Since the last FOMC meeting on September 18th, bonds have suffered a bloodbath while gold, stocks, and the dollar are all up modestly...

Source: Bloomberg

Despite the apparent dovish pivot, the market's expectations for rate-cuts (this year and next) has plunged dramatically...

Source: Bloomberg

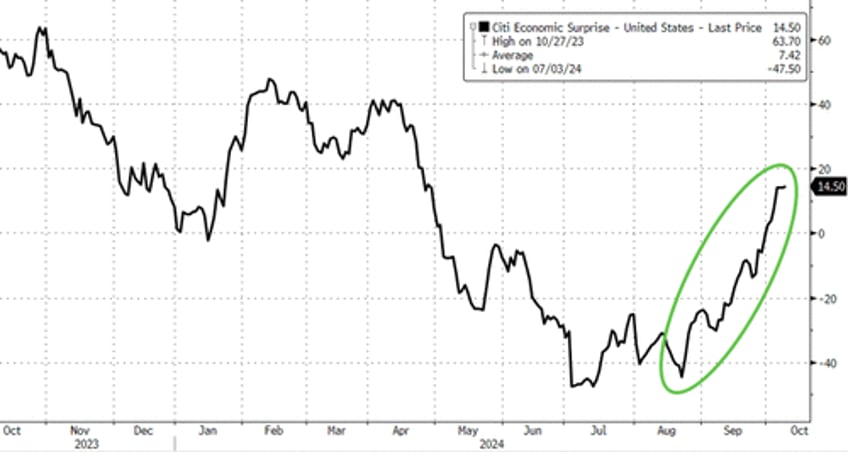

This should not come as a huge surprise as Powell's raison d'etre for major rate cuts evaporated as US macro data has surged higher, surprising to the upside almost non-stop...

Source: Bloomberg

It's hard to justify slashing rates any further in the face of that macro backdrop without exposing the 'political' decision-making process behind The Fed's move.

So, now we see the Minutes - what exactly is it that The Fed wants us to believe they are thinking?

Despite there only being one dissent against the 50bps cut (Michelle Bowman), The Fed Minutes suggest that the members are considerably more divided than headlines suggested...

Given the significant progress made since the Committee first set its target range for the federal funds rate at 5-1/4 to 5-1/2 percent, a substantial majority of participants supported lowering the target range for the federal funds rate by 50 basis points to 4-3/4 to 5 percent. These participants generally observed that such a recalibration of the stance of monetary policy would begin to bring it into better alignment with recent indicators of inflation and the labor market. They also emphasized that such a move would help sustain the strength in the economy and the labor market while continuing to promote progress on inflation, and would reflect the balance of risks.

Some participants noted that there had been a plausible case for a 25 basis point rate cut at the previous meeting and that data over the intermeeting period had provided further evidence that inflation was on a sustainable path toward 2 percent while the labor market continued to cool. However, noting that inflation was still somewhat elevated while economic growth remained solid and unemployment remained low, some participants observed that they would have preferred a 25 basis point reduction of the target range at this meeting, and a few others indicated that they could have supported such a decision.

Several participants noted that a 25 basis point reduction would be in line with a gradual path of policy normalization that would allow policymakers time to assess the degree of policy restrictiveness as the economy evolved.

A few participants also added that a 25 basis point move could signal a more predictable path of policy normalization.

A few participants remarked that the overall path of policy normalization, rather than the specific amount of initial easing at this meeting, would be more important in determining the degree of policy restriction. Participants judged that it was appropriate to continue the process of reducing the Federal Reserve's securities holdings.

Breaking down some specific topics...

ECONOMY

- Participants generally noted it was important to communicate decisions are conditional on evolution of economy, implications for balance of risks and therefore not on a preset course.

ECONOMIC OUTLOOK

Staff outlook for the September meeting was for the economy to remain 'solid': though the forecast for growth in H2 24 was 'marked' down reflecting softer-than-expected labor indicators.

"Those who commented on the degree of restrictiveness of monetary policy observed that they believed it to be restrictive, though they expressed a range of views about the degree of restrictiveness. "

EMPLOYMENT

- "..., and most remarked that the downside risks to employment had increased,"

Finally on INFLATION:

"With regard to the outlook for inflation, almost all participants indicated they had gained greater confidence that inflation was moving sustainably toward 2 percent. Participants cited various factors that were likely to put continuing downward pressure on inflation. These included a further modest slowing in real GDP growth, in part due to the Committee's restrictive monetary policy stance; well-anchored inflation expectations; waning pricing power; increases in productivity; and a softening in world commodity prices"

"Several participants noted that nominal wage growth was continuing to slow, with a few participants citing signs that it was set to decline further. These signs included lower rates of increases in cyclically sensitive wages and data indicating that job switchers were no longer receiving a wage premium over other employees. A couple of participants remarked that, with wages being a relatively large portion of business costs in the services sector, that sector's disinflation process would be particularly assisted by slower nominal wage growth."

"In addition, several participants observed that, with supply and demand in the labor market roughly in balance, wage increases were unlikely to be a source of general inflation pressures in the near future. With regard to housing services prices, some participants suggested that a more rapid disinflationary trend might emerge fairly soon, reflecting the slower pace of rent increases faced by new tenants."

This with home prices and rents at all time high, and Longshoremen just getting a 62% wage hike

ForexLive's Greg Michalowski highlights the broad use of the same quantity identifiers in the Minutes:

1. A Few

- A few participants suggested that firms remained reluctant to lay off workers after having difficulty obtaining employees earlier in the post-pandemic period.

- A few participants also added that a 25 basis point move could signal a more predictable path of policy normalization.

- A few participants remarked that the overall path of policy normalization, rather than the specific amount of initial easing at this meeting, would be more important in determining the degree of policy restriction.

2. Some

- Some participants noted, however, that labor market conditions remained solid, as layoffs had been limited and initial claims for unemployment insurance benefits had stayed low.

- Some participants stressed that, rather than using layoffs to lower their demand for labor, businesses had instead been taking steps such as posting fewer openings, reducing hours, or making use of attrition.

- Some participants remarked that reducing policy restraint too soon or too much could risk a stalling or a reversal of the progress on inflation.

- Some participants noted that there had been a plausible case for a 25 basis point rate cut at the previous meeting.

3. Several

- Several participants noted that nominal wage growth was continuing to slow.

- Several participants emphasized the importance of continuing to use disaggregated data or information provided by business contacts as a check on readings on labor market conditions obtained from aggregate data.

- Several participants remarked that reducing policy restraint too soon or too much could risk a stalling or a reversal of the progress on inflation.

- Several participants observed that with supply and demand in the labor market roughly in balance, wage increases were unlikely to be a source of general inflation pressures in the near future.

- Several participants discussed the importance of communicating that the ongoing reduction in the Federal Reserve's balance sheet could continue for some time even as the Committee reduced its target range for the federal funds rate.

- Several participants remarked that reducing policy restraint too late or too little could risk unduly weakening economic activity and employment.

4. Many

- Many participants remarked that the recent inflation data were consistent with reports received from business contacts, who had indicated that their pricing power was limited or diminishing and that consumers were increasingly seeking discounts.

- Many participants also observed that inflation developments in the second and third quarters of 2024 suggested that the stronger-than-anticipated inflation readings in the first quarter had been only a temporary interruption of progress toward 2 percent.

- Many participants emphasized that they expected that real GDP would grow at roughly its trend rate over the next few years.

- Many participants observed that the evaluation of labor market developments had been challenging, with increased immigration, revisions to reported payroll data, and possible changes in the underlying growth rate of productivity cited as complicating factors.

- Many participants remarked that the recent inflation data were consistent with reports from businesses indicating that pricing power was diminishing.

5. Most

- Most respondents had a modal expectation of a 25 basis point cut at this meeting.

- Most survey respondents did not appear to be concerned about an economic downturn in either the near or medium term.

- Most remarked that the downside risks to employment had increased.

6. Almost All

- Almost all participants judged that recent monthly readings had been consistent with inflation returning sustainably to 2 percent.

- Almost all participants expressed greater confidence that inflation was moving sustainably toward 2 percent.

- Almost all participants agreed that the upside risks to inflation had diminished.

- Almost all participants agreed that the upside risks to inflation had diminished, and most remarked that the downside risks to employment had increased.

- Almost all members agreed that to appropriately reflect cumulative developments related to inflation and the balance of risks, the postmeeting statement should note that they had gained greater confidence that inflation was moving sustainably toward 2 percent.

7. A Substantial Majority

- A substantial majority of participants supported lowering the target range for the federal funds rate by 50 basis points to 4-3/4 to 5 percent.

Read the full Minutes below...