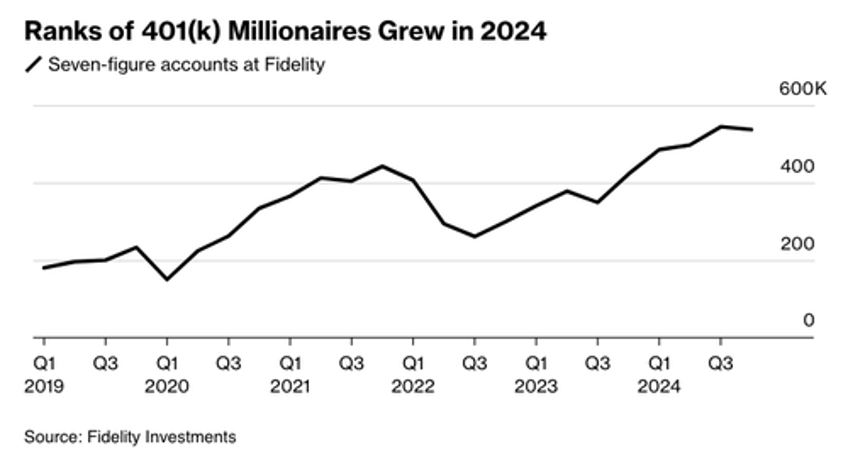

The 401(k) millionaire club has surged in size, fueled by American exceptionalism and the meteoric rise of MAG7 stocks, which have skyrocketed over recent years amid the era of "The Next AI" theme.

Bloomberg cited new Fidelity Investments data showing that the number of 401(k) accounts with balances of $1 million or more jumped 27% to 537,000 in 2024.

The data showed that while 60% of Americans have access to 401(k)-type plans, most accounts hold less than $1 million—averaging around $131,000 at Fidelity—with steady contribution rates.

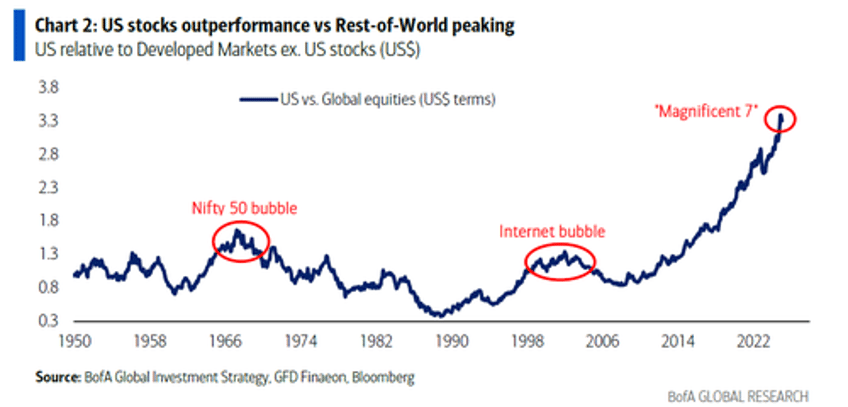

The growing size of the 401(k) millionaire club has been primarily because of the hockey-sticking Mag7 chart below—everyone loaded up on the same big tech stocks as US tech outshined China, Europe, and the rest of the world.

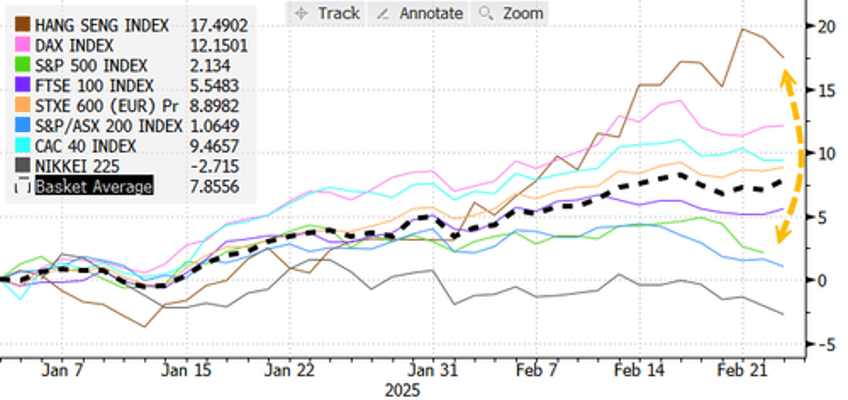

However, newly minted 401(k) millionaires must remain vigilant of the "DeepSeek China moment"—a possible inflection point for the market that has shown US exceptionalism fading in recent weeks.

There is so much grassroots excitement about AI, in iOS 18.3 Apple is forcefully including everyone into its AI product since nobody will do so on their own.

— zerohedge (@zerohedge) January 29, 2025

But yeah, $300BN in capex. pic.twitter.com/sjdDiXexMi

What could derail the MAG7 party and put those newly minted millionaires back into the poor house is if TD Cowen's report on Microsoft data center order cancellations is accurate. MSFT fired back at Cowen, denouncing the claim...

Microsoft "Strongly Refutes" Cowen Report It Is Canceling Data Center Orders... But Questions Linger https://t.co/2dBqZZ8TyQ

— zerohedge (@zerohedge) February 24, 2025

Even with the rising tide in equity markets, the inflation storm unleashed by the Biden-Harris administration has financially crushed low/mid-tier consumers, resulting in wealthy Americans trading down for Walmart in recent quarters.

More from the Bloomberg report...

... something that has happened only 10 times since 1871 — survey after survey shows most Americans remain anxious about being able to afford a comfortable retirement.

"People have concerns about the economy, the rising cost of living, rising inflation — so the thinking is that they're likely making some sort of change somewhere in their personal financial lives," said Michael Shamrell, vice president of thought leadership at Fidelity. "But it looks like they're not pulling back on their retirement savings."

...

For those behind on savings, members of Gen X have been making strides as they approach retirement age. About 14% made catch-up contributions and the cohort had a total savings rate of 15.2%, in line with what many financial advisers recommend. Additionally, those who have saved in 401(k)s for 15 years, with the same employer, saw average balances jump 18% to $589,400 last year.

Meanwhile, Gen Z savers, the oldest of whom are now 28, were no savings slouches, either. Members of that generation who have contributed to their 401(k) for five years saw average balances rise 66% to reach $52,900. Such a huge jump is likely due to having a high proportion of their savings in equities.

Overall, almost 40% of retirement savers bumped up their contribution rate last year, for an average increase of 2.9%. A chunk of that likely came from the use of auto-escalation plans, which automatically raise an employee's contribution rate by 1% a year. About 90% of savers got a contribution from their employer, Fidelity said.

For those newly minted 401(k) millionaires, just hope the US exceptionalism theme does not continue fading...

... or otherwise, you'll be back in the poor house.