- APAC stocks traded with a mild positive bias after the gains on Wall St where a downward payrolls revision and the FOMC Minutes further supported the consensus for a September Fed rate cut.

- FOMC Minutes from the July meeting continued to point to a September move as a vast majority of participants said it would likely be appropriate to ease policy at the next meeting if data continued to come in as expected.

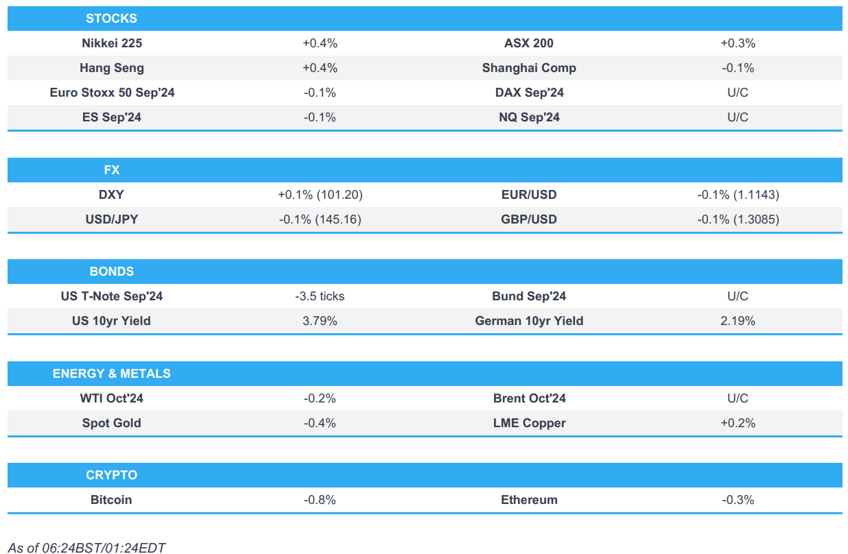

- DXY nursed some losses after retreating yesterday to briefly beneath the 101.00 level, USD/JPY rebounded and reclaimed the 145.00 status, and EUR/USD trickled back from a fresh YTD high following its fourth consecutive daily gain.

- Gaza truce talks have reached an impasse, according to Sky News Arabia citing Times of Israel; Israeli PM Netanyahu said they are ready for any scenario, whether in defence or attack in the face of near and far threats, according to Al Jazeera.

- Looking ahead, highlights include EZ, UK & US PMIs, EZ Negotiated Wages (Q2), US IJC, NZ Retail Sales, Jackson Hole Symposium, ECB Minutes, US Democratic Convention, Supply from US, Earnings from Swiss Re, Hays, Ross, Intuit & Workday.

- Click for the Newsquawk Week Ahead.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks edged higher on what was a choppy session, although the gains in the major indices and the bull steepening in Treasuries were ultimately facilitated by the downward BLS Payrolls revision and after the FOMC Minutes from the July meeting continued to point to a September move as a vast majority of participants said it would likely be appropriate to ease policy at the next meeting if data continued to come in as expected.

- SPX +0.42% at 5,621, NDX +0.53% at 19,825, DJIA +0.13% at 40,890, RUT +1.32% at 2,171.

- Click here for a detailed summary.

FOMC MINUTES

- FOMC Minutes said the vast majority of participants at the July 30th-31st meeting said it would likely be appropriate to ease policy at the next meeting if data continued to come in as expected, and participants viewed incoming data as enhancing their confidence that inflation was moving towards the 2% objective.

- A majority of participants said risk to the employment goal has increased and many noted risks to the inflation goal decreased, while several participants said recent progress on inflation and increases in the unemployment rate provided a 'plausible case' for a 25bps cut at July's meeting or that they could have supported such a move. Furthermore, many participants noted that easing policy too late or too little could unduly weaken economic activity or employment and several participants said reducing policy restraint too soon or too much could risk a reversal of progress on inflation.

APAC TRADE

EQUITIES

- APAC stocks traded with a mild positive bias after the gains on Wall St where a downward payrolls revision and the FOMC Minutes further supported the consensus for a September Fed rate cut.

- ASX 200 edged higher but with gains capped as participants digested a slew of earnings, while data showed an improvement across Australia's flash PMIs although manufacturing remained in contraction.

- Nikkei 225 marginally outperformed its peers and returned to above the key 38,000 level.

- Hang Seng and Shanghai Comp. were somewhat varied with notable strength in Hong Kong tech stocks after a solid earnings report from Xiaomi, although pharmaceutical stocks and WuXi biologics were at the other end of the spectrum after the latter reported a 24% drop in H1 net, while the mainland remained lacklustre amid growth concerns, trade frictions and a net liquidity drain.

- US equity futures were rangebound and took a pause after yesterday's mild gains.

- European equity futures indicate an uneventful open with Euro Stoxx 50 futures down 0.1% after the cash market finished higher by 0.6% on Wednesday.

FX

- DXY nursed some losses after retreating yesterday to briefly beneath the 101.00 level (to a 100.92 low) with headwinds from the negative payrolls revision and after the FOMC Minutes all but cemented a September rate cut.

- EUR/USD trickled back from a fresh YTD high following its fourth consecutive daily gain.

- GBP/USD marginally softened after failing to sustain a brief foray into 1.3100 territory.

- USD/JPY rebounded and reclaimed the 145.00 status but with further upside limited after recent fluctuations, while participants await the Jackson Hole Symposium and BoJ Governor Ueda's appearance in parliament on Friday where he is set to face a grilling following the market turmoil earlier this month.

- Antipodeans marginally softened following recent advances and lacklustre commodity prices.

FIXED INCOME

- 10-year UST futures slightly eased back following the prior day's bull steepening which was ultimately spurred by the downward payrolls revision and after the FOMC Minutes pointed to a September rate cut.

- Bund futures faded some of their recent gains after hitting resistance at the 135.00 level.

- 10-year JGB futures lacked demand amid the absence of pertinent drivers and with prices also not helped by the weaker results at the enhanced liquidity auction for long-end JGBs.

COMMODITIES

- Crude futures remained lacklustre after this week's selling pressure despite the ongoing geopolitical uncertainty and larger-than-expected drawdown in the latest inventory data.

- Spot gold marginally weakened after recent indecision to test the USD 2,500/oz level to the downside.

- Copper futures took a breather following yesterday's rebound and as sentiment in China lagged.

CRYPTO

- Bitcoin prices were pressured and retreated to beneath the USD 61,000 level.

NOTABLE ASIA-PAC HEADLINES

- BoK kept its base rate unchanged at 3.50% as expected, with the decision made unanimously. BoK said it will examine the proper timing of rate cuts and said confidence is greater that inflation will converge on the target level, while it dropped the phrase 'sufficient period of time' in saying it will maintain a restrictive policy stance. BoK Governor Rhee said inflation conditions are appropriate for a cut and that four board members said room for a rate cut should remain open although Rhee also stated that rising financial stability risks warranted the BoK's decision to hold rates today. Furthermore, Rhee said the pace and extent of an interest rate cut in South Korea will be smaller than that of the US and noted the BoK is communicating with markets using a three-month horizon forward guidance but also stated that forward guidance doesn't guarantee a rate cut.

DATA RECAP

- Japanese JibunBK Manufacturing PMI Flash SA (Aug) 49.5 (Prev. 49.1)

- Japanese JibunBK Services PMI Flash SA (Aug) 54.0 (Prev. 53.7)

- Japanese JibunBK Composite Op Flash SA (Aug) 53.0 (Prev. 52.5)

- Australian Judo Bank Manufacturing PMI Flash (Aug) 48.7 (Prev. 47.5)

- Australian Judo Bank Services PMI Flash (Aug) 52.2 (Prev. 50.4)

- Australian Judo Bank Composite PMI Flash (Aug) 51.4 (Prev. 49.9)

GEOPOLITICAL

MIDDLE EAST

- Gaza truce talks have reached an impasse, according to Sky News Arabia citing Times of Israel.

- Israeli PM Netanyahu said they are ready for any scenario, whether in defence or attack in the face of near and far threats, according to Al Jazeera.

- US President Biden spoke with Israeli PM Netanyahu to discuss the ceasefire and hostage release deal with diplomatic efforts to de-escalate regional tensions, while Vice President Harris also joined the call. It was later reported that Biden stressed to Netanyahu the urgency of bringing the ceasefire and hostage deal to closure and discussed upcoming talks in Cairo to remove any remaining obstacles, according to the White House.

- Israeli PM Netanyahu's office denied a report that the PM agreed to withdraw troops from the Philadelphi corridor and said Israel insists on all objectives for the Gaza war including securing the southern border.

- Israeli forces besiege Tulkarm refugee camp east of the city in the West Bank, while it was also reported that the Israeli army launched raids on 10 areas in Lebanon.

- Israel is expected to retaliate in a "strong manner" to Hezbollah striking the city of Katzrin in the Golan Heights with 50 rockets, according to Kann News.

- US officials said to believe that Iranian leaders have decided to postpone the response to Haniyeh's assassination but fear that Tehran will urge Hezbollah to attack, according to The Washington Post.

- US military announced on Wednesday that the USS Abraham Lincoln entered the Central Command area of responsibility in the Middle East, according to Iran International.

OTHER

- A fire broke out at a military facility in Russia's Volgograd region after a drone crashed into it, according to Interfax.