Low- to mid-income consumers, feeling the brunt of sticky inflation, elevated prices, and high interest rates, have dialed back their demand for fancy sneakers. As a result, shoe retailer chain Foot Locker slashed its full-year guidance after reporting dismal third-quarter earnings.

Foot Locker's third-quarter results missed the Bloomberg Consensus expectations on the top and bottom lines. The company blamed "softened" consumer trends and a high "promotional environment" across the marketplace.

Here's a snapshot of the third quarter (courtesy of Bloomberg):

- Comparable sales +2.4%, estimate +2.76%

- Adjusted EPS 33c vs. 30c y/y, estimate 41c

- Loss per share 34c vs. EPS 30c y/y

- Sales $1.96 billion, -1.4% y/y, estimate $2.02 billion

- Total location count 2,450, -6% y/y, estimate 2,448

- Foot Locker US stores 691, -6.6% y/y, estimate 691.86

- Kids Foot Locker stores 376, -4.1% y/y, estimate 377.38

- Champs Sports stores 390, -18% y/y, estimate 384.63

- Gross margin +230 bps

"Consumer spending trends softened following the peak Back-to-School period in August, and the promotional environment was more elevated than anticipated," CEO Mary Dillon wrote in a press release, adding, "We saw a meaningful and positive acceleration over the key Thanksgiving week period, especially in stores."

Dillon continued: "Despite that strong performance, we are taking a more cautious view and are lowering our full-year sales and earnings outlook due to a more promotional environment and softer consumer demand outside of key selling periods."

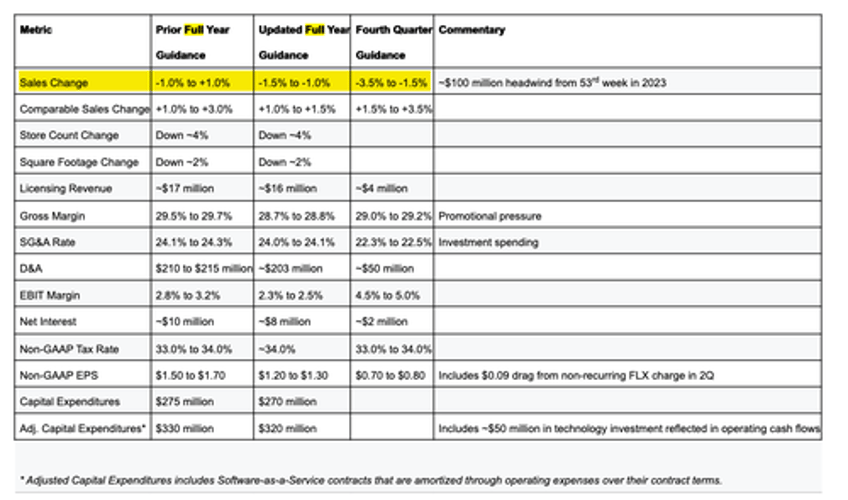

For the full year, Foot Locker now forecasts sales to dip between 1% and 1.5%, compared to previous guidance of down 1% to up 1%.

Foot Locker shares plunged 14% in premarket trading. As of Tuesday's close, they were down 22% on the year.

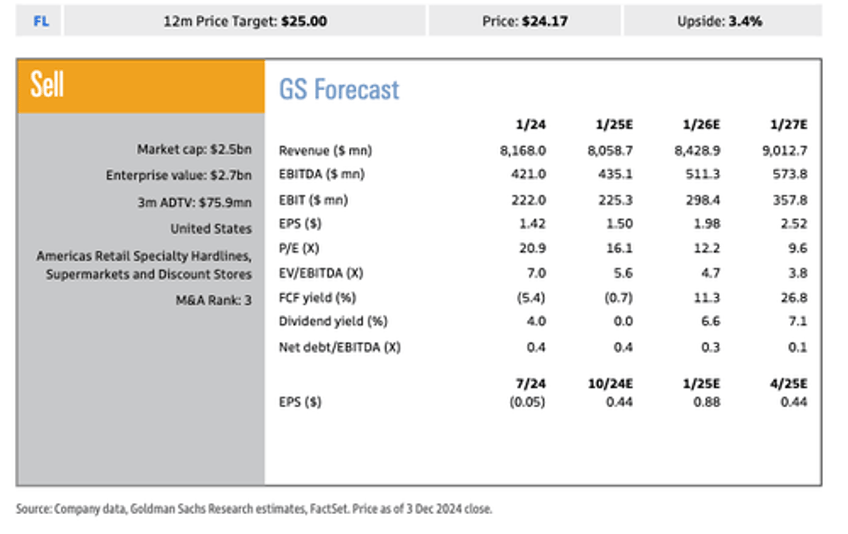

Goldman's Kate McShane has a "Sell" rating on Foot Locker with a "12-month price target of $25 based on our downside/base/upside case relative P/E multiples of 45%/50%/55."

McShane noted some upside risks:

Event driven risk has increased: Given the change in vendor mix, the high cash balance, low debt levels, and recent decline in share price, FL could be a potential M&A or LBO candidate.

FL's portfolio of brands remains strong: Despite the declining allocation of key Nike product, FL continues to have a portfolio of popular brands in its stores and online channels, including Nike, adidas, Reebok, Puma, and others. Moreover, FL has historically had higher levels of sneaker releases and innovation than other sneaker-selling retailers. These key strengths could support FL over the longer term.

New share repurchase authorization: FL's board approved a significant $1.2bn share repurchase package. If FL repurchases shares at a faster rate than the market expects, it could drive upside to the stock.

Foot Locker's customer base primarily consists of low-income consumers, offering a glimpse into discretionary spending trends. The dismal earnings and downshift in full-year outlook reveal that the bottom tier of consumers remains under significant financial strain due to elevated inflation, high interest rates, mounting credit card debt, and depleted personal savings. The ongoing inflation storm battering low-tier consumers results from an inflationary fallout from backfiring "Bidenomics."