The flash US PMIs for April are released today and will give the first concrete indication of how far upheaval in the markets has damaged sentiment.

A set of weak PMIs increases the risk of further falls in stocks (and, EM style, possibly bonds and the dollar too), compounding negative sentiment.

The stock market’s resilience continues to be tested, with the latest salvo an increasing concern that Trump is angling to de facto take charge of monetary policy himself. Stocks were already contending with tariffs and increasingly jumpy foreign capital. Before that, though, excess liquidity had begun to weaken notably, leaving equities without a safety net and more exposed to erratic policymaking.

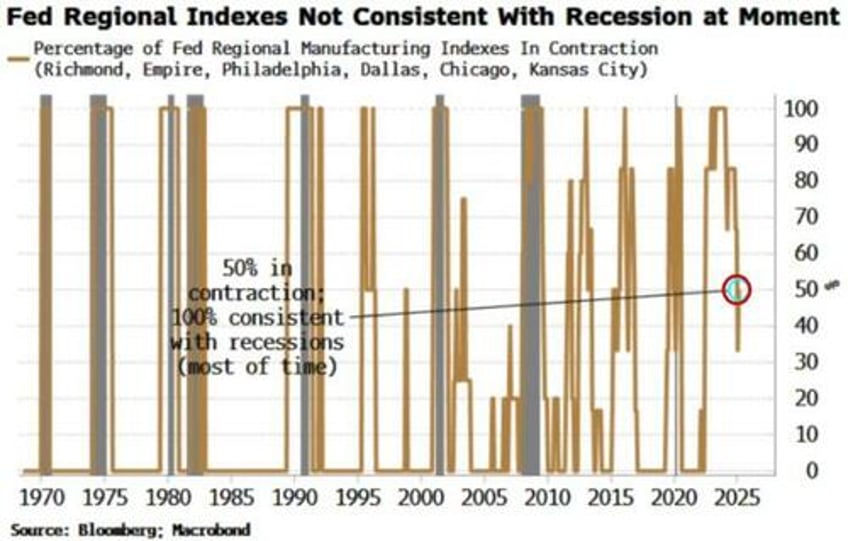

Stocks are currently down about 16% from their highs, but they would face much more downside if a recession struck. From a hard data point of view, that risk in the near term remains low. The Philadelphia Fed indicator created a bit of a stir last week when it came out much weaker than expected, but it’s wildly volatile, and in the context of the other Fed regional indexes, recession risk is not high and has been falling.

But if sentiment really started to weaken, all bets are off. The flash PMIs this week will give us the first tangible indication.

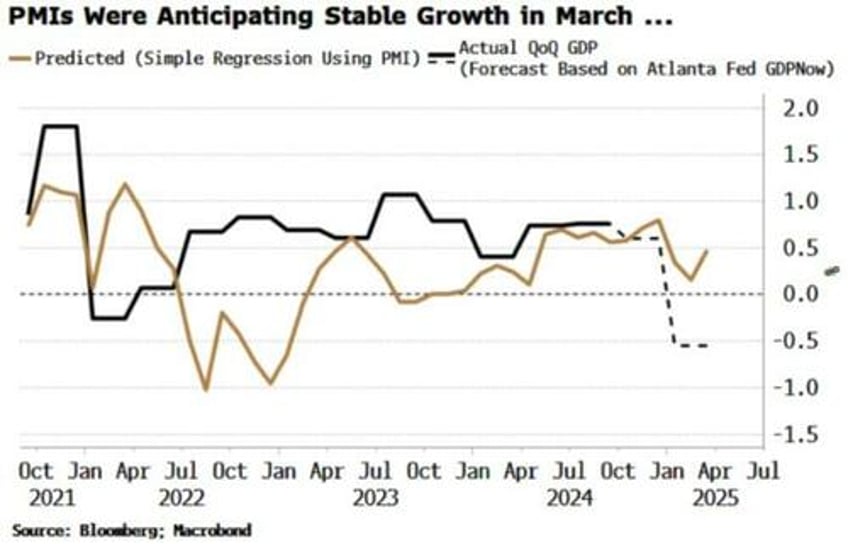

The PMIs as of March were anticipating fairly stable growth, more than the Atlanta Fed’s forecast, which has been weighed down by gold imports (which are excluded from the official GDP data).

The Bloomberg survey is expecting the composite PMI to see only a fairly modest drop to 52.2 in April versus 53.5 in March. However, if purchasing managers are much more downbeat than that given the disorder created by US tariff policy, expect stocks to selloff more. And if they pay less attention to the PMIs (which the market tends to do), then they will likely listen to the ISMs when they come out in early May (assuming of course there has been no further U-turns, zigzags or backflips in policy).

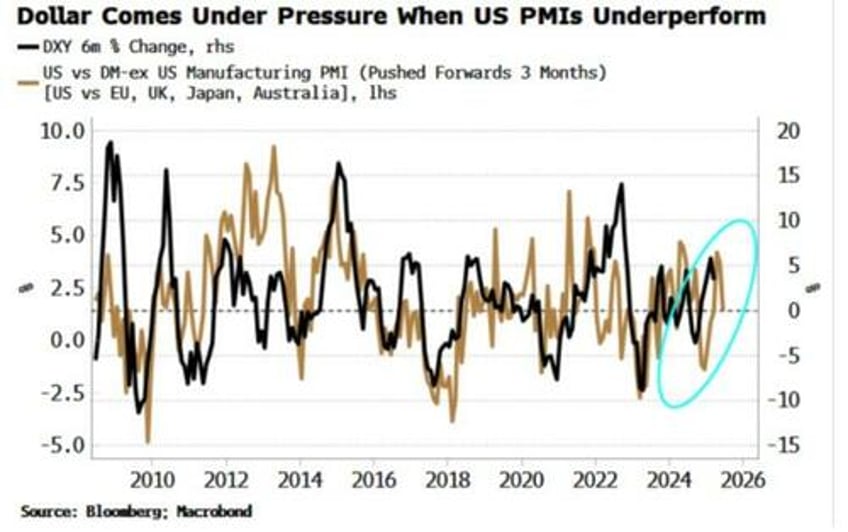

Weaker PMIs and ISMs in the current environment of the Federal Reserve’s political independence under threat (its operational independence has already in practice been compromised), the dollar - the most vulnerable of the “Trump trades” - is poised to come under more pressure.

Typically when US PMIs underperform DM PMIs, as they are doing now, this leads to dollar weakness.