- APAC stocks traded somewhat mixed albeit with a mostly positive bias among the major indices following the two-way price action across global markets owing to hot US CPI data and geopolitical optimism.

- US President Trump posted on Truth that he had a lengthy and highly productive phone call with Russian President Putin, and they agreed to have their respective teams start negotiations immediately. Trump then said he spoke to Ukrainian President Zelensky and the conversation went very well.

- US President Trump did not sign reciprocal tariffs order on Wednesday after stating that he may, while the White House schedule showed President Trump is to sign executive orders on Thursday at 13:00EST/18:00GMT.

- Fed Chair Powell offered a note of caution on the latest CPI reading and said the Fed targets PCE inflation, which is a better measure, and stated they will know what PCE readings are late on Thursday after the PPI data.

- European equity futures indicate a higher cash market open with Euro Stoxx 50 futures up by 1.1% after the cash market closed with gains of 0.3% on Wednesday.

- Looking ahead, highlights include German Final CPI, UK GDP Estimate and Services, Swiss CPI, US Jobless Claims, PPI, IEA OMR, Supply from Italy & US, Comments from ECB's Cipollone.

- Earnings from Datadog, Baxter, Deere, Duke Energy, GE Healthcare, PG&E, Coinbase, Draftkings, Applied Materials, Airbnb, Palo Alto, Roku, Wynn, Siemens, Delivery Hero, Commerzbank, Nestle, Orange, British American Tobacco, Unilever, Barclays & Moncler.

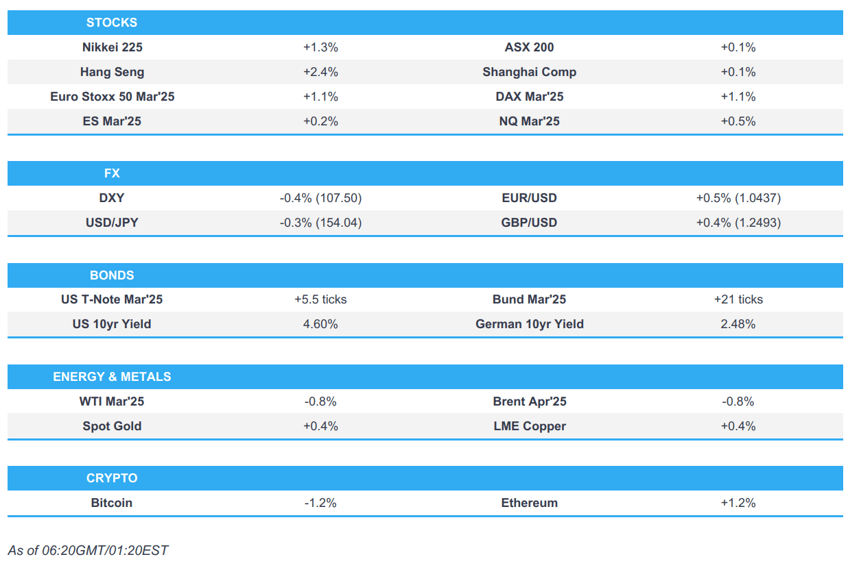

SNAPSHOT

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

LOOKING AHEAD

- Highlights include German Final CPI, UK GDP Estimate and Services, Swiss CPI, US Jobless Claims, PPI, IEA OMR, Supply from Italy & US, Comments from ECB's Cipollone,

- Earnings from Datadog, Baxter, Deere, Duke Energy, GE Healthcare, PG&E, Coinbase, Draftkings, Applied Materials, Airbnb, Palo Alto, Roku, Wynn, Siemens, Delivery Hero, Commerzbank, Nestle, Orange, British American Tobacco, Unilever, Barclays & Moncler.

- Click for the Newsquawk Week Ahead.

US TRADE

EQUITIES

- US stocks finished mixed with two-way price action seen as firmer-than-expected CPI data initially sparked a broad-based hawkish reaction which underpinned the dollar and weighed on treasuries and stock index futures.

- However, the moves in the greenback and stocks were then pared throughout the session with the NDX closing in the green and DXY flat but Treasuries held on to their weakness, with the reversals facilitated by the more positive Russia-Ukraine rhetoric after US President Trump spoke to both Russian President Putin and Ukrainian President Zelensky, separately, about ending the war.

- SPX -0.27% at 6,052, NDX +0.12% at 21,719, DJIA -0.50% at 44,369, RUT -0.87% at 2,256

- Click here for a detailed summary.

TARIFFS

- US President Trump did not sign reciprocal tariffs order on Wednesday after stating that he may, while the White House schedule showed President Trump is to sign executive orders on Thursday at 13:00EST/18:00GMT.

- White House Press Secretary responded that she believes reciprocal tariff will come before Indian PM Modi's visit on Thursday and she will let the President discuss details on the reciprocal tariffs front.

- US House speaker Johnson said he believes the White House is considering exemptions to reciprocal tariffs including autos and pharmaceuticals.

- South Korea is to discuss tariffs on Chinese steel plates on February 20th, according to Yonhap.

NOTABLE HEADLINES

- Fed Chair Powell said they want to see more progress on inflation and did not see much progress on core inflation last year but have the luxury of being able to wait for that, given a strong economy. Furthermore, he offered a note of caution on the latest CPI reading and said the Fed targets PCE inflation which is a better measure, and stated they will know what PCE readings are late on Thursday after the PPI data.

- Fed's Goolsbee (2025 voter) said if they have multiple months like this on CPI, then the job is clearly not done and the latest inflation read is "sobering" while he also said the inflation data is concerning but added it is just one month.

- Fed's Bostic (2027 voter) said the labour market is performing incredibly well and the latest inflation numbers show careful monitoring is still needed. Bostic stated if the economy evolves as expected, could get to 2% inflation in early 2026 and at that point would want to be close to neutral with neutral likely around 3.0%-3.5%, while he added that perhaps they could get further towards neutral this year but is less confident when on the next step will come. Bostic also stated that patience suggests the next cut will happen later in order to have time to get more information and he would not be comfortable moving again on rates until there is more clarity on the direction of the economy.

- US House Speaker Johnson believes Republicans will have the votes to pass the newly unveiled budget resolution.

- About 75,000 federal workers accepted the Trump administration’s deferred buyout program, according to an official.

APAC TRADE

EQUITIES

- APAC stocks traded somewhat mixed albeit with a mostly positive bias among the major indices following the two-way price action across global markets owing to hot US CPI data and geopolitical optimism.

- ASX 200 touched a record high with advances led by the mining sector following results from South32 and Northern Star.

- Nikkei 225 climbed on the back of recent currency weakness despite the firmer-than-expected PPI data from Japan.

- Hang Seng and Shanghai Comp saw mixed price action as the Hong Kong benchmark extended its recent strong upward momentum, while the mainland traded cautiously as participants continued to await Trump's reciprocal tariffs.

- US equity futures eked mild gains after having recovered from post-CPI lows but with the upside limited as attention turns to PPI.

- European equity futures indicate a higher cash market open with Euro Stoxx 50 futures up by 1.1% after the cash market closed with gains of 0.3% on Wednesday.

FX

- DXY ultimately weakened after the prior day's fluctuations despite the initial boost following the firmer-than-expected US CPI report. The data sparked a broad hawkish reaction although the moves were gradually reversed as market focus turned to the positive geopolitical updates regarding Russia and Ukraine following a phone call between US President Trump and Russian President Putin where they agreed to start negotiations to end the war and was then followed by a call between Trump and Ukrainian President Zelensky. Furthermore, attention was also on Fed Chair Powell's testimony which offered little new by way of monetary policy or the economy, although he did touch on January's CPI report and stated they are still not there on inflation.

- EUR/USD extended on its recent rebound against the dollar and reclaimed the 1.0400 handle with the single currency underpinned by optimism regarding the Russia-Ukraine war.

- GBP/USD remained firmer and climbed to just shy of the 1.2500 handle heading into the latest UK GDP data.

- USD/JPY took a breather above the 154.00 level after yesterday's advances which coincided with higher US yields, while upward momentum was capped overnight following the firmer-than-expected Japanese PPI data.

- Antipodeans gained but with the upside capped as participants still await the touted US reciprocal tariffs, while the latest New Zealand inflation expectations were mixed and had little effect on the current market pricing of a coin flip between a 25bps or 50bps cut to the OCR from the current 4.25% level at next week's RBNZ meeting.

- PBoC set USD/CNY mid-point at 7.1719 vs exp. 7.3000 (prev. 7.1710).

- BoC Minutes stated the Governing Council agreed a protracted trade conflict with the US would permanently cut the level of Canadian GDP and agreed that in this case, Canadian GDP growth would be reduced until the economy adjusted to tariffs. BoC Minutes also stated that even if no tariffs were imposed, the GC felt a long period of uncertainty would almost certainly damage business investment.

FIXED INCOME

- 10yr UST futures attempted to nurse some of the recent losses after slumping beneath the 109.00 level in reaction to the firmer-than-expected US CPI data and with demand contained following the soft 10yr auction stateside.

- Bund futures partially clawed back some lost ground but remained firmly beneath the 133.00 level after global yields climbed on the back of the hot US inflation data, while prices were also not helped after recent bund supply.

- 10yr JGB futures languished near contract lows after declining in tandem with global peers and following firmer-than-expected Japanese PPI.

COMMODITIES

- Crude futures remained pressured after retreating yesterday amid reports that US President Trump conducted calls with Russian President Putin and Ukrainian President Zelensky about ending the war.

- Spot gold gradually edged higher after rebounding from yesterday's trough to back above the USD 2,900/oz level, while the recent fluctuations in the precious metal coincided with the swings in the greenback.

- Copper futures eventually extended on recent advances amid the mostly constructive risk environment.

- Polish EU Presidency said EU member states are determined to protect the European steel and aluminium sector against possible market destabilisation.

CRYPTO

- Bitcoin was ultimately pressured and eventually slipped beneath the USD 97,000 level.

- ECB's Nagel said Bitcoin is not the kind of liquid thing you want on your balance sheet and should be very cautious.

NOTABLE ASIA-PAC HEADLINES

- US private equity groups invested billions of dollars in data centres serving ByteDance, according to FT.

DATA RECAP

- Japanese Corp Goods Price MM (Jan) 0.3% vs. Exp. 0.3% (Prev. 0.3%, Rev. 0.4%)

- Japanese Corp Goods Price YY (Jan) 4.2% vs. Exp. 4.0% (Prev. 3.8%, Rev. 3.9%)

- New Zealand Inflation Forecast 1 Yr (Q1) 2.15% (Prev. 2.05%)

- New Zealand Inflation Forecast 2 yrs (Q1) Q1 2.06% (Prev. 2.12%)

GEOPOLITICS

RUSSIA-UKRAINE

- US President Trump posted on Truth that he had a lengthy and highly productive phone call with Russian President Putin and they agreed to have their respective teams start negotiations immediately, while he will begin by calling Ukrainian President Zelensky. Trump said they discussed Ukraine, the Middle East, energy, AI, the power of the dollar, and various other subjects, while they agreed to work together, very closely, including visiting each other’s countries. Furthermore, Trump asked Secretary of State Rubio, CIA Director Ratcliffe, National Security Advisor Waltz, and Ambassador and Special Envoy Steve Witkoff, to lead the negotiations which Trump strongly feels will be successful.

- US President Trump posted on Truth that he spoke to Ukrainian President Zelensky and the conversation went very well, while he added that Zelensky like Putin, wants to make peace.

- US President Trump thinks they are on the way to peace with Russia and Ukraine, while he added that Putin wants to see the war end as well and he expects to ultimately meet with Putin, probably in Saudi Arabia. Trump added that he doesn't think it is practical for Ukraine to have NATO membership and it is unlikely Ukraine will get all its land back. Furthermore, Trump said US Treasury Secretary Bessent is going to Ukraine to make sure they get money back and noted that he is backing Ukraine but wants security for their money.

- Russia’s Kremlin confirmed President Putin and US President Trump held a phone call in which they discussed the Middle East, Ukraine, and bilateral relations, while Putin invited Trump to meet him in Moscow. Russia's Kremlin earlier stated that Russia will never discuss swapping Ukrainian territory it controls, or the area Ukraine holds in the Kursk region, and that Ukrainian forces will be driven out of Kursk.

- Ukrainian President Zelensky’s office said Zelensky had a call with US President Trump and the call lasted about an hour, while Zelensky said he had a meaningful call with Trump and talked about opportunities to achieve peace. Furthermore, they discussed the preparation of a new document on security, economic cooperation and resource partnership.

- Chinese officials in recent weeks have floated a proposal to the Trump team through intermediaries to hold a summit between US President Trump and Russian President Putin and to facilitate peacekeeping efforts in Ukraine after an eventual truce, according to WSJ.

- Germany, France, the UK, the European Commission, and others express readiness to enhance support for Ukraine and commit to its independence, while it was separately reported that UK Defence Minister Healey said it is for Ukraine to decide when to begin negotiations and on what terms.

- Polish Foreign Minister said Poland will continue unwavering support for Ukraine and reinforce sanctions before potential talks with Russia.

- Romanian Defence Ministry said radar detected drone breaches of its territory in Russian overnight attack on Ukraine.

MIDDLE EAST

- Israel conveyed a message to Hamas that if they abide by the agreement and release the three hostages on Saturday, Israel will also continue to implement the agreement for its part, according to Axios citing an Israeli official.

- US intelligence agencies concluded during the final days of the Biden administration that Israel is considering significant strikes on Iranian nuclear sites this year and is aiming to take advantage of Iran’s weakness, according to WSJ.It was separately reported that Israel is likely to attempt a strike on Iran’s nuclear program in the coming months in a preemptive attack that would set back Tehran’s program by weeks or perhaps months, according to Washington Post citing a US intelligence report.

- US President Trump's hostage envoy Boehler said Iran has Americans, while the White House said President Trump's red line is not letting Iran have nuclear capabilities.

OTHER

- South Korea said North Korea is removing a facility at Mount Kumgang meant for meetings between separated families, according to Yonhap.

EU/UK

NOTABLE HEADLINES

- BoE Chief Economist Pill said he expects further rate cuts but urges caution on cutting interest rates and said the disinflation process is not yet complete, while he added that the BoE wage deal intentions survey shows the job is not done. Pill also commented that US trade tariffs could have substantial effects and the risk of second-round effects from the 2025 inflation hump is lower than after COVID.

- ECB's Nagel said the closer they get to a neutral rate, the more appropriate it is to take a gradual approach, while he added the limits of the neutral rate concept are clear and it is risky to base policy decisions mainly on R-star estimates. Furthermore, Nagel said spillovers from the economy could mean inflation falls below their target, but it is not a high probability scenario.

DATA RECAP

- UK RICS Housing Survey (Jan) 22.0 vs. Exp. 27.0 (Prev. 28.0, Rev. 26)