15% decline… pic.twitter.com/Jb8UOSZG0A

"Austin is remarkable because only two years ago, most housing analysts believed this market wouldn't crash. They believed the Kool-Aid of "everyone is moving to Austin." It's becoming the Silicon Valley, etc. But it was always obvious that this market would crash," he said.

1) Austin is remarkable because only 2 years ago, most housing analysts believed this market wouldn't crash.

— Nick Gerli (@nickgerli1) June 21, 2024

They believed the Kool-Aid of "everyone is moving to Austin". It's becoming the Silicon Valley, etc.

But it was always obvious that this market would crash.

Gerli continued, "Back in May 2022, Austin's Housing Market hit a 50% overvaluation rate. Typical home value of $556k v fair home value of $365k based on local incomes. Locals were completely priced out of the market. And once the inevitable slowdown in inbound migration came, the market would obviously correct."

2) Here's why it was obvious.

— Nick Gerli (@nickgerli1) June 21, 2024

Back in May 2022, Austin's Housing Market hit a 50% overvaluation rate.

Typical home value of $556k v fair home value of $365k based on local incomes.

Locals were completely priced out of the market. And once the inevitable slowdown in inbound… pic.twitter.com/QLooh3hxDC

He said home prices in the metro area have dropped about 20% over the past two years, and further downside is expected.

3) The downturn in prices in Austin over the last two years (about -20%) combined with some income growth has now made the market only 15% overvalued in 2024.

— Nick Gerli (@nickgerli1) June 21, 2024

Meaning that most of the pain in terms of the correction is likely over.

However, there is still more downside to…

More pain to come.

4) Now - prices in Austin *could* drop by even more, below the long-term norm, if there is a corresponding recession that leads to lots of job losses.

— Nick Gerli (@nickgerli1) June 21, 2024

In that scenario, like what happened from 2007-2012, we can see prices drop further than you would anticipate.

So that's…

This is important.

5) One thing that's important for you to do as a buyer or investor is track that overvaluation % in your market.

— Nick Gerli (@nickgerli1) June 21, 2024

The more overvalued prices are, the greater the likelihood of a) declines or b) stagnant appreciation.

The most overvalued housing markets in America are… pic.twitter.com/TvWA1xmqcG

"Note that if a housing market is overvalued, it isn't guaranteed to crash," he said, adding, To facilitate big declines in prices, there needs to be a corresponding spike in inventory and price cuts. As well as selling pressure from owners."

7) Note that if a housing market is overvalued, it isn't guaranteed to crash.

— Nick Gerli (@nickgerli1) June 21, 2024

To facilitate big declines in prices, there needs to be a corresponding spike in inventory and price cuts. As well as selling pressure from owners.

If those things don't happen, a market can stay…

Gerli concluded, "If those things don't happen, a market can stay overvalued, and eventually become fairly valued through income growth."