This wasn't supposed to happen... or rather this wasn't supposed to happen outside of a crisis (and certainly not with stocks at all time highs).

Sure, the "impossible" did happen back back in April 2020, just as the world was about to break and the Fed was injecting trillions into the system. That's when we first reported that "Something Impossible Just Happened: A CLO Failed Its AAA Overcollateralization Test." So yes, while the AAA tranche of any structured vehicle is supposed to be guaranteed from impairments even in a 6-sigma event (not really: it happened quite frequently during the global financial crisis) that was hardly the case four years ago, but then again, with the world locked down for covid, the S&P crashing 30% in a week, and amid general panic, it's safe to say that nobody noticed.

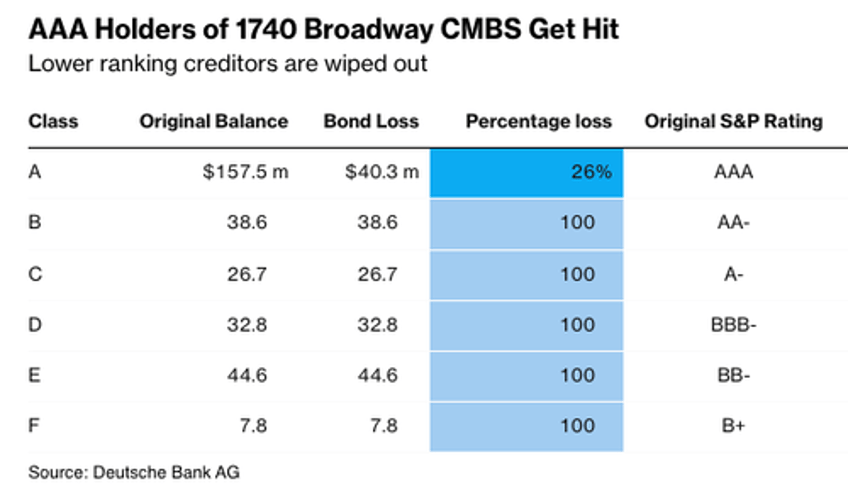

But then it happened again and this time there was no crisis: in the last week of May we learned that for the first time since the Lehman bankruptcy, Investors holding the top-most tranche debt backed by commercial real estate have suffered losses for the first time since the housing meltdown collapsed the economy 16 years ago. According to CMBS strategists at Barclays, buyers of the AAA portion of a $308 million note backed by the mortgage on the 1740 Broadway building in midtown Manhattan received less than three-quarters of their initial investment in recent weeks after the loan was dumped at a sizeable discount. All low-tier creditors were wiped out.

So let's recap: while a CLO AAA-tranche was impaired back in April 2020 - the first time this happened since the global financial crisis - one could at least understand why: the economy was literally halted, the Fed was pumping trillions into the economy every day to keep the zombified patient from dying, and nobody knew where their toilet paper would come from tomorrow, let alone their next structured finance paycheck.

But for this to happen in May of 2024, when the S&P was hitting record high after record high an AAA tranche to see a 25% haircut, that signals something is very broken with the system.

And then it happened again.

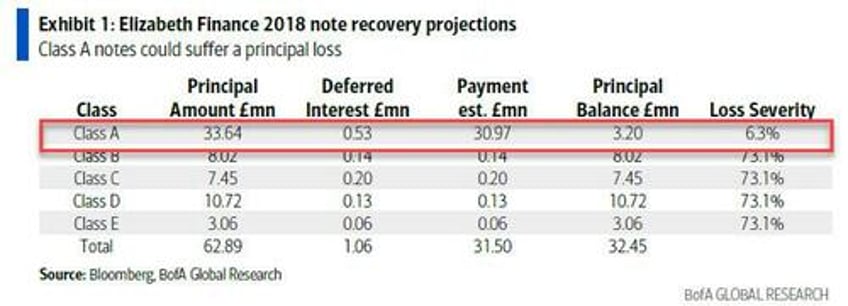

According to Bank of America, investors in the AAA tranche of a loan backed by UK shopping malls are facing losses, in what may be the first such impairment since the global financial crisis. In a Wednesday note by Mark Nichol (available to pro subscribers in the usual place) he estimates that Class A noteholders of commercial mortgage-backed security Elizabeth Finance 2018 could suffer a partial principal loss based on the amount that is expected to be recouped from the disposal sale of the underlying properties.

As BofA explains, Mount Street, the special servicer of the UK loan called Elizabeth Finance 2018 which has been in default since 2020, announced it has decided to accept a cash bid of £35.0mn for the Maroon properties, which was the highest of the portfolio bids received. Mount Street estimates net proceeds of around £31.5mn, which is less than the £33.6mn principal balance of the class A notes. And based on Mount Street’s estimate, BofA projects that the class A notes will suffer a 6% principal loss.

As Bloomberg notes, as recently as April, ratings agency Morningstar DBRS estimated the value of the three retail properties underlying the loan at £50.4 million, which set the loan-to-value at 125%. However, the agency noted that there was “uncertainty around the outcome of the sales process against the backdrop of challenging market conditions”.

Well, in the two months since market conditions must have imploded because according to BogA, "the decline in the Maroon property values has been striking and exceeded our 2021 projection that principal losses would reach the class B notes." As it turns out, the principal losses will reach class A notes, which are currently rated A (sf) by DBRS and BBB- (sf) by S&P. Both agencies took downgrade actions earlier this year.

As the BofA analyst further notes, and to nobody's surprise, Goldman Sachs was the originator and arranger of Elizabeth Finance 2018, which initially included two loans. At the time of issuance, Fitch voiced concerns that the class A notes did not merit AAA or AA ratings, regardless of leverage, owing to the pro-rata repayment structure. That is, "were either loan to be refinanced, the class A notes would remain outstanding and therefore reliant on the performance of the remaining loan."

It turns out that Fitch was right, for once, it now appears that the Class A noteholders, i.e. the AAA tranche, of Elizabeth Finance 2018 will suffer a partial principal loss: "It would be the first CMBS initially rated AAA in a post-financial crisis in Europe, to our knowledge."

And while the Elizabeth Finance 2018 loss is not the first - it follows just one month after the first AAA loss in US CMBS, which as noted above occurred in a transaction backed by a single office property, 1740 Broadway, the European AAA-impairment is the first one to focus on the retail property sector.

The Maroon loan was backed by three shopping centers located in England and Scotland. But it wasn't meant to last: the loan breached its default covenant in 2019, just one year after inception, and in 2020 was transferred to special servicing and accelerated. Under the deal’s pro-rata waterfall, £9mn of principal proceeds was paid to the subordinated notes from a prior loan redemption.

As Bloomberg details, UK regional malls that relied on department stores and fashion retailers — among the most vulnerable to the rise of online shopping — were already suffering before the coronavirus pandemic forced them to close. Vacancy rates are yet to recover in some areas, with higher financing costs adding to an already challenging situation.

“This property sale price shows that declines may be more severe than thought, but it could be specific to this particular portfolio,” Cas Bonsema, ABS and covered bond analyst at Rabobank, said. “CMBS is always very specific and in this case the properties got hit hard by the pandemic.”

“There have been some signs of distress in the CMBS market, particularly around shopping malls, some of which haven’t really recovered from the pandemic era,” said Harjeet Lall, a securitization partner at law firm Pinsent Masons LLP. “Many malls are struggling because of reduced consumer spending and a drop in occupancy levels.”

And so, after years of sanctity for the AAA-class, in the span of just one month we have seen not only but two AAA impairments, one in an office-backed loan and another in a European loan CMBS. They are just the the tip of the formerly invincible iceberg, especially since these take place with stocks at all time high. Imagine what happens when stocks enter a bear market after the coming post-election crash? The bigger problem is that the money that was allocated to these AAA tranches was not sourced from billionaires who can afford to blow a few million on some financial speculation; this particular money comes literally from "widows and orphans" since it was supposed to be safe from impairment come hell or high water. The question now is how does society react when some of the most vulnerable members realize that what little money they had has just vaporized because their financial advisor was certain, absolutely certain that the AAA tranche can never suffer a loss.

More in the full BofA note available to pro subs.